According to Alphaliner, the first half of 2025 has delivered a noticeable slowdown in global container fleet expansion, but don’t tell that to MSC. The Geneva-based giant continues to forge ahead, while ZIM stands out as the only top-tier carrier actively scaling back.

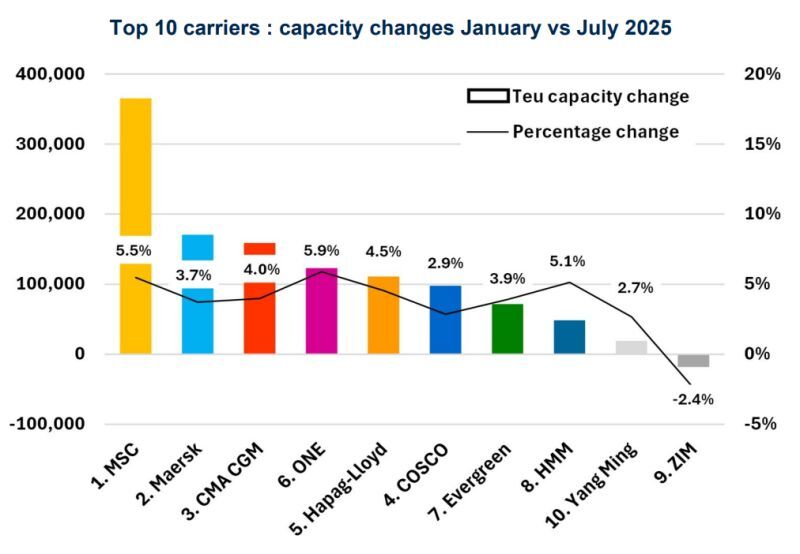

According to new fleet data, the global cellular fleet grew by 1.18 million TEU in the first six months of the year, a relatively modest 3.8% increase compared to the aggressive growth patterns seen in recent years. MSC alone was responsible for nearly a third of that growth, adding 365,173 TEU to its fleet since January.

This brings MSC’s total capacity to over 6.6 million TEU, thanks to a steady pipeline of newbuilding deliveries and continued secondhand vessel acquisitions. So far in 2025, the company has taken delivery of 25 new vessels, including 12 ‘Neo-panamax’ units ranging between 15,400 and 16,200 TEU, a move that further strengthens its standalone global network.

MSC’s growth is anything but a surprise. It’s been the top fleet expander for several years, with impressive annual increases of 12.3% in 2024, 22.0% in 2023, 7.5% in 2022, and 10.7% in 2021.

This aggressive strategy has widened the gap between MSC and second-place Maersk, whose capacity remains steady at around 4.5 million TEU. The gap, nearly 2.1 million TEU, is equivalent to the entire fleet operated by Ocean Network Express (ONE), currently in sixth place.

While MSC dominated in absolute terms, ONE topped the growth charts percentage-wise. The Singapore-based carrier expanded its fleet by 5.9% in H1 2025, ahead of MSC’s 5.5% and HMM’s 5.1%. Notably, this marks a new chapter for ONE, which has begun receiving vessels under direct ownership.

Meanwhile, ZIM Integrated Shipping Services took a different path. The Israeli carrier became the only player in the global Top 10 to reduce its fleet capacity during the period.

As the second half of the year unfolds, all eyes will be on how these contrasting strategies play out.