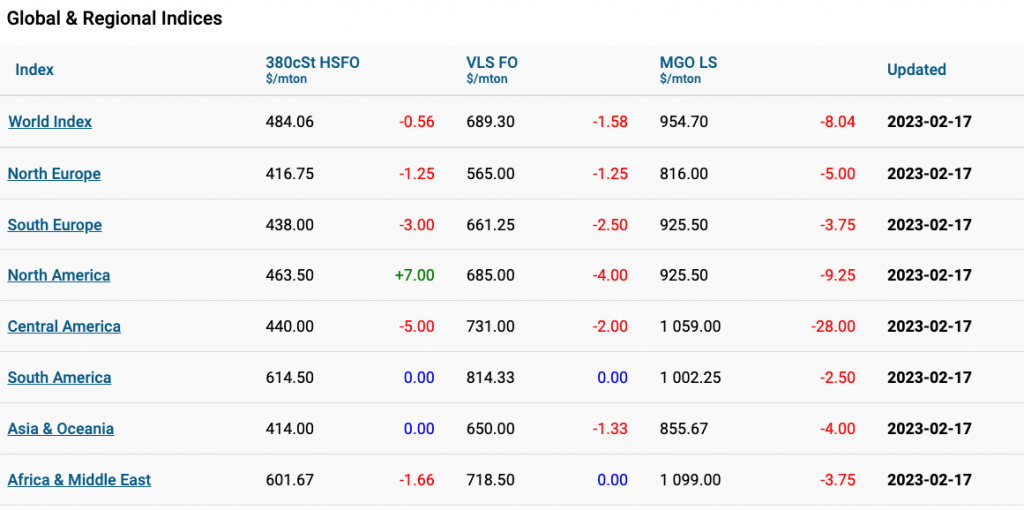

Over the seventh week of the year, Marine Bunker Exchange (MABUX) global bunker indices did not show the same trend and changed sideways.

On the one hand, the 380 HSFO index rose to US$483.44/MT, while on the other hand, the VLSFO index fell slightly to US$696.82/MT and the MGO index decreased to US$967.52/MT.

“At the time of writing, indices continued changing irregularly in the global bunker market,” pointed out a MABUX analyst.

