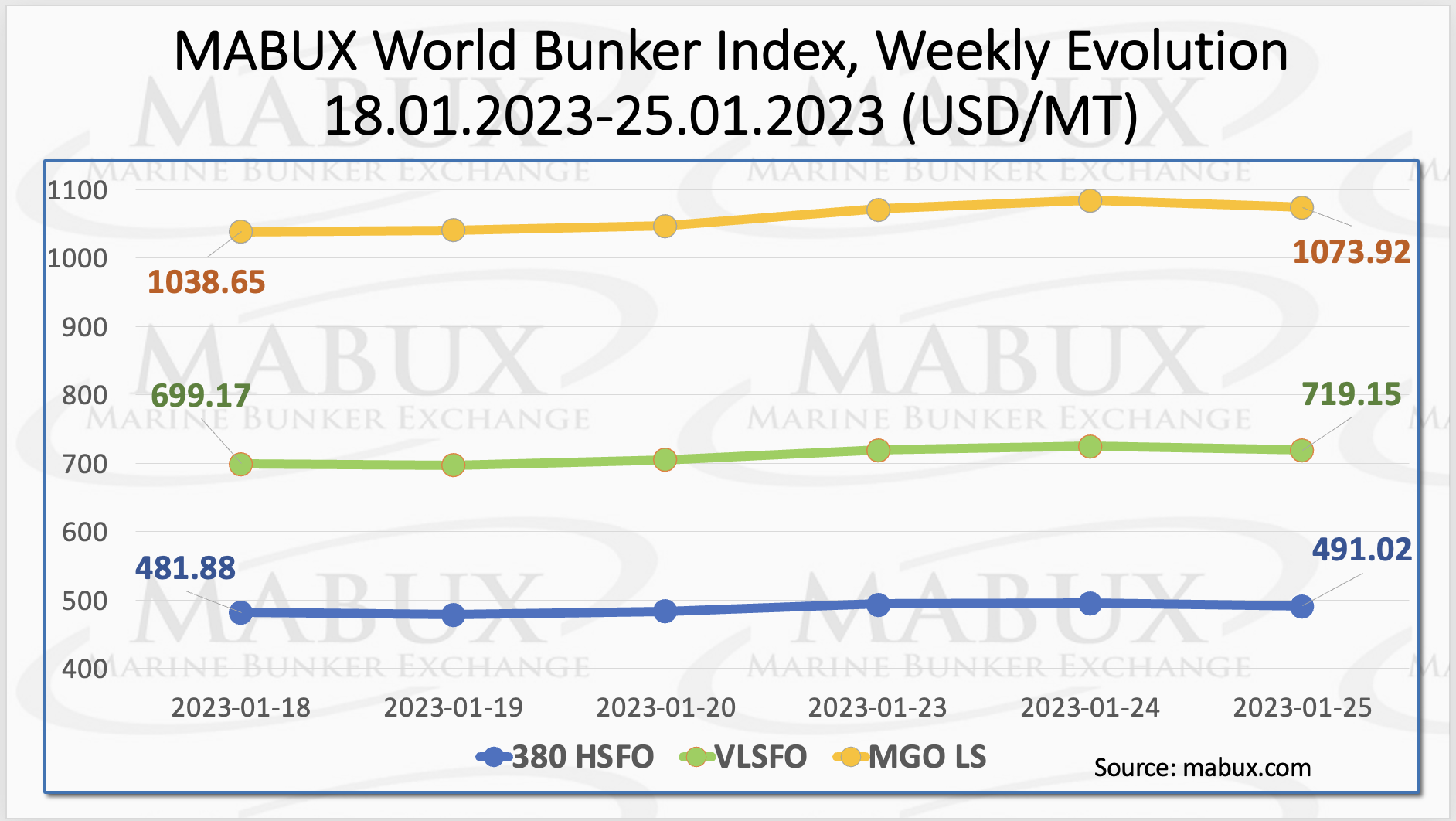

Over the fourth week of the year, Marine Bunker Exchange (MABUX) global bunker indices continued a sustainable upward trend.

The 380 HSFO index rose by US$9.14 to US$491.02/MT, the VLSFO index added US$19.98 USD reaching US$719.15/MT and the MGO index also increased by US$35.37 to US$1,073.92/MT.

“At the moment, the global bunker market retains the potential for a further uptrend,” commented a MABUX official.

