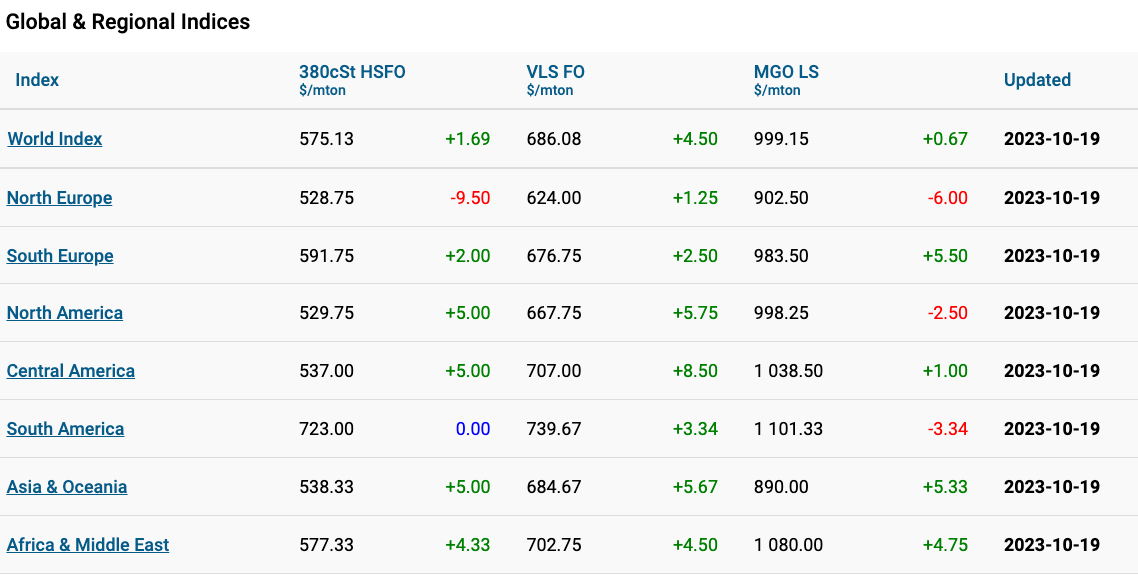

Marine Bunker Exchange (MABUX) global indices turned into an upward trend, primarily driven by the escalating conflict in the Middle East.

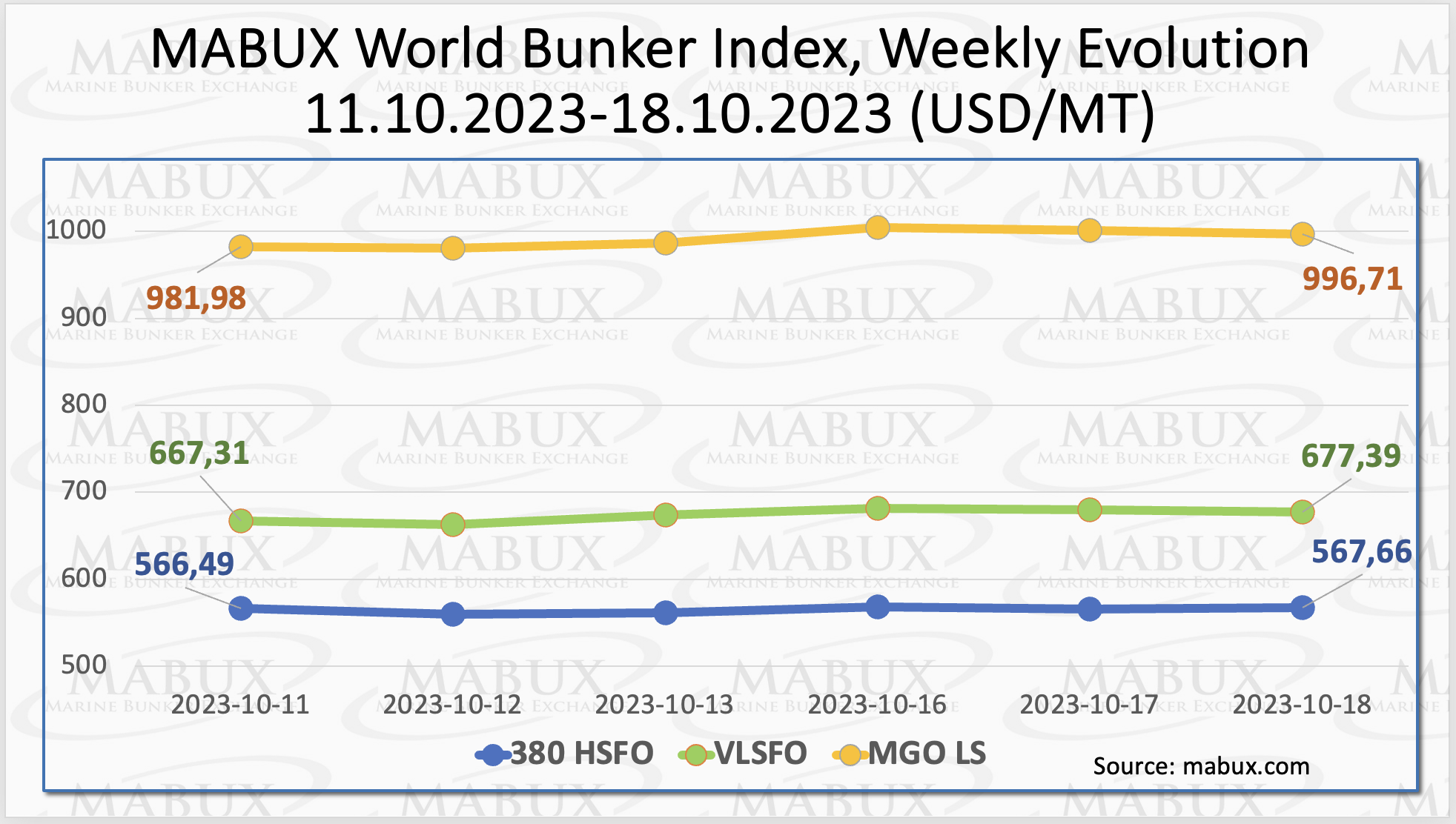

The 380 HSFO index rose by US$1.17, the VLSFO index added US$10.08 and the MGO index increased by US$14.73.

