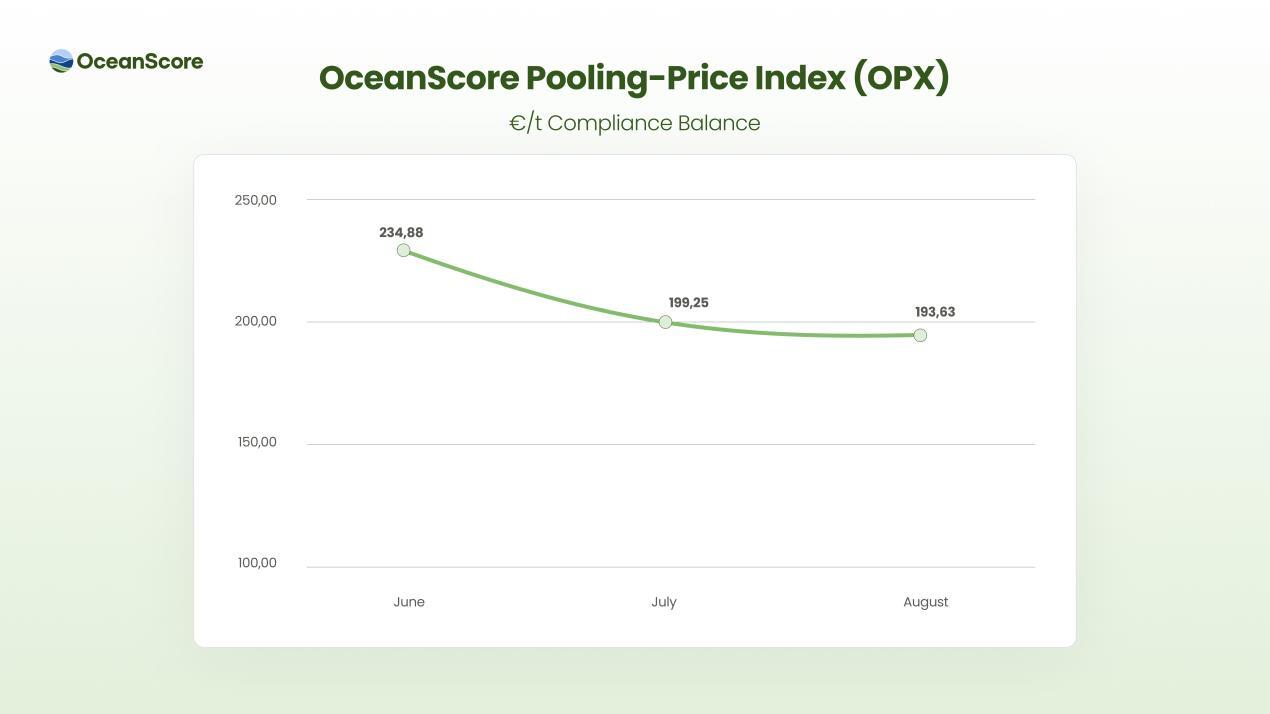

OceanScore has introduced the OceanScore Pool-Price Index (OPX), which it calls the industry’s most accurate benchmark for FuelEU pooling prices. The new index, published monthly, provides transparency on compliance surplus costs measured in euros per tonne of CO₂ equivalent.

The FuelEU Maritime regulation, which came into effect this year, created a fast-growing market for pooling compliance surpluses. But with most deals happening in private negotiations, market participants have faced a lack of visibility.

“The lack of transparent pricing benchmarks has been one of the biggest obstacles to efficient FuelEU compliance,” said Albrecht Grell, Managing Director at OceanScore. “Companies have been making million-dollar compliance decisions based on incomplete market information. OPX changes that fundamentally.”

The index uses a volume-weighted methodology to reflect real deal sizes, instead of simple averages that can distort market trends. Small transactions carry the highest weighting, with medium and large deals factored in at lower levels.

Unlike other indexes, OPX is directly linked to OceanScore’s FuelEU Pooling Marketplace. The company says this combination of transparency, open methodology, and independence ensures the benchmark reflects true market dynamics.

OPX already has the backing of major industry players including MSC, Anglo-Eastern, V-Ships, IINO Lines, Nordic Shipping, and Döhle Group.

Analysts expect OPX to play a central role in financial forecasting, compliance planning, and contract negotiations. With FuelEU penalties set at €640 per tonne of CO₂ equivalent, current pooling prices tracked by OPX remain well below the penalty rate, offering significant savings for operators.

OceanScore plans to expand OPX coverage and introduce further compliance benchmarks as the regulatory landscape evolves.