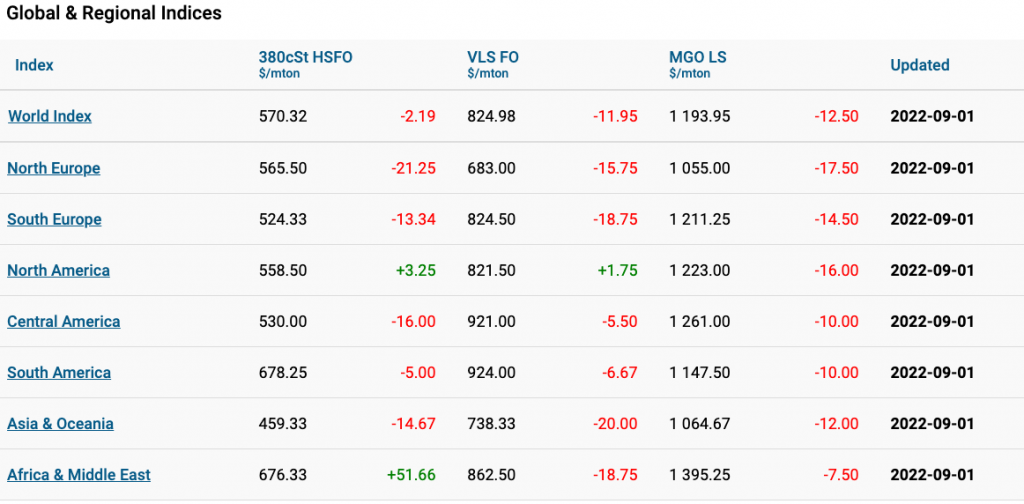

“Over the Week 35 MABUX global bunker indices continued slight irregular changes with no firm trend,” noted Sergey Ivanov, director of Marine Bunker Exchange (MABUX).

The 380 HSFO index dropped by US$24.39 from US$600.21/mt last week. The VLSFO index also lost US$20.21 reaching US$835.99/mt. The MGO index, on the contrary, added US$1.25 from US$1,204.13/mt.

