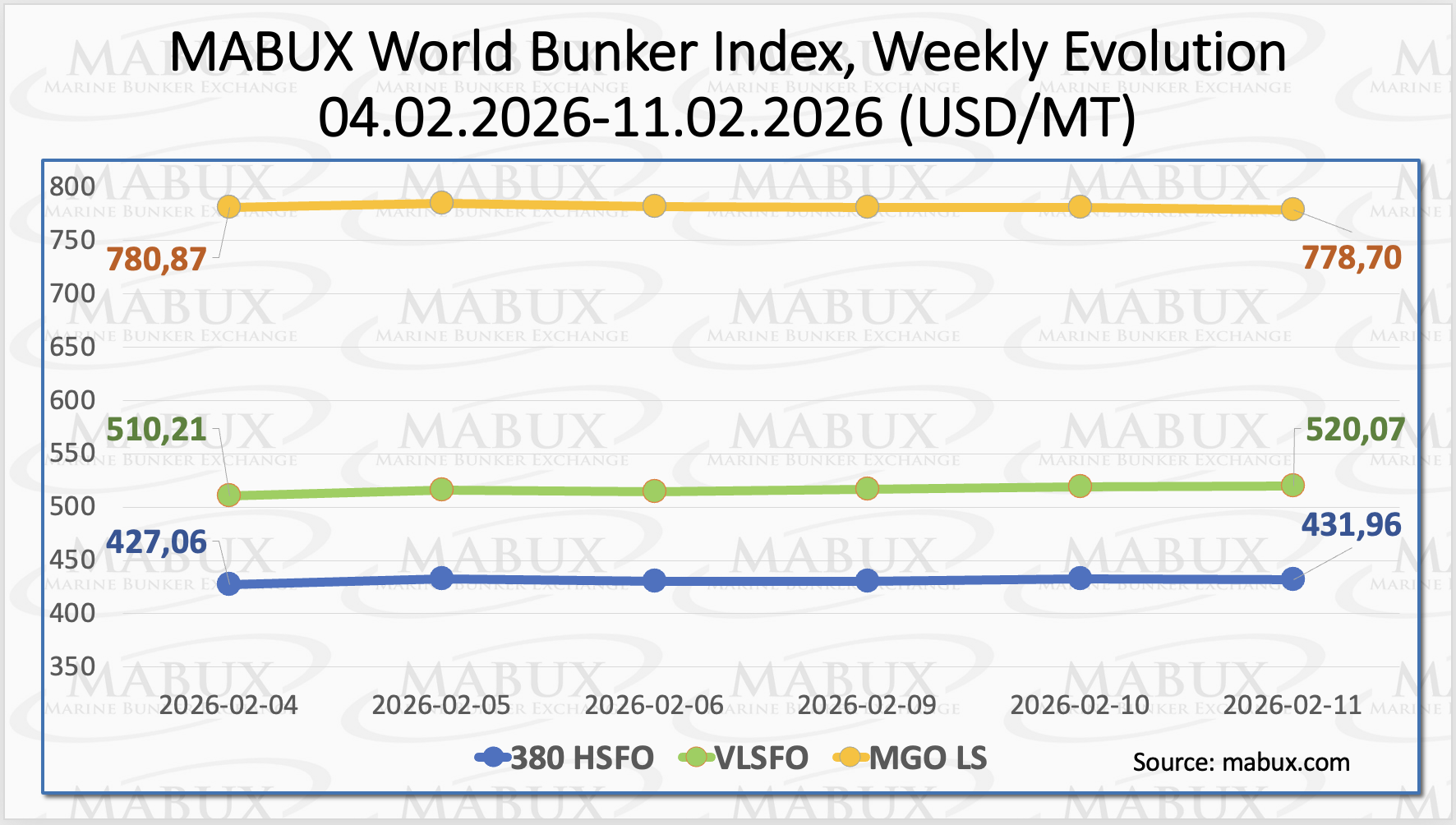

At the close of Week 07, MABUX global bunker indices continued to move in mixed directions, according to Sergey Ivanov, Director, MABUX. The 380 HSFO index rose by US$ 4.90, increasing from US$ 427.06/MT last week to US$ 431.96/MT.

