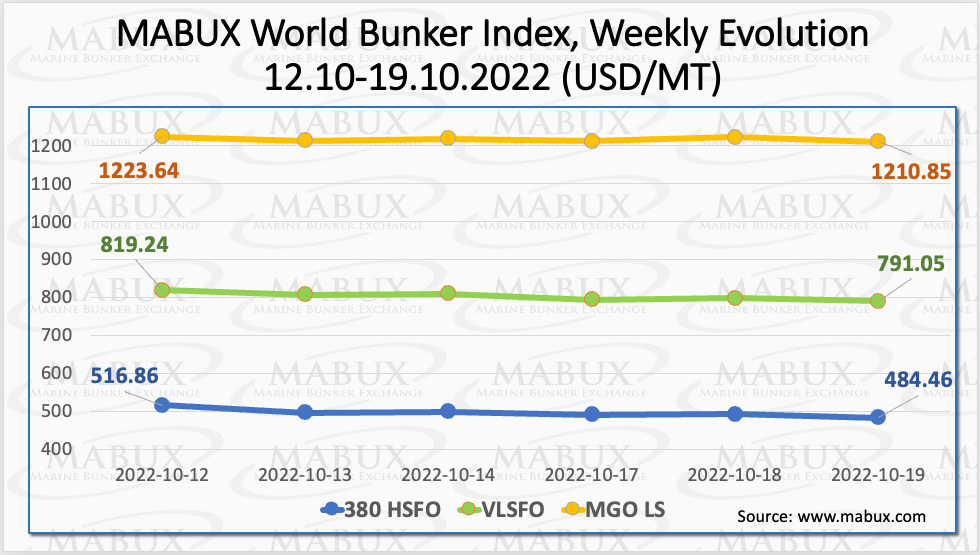

Over Week 42, Marine Bunker Exchange (MABUX) global bunker indices turned into a downward trend again with the 380 HSFO index falling to US$484.46/MT, the VLSFO index decreasing to US$791.05/MT, while the MGO index dropped to US$1,210.85/MT.

Meanwhile, the Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – continued its upward movement over Week 42 – plus US$14.06 (US$306.37 vs. US$ 292.31 last week). In Rotterdam, the average SS Spread rose to US$255.17, while in Singapore, the average weekly price difference of 380 HSFO/VLSFO was also growing: plus US$16.17 (US$353.00 vs. US$336.83 last week).

“The growth of SS Spread indicates that the volatility of the global bunker market remains at a high level,” commented MABUX analysts.

MABUX has noted that gas prices in Europe have dropped from record highs and hit on 17 October the lowest level in three months as the European Commission continues to work on measures to limit price spikes in derivatives trading.

The price of LNG as bunker fuel at the port of Sines in Portugal decreased sharply by US$1,198/MT to US$1,822/MT on 17 October. Thus, LNG prices approached the levels of traditional bunker fuel: the price of MGO LS in the port of Sines was quoted at US$1,257/MT on the same day.

Over Week 42, the MDI Index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed a noticeable

underestimation of 380 HSFO fuel in all four selected ports.

Underprice premium continued to rise in all ports except Houston and amounted to the following: Rotterdam – minus US$144, Singapore – minus US$178, Fujairah – minus US$185 and Houston – minus US$86.

VLSFO fuel grade, according to MDI, was overvalued in three out of four ports selected:

Singapore – plus $71, Fujairah – plus $41 and Houston – plus $13, with Houston moving

again into the overpricing zone. The only undervalued port in the VLSFO segment was

Rotterdam – minus $15.

In the low sulphur marine gas segment, MDI registered an underestimation in two of the four selected ports: Rotterdam – minus US$78, Singapore – minus US$98. Houston moved into the fuel overprice zone and joined Fujairah – plus US$62 and plus US$19 respectively. The underestimation premium decreased moderately, while the overestimation rose.

“MABUX expects global fuel indices to show moderate growth next week. Meantime, irregular fluctuations in the Global bunker market will continue,” pointed out Sergey Ivanov, director of MABUX.