Global oil and fuel prices are picking up as demand returns to pre-pandemic levels amid the easing of coronavirus lockdowns in key countries including China and India and signs of increasing road travel in several countries, according to Marine Bunker Exchange (MABUX).

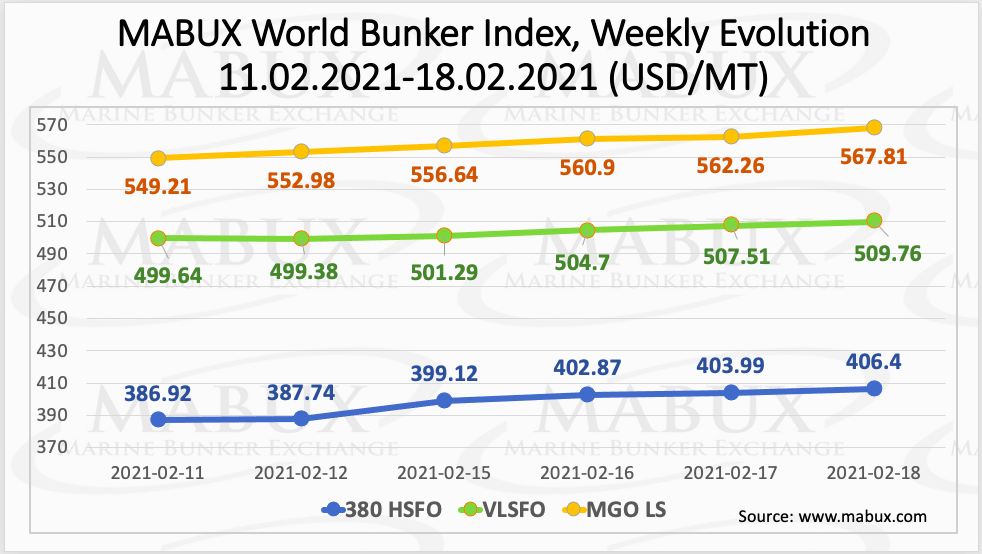

[s2If is_user_logged_in()]MABUX World Bunker Index has shown a firm uptrend during the week with the 380 HSFO index has risen to US$406.40/mt, VLSFO has increased to US$509.76/mt while MGO has risen to US$567.81/mt.

The global scrubber spread (SS) – the difference in price between 380 HSFO and VLSFO – has not changed during the week and averaged U$105.87.

The SS in Rotterdam has widened during the week from US$108 to US$111, while the average value of the SS for the week has risen to US$108.83.

In Singapore, the SS has also risen during the week by US$5 reaching US$146. At the same time, the average weekly SS in Singapore has gained US$22.84 and climbed to US$143.17. Price differentials between 380 HSFO and VLSFO continue to widen.

The correlation between MBP Index (Market Bunker Prices) vs DBP Index (MABUX Digital Benchmark) in four global hubs during the past week showed that 380 HSFO and MGO LS fuel grades remain moderately undercharged in all selected ports.

According to DBP Index, the underestimation of the 380 HSFO increased slightly from last week, ranging from US$13 in Fujairah to minus US$16 in Houston and US$19 in Rotterdam.

Low sulphur MGO was also undervalued, ranging from US$5 in Houston to US$29 in Singapore). The only fuel that, according to DBP Index, remains overvalued in all selected ports, is VLSFO, whose range of overcharging has not changed significantly.

As per Veritas Petroleum Services (VPS), very low sulphur fuel oil (VLSFO) has become the dominant fuel grade over the course of 2020, accounting for 66% of fuel samples tested by VPS. An average of 8% of fuels were-off spec across last year, indicating that bunker fuel quality has been steadily deteriorating.

The geographical distribution of off-spec fuels was not even, with Europe and America on the high side, Asia on the low side and Africa in the mid-range. It was also highlighted the continuing quality challenges posed by VLSFOs in relation to issues such as high Total Sediment Potential (TSP) and cold flow properties.

[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]