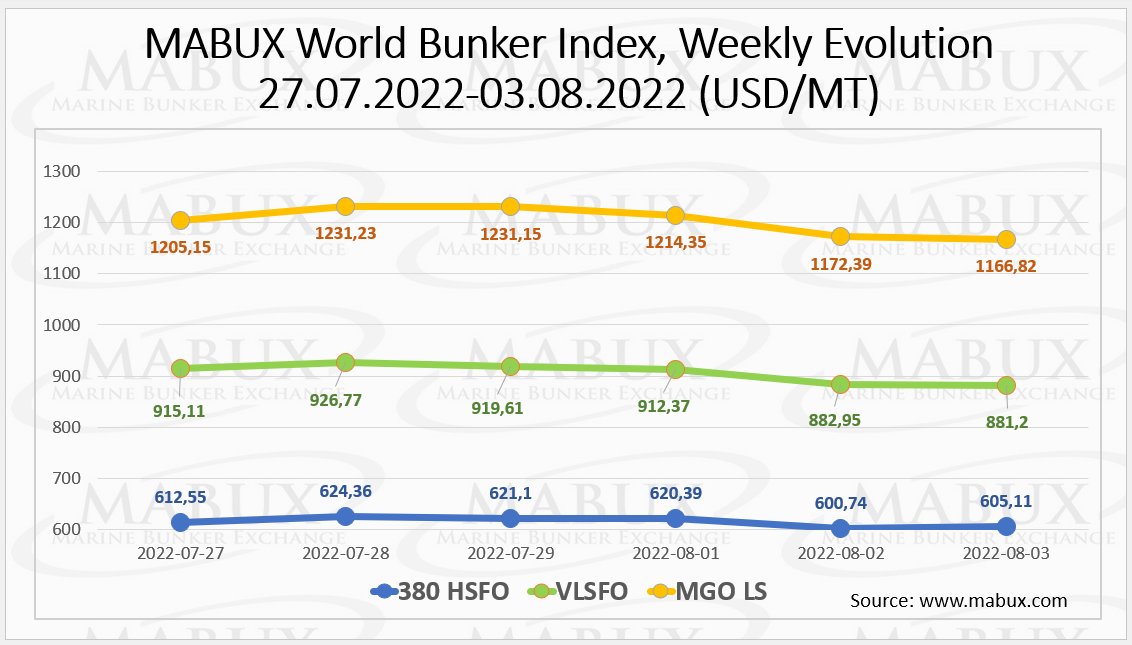

“Over the Week 31, MABUX global bunker indices continued firm downward trend,” said Anastasia Pervova, marketing analyst of Marine Bunker Exchange (MABUX).

The 380 HSFO index declined by US$7.44 to US$605.11/mt. The VLSFO index also fell by US$33.91 to US$881.20/mt. The MGO index also lost US$38.33 reaching US$1,166.82/mt.

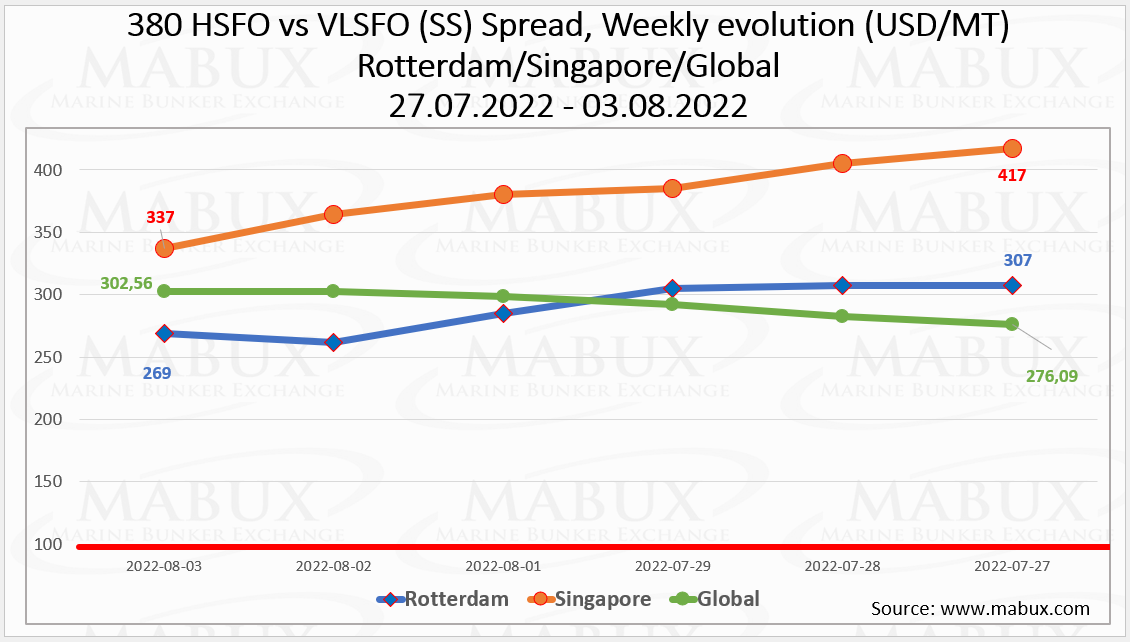

The Global Scrubber Spread (SS) weekly average – the difference in price between 380 HSFO and VLSFO – decreased for the fourth week in a row – minus US$13.79 (vs. US$306.08 last week). In Rotterdam, the average SS Spread also declined US$12 (vs. US$301.17). The average weekly price difference of 380 HSFO/VLSFO in Singapore (the most significant decline) was minus US$67.67 (vs. US$449 last week).

