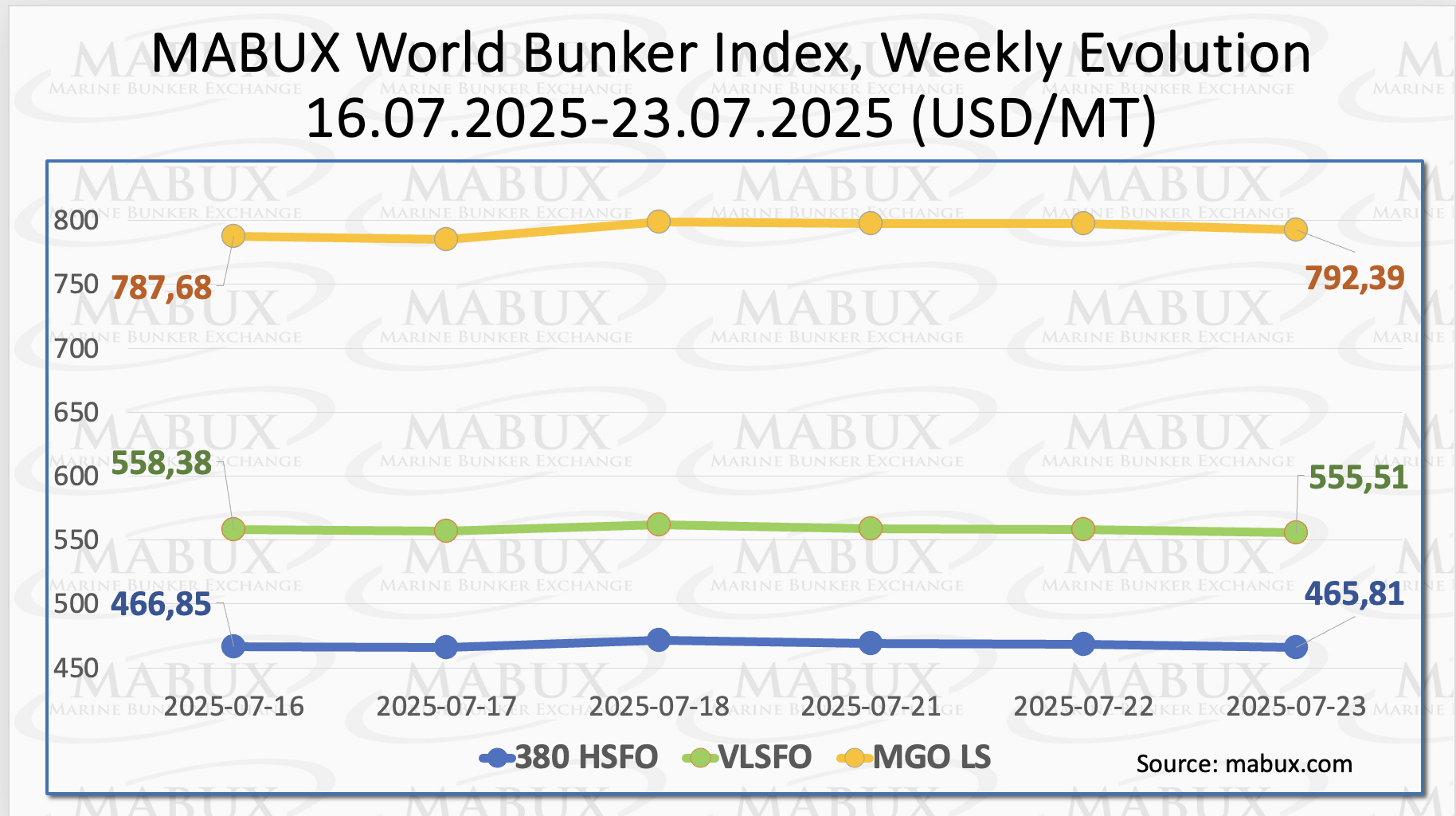

Global bunker indices tracked by Marine Bunker Exchange (MABUX) displayed mixed dynamics. The 380 HSFO index edged down by US$1.04, and remained well below the US$500.00 threshold.

The VLSFO index also saw a decline, falling by US#2.87 from US$558.38/MT to US#555.51/MT. In contrast, the MGO index rose by US#4.71.

”The global bunker market was experiencing uneven fluctuations across indices, with no distinct trend emerging,” said Sergey Ivanov, Director, MABUX.