The VLSFO index also recorded a gain of US$ 9.86, climbing to US$ 520.07/MT compared to US$ 510.21/MT the previous week. In contrast, the MGO LS index declined by US$ 2.17, falling from US$ 780.87/MT to US$ 778.70/MT. At the time of writing, the global bunker market was undergoing a moderate upward correction, Sergey Ivanov, Director, MABUX, said.

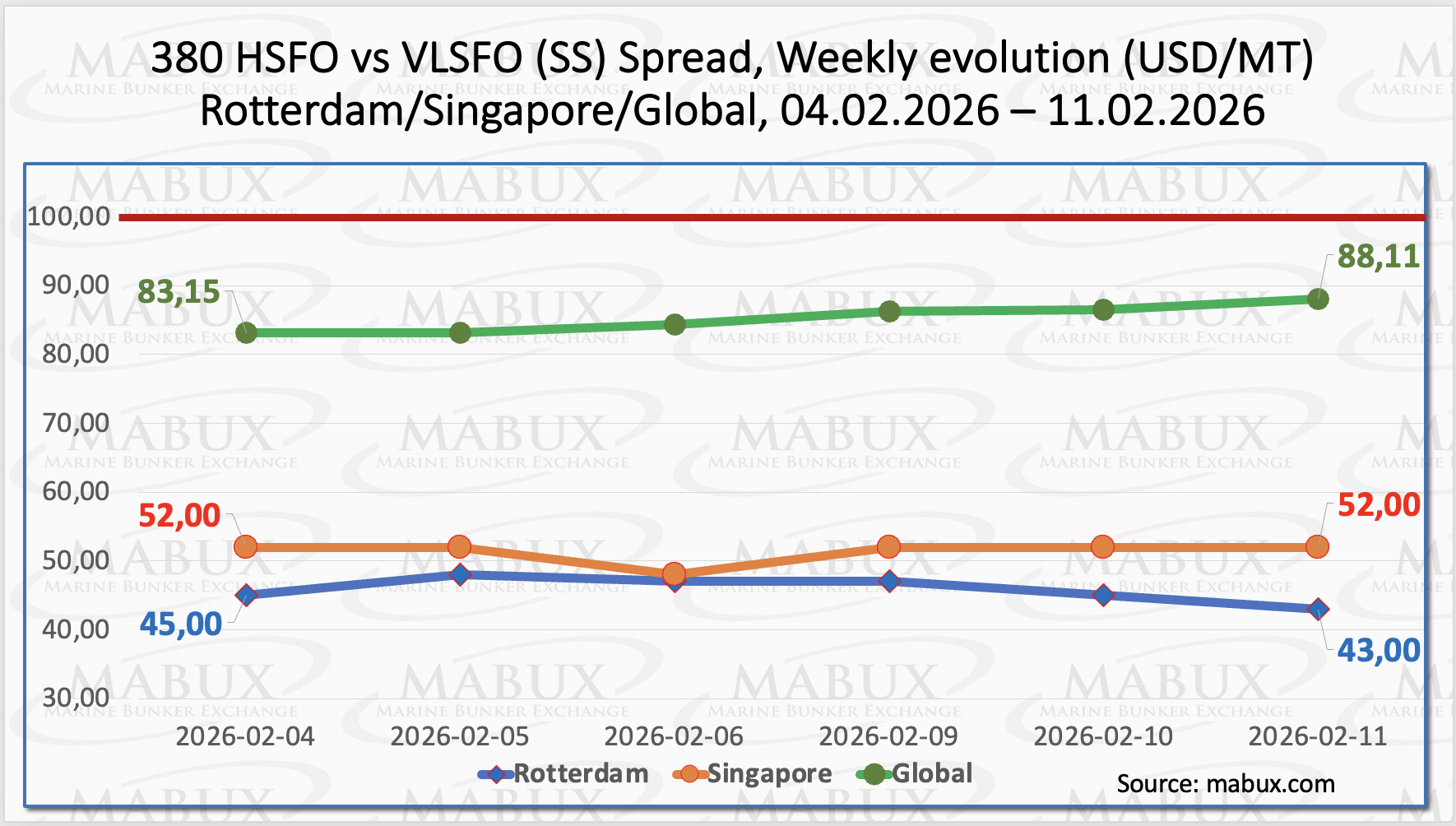

The MABUX Global Scrubber Spread (SS)—the price differential between 380 HSFO and VLSFO—continued its moderate upward movement, increasing by US$ 4.96 from US$ 83.15 last week to US$ 88.11, gradually approaching the psychological threshold of US$ 100.00 (SS Breakeven). The average weekly value of the index also rose by US$ 4.07. In Rotterdam, the SS Spread declined by US$ 2.00, narrowing to US$ 43.00 compared to US$ 45.00 the previous week. However, the port’s average weekly SS value increased by US$ 6.16. In Singapore, the price differential between 380 HSFO and VLSFO remained unchanged at US$ 52.00, while the average weekly value in the port decreased by US$ 2.50. Overall, the SS Spread dynamics at the end of the week did not demonstrate a pronounced trend. The market continues to reflect stronger economic performance for conventional VLSFO compared to the 380 HSFO + scrubber combination. ”We expect mixed SS Spread movements to persist into next week”, Sergey Ivanov, Director, MABUX, commented.

