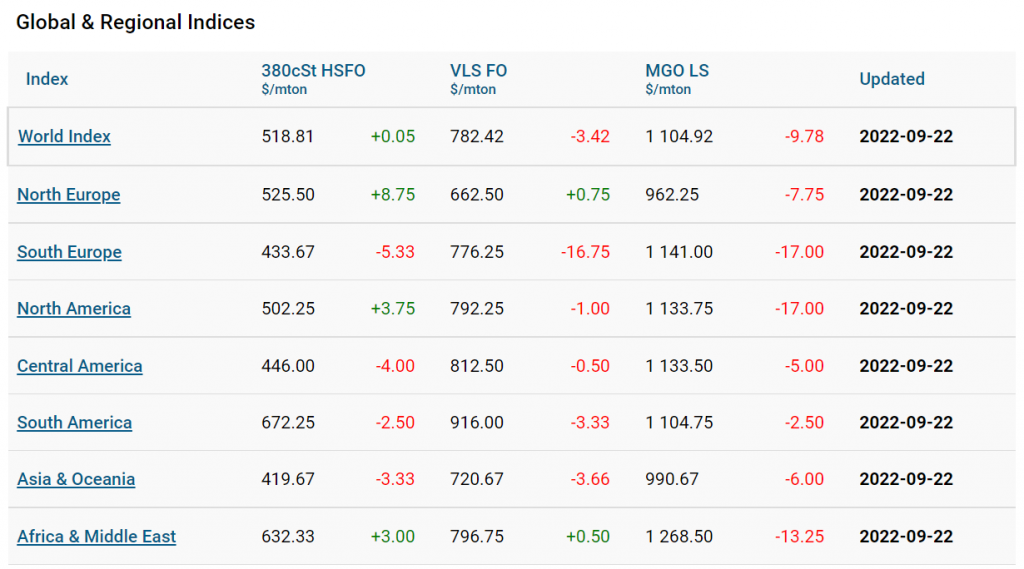

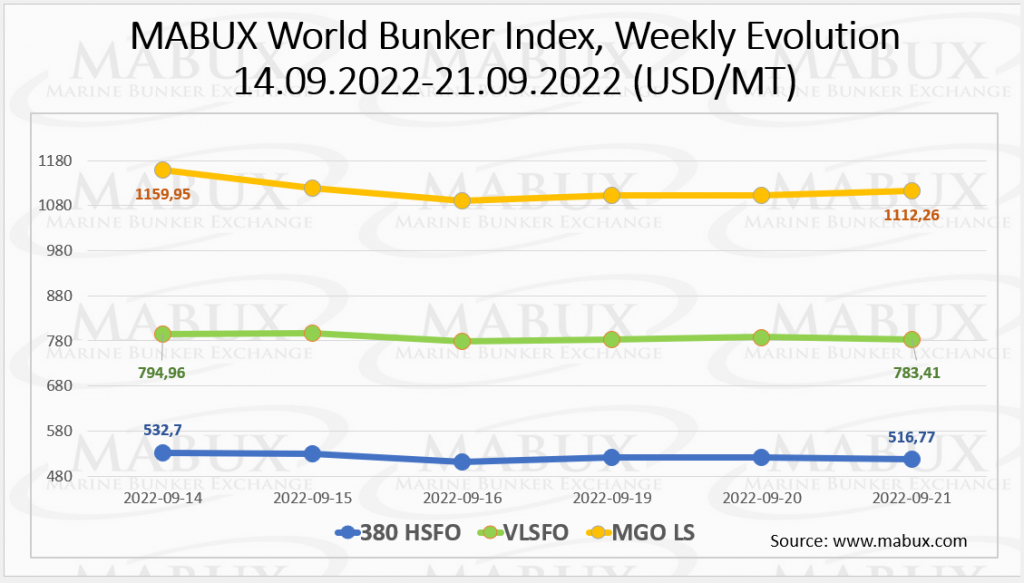

Over Week 38, Marine Bunker Exchange (MABUX) global bunker indices continued moderate sliding downward with the 380 HSFO index falling to US$516.77/MT, the VLSFO index decreasing to US$783.41/MT and the MGO index dropping to US$1,112.26/MT).

The Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – continued to increase over Week 38 reaching US$266.64. In Rotterdam, the average SS Spread declined to US$241 and in Singapore, the average weekly price differential of 380 HSFO/VLSFO increased to US$286.83.

MABUX analysts noted that “the indicators of the Global SS Spread and the values of SS Spread in the largest hubs are practically at the same level.”

Gas prices are now down by nearly 50% from their peak earlier in the summer, when Russia’s decision to stop all gas flows through the Nord Stream 1 pipeline due to repair works triggered fears of widespread rationing across the continent. Russian imports typically account for 40% of the European total, but they are currently running at less than 10% of imports, reflecting European success in sourcing alternative gas over recent months, largely in the form of LNG.

Meanwhile, price for LNG as a bunker fuel at the port of Sines in Portugal fell on 19 September to US$3,324/MT. LNG prices are still nearly three times higher than the most expensive type of traditional bunker fuel: the price of MGO LS at the port of Sines was quoted on 21 September at US$1,114/MT.

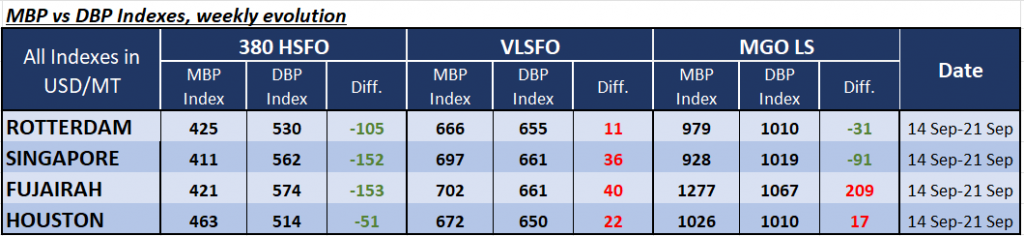

Over Week 38, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed an underpricing of 380 HSFO fuel grade in all four selected ports. The underestimation margins continued to grow and amounted for: Rotterdam – minus US$105, Singapore – minus US$152, Fujairah – minus US$153 and Houston – minus US$51.

VLSFO fuel grade, according to MDI, remained, on the contrary, overpriced in all selected ports: plus US$11 in Rotterdam, plus US$36 in Singapore, plus US$40 in Fujairah and plus US$22 in Houston. “In this fuel segment, the MDI index did not have any firm dynamics, the overprice premium down all ports except Singapore,” commented MABUX.

In the MGO LS segment, MDI registered overpricing in two ports out of four selected over Week 38: Fujairah – plus US$209 and Houston – plus US$17. In Rotterdam and Singapore, MGO LS fuel remained undervalued: minus US$31 and minus US$91.

“MDI index increased for all selected ports except Singapore,” pointed out MABUX.

Anastasia Pervova, Marketing analytic of MABUX, said, “The global bunker market is still in a state of high volatility. At the same time, in the market, there are premises for turning price indexes into upward deviation.”