The Marine Bunker Exchange (MABUX) anticipates a stronger year ahead as the rollout of coronavirus vaccine programmes allows global activity to recover which is expected to lead to higher refinery runs and growing demand for all types of fuels, including marine fuels.

[s2If is_user_logged_in()]However, the global bunker market faced some historically significant challenges last year, according to MABUX.

It started with IMO2020, the greatest change in fuel regulation in a century, with increased expectations and contradictory predictions. However, the appearance of the so-called “Joker factor”, Covid-19, drastically changed the situation on the market.

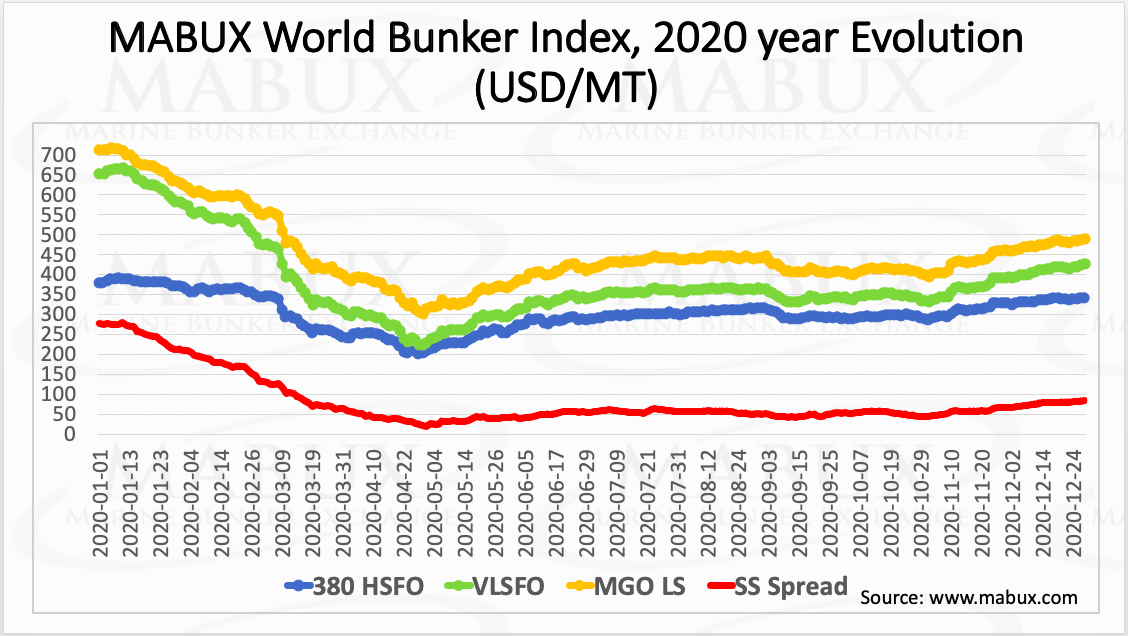

MABUX MGO LS Global Bunker Index and VLSFO Global Bunker Index fell from January to May 2020 by 57.4%, from US$714/MT in January to US$304/MT in May and by 64.7%, from US$654/MT to US$231/MT, respectively.

Despite fears that prices for traditional high-sulphur fuel (380 HSFO) would also drop sharply amid limited demand, in reality, 380 HSFO Global Bunker Index in the first half of 2020 remained more stable, decreasing by 45.7%, from US$387/MT in January to US$210/MT in May.

However, the main surprise was the sharp reduction in the scrubber spread Index (SS), the price difference between VLSFO and 380 HSFO, which is an indicator of economic attractiveness for one of the main ways to comply with IMO2020 regulations, the use of scrubbers in combination with cheap high-sulphur fuel oil.

“The 90% drop in the SS Index (from US$275 in January to US$25 in May) in the first five months of 2020 led to a sharp decline in scrubber orders and to delays and cancellations of the installations of ordered scrubbers,” explains MABUX in its first bunker report for 2021.

The second half of 2020 was marked by a gradual recovery in demand in the global bunker market supported by vaccines optimism and reflected in a moderate increase in bunker fuel prices, which continues to this day.

MGO LS Index increased by 38% to US$490/MT, VLSFO Index – by 46% to US$427/MT, 380 HSFO Index – by 38.6% to US$342/MT. The revival of the market was reflected in the SS Index as well – it widened by 70% to an average of US$83, bringing back the relevance of a scrubbers solution.

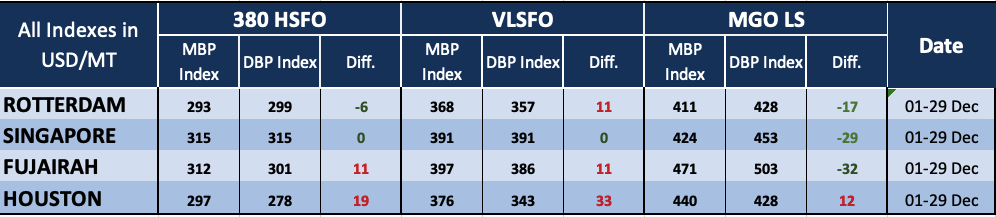

The correlation of MBP (Market Bunker Prices) Index vs DBP (Digital Bunker Prices) Index at four of the largest global hubs (Rotterdam, Singapore, Fujairah and Houston) in December 2020 showed that 380 HSFO fuel was undervalued in Rotterdam (minus US$6/MT).

At the same time, in Singapore, there was a situation when both MBP and DBP Indices had a 100% correlation on 380 HSFO and VLSFO in December. Meanwhile, in Fujairah and Houston, both types of fuel, 380 HSFO and VLSFO, remained overpriced.

MGO LS, in turn, was undervalued at all selected ports ranging from minus US$17/MT to minus US$32/MT, with the exception of Houston, where it was overvalued by US$12/MT.

[/s2If]

[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]