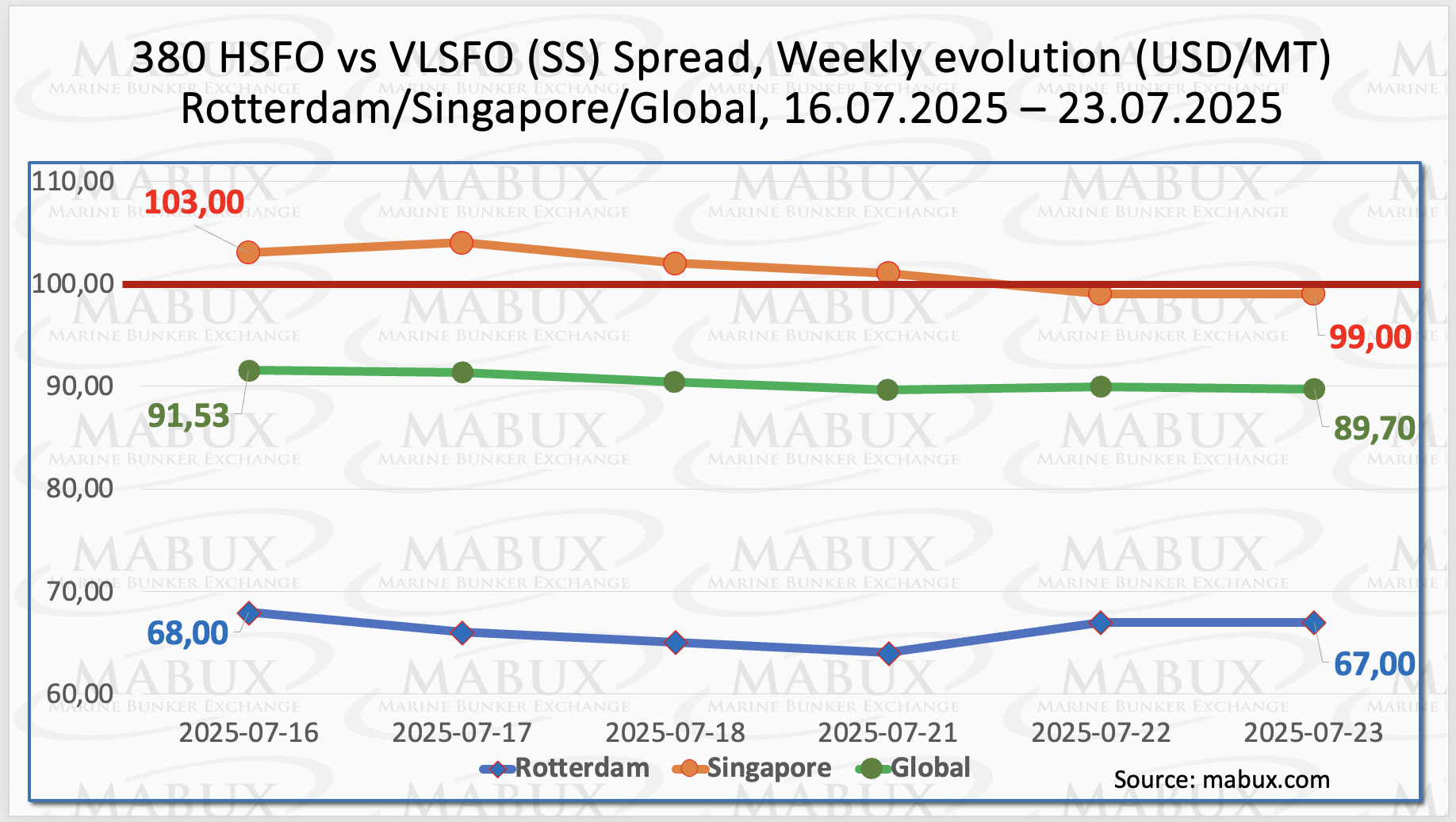

The MABUX Global Scrubber Spread (SS)—the price differential between 380 HSFO and VLSFO—continued its moderate decline, falling by US$1.83 to US$89.70 from US$91.53 last week.

The spread remains consistently below the psychological threshold of US$100.00, also known as the SS Breakeven point. The weekly average of the global SS index mirrored this decrease, also down by US$1.83.

In Rotterdam, the SS Spread slipped by US$1.00, reaching US$67.00, while the port’s weekly average saw a more pronounced drop of US$8.83. In Singapore, the 380 HSFO/VLSFO spread fell by US$4.00, dipping below the key US$100.00 level.

