Last week ended with the largest one-day drop in crude oil prices since April 2020, as markets reacted to the discovery of the new Omicron coronavirus variant and the introduction of a raft of travel restrictions.

Marine fuel prices followed the crude market and experienced a significant decline. Marine Bunker Exchange (MABUX) representatives said that while uncertainty remains about the potential impact of Omicron on international travel and global trade, there are some signs that the initial reaction to the new variant may have been overly pessimistic.

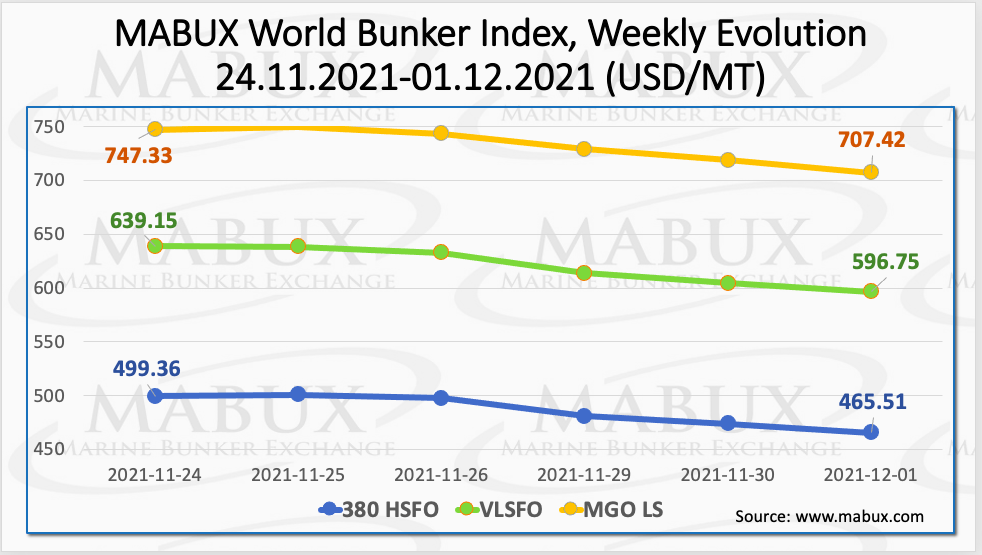

In particular, the MABUX World Bunker Index showed a sharp decline in the main grades of bunker fuels during week 48. The 380 HSFO Index dropped to US$465.51/MT and the VLSFO index declined to US$596.75/MT, while the MGO index decreased to US$707.42/MT.

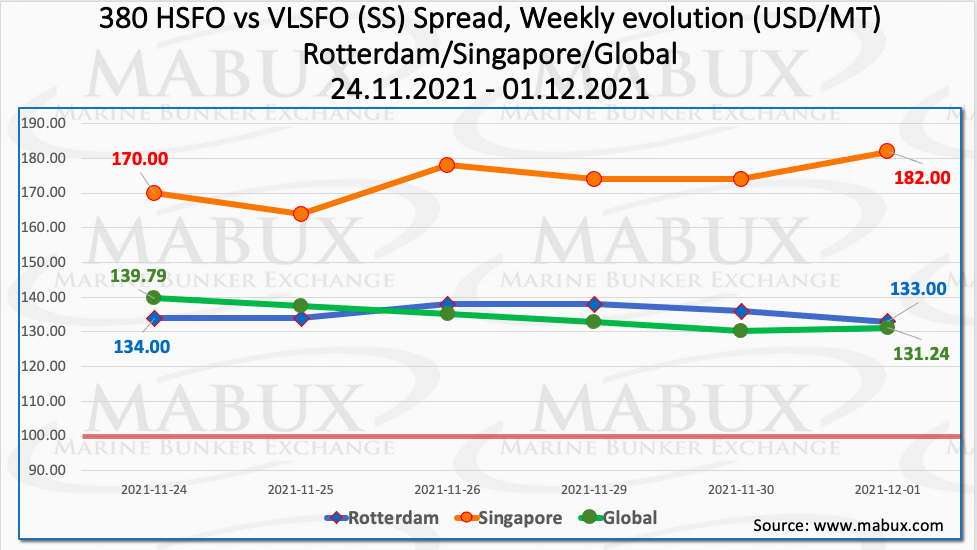

Despite the sharp drop in bunker prices, the weekly average Global Scrubber Spread (SS) showing the difference in price between the 380 HSFO and VLSFO, remained virtually unchanged over the week, just US$1.15 down.

