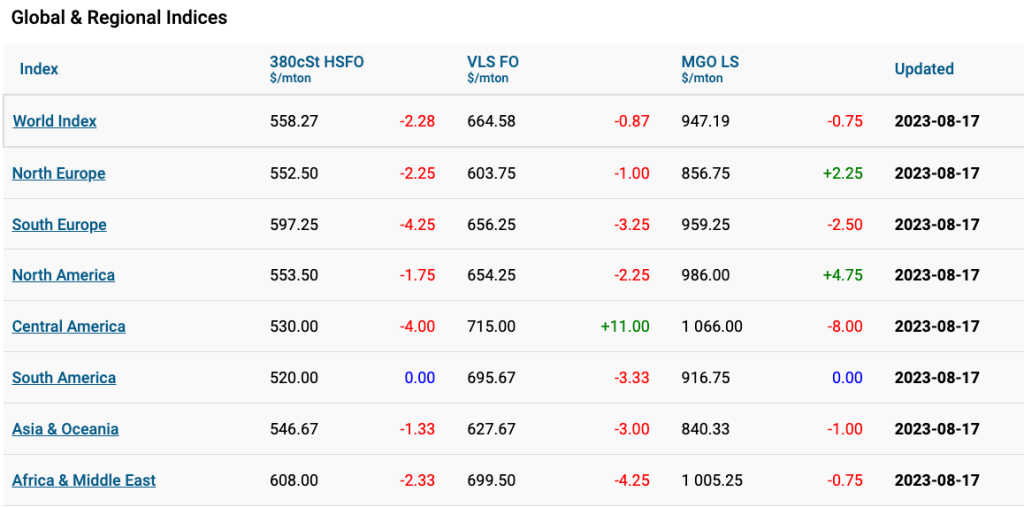

Marine Bunker Exchange (MABUX) global indices showed moderate growth with no significant changes. The 380 HSFO index rose to US$564.04/MT, the VLSFO index increased to US$666.24/MT and the MGO index climbed to US$938.37/MT.

“At the time of writing, the market was in a state of a steady downtrend,” commented a MABUX official.

The Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO –

remained relatively stable, decreasing by US$1.06 to US$102.20. The weekly average also dropped by US$2.92.

In Rotterdam, SS Spread dropped by another US$1, reaching US$39, the lowest since 17 September 2020. The average weekly SS Spread in Rotterdam continued to decrease, shedding another US$15.83.

Conversely, only in Singapore did the price difference of 380 HSFO/VLSFO increase during the week by US$9, going from US$71 to US$80. The weekly average for SS Spread in Singapore also rose by US$29.50.

The deceleration in the narrowing of the SS Spread suggests that the indicators

might have reached their lowest points, potentially indicating an upcoming upward

correction.

Earlier this month, natural gas prices in Europe experienced a substantial increase of up to

40%. This surge was attributed to reports indicating potential industrial action by gas

platform workers in Australia. Presently, European gas inventories are at an all-time high for this period of the year.

In the previous year, liquefied natural gas (LNG) accounted for 34% of the European Union’s total gas imports in 2022. This figure is projected to climb to 40% this year. Remarkably, this anticipated increase would mirror the market share previously

held by Russian pipeline gas within the European Union prior to February 2022.

Consequently, this shift implies that the European Union (EU) has essentially substituted one form of gas dependency for another. This transition aligns with ongoing concerns about austerity measures and the declining competitiveness faced by some of the continent’s most crucial industries.

The price of LNG as bunker fuel in the port of Sines (Portugal) has once again experienced a notable increase, reaching US$821/MT on 14 August. This marks an uptick of US$109 in

comparison to the previous week.

Concurrently, the price gap between LNG and traditional fuel as of 14 August has contracted to US$152, favoring LNG. On the same day, MGO LS was priced at US$973/MT at the Sines port.

In Week 33, the MDI index, which compares market bunker prices (MABUX MBP Index) to

the digital bunker benchmark MABUX (MABUX DBP Index), indicated a continuing shift of

certain ports towards the overcharge zone, despite the prevailing trend of underpricing.

During this period, Fujairah stood as the sole underestimated port within the 380 HSFO

segment, with its weekly average declining by 6 points. In contrast, the MDI index detected

overpricing in the other three ports. Rotterdam observed a 16-point increase in its weekly

average, while Singapore experienced a 12-point decrease, and Houston recorded a 3-point

drop.

Within the VLSFO segment, the MDI revealed that Singapore transitioned into the overprice

zone, as its weekly average surged by 4 points. On the other hand, the remaining ports

continued to be undervalued, with Rotterdam and Fujairah showing a 2-point increase in

their weekly averages, while Houston witnessed a significant 16-point narrowing.

In the MGO LS segment, all selected ports remained undervalued. Rotterdam and Fujairah

both saw an average underpricing increase of 1 point, whereas Singapore’s underpricing

decreased by 1 point, and Houston’s decreased by 2 points.

“There are early signs of a downtrend in the market. We expect world bunker indices may turn into a moderate decline next week,” commented Sergey Ivanov, director of MABUX.