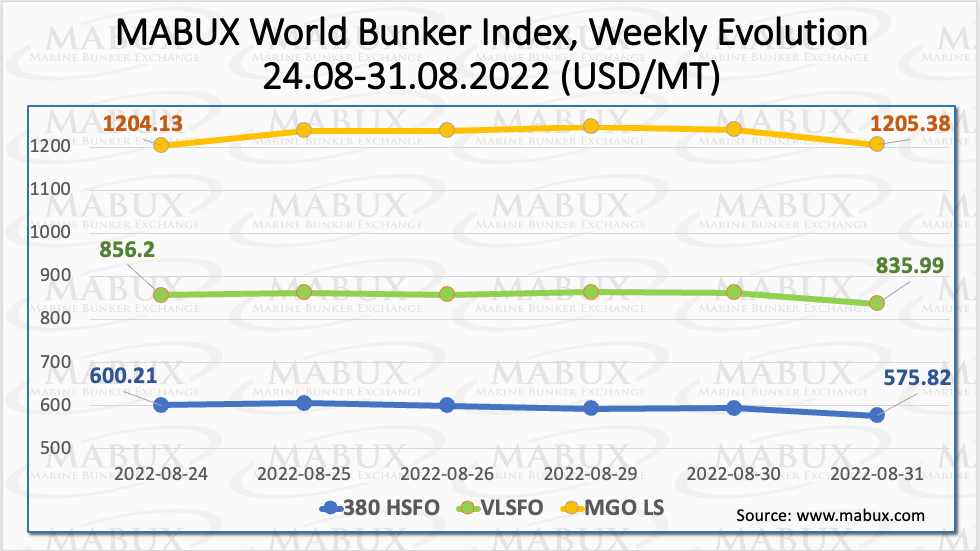

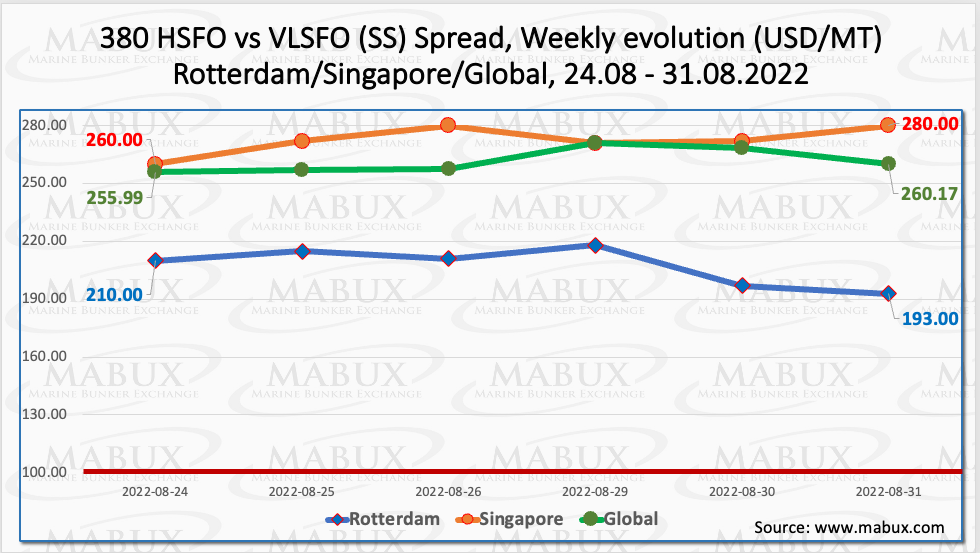

The Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – has started to rise again after dropping for six straight weeks – plus US$15.67 (vs US$246.12 last week). In Rotterdam, the average SS Spread decreased slightly to US$207.33 (vs US$208.83). In Singapore, the average weekly price differential of 380 HSFO/VLSFO showed an uptrend: plus US$32.17 (vs US$240.33 last week).

“At the moment there is not a firm trend of SS Spread in the Global bunker market,” Ivanov continued.

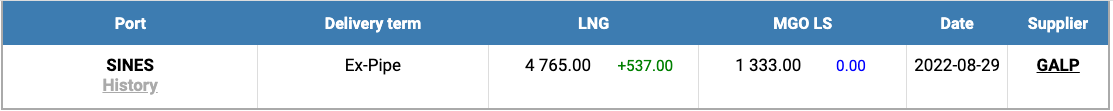

“Benchmark power prices in Europe are breaking records, as natural gas supply from Russia continues to be limited ahead of the winter. The EU energy ministers are set to hold an emergency meeting to discuss the crisis on 9 September in Prague,” he highlighted. LNG as a bunker fuel at the port of Sines (Portugal) rose on 29 August by another US$537/mt (vs US$4228/mt a week earlier) – a record price level. LNG price index is more than three times the cost of the most expensive conventional fuel grade: MGO LS was quoted at US$1,333/mt in the port of Sines on 29 August.

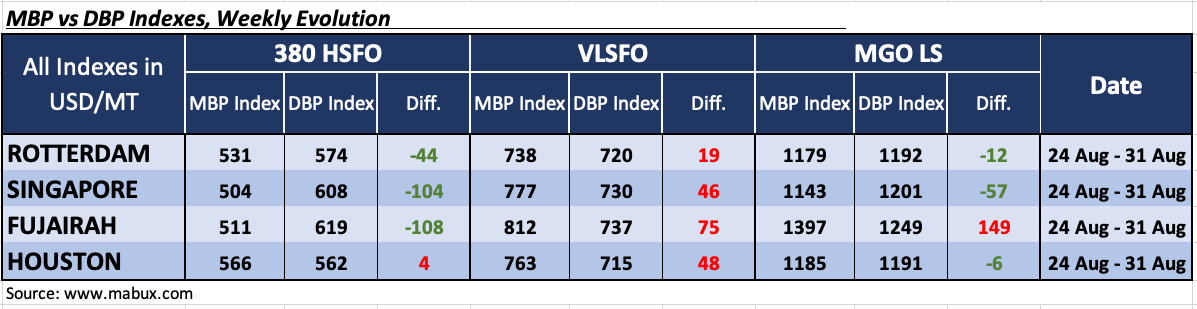

Over the Week 35, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed an undervaluation of 380 HSFO fuel in three of the four selected ports: Houston remains the only overestimated hub: plus US$4. In other ports, the underpricing premium grew moderately and amounted to: Rotterdam – minus US$44, Singapore – minus US$104 and Fujairah – minus US$108.

VLSFO fuel grade, according to MDI, remained, on the contrary, overpriced in all four selected ports: plus US$19 in Rotterdam, plus US$46 in Singapore, plus US$75 in Fujairah and plus US$48 in Houston. All ports demonstrated a downward trend in overcharge margins.

As for MGO LS, MDI index registered an overestimation of this fuel grade in only one port: Fujairah – plus US$149. In other ports, MGO LS fuel remained underestimated: Rotterdam – minus US$12, Singapore – minus US$57 and Houston – minus US$6. The overcharge ratio in Fujairah fell by 56 points over the week. The underpricing grew slightly in Rotterdam and Singapore but declined in Houston.

“No firm trend is expected in the Global bunker market next week, while irregular fluctuations may prevail,” Ivanov concluded.