Overcapacity in the shipyards has seen the market develop in favour of the buyer with the latest deals, including OOCL’s five vessel order for 23,000TEU ships, a snip at US$155.68 million a-piece, a real cut on the US$200 million paid by Maersk for the 18,000TEU Triple E’s in 2012.

Braemar reports that the Gerry Wang lead Greathorse Shipmanagement has signed at China’s Yangzijiang for two plus six options on 14,000TEU dual fuel vessels at US$110million whilst Capital have also signed with Yangzijiang for conventionally fuelled 13,000TEU vessels at a price below US$90 million.

In addition, Braemar said that the second-hand market enquiries have been muted, but buyers are seeing real opportunities to secure newbuilding contracts at attractive pricing.

“We will likely see more opportunistic ordering in the coming months, especially at Chinese yards under pressure to fill berths,” said Braemar.

With newbuilding prices under pressure it is expected that second-hand prices would suffer too, but most newbuildings are for the larger sizes of ship while the resale market is dealing with smaller vessels on average.

In the years from 2016 to 2018 the average size of second-hand vessel sold was between 39,000dwt and 43,000dwt. This year and last year the average size has increased a little from 53,000dwt last year to 46,000dwt this year, on average. This translates to vessels of about 4,000TEU. The average price per vessel in 2016 was US$10.3 million, and that peaked in 2019 at US$17.8 million vessel. This year the average has slipped again to US$14.87 million per ship.

| Year | No. of ships | Total DWT | Average Age | Invested Capital |

| 2016 | 112 | 4.392m tonnes | 11 | US$1.153bn |

| 2017 | 277 | 11.92m tonnes | 11 | US$2.251bn |

| 2018 | 190 | 7.255m tonnes | 11 | US$1.973bn |

| 2019 | 125 | 6.72m tonnes | 12 | US$2.229bn |

| 2020* | 38 | 1.75m tonnes | 13 | US$565.1m |

Second-hand Sales of Container ships. Source: Allied Shipping.

*To date.

However, Braemar reports that China, the world’s second-largest economy, has been severely hit by the Covid-19 virus outbreak.

“Exports fell by 17.2% in January and February combined compared to the same period a year earlier, according to data released on Saturday by the General Administration of Customs. This was down from 7.9% growth in December. Imports dropped 4% from a year earlier, down from 16.5% growth in December,” said Braemar.

Given that the chaotic economic situation has now been added to by the uncertainty around the oil price, which will mean lower costs for operators, but could also mean a decline in demand for goods, the ensuing insecurity around the global financial situation could mean that the second-hand market remains subdued.

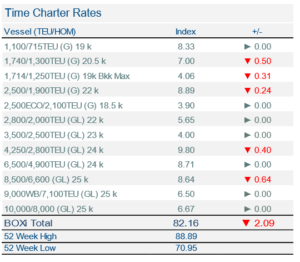

Braemar’s BOXi charter index is showing signs of decline particularly in the smaller sectors and this could be a sign that the markets are deteriorating further following the early year hits to the global economy. The question now for the liner operators is when do we hit the bottom and start to bounce back up?