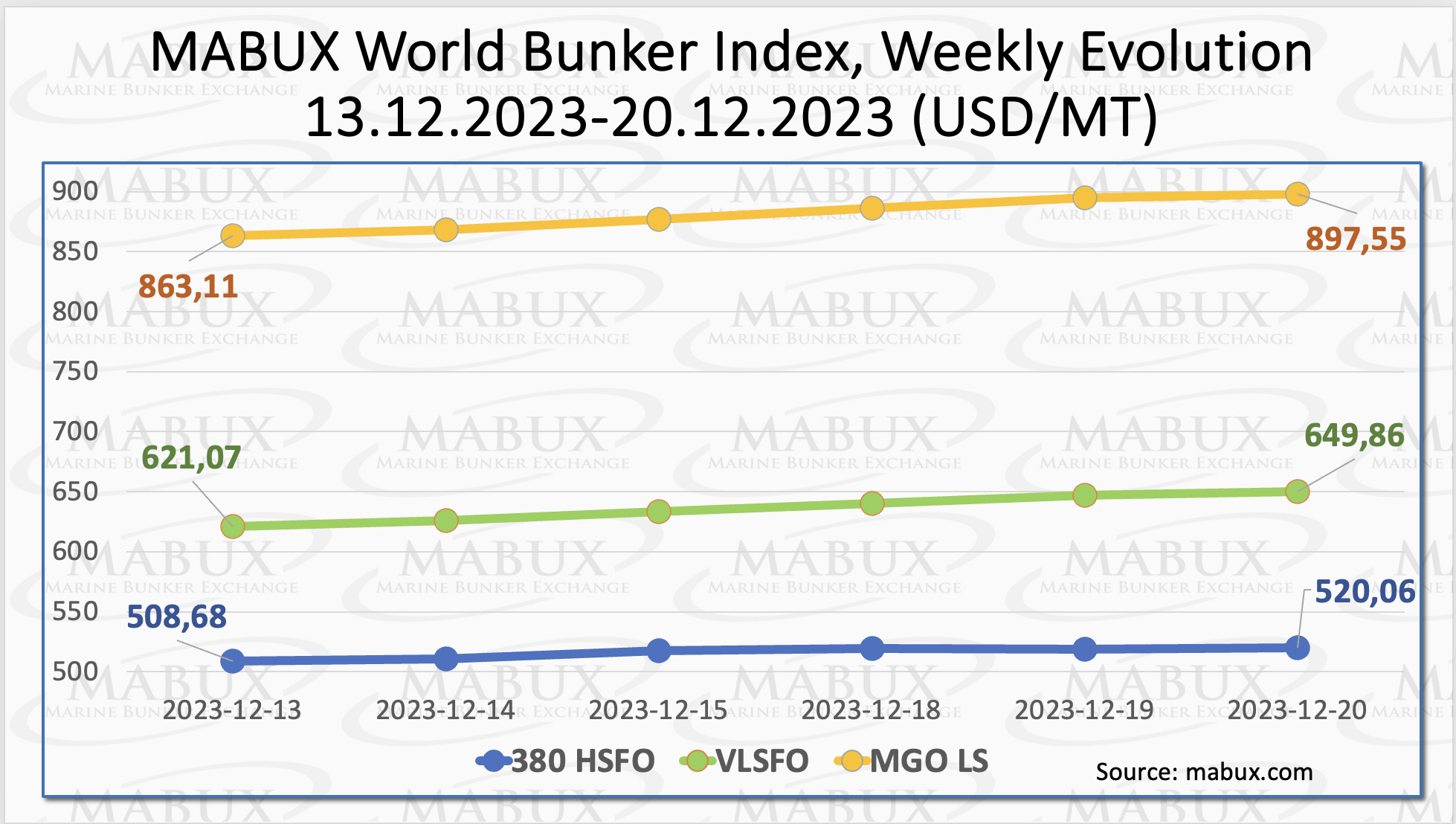

During Week 51, the MABUX global bunker indices began an upward trajectory, marking the first positive movement in the past five weeks. The 380 HSFO index rose by US$11.38 to US$520.06/MT. The VLSFO index, in turn, added US$28.79. The MGO index increased by US$34.44.

