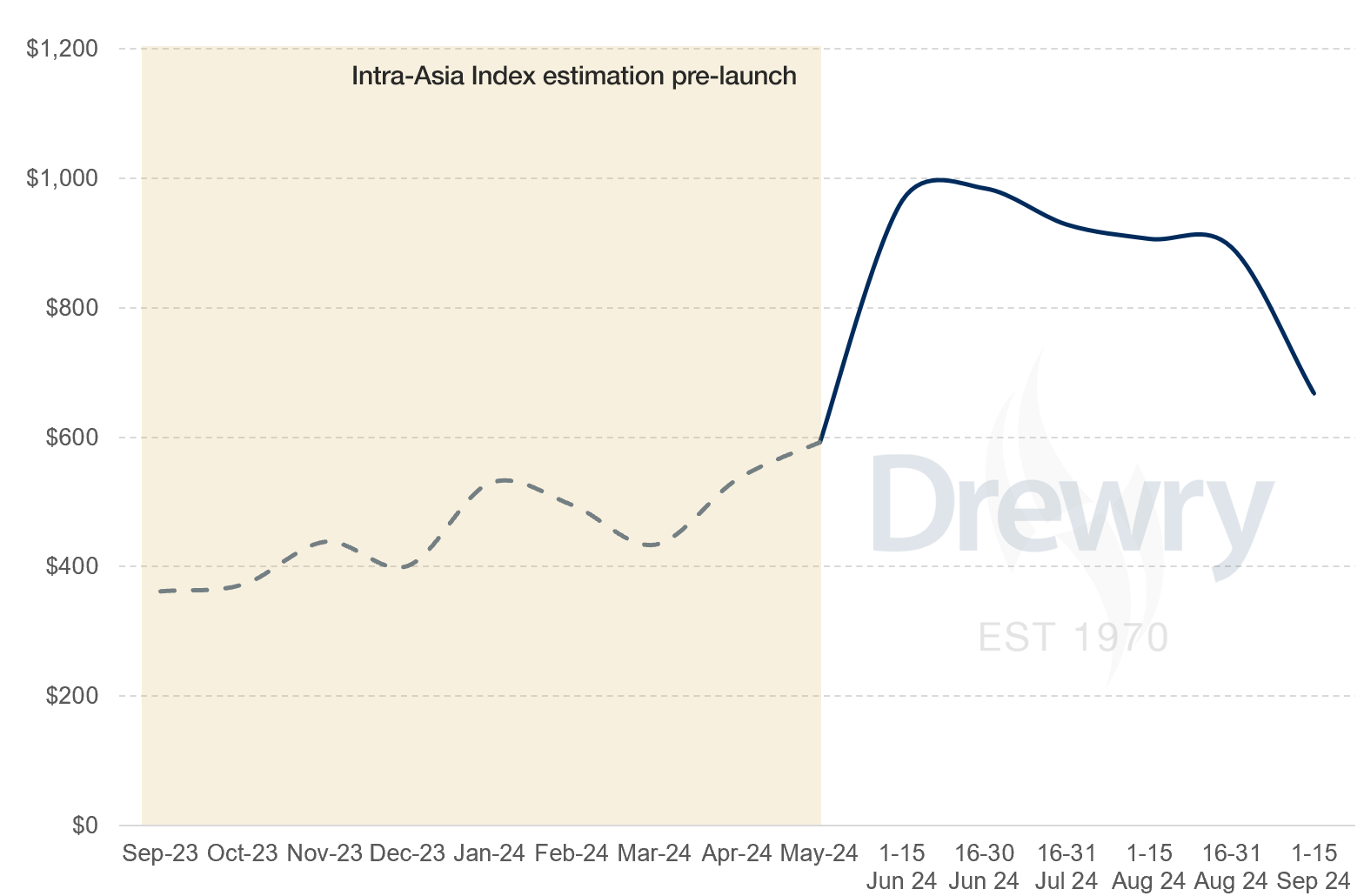

Average spot rates on most intra-Asia container trade lanes weakened again in the first two weeks of September, according to Drewry’s new Intra-Asia Container Index (IACI).

Drewry’s new composite Intra-Asia Container Index (IACI), a weighted average of spot container freight rates, decreased 25% to US$668 per 40ft container in the past fortnight and has fallen back 35% since its recent peak of US$1,025 in the second fortnight of July.

Drewry Intra-Asia Container Index (IACI) composite index (US$/40ft container) – 16 Sep 24

Source: Drewry Supply Chain Advisors

Note: Freight rates exclude origin and destination terminal handling charges

Much like Drewry’s World Container Index (WCI), one of the most followed industry indices for East-West trade lane spot rates, IACI will be an open-access resource allowing shipping stakeholders to follow the pulse of one of the world’s most important container shipping markets.

IACI is a volume-weighted index of spot container freight rates on 18 large Intra-Asia trade lanes to and from China, three North/East Asian countries (Japan, South Korea and Taiwan), five South East Asian countries (Indonesia, Malaysia, Philippines, Thailand and Vietnam) and two South/West Asia countries (India and the United Arab Emirates).

The new index will be published every two weeks on the Drewry website with indices for eight featured regional trade routes accessible by registered website users.

“As growth in container shipping shifts from inter-continental to intra-regional trades, monitoring these trades is now far more important than was the case 13 years ago, when we launched the World Container Index,” said Philip Damas, Head of Supply Chain Advisors and Managing Director of Drewry.

Drewry has noted increasing volatility in Intra-Asia spot rates over recent years, with rates rising strongly this summer and now correcting downwards sharply with softening regional demand.

The article was written by Philip Damas, Head of Supply Chain Advisors and Managing Director of Drewry.