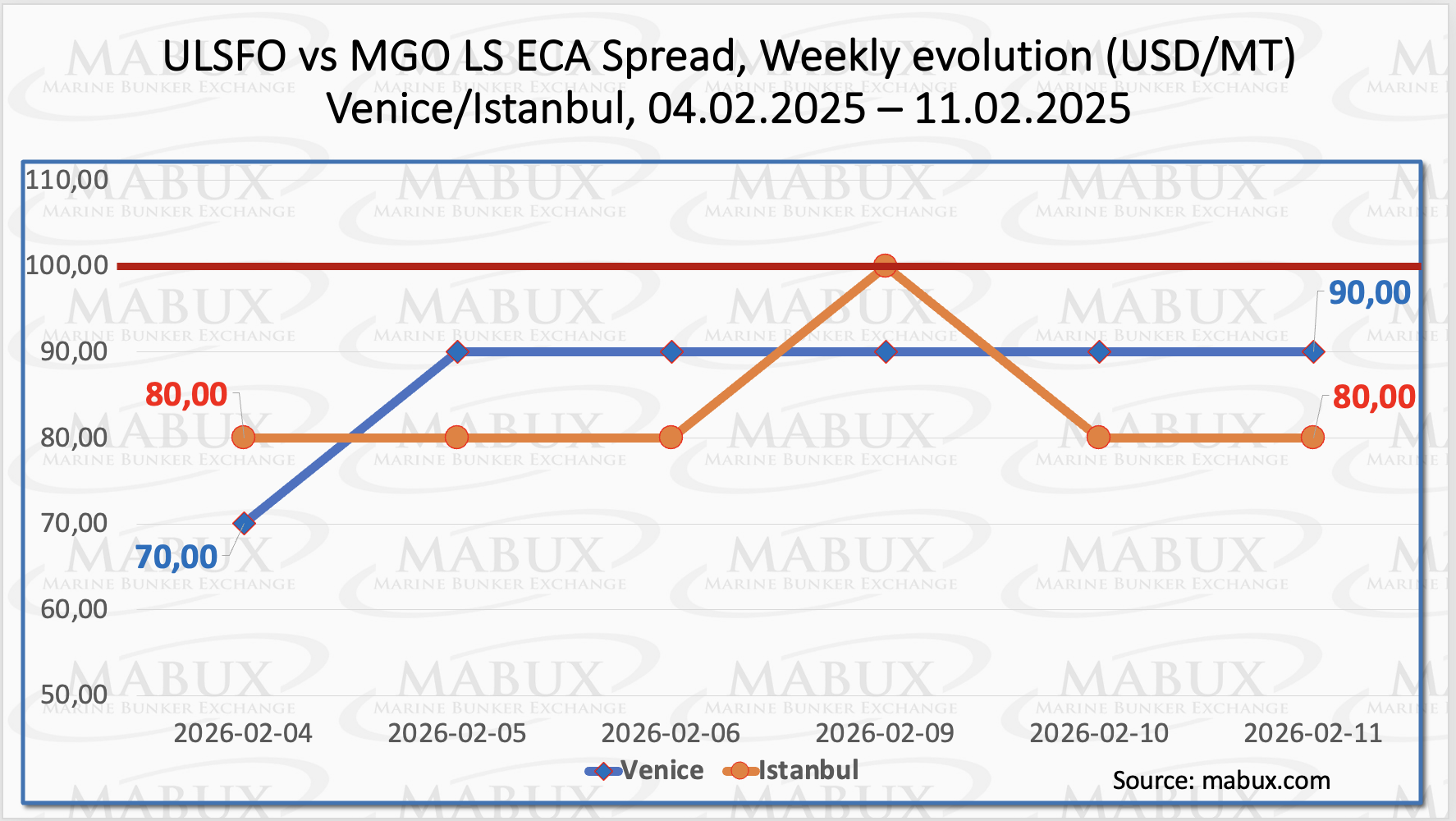

At the close of the week, the Istanbul ECA Spread (ES) remained unchanged at US$ 80.00, although it temporarily reached US$ 100.00 during the week. The weekly average increased by US$ 3.33. In Venice, the ECA Spread rose by US$ 20.00, from US$ 70.00 to US$ 90.00, while the weekly average gained US$ 9.34. Throughout the week, ES indices in both ports hovered close to the psychological threshold of US$ 100.00. ”We expect the moderate upward trend in the ECA Spread to persist into next week”, Sergey Ivanov, Director, MABUX, added.

Contrary to expectations of an LNG supply surplus this year, Italy’s energy major Eni expects the global gas market to remain relatively balanced in 2026. European demand is set to stay elevated after the winter as the region moves to replenish significantly depleted inventories, while Asian consumption is likely to recover amid softer prices. Gas withdrawals from European underground storage facilities are occurring at the fastest pace in several