Global supply chain issues are threatening Christmas deliveries to retailers, as we’ve seen sustained port congestion in the US, and now parts of the UK. It continues to disrupt shipping lines and the movement of goods worldwide. We have seen congestion ease in major Chinese container ports such as Ningbo, with the number of vessels waiting more than halving since mid-August, but congestion at import ports is now concerning as ports struggle to clear containerised throughput.

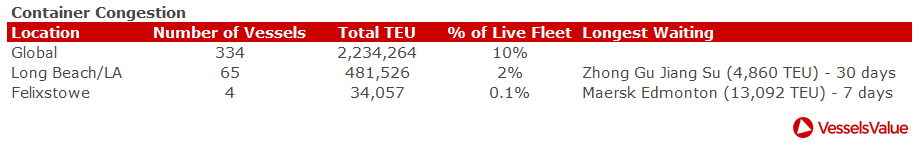

The containership market has been under immense pressure over the last year, with Covid-related pent up demand pushing consumer spending, bad weather in China and Covid-related terminal lockdowns contributing to high port congestion. Shipping rates have continued to tighten due to a lack of vessel capacity on the water, and these disruptions are spreading into land-based supply chains. Californian import ports, Long Beach and Los Angeles, are among the worst affected, with significantly high congestion showing few signs of easing in the approach to Christmas, as record high vessel counts anchor and drift off the port waiting to unload. The current number of vessels waiting is around 65, which has increased compared to the number waiting a month ago.

Felixstowe is one of the UK’s major container ports, having received 927 Post Panamax, 554 Panamax, 532 ULCV and 484 New Panamax container ships since the beginning of 2021. The majority of containers into the UK are transporting manufactured goods from export hubs in China, ranging from toys, fitness equipment, electricals and clothing to frozen food, with 40% of the UK’s containerised imports moving through the port. Felixstowe is the latest port to report congestion building, as a severe shortage of truck drivers means containers are piling up in port storage yards. Making it increasingly difficult to unload containers and re-load empty containers back to Asian ports.

Vessels are spending longer in port than usual to unload and depart due to a pile up of containers in port, causing disruptions to liner schedules and further reducing vessel availability. Since the beginning of the month, 31 vessels have moved through Felixstowe, equating to 281,408 total TEU vessel capacity. This is 45% less than the same period in 2020, and 51% less than the same period in 2019, suggesting that the port is struggling with turnaround times.

The disruptions being seen could mean retailers struggle to fill their shelves this Christmas period, without a steady flow of containers moving through this major port and enough trucks to re-distribute the manufactured goods. Some shipping lines have reported that they are diverting ships to other European ports to avoid the Felixstowe bottleneck and keep vessels moving. The 18,340TEU Marchen Maersk was sailing en route from Tanger Med, changing course from Felixstowe to Wilhelmshaven, Germany, on 13 October in a bid for a faster discharge.

Things that take longer tend to cost more, so being forced to make decisions to change vessel itineraries and getting held up in congested ports can be costly for shipping lines. Retailers also make the biggest proportion of the sales at this time of year, so if retailers struggle to source enough stock and profit margins lessen, we could see the price trickle back to the consumer.

We may also see an increase in the use of alternative modes of transport to get products in stores, such as rail and air freight, although distribution issues are simultaneously impacting most parts of the supply chain.

Author of the article: Charlotte Cook – AIS and Trade Manager at VesselsValue

Charlotte Cook heads up the AIS and Trade research departments at VesselsValue, overseeing the maintenance and advancements of the databases.

Charlotte Cook heads up the AIS and Trade research departments at VesselsValue, overseeing the maintenance and advancements of the databases.

Charlotte is experienced in large scale data analysis, with a focus on AIS, global trade flows and maritime infrastructure, working closely with Analyst and Development departments in the design, testing and launch of Trade related products and services. Prior to joining VesselsValue in 2016, Charlotte attended Portsmouth University graduating with a BA(Hons) in Geography.