“At the time of writing, the upward trend in the market continued,” stated a MABUX official.

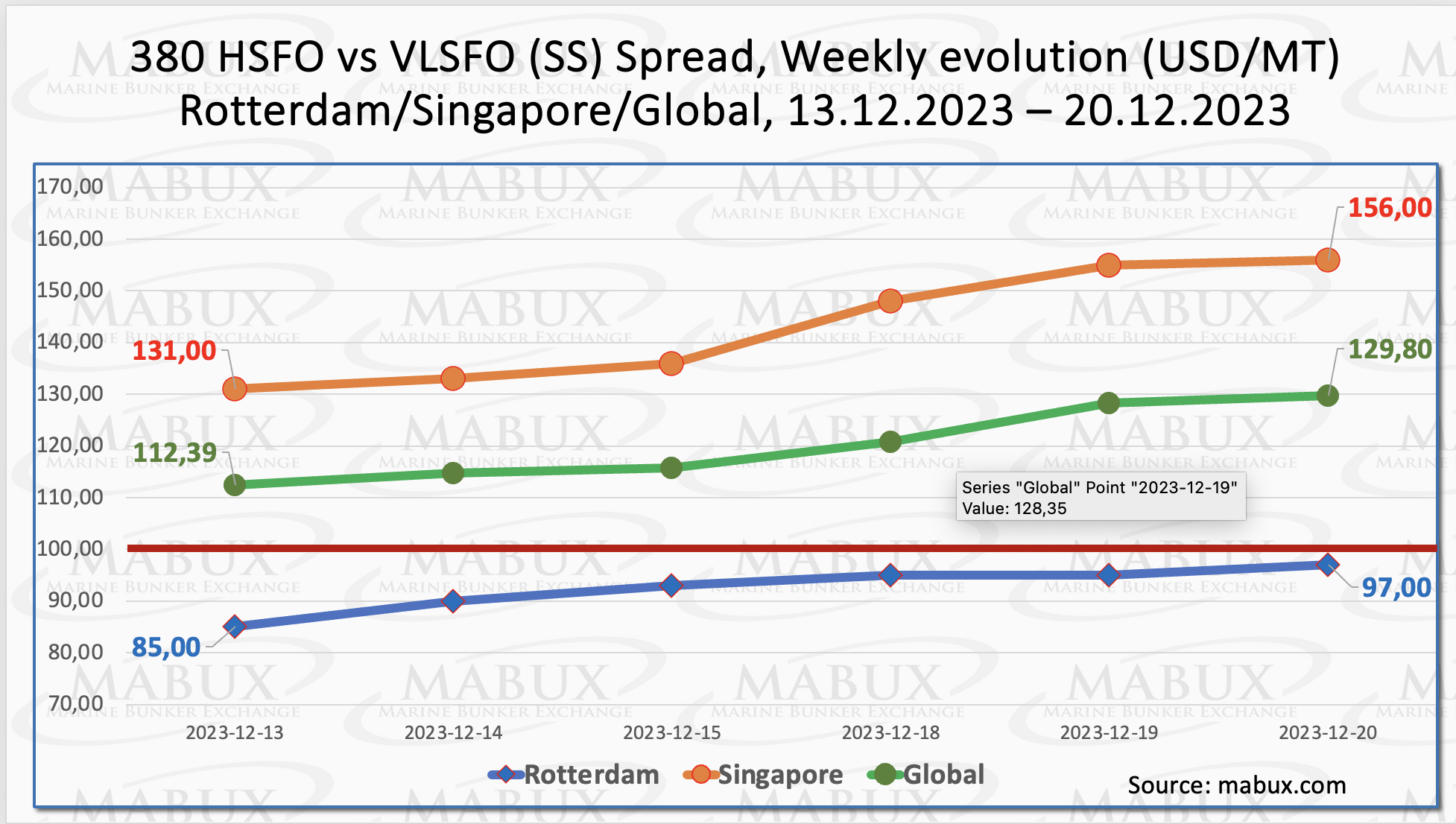

The Global Scrubber Spread (SS), which is the price difference between 380 HSFO and VLSFO, has entered the growth phase, with a plus US$17.41. The weekly average climbed by US$1.49 as well. In Rotterdam, the SS Spread increased by US$12.00, but the weekly average decreased by US$3.00.