years, pointing to end-of-winter inventory levels at their lowest since 2022. As a result, Europe will require exceptionally high import volumes during the shoulder seasons and summer to rebuild storage to the EU-mandated 80–90% capacity by November 2026. Alongside stronger European demand, Eni also anticipates a recovery in Asian consumption, which could further constrain available supply and result in a structurally tight market balance next year, according to Sergey Ivanov, Director, MABUX.

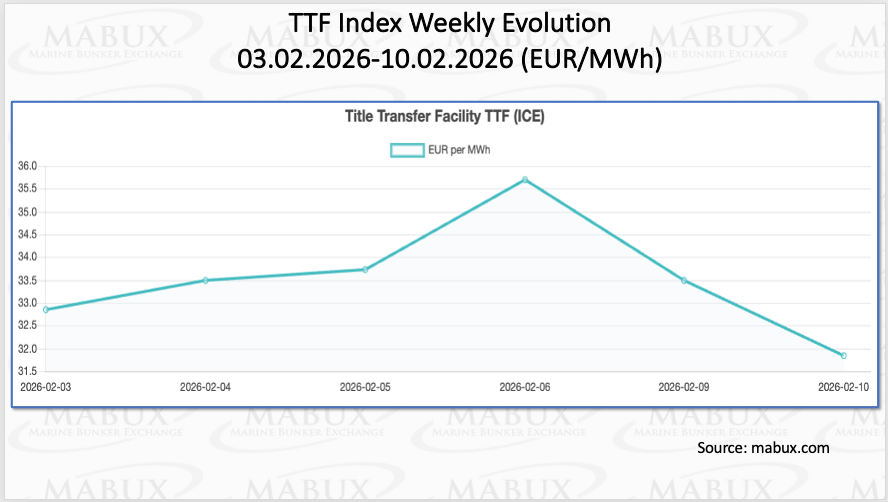

As of February 10, the level of gas reserves in European underground storage facilities continued to decline, falling to 36.13% of total capacity, down 3.73 percentage points compared to the previous week. At the same time, storage levels are already 25.33% below the level recorded on January 1, 2026 (61.46%). By the end of Week 07, the European gas benchmark TTF extended its downward movement, decreasing by 1.014 euros/MWh to 31.846 euros/MWh, compared to 32.860 euros/MWh the previous week.

