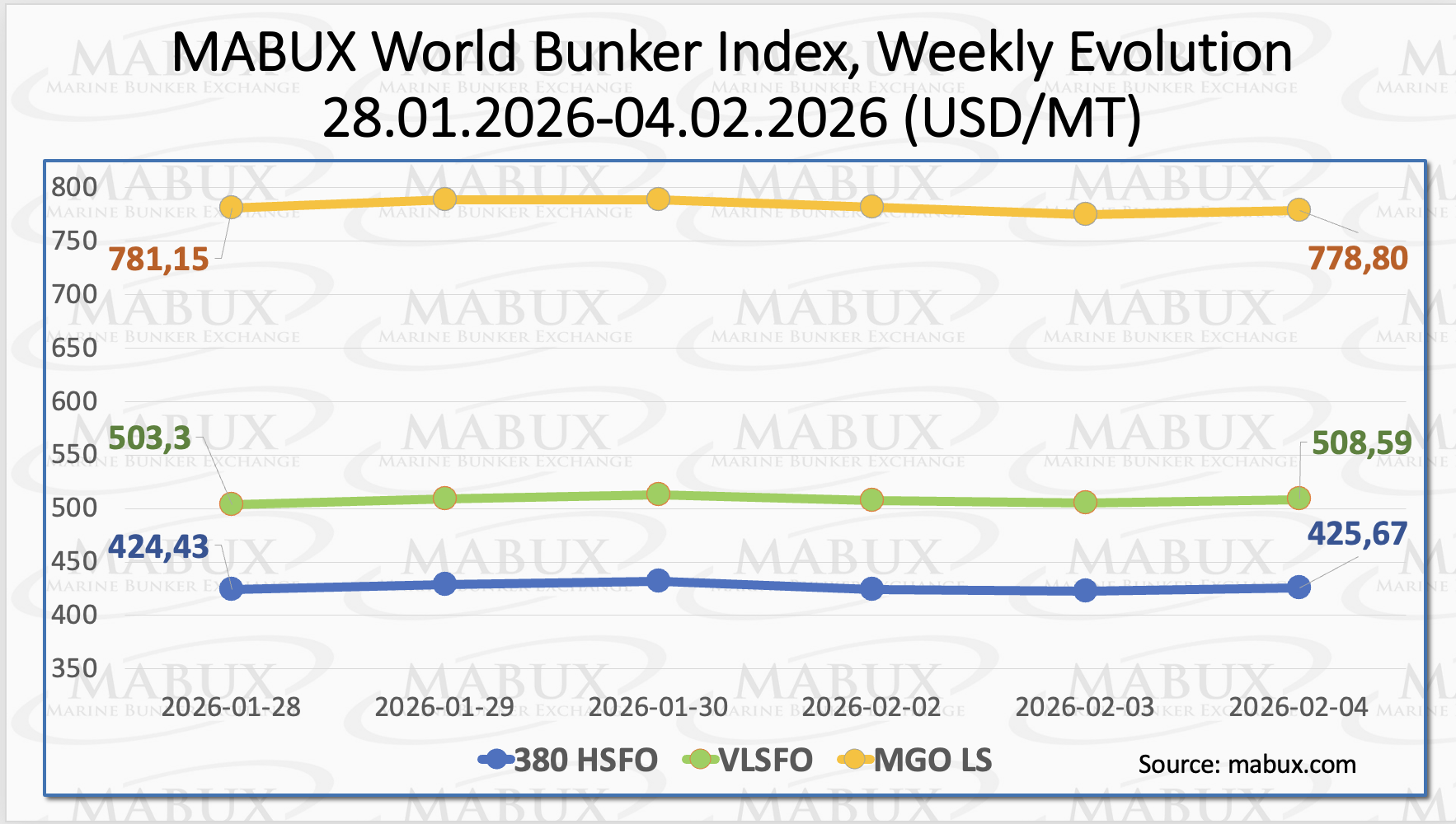

Over the Week 06, the global MABUX bunker indices did not demonstrate significant overall changes and moved in mixed directions, according to Sergey Ivanov, Director, MABUX.

The 380 HSFO index edged up by US$ 1.24, rising from US$ 424.43/MT last week to US$ 425.67/MT. The VLSFO index posted a more notable increase of US$ 5.29, climbing from US$ 503.30/MT to US$ 508.59/MT and remaining above the US$ 500 threshold. In contrast, the MGO LS index declined by US$ 2.35, falling from US$ 781.15/MT last week to US$ 778.80/MT.

