The major ocean carriers reported a combined EBIT (Earnings Before Interest and Taxes) of US$17.06 billion for the third quarter of 2024, marking a 600% year-over-year increase.

Sea-Intelligence noted that this growth excludes ZIM, which reported a one-time non-cash impairment loss of US$2.06 billion in Q3 2023, as including this would artificially inflate the year-over-year comparison.

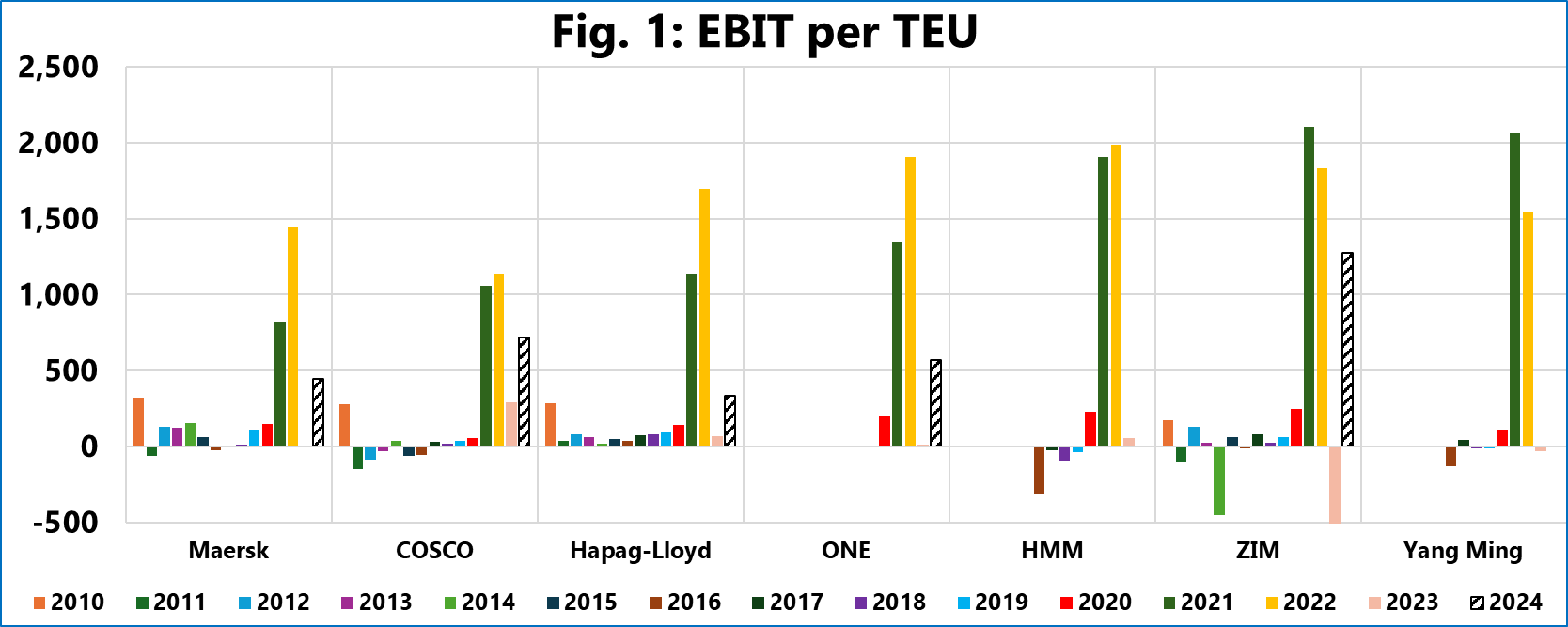

Of these nine reporting carriers, eight have reported EBIT of over US$1 billion, of which three have reported EBIT of over US$2 billion. Chinese shipping giant COSCO had the highest 2024-Q3 EBIT of US$4.71 billion. Even with the highest EBIT, COSCO did not have the highest EBIT/TEU as they also grew their global volumes by 10.8%. Their EBIT/TEU of US$716/TEU was surpassed by ZIM’s EBIT/TEU of US$1,273/TEU. COSCO was followed by ONE (US$567/TEU) and Maersk (US$446/TEU).

“Given these results, it seems as though the market is in a conflicted state,” pointed out Alan Murphy, CEO of Sea-Intelligence.

Murphy added, “While this is clearly not pandemic-level profitability, it is also higher than any ‘normal’ Q3. It seems as if the current supply chain disruptions have jolted the market enough to drive up freight rates, increase volumes (only partially in Asia-Europe), and substantially increase carrier profitability to a level not seen across the pre-pandemic decade, but not enough to increase these figures to the highs seen during 2021-2022.”