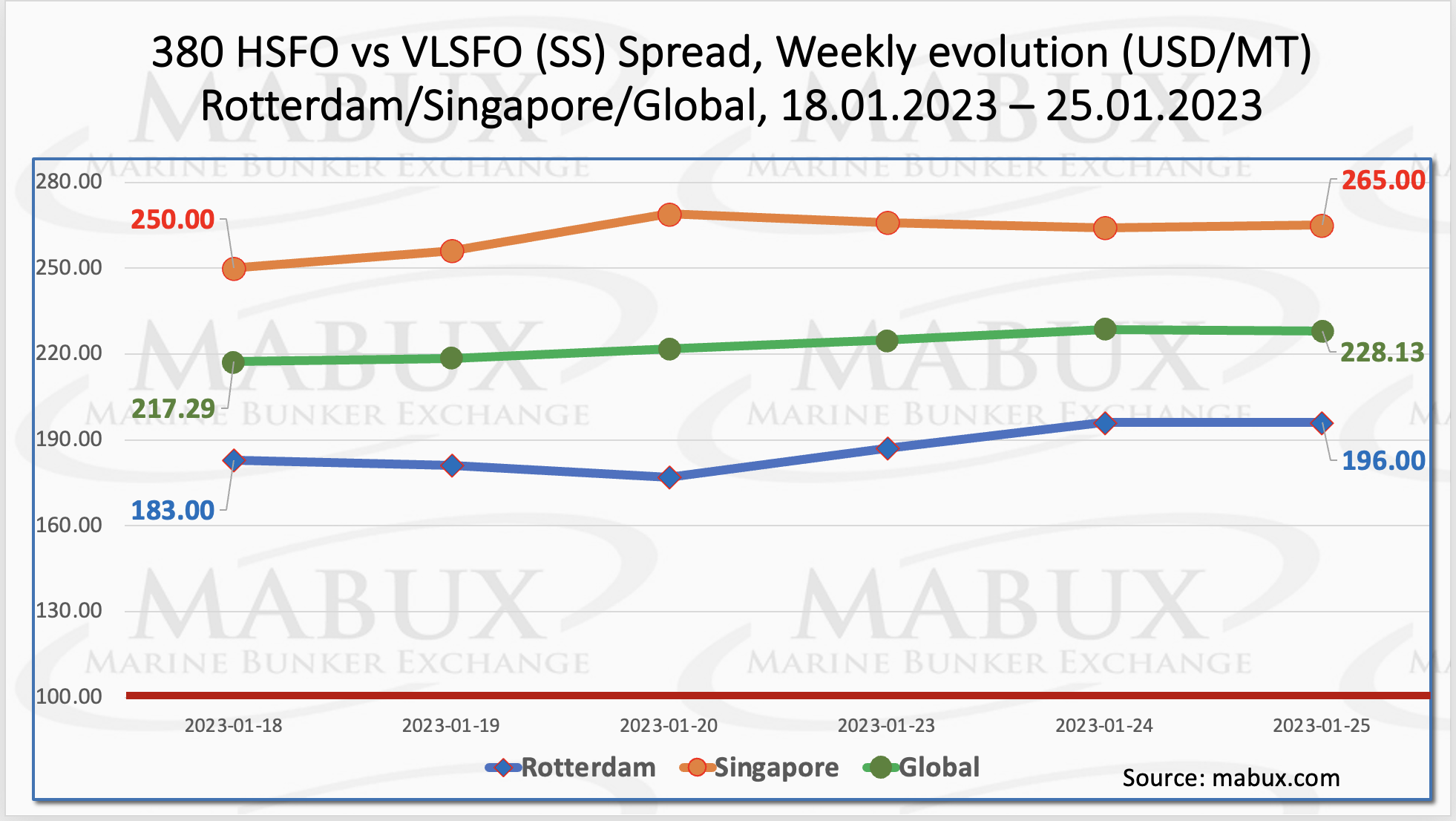

Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – continued widening over the last week – plus US$10.84 climbing to US$228.13.

In Rotterdam, SS Spread rose by US$13 to US$196. In Singapore, the price differential of 380 HSFO/VLSFO increased by US$15 to US$265. The SS Spread weekly averages in Rotterdam and Singapore also added US$8.67 and US$26.50 respectively.