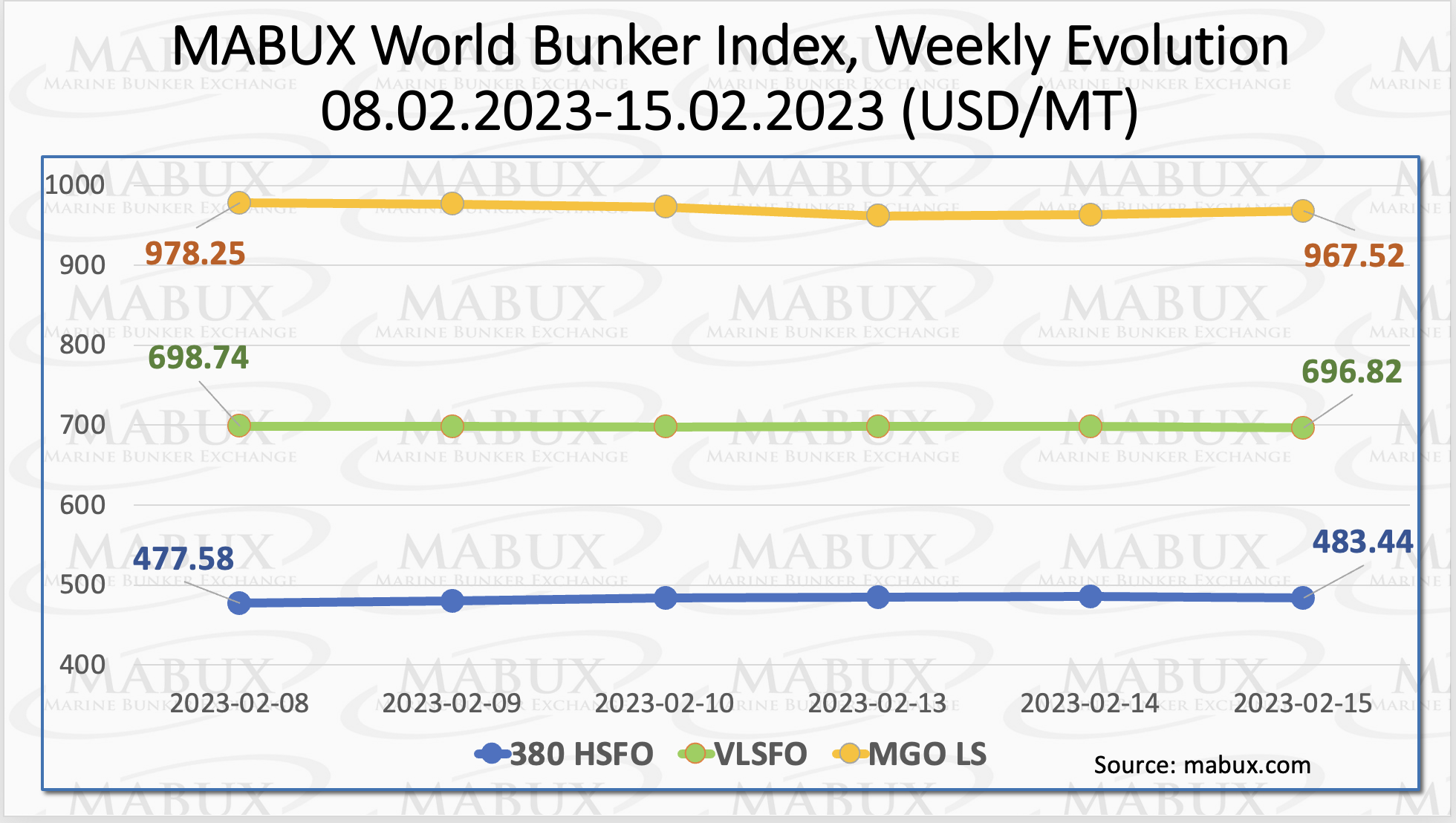

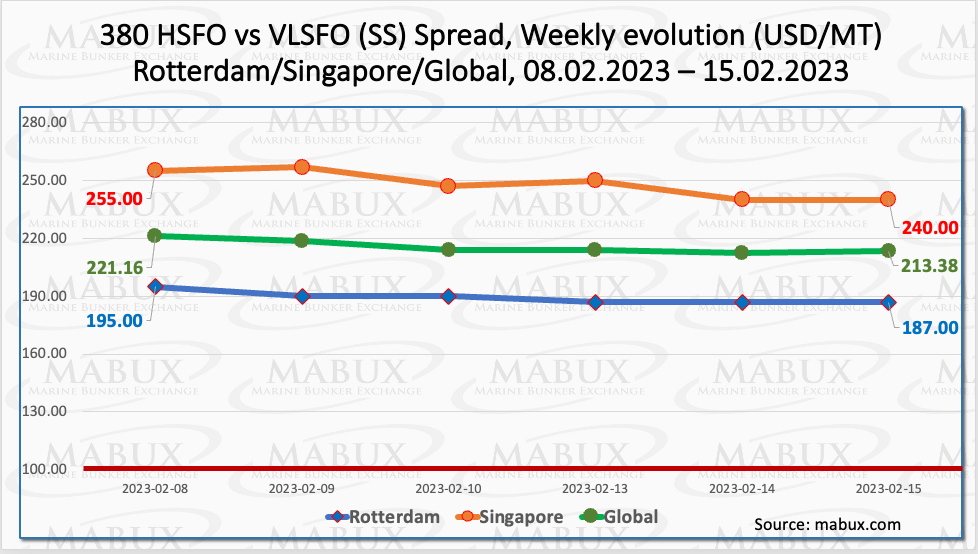

The Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO -continued to decline for the seventh week of 2023 – minus US$7.78, to US$213.38, while the average also decreased by US$13.47.

