The 2M Alliance, which currently includes the top two shipping lines MSC and Maersk, is scheduled to conclude in February 2025. Following this, Maersk will join forces with Hapag-Lloyd to establish the Gemini Cooperation.

In response, MSC appears to be redirecting its attention towards expanding its independently operated services. Specifically, MSC has been increasing its market share in capacity for standalone services in the Transpacific and Asia-Europe trades.

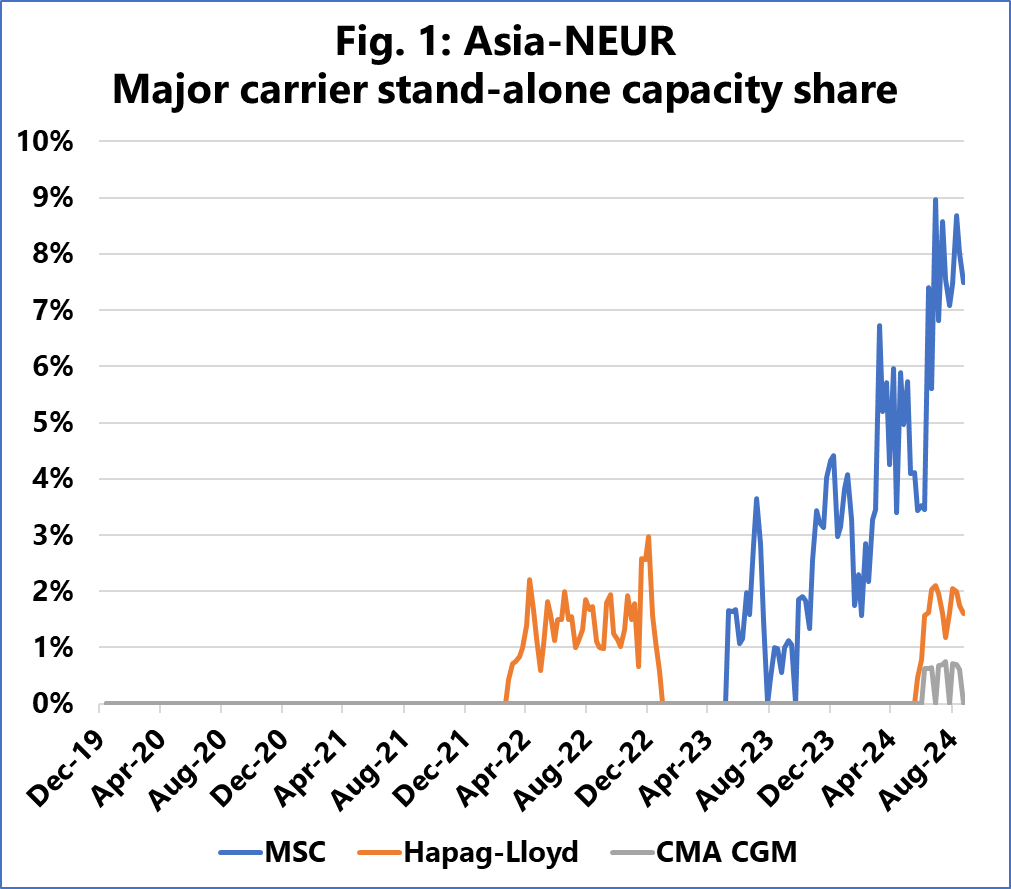

Figure 1 illustrates the share of Asia-North Europe capacity (three-week average) provided by MSC on their standalone services, compared to those of Hapag-Lloyd and CMA CGM, the only other major carriers offering standalone services on this trade route.

This growth for MSC should be viewed not only in the context of the current extreme market pressures but also considering the imminent end of the 2M Alliance. MSC is proactively developing its services ahead of the alliance’s termination, unlike Maersk.

FMC puts brakes on Gemini Cooperation, demands more information from Maersk and Hapag-Lloyd

Additionally, MSC’s independent expansion began before the Red Sea crisis, with a notable acceleration following the crisis outbreak. On the Asia-Mediterranean route, MSC’s move to boost standalone capacity share started before the Red Sea crisis, with their standalone services comprising about 9% of the deployed capacity in this trade lane since Q2 2023.

“A similar trend can also be seen on the two Transpacific trade lanes, especially on Asia to North America East Coast, where MSC have been increasing their stand-alone capacity market share from 3% to 6% in 2023-Q3. On the Asia to North America West Coast trade lane, MSC stand-alone services were introduced when the pandemic market tightened in 2020-Q3, and have held a somewhat consistent capacity market share of around 6%, outside of a temporary increase to around 12% during the height of the pandemic in late 2021,” explained Alan Murphy, CEO of Sea-Intelligence.