In Singapore, the price differential for 380 HSFO/VLSFO increased by US$25, while the weekly average decreased by US$11.33. “We anticipate that the increasing trend in the SS Spread will continue in the following week,” added a MABUX spokesperson.

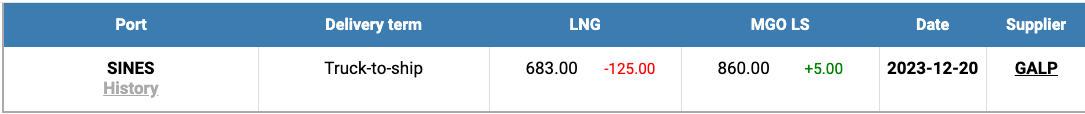

High inventories, reduced supply worries, weakening demand, and increasing confidence in Europe’s capacity to get through the winter without major supply interruptions have all led to a drop in natural gas prices across Europe in recent weeks. Winter premiums have nearly vanished in both the futures and options markets. Meanwhile, worldwide exports from January to November (492 billion cubic meters) grew by 2.4% (11.4 billion cubic meters) compared to the same time previous year. This rise is still far smaller than the 5% (22-24 billion cubic meters) increase projected in both 2021 and 2022. LNG bunker fuel prices in the port of Sines (Portugal) continued to fall sharply, hitting US$683/MT on 20 December.

Concurrently, the price differential between LNG and conventional fuel on 20 December benefited LNG by US$117, up from US$22 the previous week. MGO LS was quoted for US$860/MT in the port of Sines on that day.

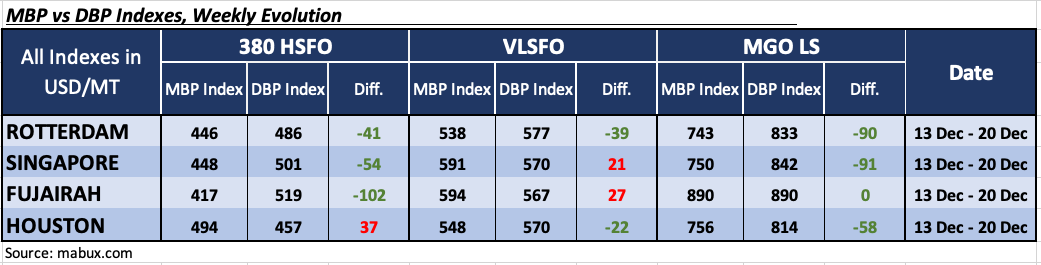

The MDI index (the ratio of market bunker pricing (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) shows the following patterns in four chosen ports during the 51st week: Rotterdam, Singapore, Fujairah, and Houston are among the destinations.

Houston was the only overpriced port in the 380 HSFO section, with the average weekly overpricing increasing by 4 points. Rotterdam and Singapore witnessed weekly average rises of 4 and 5 points, respectively, while Fujairah saw a 2-point reduction, retaining an undervaluation premium above US$100.

According to the MDI, Singapore and Fujairah were overcharged in the VLSFO area, with the average weekly ratio dropping by 19 points in Singapore and 13 points in Fujairah. VLSFO remained cheap in Rotterdam and Houston. Undercharging grew by 7 points in Rotterdam and 5 points in Houston on a weekly basis.

All ports in the MGO LS category remained underpriced, with average margins decreasing by 5 points in Rotterdam, 20 points in Singapore (where the undervaluation level went below US$100), and 17 points in Houston. The MDI index in Fujairah established a 100% correlation between market pricing and the digital benchmark.

“We expect that the global bunker market will maintain the potential for moderate growth

in the coming week,” stated Sergey Ivanov, director of MABUX.