Niche carriers accounted for 7%-10% of the total weekly capacity deployed on Asia-North America West Coast (NAWC) throughout 2019, according to Sea-Intelligence’s report.

The Danish analysts explain that during the height of the pandemic, the Asia-NAWC trade lane saw a slew of new entrants – carriers which had no previous footprint on Asia-NAWC and were only there to seize an opportunity that had presented itself in the form of unnaturally high freight rates and a very strong consumer demand for goods.

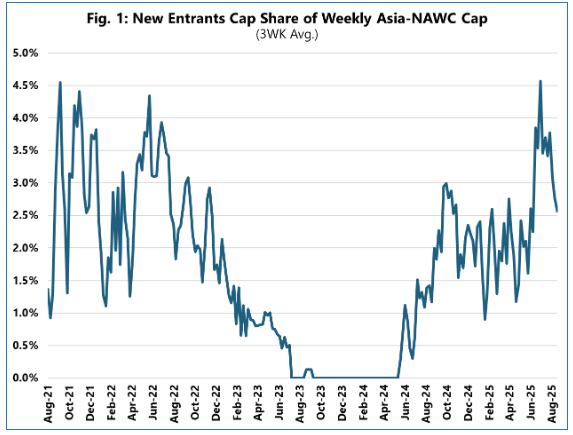

At peak deployment, these new entrants accounted for roughly 4.5% of the weekly Asia NAWC capacity, with niche carriers on a whole increasing their share to 10%-15% in August 2021-May 2023.

“While 4.5% may not seem much, these new entrants accounted for nearly a third of the capacity deployed by the niche carriers on the trade lane,” noted Sea-Intelligence’s analysts.

What is perhaps not surprising, for Alan Murphy, CEO of Sea-Intelligence, is that these carriers started to phase out their services once the supply/demand situation started to ease up and the freight rates started to settle down.

By June 2023, the last service deployed by these new entrants was phased out.

“If opportunistic carriers only ever enter the Transpacific market when it makes financial sense and phase out when they no longer stand to gain, then the geopolitical turmoil of the last 18 months should have provided plenty of opportunities to re-enter the market,” pointed out Murphy.

And this is exactly what has happened, according to Sea-Intelligence’s report. Niche carriers went from offering 7% of the weekly Asia-NAWC capacity in January 2024 to 13% by May 2025. So, what changed? The new entrants started to deploy their services onto the Asia-NAWC trade once again.

Murphy commented: “We see a sharp ramp-up in capacity deployed by these new entrants in recent months, to 4.5% of the weekly deployed capacity on Asia-NAWC. This is back at the level that we saw during the height of the pandemic. This means that the current market conditions are such that these new entrants feel that there is an opportunity reminiscent of the global pandemic; and if history is anything to go by, we will see these carriers remove capacity as quickly as it was introduced, once the market conditions start to normalise.”