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – continued to widen, plus US$8.91. It remained consistently above the US$100 mark, which is the SS breakeven point. The weekly average also surged by US$10.69.

In Rotterdam, SS Spread saw a growth of US$8, and the average rose by US$6. Singapore observed a US$10 increase in the price difference of 380 HSFO/VLSFO, with the weekly average widening by US$14.

“Due to high volatility in the fuel market, we expect that the SS Spread may continue to grow moderately in the upcoming week,” commented a MABUX representative.

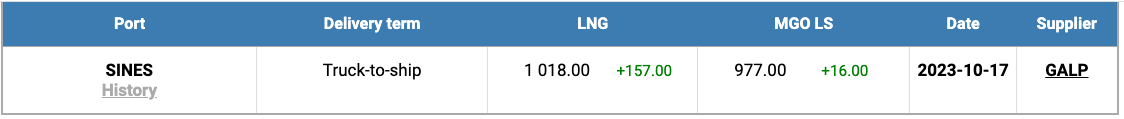

Gas prices have soared over recent days, with geopolitical volatility rattling spot markets and escalating fears of supply shortages this winter. Hamas’ attack on Israel has introduced fresh uncertainty into markets, with the country closing its Tamar gas field in the Mediterranean.

There are also fears of sabotage in Europe after a leak was identified on a

77 km-long Baltic Sea gas pipeline between Finland and Estonia. The price of LNG as bunker fuel in the port of Sines (Portugal) increased sharply and reached US$1,018/MT on 17 October.

The difference in price between LNG and conventional fuel on 17 October was again in favor of MGO for the first time since 11 July 2023, US$41 versus US$112 in favor of LNG a week earlier, MGO LS was quoted that day in the port of Sines at US$977/MT.

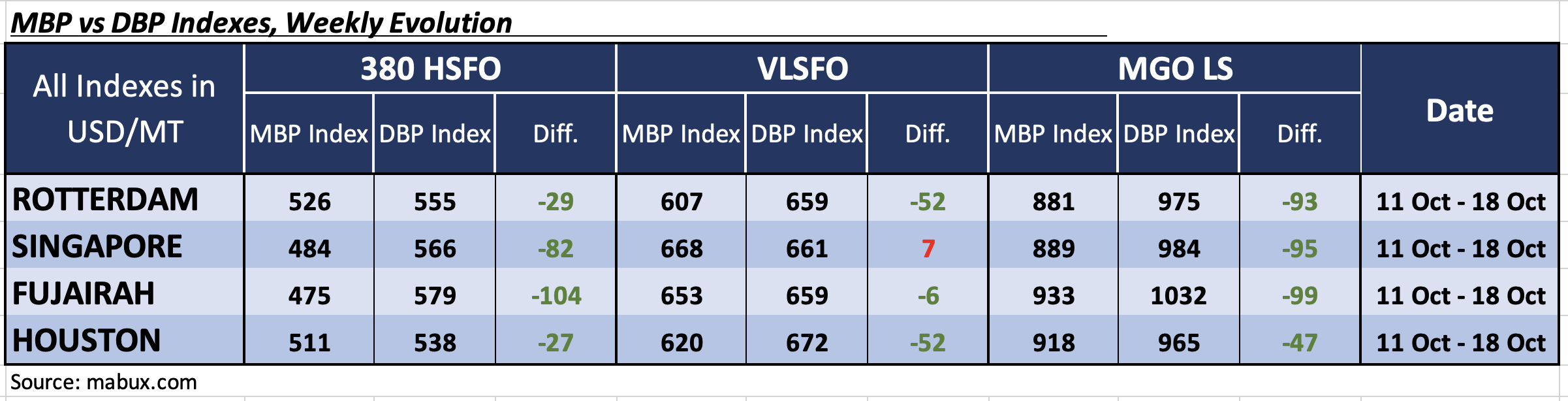

During the 42nd week, the MDI index [the ratio of market bunker prices (MABUX MBP

Index) vs. the digital bunker benchmark MABUX (MABUX DBP Index)] recorded the following trends in four selected ports, Rotterdam, Singapore, Fujairah and Houston.

In the 380 HSFO segment, all four ports were undervalued. Average weekly underpricing increased by 4 points in Rotterdam but decreased by 4 points in Fujairah and 7 points in Houston. The MDI index in Singapore remained unchanged.

In the VLSFO segment, according to the MDI, Singapore shifted into the overcharge zone, with its weekly average increased by 12 points. In the other three ports, VLSFO remained undervalued. Average levels of undervaluation fell by 1 point in Rotterdam, 6 points in

Fujairah and 9 points in Houston.

In the MGO LS segment, the average undercharge premium showed an increase in Rotterdam by 11 points and in Houston by 12 points, but decreased in Singapore by 8 points and in Fujairah also by 8 points.

“We expect that the upward trend in the bunker market will persist in the week ahead,

driven by the escalating conflict in the Middle East,” pointed out Sergey Ivanov, director of MABUX.