At the time of writing, the global bunker market was experiencing a moderate upward corrective movement, commented Sergey Ivanov, Director, MABUX.

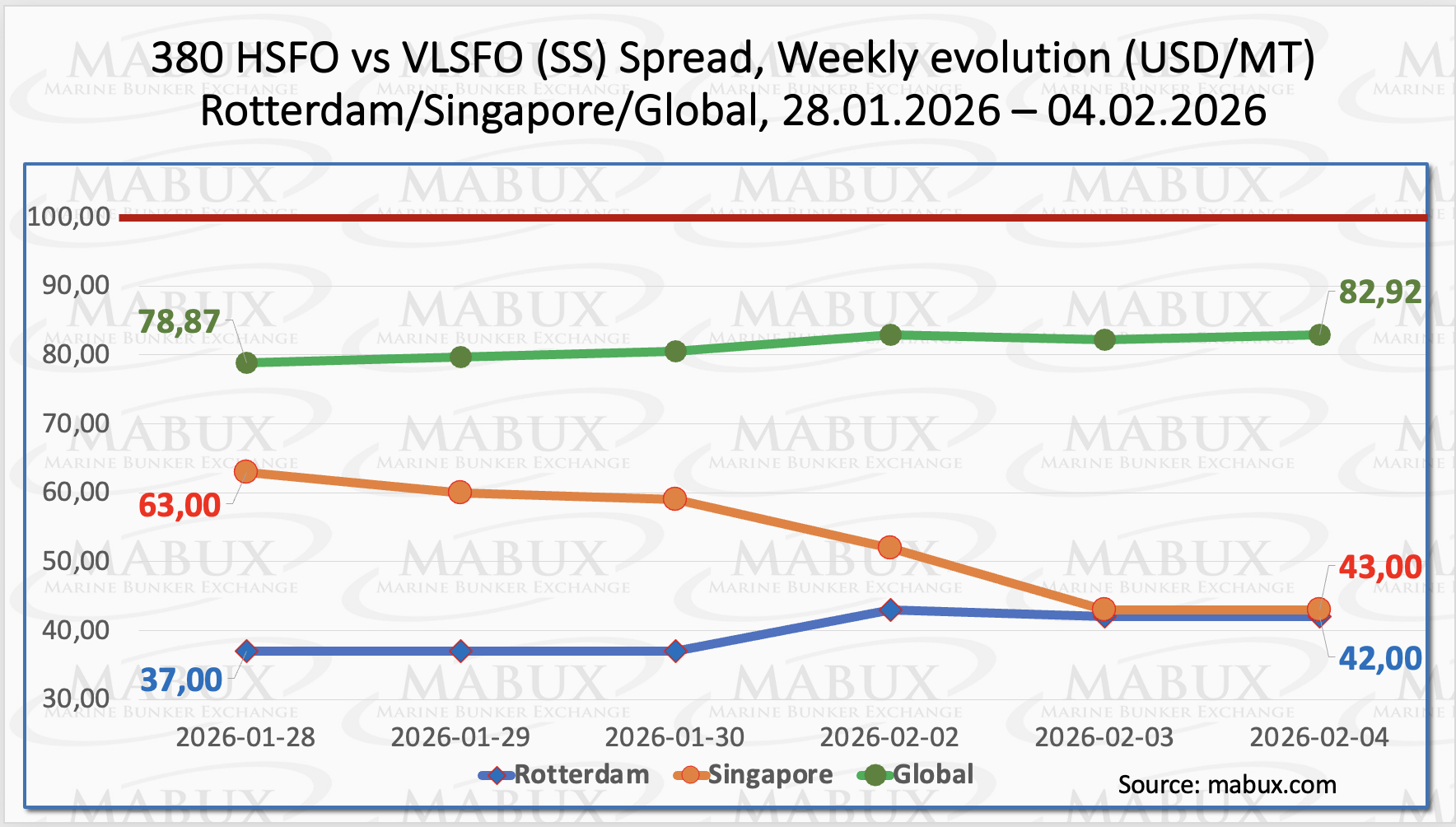

The MABUX Global Scrubber Spread (SS)—the price differential between 380 HSFO and VLSFO—recorded a moderate increase of US$ 4.05, rising from US$ 78.87 last week to US$ 82.92. The spread thus moved above the US$ 80.00 level, while still remaining steadily below the psychological threshold of US$ 100.00 (SS breakeven). At the same time, the weekly average value of the index increased by US$ 1.28.