Meanwhile, the average SS Spread in Rotterdam rose to US$135.50. However, the most significant change was the growth of the SS Spread average in Singapore to US$173.67.

Sharp price fluctuations, observed in the bunker market over the past week, hampered the formation of a firm SS Spread trend, according to MABUX.

Gas indexes continued to rise on week 48. Europe anticipates a cold start of December, higher withdrawals from the storage, while gas supply is tight.

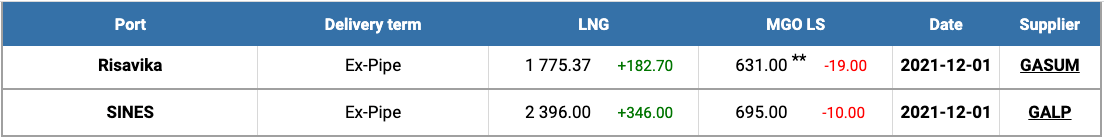

On 1 December, another increase of LNG bunker prices was recorded at the port of Risavika in Norway to US$1,775.37/MT, while the current price of LNG in Risavika is US$1,144 up the price of MGO LS in Bergen.

At the same time, the LNG bunker price at the port of Sines in Portugal jumped on 1 December to US$2,396/MT. Here, the current price of LNG is US$1,701 higher than the price of MGO LS – a record premium in 2021.

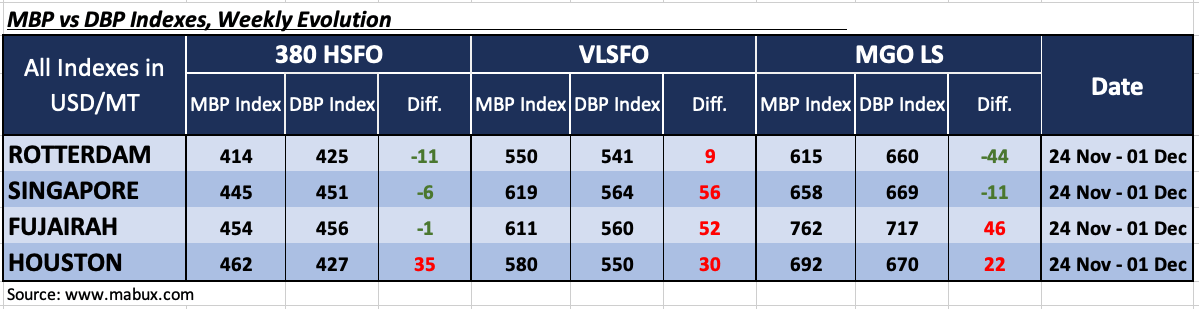

The volatility in the global bunker market also affected the correlation differences between the MABUX MBP Index (market bunker prices) and the MABUX DBP Index (MABUX digital bunker benchmark) in the four global largest hubs over the past week.

In particular, 380 HSFO grade was underestimated in three out of four ports: in Rotterdam, by minus US$11, in Singapore by minus US$6 and in Fujairah by minus US$1. Meanwhile, Houston remains the only port where the MABUX MBP/DBP Index registered an overpricing of US$35.

VLSFO fuel grade, according to the MABUX MBP / DBP Index, came over to the overcharge segment for all ports: plus US$9 in Rotterdam, plus US$56 in Singapore, plus US$52 in Fujairah and plus US$30 in Houston.

Moreover, while in Singapore and Fujairah, the overpricing ratio increased by 19 points for each port, in Houston the Index added 29 points at once.

As for the MGO LS, the MABUX MBP/DBP Index has registered an overcharge of this fuel grade in two out of four selected ports: in Fujairah, plus US$31 and in Houston, plus US$22.

In all other ports, MGO LS grade was underestimated, by minus US$44 in Rotterdam and in Singapore by minus US$11. The most significant change was the increase of the overcharge margin in Houston by US$23.