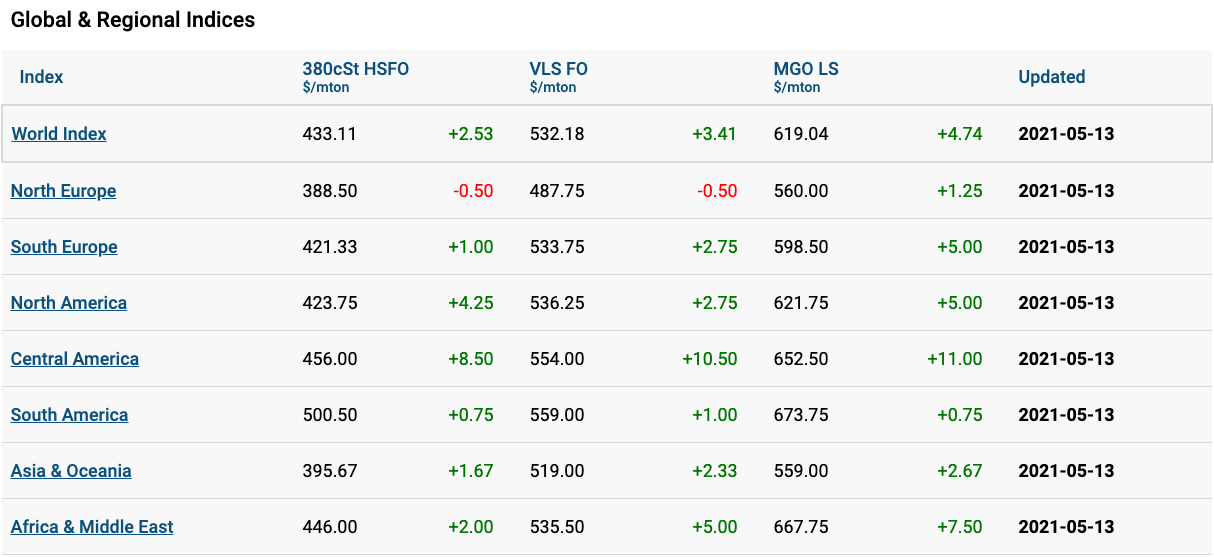

The Marine Bunker Exchange’s (MABUX) World Bunker Index has shown a steady process without any drastic changes in values during the 19th week of the year.

In the first instance, 380 HSFO index rose slightly to US$433.11/mt, VLSFO Index increased to US$532/mt, while the MGO Index climbed to US$618.86/mt.

Simultaneously, the MABUX ARA (Amsterdam-Rotterdam-Antwerp) LNG Bunker Index, available from 29 April and calculated as an average price of LNG as marine fuel in the ARA region, rose on the 19th week and showed a weekly average of US$565.84/mt.

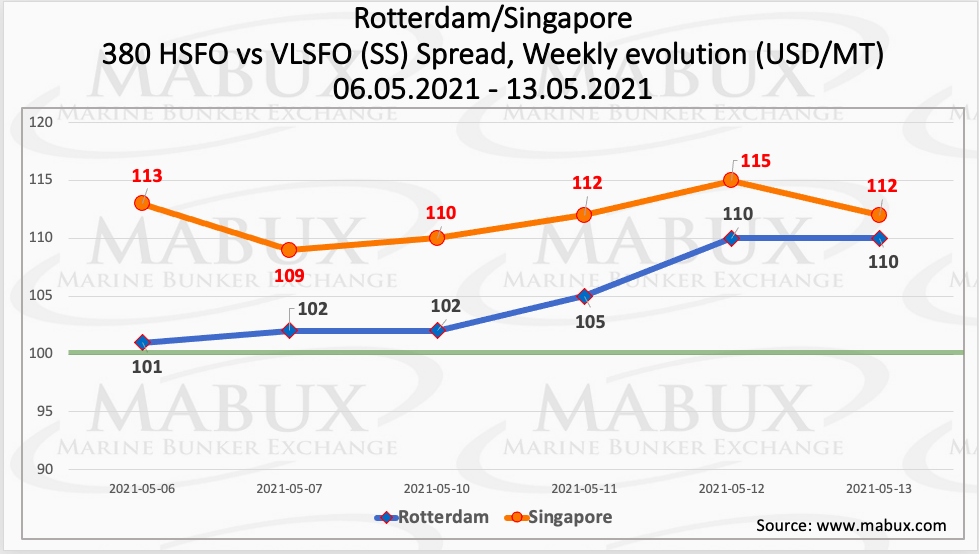

In the meantime, the average Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – widened modestly to US$97.95 and came much closer to the US$100 key point.

Moreover, SS in Rotterdam has widened during the week and now its average mark is staying at US$105, while in Singapore, SS has lost US$1 and has reached US$111.83.

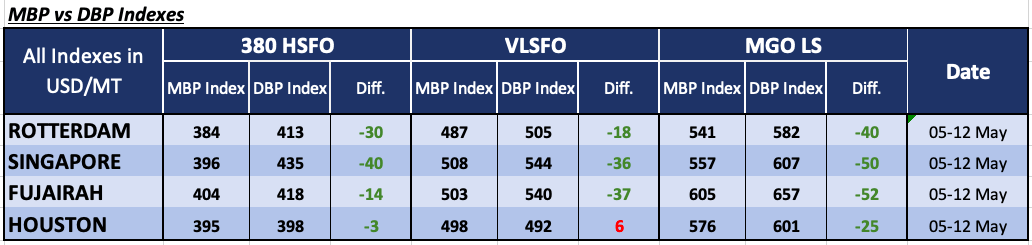

Furthermore, the correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs showed this week that 380 HSFO fuel was still undercharged in all four selected ports ranging from US$3 at Houston and US$14 at Fujairah up to US$30 in Rotterdam and US$40 in Singapore, with the margin of the underestimation not having any significant fluctuations.

Meanwhile, the situation with VLSFO bunker prices, according to MABUX DBP Index, practically has not changed as well: underpricing in Rotterdam by US$18, in Fujairah by US$37, in Singapore by US$36, while in Houston, VLSFO remained overcharged by US$6.

Last but not least, MABUX DBP Index also registered undercharge of MGO LS in all selected ports ranging from US$25 in Houston up to minus US$50 in Singapore and US$52 in Fujairah.