In Rotterdam, the SS Spread also expanded by US$ 5.00, reaching US$ 42.00 compared to US$ 37.00 last week. However, the weekly average SS Spread in the port declined by US$ 12.33. In Singapore, the 380 HSFO/VLSFO price differential narrowed sharply by US$ 20.00, falling from US$ 63.00 last week to US$ 43.00 and breaking below the US$ 50.00 mark.

The weekly average SS Spread in the port likewise decreased by US$ 11.50. Overall, SS Spread dynamics over the week were mixed, continuing to reflect higher economic attractiveness of conventional VLSFO usage compared to the 380 HSFO plus scrubber combination. ”We expect the SS Spread to remain largely flat next week, with mixed index movements likely to persist”, said Ivanov.

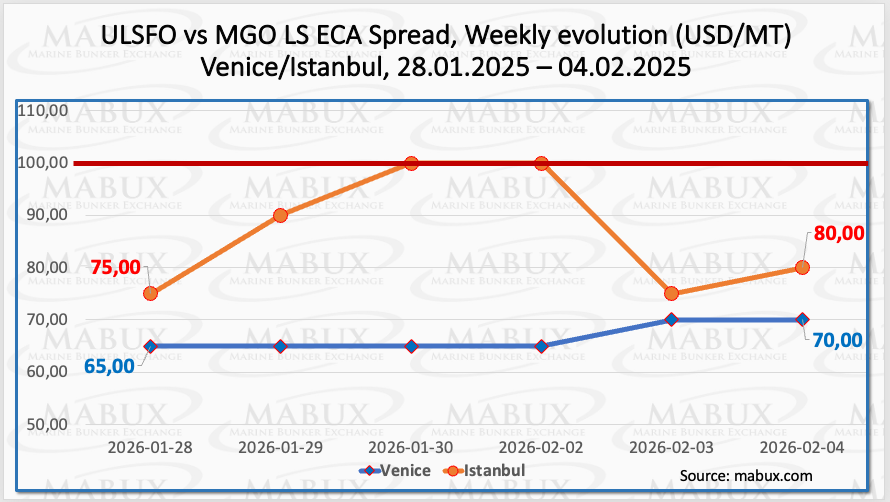

By the end of the week, the Istanbul ECA Spread (ES) increased by US$ 5.00, rising from US$ 75.00 to US$ 80.00, and briefly touched the US$ 100.00 level, while the weekly average value advanced by US$ 6.67. In Venice, the ECA Spread also rose by US$ 5.00, moving from US$ 65.00 to US$ 70.00. However, the weekly average in the port declined by US$ 10.66. End-of-week ES dynamics in both ports pointed to emerging upward momentum. ”We expect the upward trend in the ECA Spread to continue into next week”, Sergey Ivanov added.

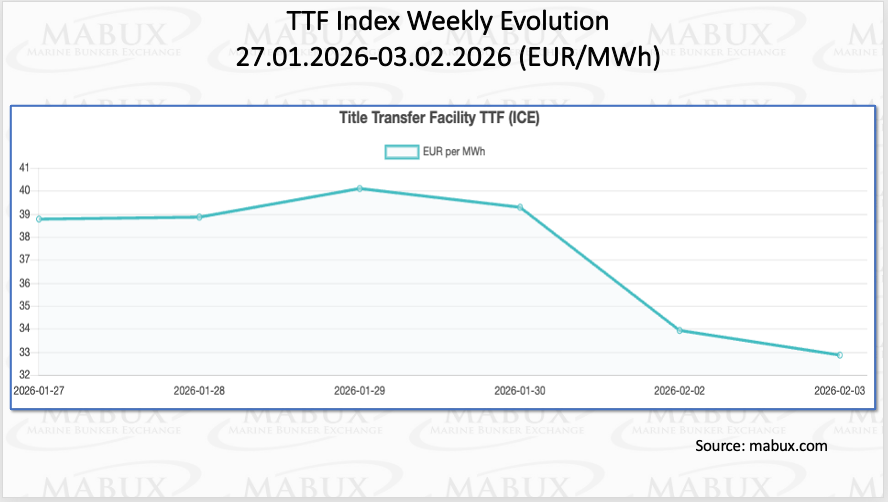

European gas storage levels fell to 39,86% of total capacity as of February 03, (down by 4.37 percentage points from the previous week) marking the lowest level for this time of year since 2022, when inventories dropped to 40%. Current storage is well below the 10-year seasonal average of 58%, underscoring the growing imbalance in the European gas market. If prevailing drawdown trends persist, storage levels could decline to 30% or lower by the end of March. Under this scenario, Europe would need to inject approximately 60 billion cubic meters (bcm) of gas to rebuild inventories to 83% capacity—the level at which the region entered last winter. Importantly, not all gas imports are directed into storage.

A substantial share is consumed immediately to meet daily demand, implying that Europe’s total gas procurement requirements in the coming months will be significantly higher than storage replenishment needs alone suggest. Despite continued pipeline supplies from Norway, North Africa, and Azerbaijan, as well as limited domestic production, the scale of the refilling challenge remains immense. Rebuilding underground storage ahead of the next heating season will require exceptionally high import volumes, keeping the European gas balance structurally tight and sustaining upward pressure on procurement and price risk through the summer injection cycle.

By the end of the 6th week, the European gas benchmark TTF recorded a significant decline of 5.901 euros/MWh, falling from 38.761 euros/MWh last week to 32.860 euros/MWh, according to Sergey Ivanov, Director, MABUX.

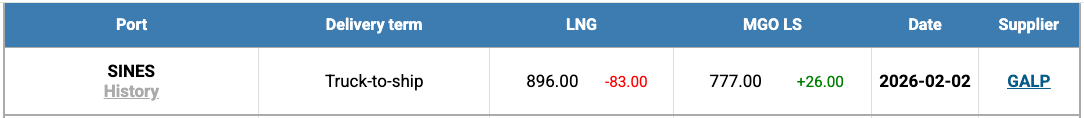

The price of LNG as a bunker fuel at the port of Sines (Portugal) fell by US$ 83.00 this week (US$ 896/MT compared to US$ 979/MT last week). The price differential between LNG and conventional fuel remained in favor of conventional fuel, narrowing to US$ 119. MGO LS was quoted at US$ 777/MT on February 2 in the port of Sines.

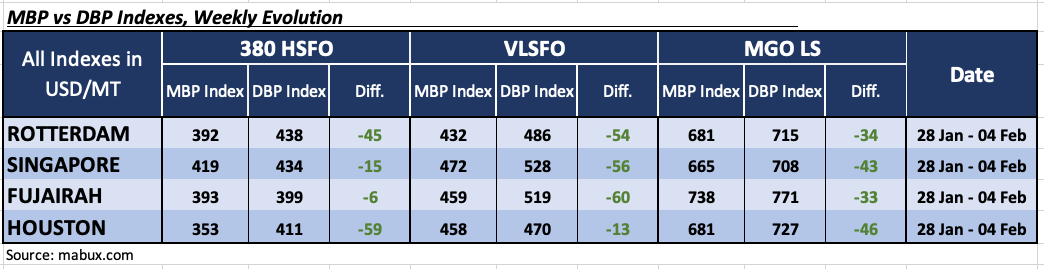

During the Week 06, the MABUX Market Differential Index (MDI)—which reflects the ratio between market bunker prices (MBP) and the MABUX Digital Bunker Benchmark (DBP)—continued to indicate undervaluation across all bunker fuel grades in the world’s largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: Average weekly MDI undervaluation increased by 5 points in Rotterdam and by 13 points in Houston, while declining by 7 points in Singapore and by 11 points in Fujairah. Notably, Fujairah’s MDI approached the 100% correlation level between MBP and DBP.

• VLSFO segment: The MDI rose across all ports, increasing by 20 points in Rotterdam, 7 points in Singapore, 5 points in Fujairah, and 10 points in Houston.

• MGO LS segment: MDI dynamics were mixed: undervaluation increased by 12 points in Rotterdam and by 14 points in Fujairah, while decreasing by 4 points in Singapore and by 6 points in Houston.

”Although the overall undervaluation trend remained dominant across all bunker fuel segments last week, MDI movements were mixed. Nevertheless, we expect MDI values to continue indicating undervaluation for all bunker fuel grades in the coming week” said Ivanov.

”We expect a moderate upward trend to emerge in bunker fuel price dynamics next week”, added Sergey Ivanov, Director, MABUX.