The weekly average in Singapore also edged down by US$1.17.

”These modest declines in SS Spread values appear to be temporary but are expected to continue into next week, suggesting the emergence of a more sustainable trend. Nevertheless, with SS values remaining under US$100.00, the use of conventional VLSFO continues to be more economically viable than the HSFO + Scrubber option”, commented Ivanov.

According to the latest data from the Joint Organizations Data Initiative (JODI), natural gas production in 58 countries declined by 4.8 billion cubic meters (bcm) in May 2025 compared to April.

The decrease was primarily driven by lower output in Russia (-3.2 bcm), the United States (-1.6 bcm), and Norway (-1.3 bcm). However, compared to May 2024, global gas production rose by 0.7 bcm, supported by increased output in China, Qatar, Nigeria, and a modest year-on-year gain in the United States.

Natural gas demand in JODI-reporting countries dropped by 12 bcm month-on-month and by 2.7 bcm year-on-year in May. This decline was attributed to relatively mild spring temperatures following the winter season. Notably, consumption fell in the US, South Korea, Japan, Turkey, and the UK. Within the EU and the UK, demand fell by 2.1 bcm compared to April, but increased by 2.8 bcm relative to May 2024.

As of July 22, European regional gas storage facilities were filled to 65.42%, reflecting an increase of 2.18 percentage points compared to the previous week. However, this level remains 5.91 percentage points lower than at the start of the year, when storage stood at 71.33%. The European Union continues its efforts to replenish gas reserves across the region.

