A.P. Moller-Maersk delivered strong financial results in 2024, achieving growth across all segments and significantly improving profitability.

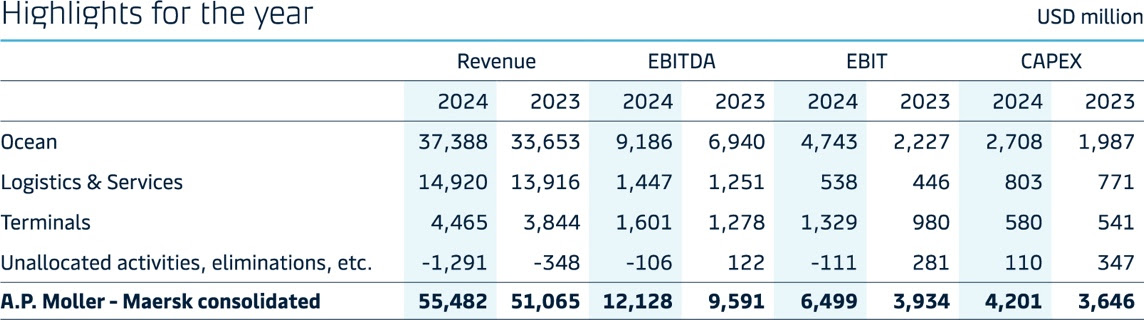

The company’s earnings before interest and taxes (EBIT) surged by 65% to US$6.5 billion, driven by higher container demand, elevated freight rates in the ocean sector, top-line and volume growth in the terminals segment, and solid performance in most logistics & services products.

Additionally, the Danish shipping giant achieved growths in both revenues and earnings before interest, taxes, depreciation and amortization (EBITDA), reaching US$55.5 billion and US$12.1 billion respectively.

In light of these strong results and a robust balance sheet, the Board of Directors has proposed a dividend of DKK1,120 (around US$155) per share and announced a share buyback program of up to US$2 billion over 12 months. The company’s stock price today (6 February) stands at DKK11,980 (around US$1,660).

“Our ability to navigate shifting circumstances and ensure steady supply chains for our customers was put to the test throughout 2024,” said Vincent Clerc, CEO of Maersk.

He added: “Our efforts were rewarded with record-high customer satisfaction. We successfully capitalized on increased demand while enhancing productivity and rigorously managing costs — all of which contributed to our strong financial performance. With three strong businesses — Ocean, Logistics & Services, and Terminals — plus integrated offerings across the supply chain, we are uniquely positioned to support our customers in an era where geopolitical changes and disruptions continue to reinforce the need for resilient supply chains.”

The Ocean segment saw improved profitability compared to the previous year, benefiting from a substantial increase in freight rates due to heightened demand and disruptions in the Red Sea. Strong utilization rates and cost discipline helped streamline operations, mitigating uncertainties. Operational costs remained stable year-over-year, balancing increased expenses and additional bunker consumption due to rerouting around the Cape of Good Hope.

Logistics & Services demonstrated resilience in 2024, showing steady momentum each quarter. This resulted in volume growth, higher revenue, and an improved EBIT margin compared to 2023. Revenue increased by 7%, driven by strong performance in Warehousing, Air, and First Mile product categories, while profitability improved across most service lines.

Terminals achieved record-breaking financial results in 2024, with EBITDA and EBIT reaching all-time highs. This success was fueled by strong volume growth, inflation offsetting tariff increases, a more favourable customer and product mix, and higher storage revenue.

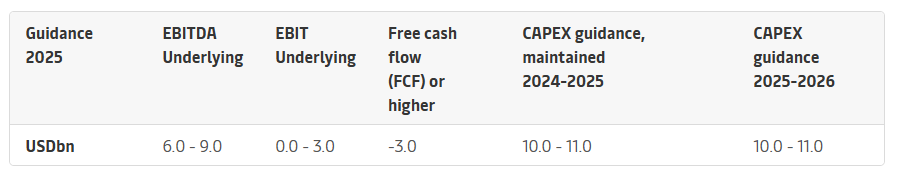

For 2025, Maersk anticipates global container volume growth of around 4% and expects to expand in line with the market. The financial guidance assumes that the Red Sea will reopen by mid-year for the lower end of the outlook and by year-end for the upper end. However, Maersk’s 2025 outlook remains subject to macroeconomic uncertainties affecting container volumes and freight rates.

In 2024, Maersk returned US$1.6 billion to shareholders through dividends and share buybacks. Additionally, the demerger and spin-off of Svitzer provided shareholders with US$1.1 billion via a dividend in-kind.

In February 2024, the Board of Directors opted to suspend the share buyback program, with plans to reassess its re-initiation once market conditions in Ocean stabilize. However, the Board has now approved the launch of a new share buyback program of up to approximately US$2 billion, set to be executed over the next 12 months.