In Rotterdam, SS Spread fell by US$8 to US$187. In Singapore, the 380 HSFO/VLSFO price difference declined the most, minus US$15 to US$240.

The SS Spread weekly averages in Rotterdam and Singapore also fell by US$7 and US$22.50 respectively.

“Next week, we expect the SS Spread to continue a downward trend,” noted a MABUX representative.

Milder weather, the end of a supply outage in Norway, and expectations of stronger winds

in northwest Europe sent at the beginning of the week European benchmark natural gas

prices down by 4% to the lowest level since September 2021.

According to MABUX, recent data shows that across European Union, gas storage sites were 66.48% full as of 11 February, well above the five-year average for this time of the year.

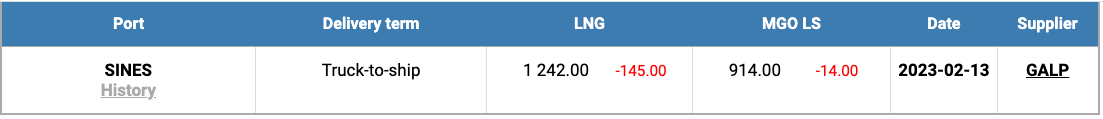

The price of LNG as bunker fuel at the port of Sines (Portugal) decreased and reached US$1,242/MT on 13 February.

The price difference between LNG and conventional fuel on 13 February was US$328. MGO LS at the port of Sines was quoted at US$914/MT that day. The price difference

is gradually decreasing.

“We expect this trend to continue next week,” said a MABUX official.

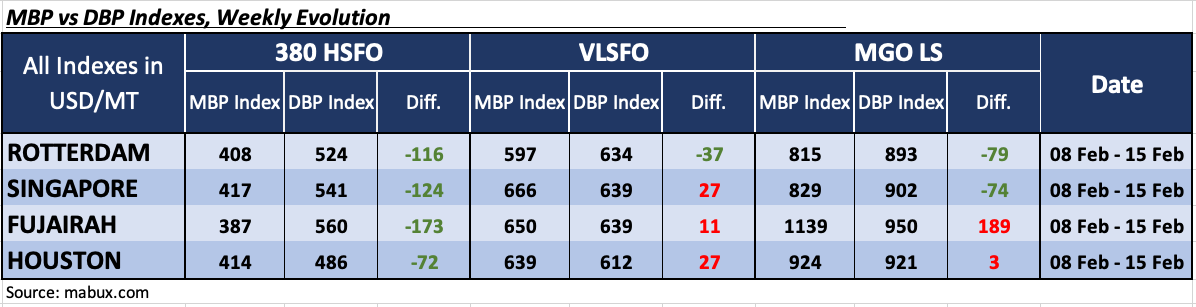

Furthermore, over the seventh week of the year, the MDI index (correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) registered an underestimation of fuel 380 HSFO at all four selected ports.

The underestimation average did not change significantly and amounted to minus US$116 in Rotterdam, minus US$124 in Singapore, minus US$173 in Fujairah and minus US$72 in Houston.

In the VLSFO segment, according to MDI, three selected ports: Singapore, Fujairah and Houston, were still in the overprice zone, plus US$27, plus US$11 and plus US$27, respectively. Rotterdam remained the only underpriced port, minus US$37. Overprice premium has been declining, while underprice has grown marginally.

In the MGO LS segment, there are two ports in the overcharge zone: Fujairah and Houston, plus US$189 and plus US$3, respectively. In the other two ports, the MDI registered MGO LS underpricing, Rotterdam – minus US$79, Singapore – minus US$74.

The most significant change, according to MABUX, in this bunker fuel segment was a decrease of the overcharge average in Houston by 36 points.

“The global bunker market awaits the formation of a sustainable trend. We expect

irregular fluctuations to prevail in the market next week,” commented Sergey Ivanov, director of MABUX.