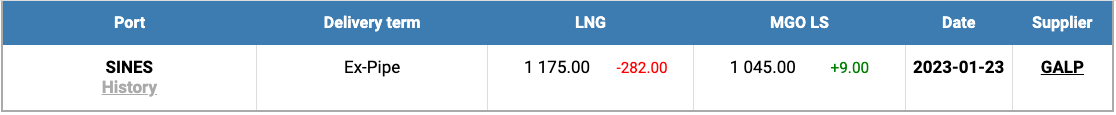

Europe’s natural gas prices had slumped to the level last seen before the conflict in Ukraine. As MABUX analysts comment, mild weather, ample volumes of gas in storage sites—well above the five-year average for this time of the year—and continued LNG imports have dragged gas prices lower in recent weeks.

The price of LNG as bunker fuel at the port of Sines in Portugal continued to decline for the seventh week in a row and reached US$1,175/MT on 23 January. The price difference between LNG and conventional fuel on the same date was US$130. The MGO LS at the port of Sines was quoted at US$1,045/MT that day.

MABUX official said, “it is expected that the trend towards a further narrowing of the price difference between LNG and conventional fuel will continue next week.”

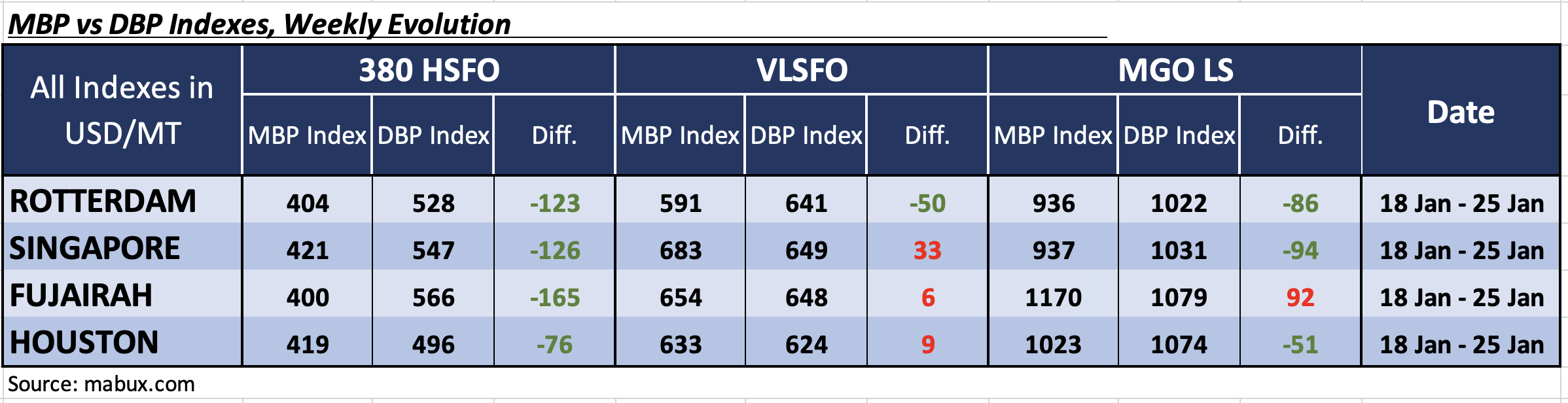

Moreover, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered an underestimation of 380 HSFO fuel in all four selected ports. Underprice ratio rose slightly and reached the following levels, in Rotterdam – minus US$123, Singapore minus US$126, Fujairah minus US$165 and Houston minus US$76.

In the VLSFO segment, according to the MDI, Fujairah moved into the overprice zone and joined Singapore and Houston. Fuel overprice margins were registered as plus US$6, plus US$33, and plus US$9, respectively. Thus, at the moment, Rotterdam remains the only port where VLSFO is underpriced, minus US$50.

In the MGO LS segment, the only overvalued port is still Fujairah, plus US$92. The overprice premium there is gradually decreasing. In all other ports, the MDI registered an underpricing of MGO LS, Rotterdam – minus US$86, Singapore – minus US$94 and Houston – minus US$51. The underprice ratio continued to grow moderately.

“The global bunker market retains growth potential ahead of the implementation of the EU ban on Russian oil products set to come into force on 5 February. We expect bunker prices to continue their uptrend next week,” commented Sergey Ivanov, director of MABUX.