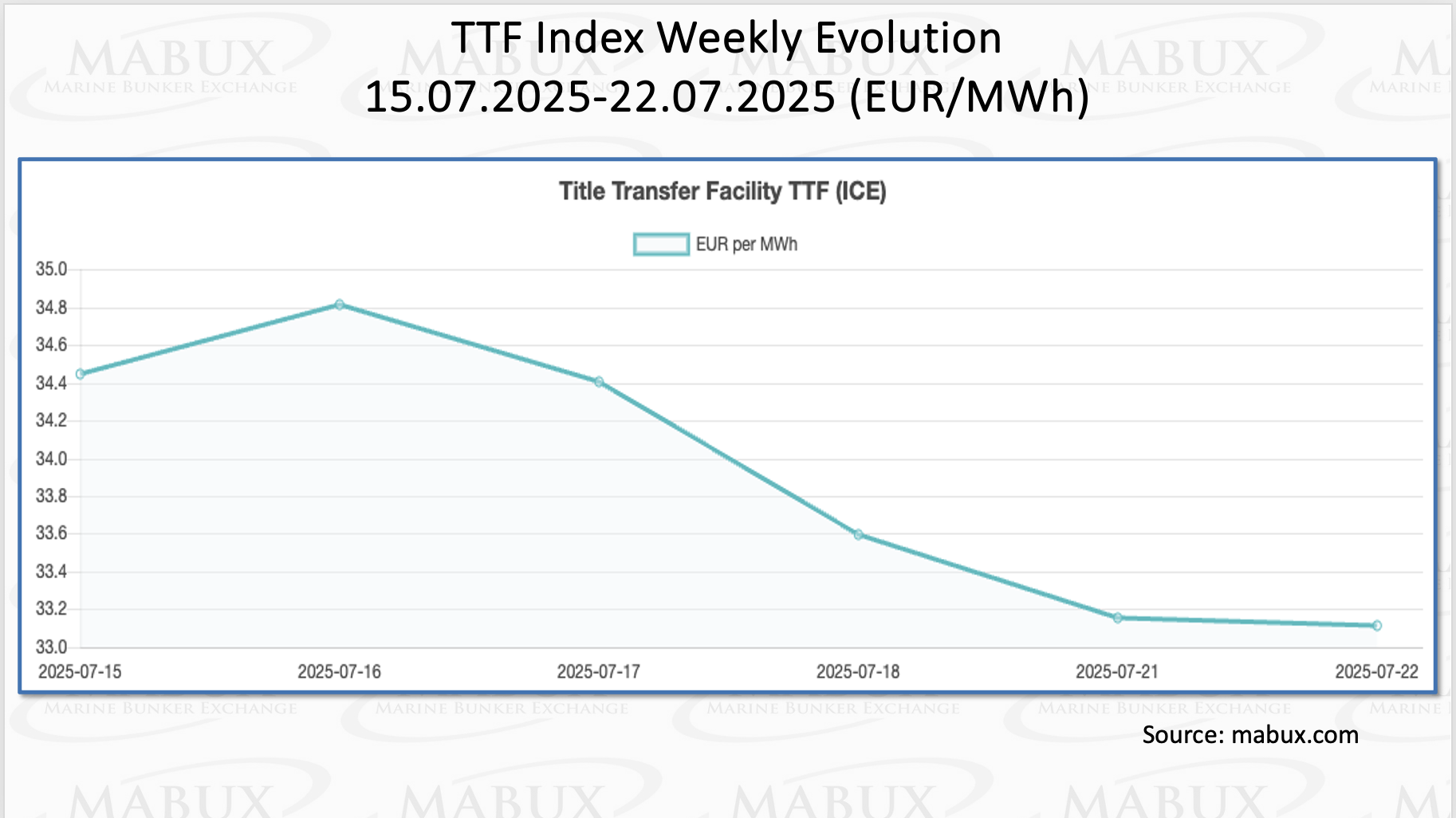

”By the end of Week 30, the European gas benchmark TTF recorded a decline of 1.334 euros/MWh, falling to 33.111 euros/MWh from 34.445 euros/MWh the previous week,” stated Sergey Ivanov, Director, MABUX.

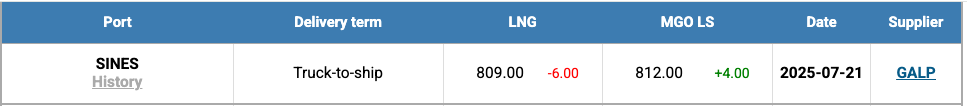

The price of LNG as a bunker fuel in the port of Sines (Portugal) declined by another US$6 over the past week, reaching US$809/MT, down from US$815/MT the previous week. Notably, the price differential between LNG and conventional fuel shifted in favor of LNG for the first time since July 29, 2024. As of July 21, the price gap stood at US$3 in favor of LNG, compared to US$7 in favor of conventional fuel the week prior. On the same day, MGO LS was quoted at US$812/MT in the port of Sines.

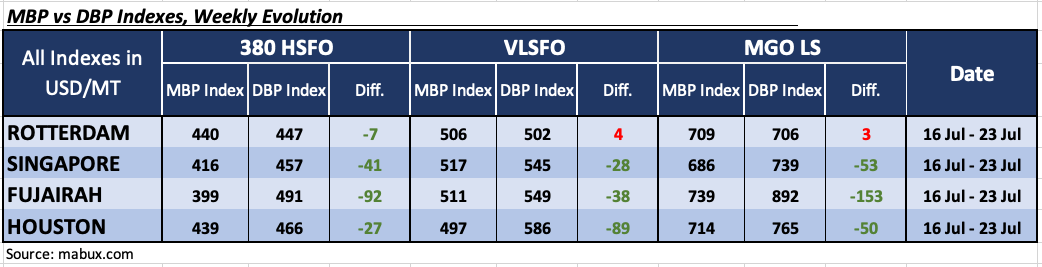

At the end of Week 30, the MABUX Market Differential Index (MDI) revealed the following weekly trends in the world’s major bunkering hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: All ports remained in the undervalued zone. MDI values in Rotterdam were unchanged from the previous week, while Singapore and Fujairah saw slight increases of 6 and 5 points, respectively. Houston, however, experienced a noticeable drop of 11 points..

• VLSFO segment: Rotterdam continued to be the only overvalued port, though its MDI index decreased by 8 points and moved very close to the 100% correlation mark between MBP and DBP. In contrast, Singapore, Fujairah, and Houston stayed in the undervalued zone. The level of undervaluation increased in Singapore and Fujairah by 5 and 2 points respectively, while Houston’s MDI declined by 4 points.

• MGO LS segment: Rotterdam shifted into the overvalued zone, making it the only overvalued port in this category, with a 3-point increase in its MDI. Meanwhile, Singapore, Fujairah, and Houston continued to be undervalued. Their MDI levels dropped by 10, 13, and 3 points, respectively, with Fujairah’s MDI remaining steadily above the US$100.00 mark.

”Overall, during the week, Rotterdam entered the overvalued category in both the VLSFO and MGO LS segments. Despite this movement, the broader global market remains dominated by a trend of undervaluation in bunker fuel prices. Based on current patterns, it is expected that the present MDI dynamics will likely continue into the next week,” said Ivanov.

Lastly, Ivanov added that the global bunker market continues to shape a sustainable trend and they anticipate that moderate and mixed movements will dominate the dynamics of bunker indices in the coming week.