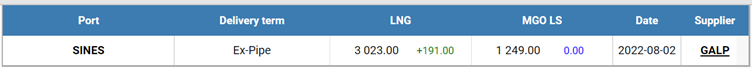

“The natural gas market in Europe remains highly volatile amid the risks of gas supplies outages from Russia,” noted Pervova.

LNG as bunker fuel in the port of Sines (Portugal) rose again on 2 August by US$191/mt to US$3023.00 /mt. LNG prices are still more than double the price of the most expensive conventional bunker fuel: MGO LS at the port of Sines was quoted on 3 August at US$1,249/mt.

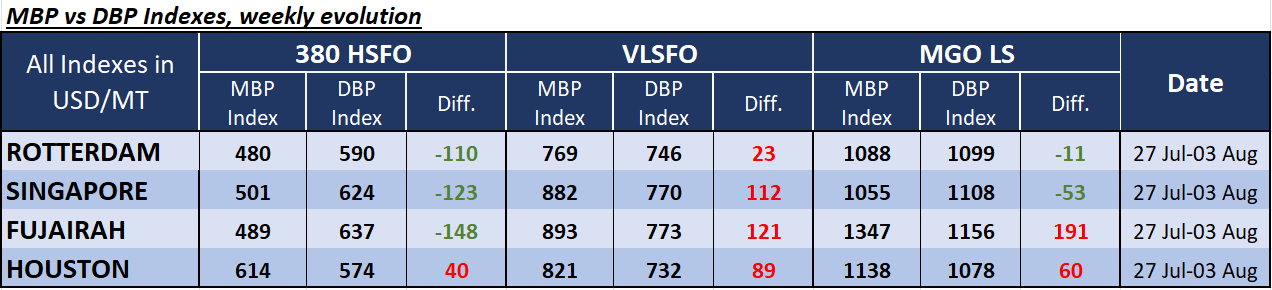

Over the Week 31, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed an undercharge of 380 HSFO fuel grade in three out of four ports selected. Houston remained in the overprice zone: plus US$40. In other ports, the undercharge level declined slightly in the most of them and amounted to: Rotterdam – minus US$110, Singapore – minus US$123 and Fujairah – minus US$148.

VLSFO fuel, according to MDI, remained, on the contrary, overpriced in all selected ports: plus US$23 in Rotterdam, plus US$112 in Singapore, plus US$121 in Fujairah and plus US$89 in Houston.

“The MDI index still did not have firm dynamics: the overcharge decreased in Rotterdam, Singapore and Fujairah, but increased again in Houston,” highlighted Pervova.

The most significant changes were registered in Singapore and Fujairah, where the overprice level declined by 47 and 59 points respectively. Nevertheless, VLSFO remains the most overvalued segment in the global bunker market.

As for MGO LS grade, the MDI index registered a fuel undercharge in two out of four selected ports: in Rotterdam – by US$ 11, and in Singapore – by minus US$53. This fuel grade remained overcharged in Fujairah – by plus US$191 and Houston – by plus US$60. The MDI index declined in all selected ports.

The Port of Rotterdam has reported that Q2 sales of marine fuel oils and distillates totalled 2,432,780 metric tonnes (mt) – down from 2,507,146 mt in the previous quarter – while LNG sales were down almost 44% from 111,804 cubic metres (cbm) to 63,497 cbm.

The Q2 statistics also showed a drop in VLSFO volumes – from 1,067,532 mt to 1,039,397 mt – and a hike in high sulphur fuel oil (HSFO) sales from 708,131 mt to 737,004 mt. Following the introduction of the IMO 2020 sulphur cap, VLSFO accounted for a very big chunk of the market, but HSFO sales have been rising as more scrubber-equipped vessels have continued to come onto the market and the price differential between the two grades has made it very advantageous to use the higher sulphur grade of fuel.

The Q2 sales figures were a mixed bag for bio-blended fuels. More specifically, sales of bio-blended ultra-low sulphur fuel oil (ULSFO) more than doubled from last quarter, from 9,520 mt to 22,167 mt, and bio-blended HSFO saw a huge hike from 819 mt to 18,679 mt. Sales of bio-blended VLSFO, however, were down from 137,051 mt to 119,174 mt.

“We expect downward changes to continue in the global bunker market next week,” pointed out Pervova.