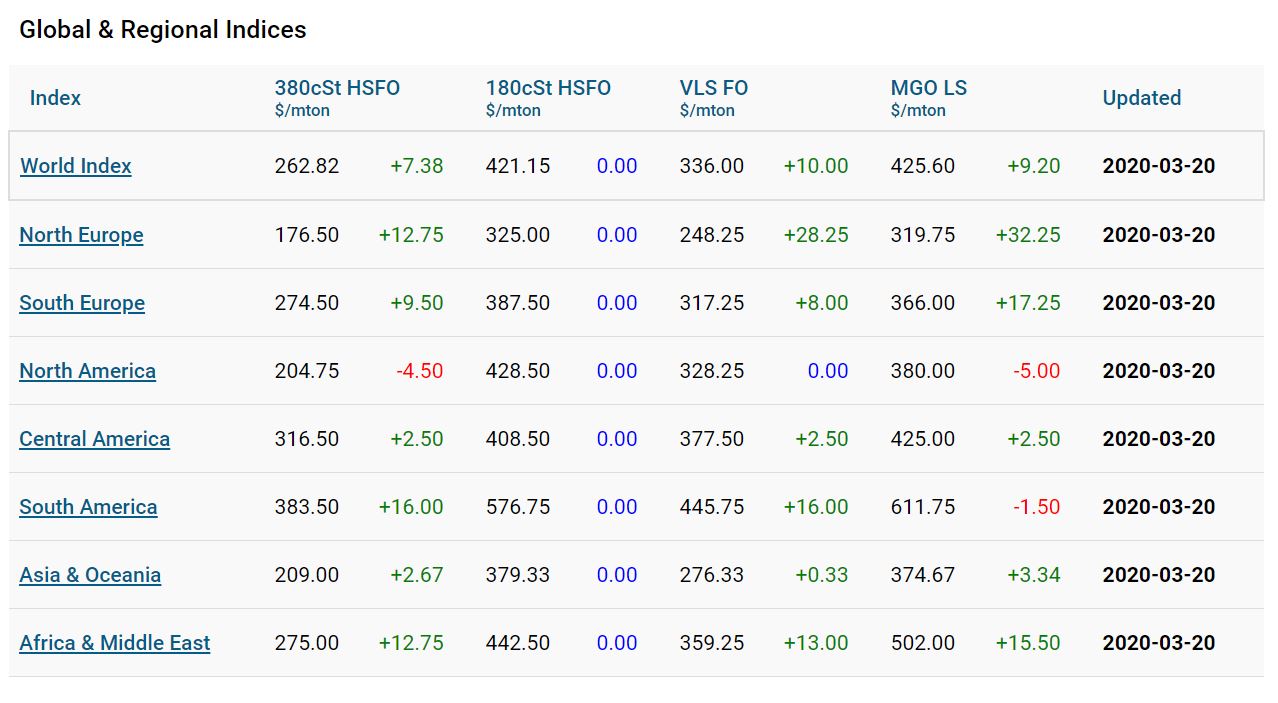

In the topsy turvy world that is the global crude oil market bunker fuel of all types, in all regions increased their prices in the face of further falls today in the crude market: excepting North and South American MGO and 380 HFO in the US, which saw comparatively minor losses.

West Texas Intermediate crude lost almost all the gains it made yesterday, down 3.59%, but Brent Crude has managed to hold onto its gains at a reported US$28.25/bbl, down just 0.77%.

However, according to some analysts the steadying of the ship will not be a long-term feature with the price of crude still expected to hit the teens before it rises again sometime later this year, depending on the rebound from the global viral infection.

Reuters’ John Kemp writes, “Brent’s six-month calendar spread has collapsed into a contango of US$8/barrel, indicating traders anticipate an enormous build-up in oil inventories that will fill all available storage within the next few months.”

That would indicate further significant price falls for crude with the consequent price erosion for marine bunkers as a result.

Meanwhile, Singapore, a major vessel refuelling spot said that VLSFO accounted for 71.5% of its sales with MGO a further 12.5% of the bunkers sold, in February, 84% of the fuels in total were low sulphur fuels, an increase of 1% on the January figure.

However, BIMCO adds that the global bunker sales in February fell 16% to 3.9 million tonnes compared to January records, with demand for shipping hit by the coronavirus outbreak in Asia.

As a result of the introduction of the sulphur cap the International Maritime Organization (IMO) calculates that sulphur emissions from the maritime sector will fall by 77% overall. With the current stifling of trade by the Covid-19 virus that could be a significant underestimate.