The pause in the US-China trade war, and the associated demand boom, has caused a scramble amongst box lines to inject capacity swiftly, according to Sea-Intelligence, a Danish maritime data analysis firm.

On Asia-North America West Coast (NAWC), the Danish analysts are seeing capacity growth over 30% Y/Y in five of the next 11 weeks.

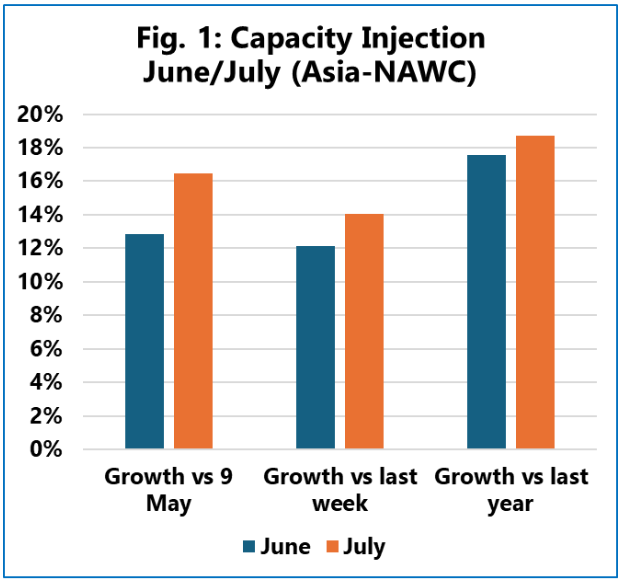

“If we aggregate it across June/July for Asia-NAWC, then in June, the lines are increasing capacity 12.8% compared to before the tariff pause, and in July, the capacity injection is increasing to 16.5% compared to the pre-pause situation,” explain Sea-Intelligence analysts.

This is shown in the following figure, with capacity having also ramped up sharply compared to just a week ago, with this injection of capacity equalling 397,000 TEUs across the two months.

What is potentially more important, for the analysts, is the Y/Y growth also shown in the figure above. In June/July, shipping lines are planning to offer approximately 18% more capacity Y/Y.

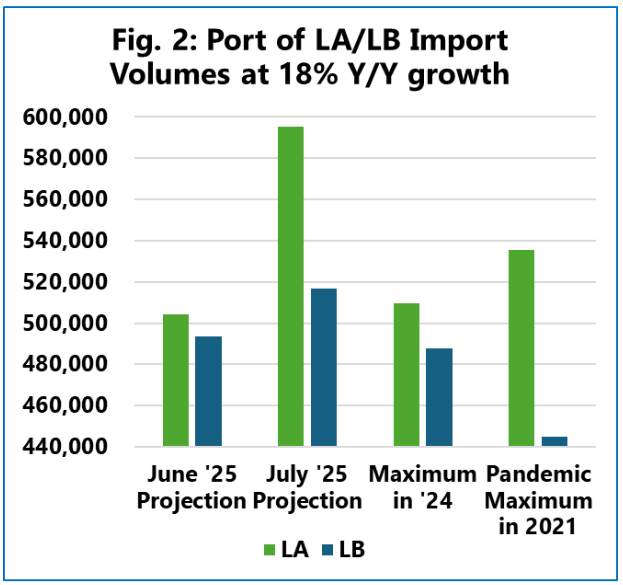

Alan Murphy, CEO of Sea-Intelligence, noted that it is an open question whether the tariff-induced volume surge will match this capacity injection. If it does, it can create a significant issue in the ports of Los Angeles and Long Beach, he said.

“If we – quite simplistically – assume that the 18% Y/Y capacity injection matches the volume surge going into the ports of LA/LB, then Figure 2 shows the projected laden import container handling in the ports of LA/LB in June/July. It also compares to the maximum monthly volume handled in 2024, as well as the largest monthly volume seen during the pandemic disruptions in 2021,” said the Sea-Intelligence report.

If the San Pedro Bay ports achieve an 18% Y/Y laden import growth, then the Port of Los Angeles will see June volumes almost at the level seen at the maximum in 2024, while in July, it will face significantly higher volumes than in the pandemic period. Meanwhile, the Port of Long Beach would see new volume handling records for both June and July.