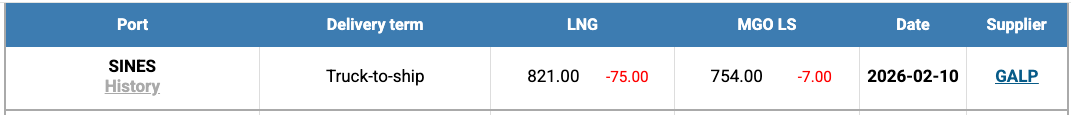

The price of LNG as a bunker fuel at the port of Sines (Portugal) continued its downward trend this week, declining by US$ 75.00 to US$ 821/MT, compared with US$ 896/MT last week. Despite the decrease, the price differential between LNG and conventional fuel remains in favor of conventional fuel, although it has narrowed to US$ 67. As of February 10, MGO LS at the port of Sines was quoted at US$ 754/MT.

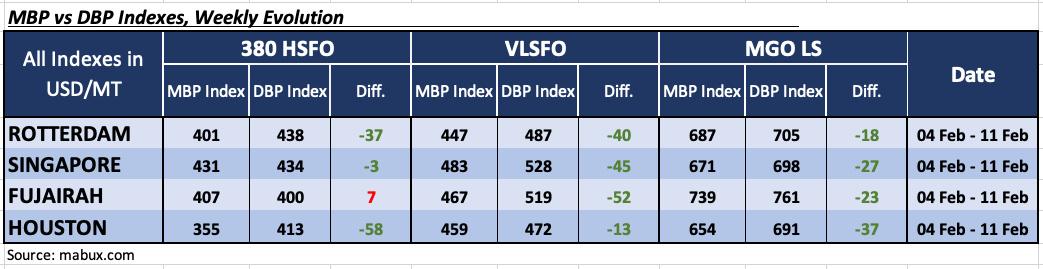

At the close of Week 07, the MABUX Market Differential Index (MDI)—the ratio of Market Bunker Prices (MBP) to the MABUX Digital Bunker Benchmark (DBP)—reflected the following trends across the world’s major hubs: Rotterdam, Singapore, Fujairah, and Houston, Sergey Ivanov, Director, MABUX, said:

• 380 HSFO segment: Fujairah moved into the overvalued zone, becoming the only overvalued port in this fuel segment, with the average weekly overvaluation increasing by 13 points. The other three ports remained undervalued. MDI levels declined by 8 points in Rotterdam, 12 points in Singapore, and 1 point in Houston. Notably, the MDIs in Singapore and Fujairah remained close to the 100% correlation mark between MBP and DBP.

• VLSFO segment: All ports continued to be undervalued. The MDI decreased by 14 points in Rotterdam and by 12 points in Singapore, while in Fujairah the index fell by 8 points. Houston’s MDI remained unchanged.

• MGO LS segment: All ports were also undervalued in this segment. The MDI declined by 16 points in both Rotterdam and Singapore, by 11 points in Fujairah, and by 9 points in Houston.

Based on the results of the past week, the balance between undervalued and overvalued ports included one—and so far the only—overvalued port: Fujairah (380 HSFO segment). At the same time, undervaluation levels across all bunker fuel segments continued to decline gradually. Although the market remains predominantly undervalued, we expect MDI indices to continue trending toward reduced undervaluation, with the potential for additional ports to shift into the overvalued zone, Sergey Ivanov, Director, MABUX, concluded. We expect bunker fuel price dynamics next week to continue reflecting mixed index movements, without the formation of a clear sustainable trend.