Hawaii-headquartered shipping company Matson has ordered three new 3,600 TEU container vessels at Philly Shipyards, via its subsidiary carrier, Matson Navigation Company.

Matson and US-based Philly Shipyards signed a contract, according to which the cost for the three Aloha Class container ships will be US$1 billion.

The first vessel is expected to be delivered in the fourth quarter of 2026 with subsequent deliveries in 2027.

The new vessels will join two Aloha Class ships previously built for Matson by Philly Shipyard that entered service in 2018 and 2019, respectively.

Like their sisterships, the new vessels will be equipped with dual fuel engines that are designed to operate on either conventional marine fuels or liquefied natural gas (LNG), as well as other “green ship technology” features, such as a fuel-efficient hull design and environmentally safe double hull fuel tanks and freshwater ballast systems.

Matson said that while the earlier ships require some modification to operate with LNG, the new vessels will be delivered LNG-ready.

“Our existing Aloha Class ships are among the fastest, most efficient vessels in the Matson fleet,” pointed out Matt Cox, chairman and CEO of Matson.

He went on to add, “These new Jones Act compliant vessels will be built specifically for our China-Long Beach Express service, and like their sisterships, are expected to help Matson achieve its 2030 greenhouse gas emissions reduction goal while also providing additional capacity and speed benefitting our Hawaii service as well as the CLX.”

The Aloha Class vessels are the largest container ships ever built in the United States and are designed to operate at speeds in excess of 23 knots.

“We are proud of the six vessels previously delivered to Matson, and are again ready to execute and deliver this important project,” commented Steinar Nerbovik, Philly Shipyard president and CEO.

The three new Aloha Class ships will replace three vessels currently deployed on Matson’s China-Long Beach Express (CLX) service, which will in turn replace three older vessels currently deployed in its Alaska service.

Matson expects to finance the new vessels with cash currently in the Capital Construction Fund and through cash flows from operations, borrowings available under the company’s unsecured revolving credit facility and additional debt financings.

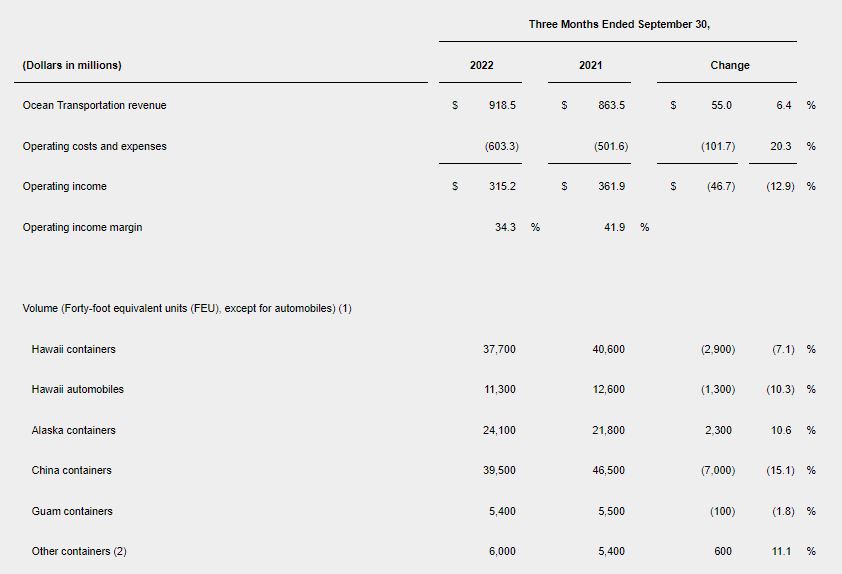

Meanwhile, Matson reported a net income of US$266 million for the third quarter of the year, translating to a decrease of approximately US$17 million from the same period in 2021. Additionally, the company’s total revenue for the third quarter surpassed US$$1.1 billion, compared to around US$1 billion in 2021 Q3.

Cox said the new container ships will bring additional capacity to the CLX service, which is expected to be a “meaningful contributor” to profit, operating income and earnings before interest, taxes, depreciation, and amortization (EBITDA).

During the third quarter of the year, Matson has seen a drop in its container volumes on a year-over-year FEU basis, as seen in the following table: