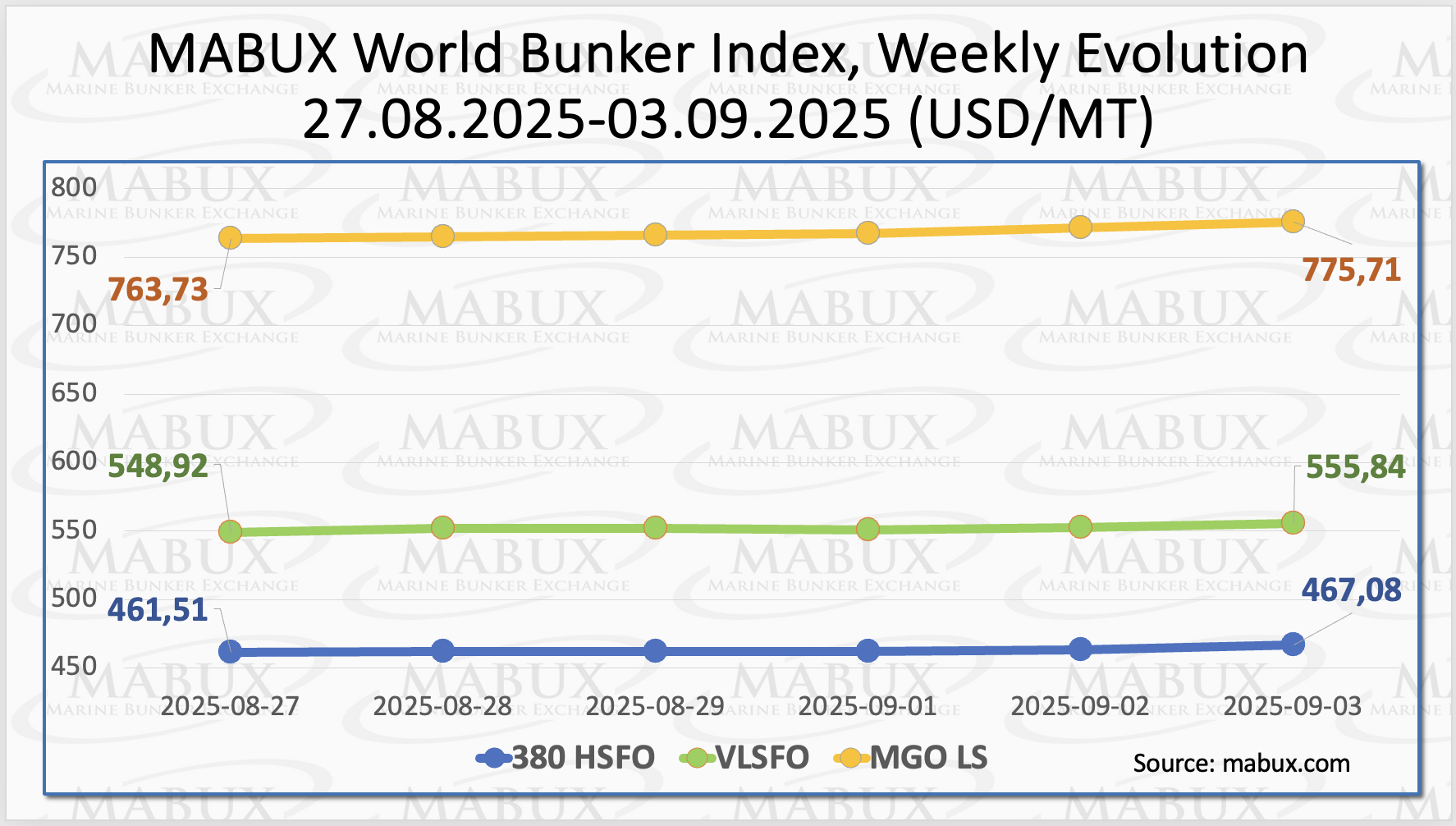

At the close of the 36th week, the global bunker indices MABUX maintained their moderate upward trend. The 380 HSFO index rose by US$5.57 to US$467.08/MT. The VLSFO index gained US$6.92, reaching US$555.84/MT, surpassing the US$550 mark.

The MGO index increased by US$11.98, climbing to US$775.81/MT. However, as of the time of writing, the global bunker market showed no clear overall direction.

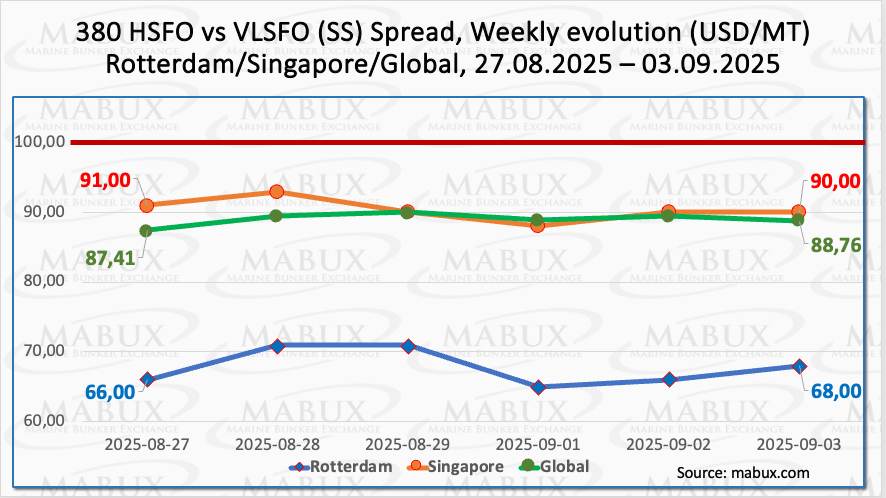

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—continued its slight growth, rising by US$1.35, to US$88.76. The index is gradually approaching the US$90.00 mark but remains steadily below the psychological level of US$ 100.00 (SS Breakeven).

The weekly average also gained US$1.97. In Rotterdam, the SS Spread increased by US$ 2.00, with the weekly average up by US$3.66. In contrast, Singapore saw a decline: the 380 HSFO/VLSFO price difference fell by US$1.00, while the weekly average decreased by US$0.84.

At present, SS indicators show no clear dynamics, with values fluctuating around previously reached levels. We do not anticipate significant changes in the SS Spread trend next week. Under current conditions, conventional VLSFO remains more profitable than the HSFO + Scrubber combination.

Exxon forecasts that global natural gas demand will rise more than 20% by 2050 compared with 2024, driven by coal displacement in industry and higher power use in emerging markets. This outlook supports Exxon’s long-term strategy, including an 18% production increase over the next five years. Oil demand is projected to plateau after 2030 but stay above 100 million barrels per day through 2050, while oil and gas together are expected to account for roughly 55% of the global energy mix.

Exxon positions natural gas as a key transition fuel for industry and dispatchable power generation, where coal remains entrenched. The company also projects energy-related CO₂ emissions of about 27 billion metric tons by 2050, down around 25% from today’s levels but still above United Nations targets.

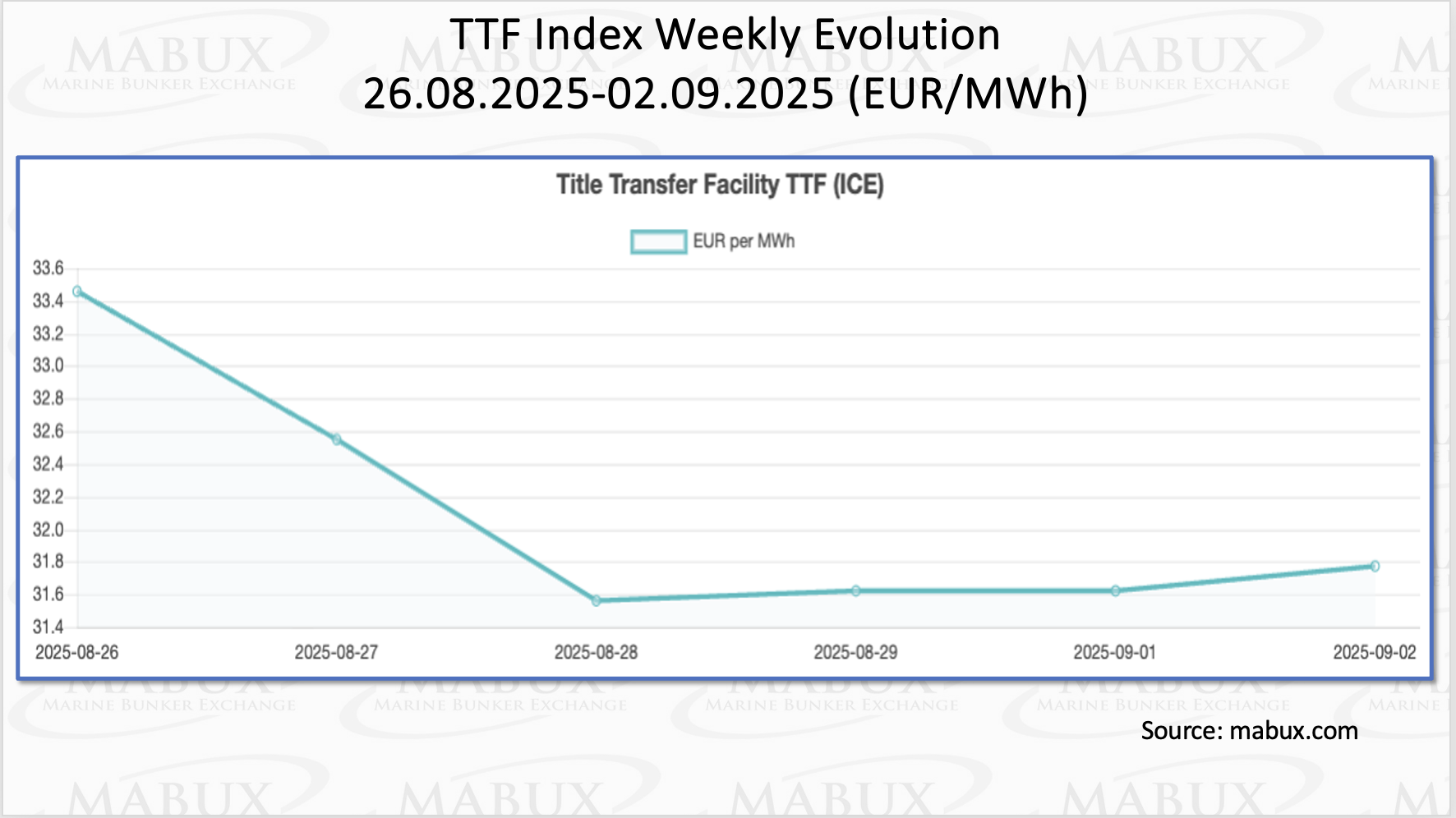

As of September 2, European regional gas storage facilities were 78.08% full, an increase of 1.84% from the previous week. Occupancy levels are 6.75% higher compared to the beginning of the year (71.33%), although the pace of injections has slowed slightly. By the end of the 36th week, the European gas benchmark TTF fell by 1.688 euros/MWh, reaching 31.772 euros/MWh compared with 33.460 euros/MWh a week earlier.

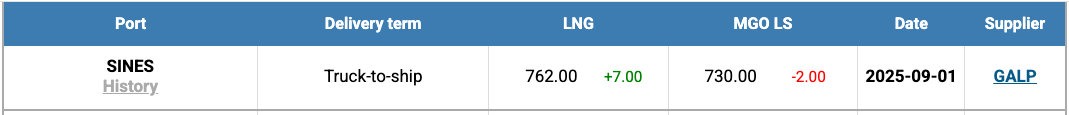

The price of LNG as a bunker fuel in the port of Sines (Portugal) rose by another US$7.00 by the end of the week, reaching 762 US$/MT compared with 755 US$/MT the previous week. At the same time, the price gap between LNG and conventional fuel widened further in favor of conventional fuel— US$32 versus just US$9 a week earlier. On this day, MGO LS was quoted at 730 US$/MT in the port of Sines.

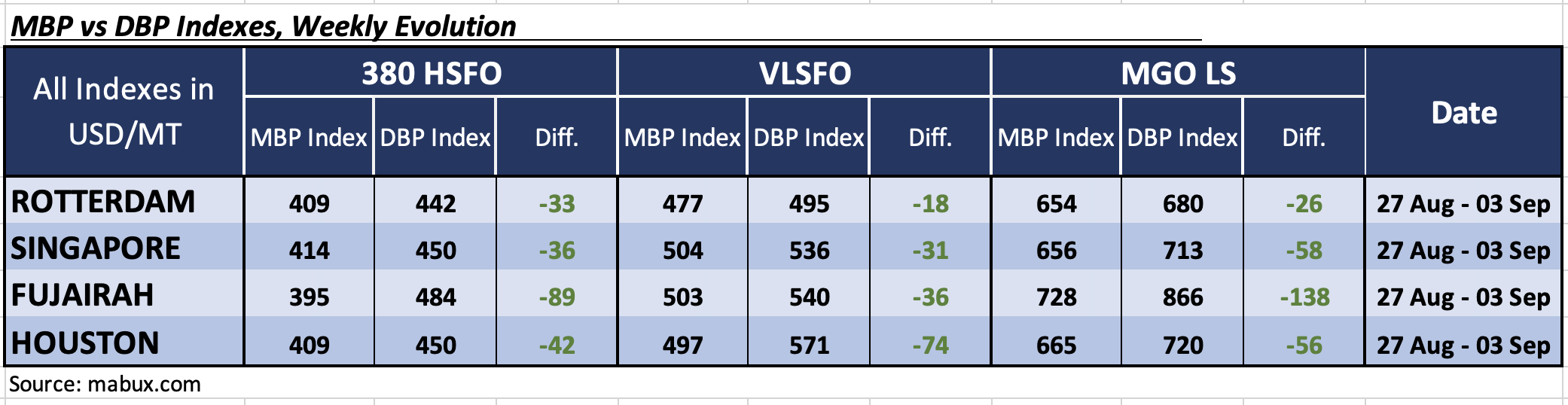

At the close of the 36th week, the MABUX Market Differential Index (MDI)—the ratio of market bunker prices (MBP) to the digital bunker benchmark MABUX (DBP)—continued to indicate undervaluation across all bunker fuel types in the world’s largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: Weekly average undervaluation increased by 8 points in Rotterdam and 22 points in Houston, while it decreased by 2 points in Singapore and 3 points in Fujairah. All MDI values in this segment remained below the USD 100 mark.

• VLSFO segment: Undervaluation levels rose by 6 points in Rotterdam and 1 point in Singapore, but declined by 5 points in Fujairah and 1 point in Houston.

• MGO LS segment: Values increased by 5 points in Rotterdam, 1 point in Singapore, and 3 points in Fujairah, while dropping by 1 point in Houston. Notably, the Fujairah MDI continues to hold above the USD 100 threshold.

”Overall, there were no major shifts in the structure of overvalued versus undervalued ports during the week. MDI values remained steady at previously established levels, with the undervaluation trend continuing to dominate across all bunker fuel segments. No significant changes in the dynamics of MDI indices are expected in the coming week,” commented Sergey Ivanov, Director, MABUX.

”We expect the global bunker market will sustain its moderate upward momentum in the coming week”, said Ivanov.