The International Maritime Organization (IMO) and Germany have signed an agreement on the development of a project proposal to help reduce maritime transport emissions in East and Southeast Asian countries.

The full-size project, once approved, will target the reduction of greenhouse gas (GHG) and other pollutant emissions from ships within ports, and from hinterland transport through energy efficiency improvements, optimised processes and ‘innovative technologies’, according to the weekly report from Marine Bunker Exchange (MABUX).

The agreement confirms the allocation of €385,697 (approximately US$465,000) in funds to develop a full-size project proposal. IMO added that, at the preparatory stage, it will work with the following focus partner countries to develop the full-size project proposal: China, Indonesia, Malaysia, the Philippines, Thailand and Vietnam. Japan, the Republic of Korea and Singapore are expected to be invited to serve as knowledge partner countries and their level of involvement in the project will be identified and confirmed during the appraisal stage.

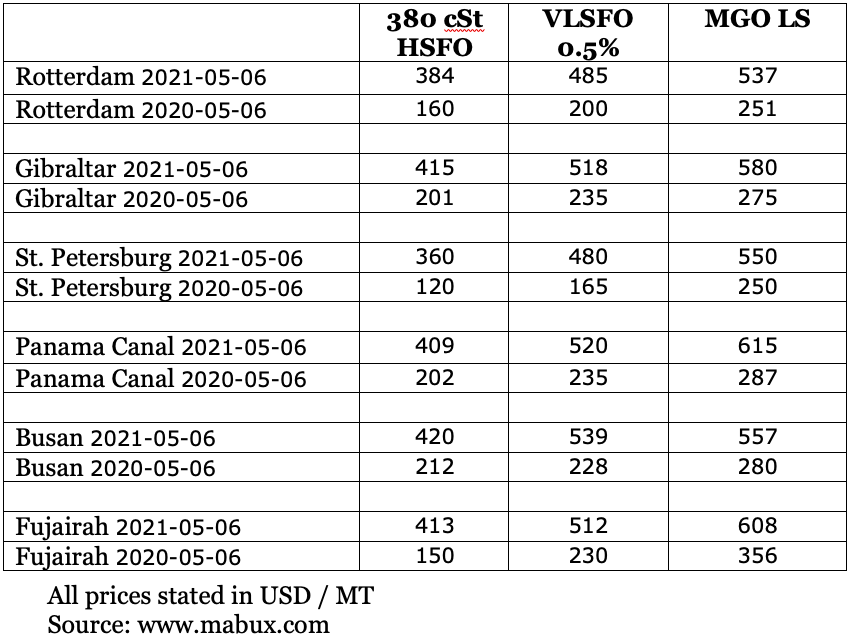

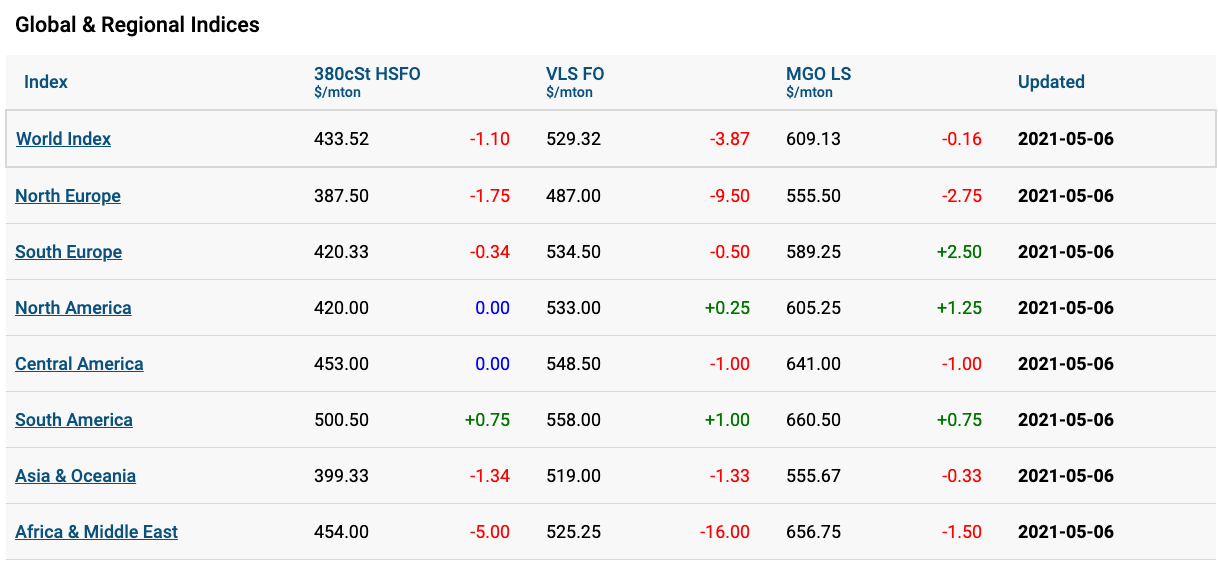

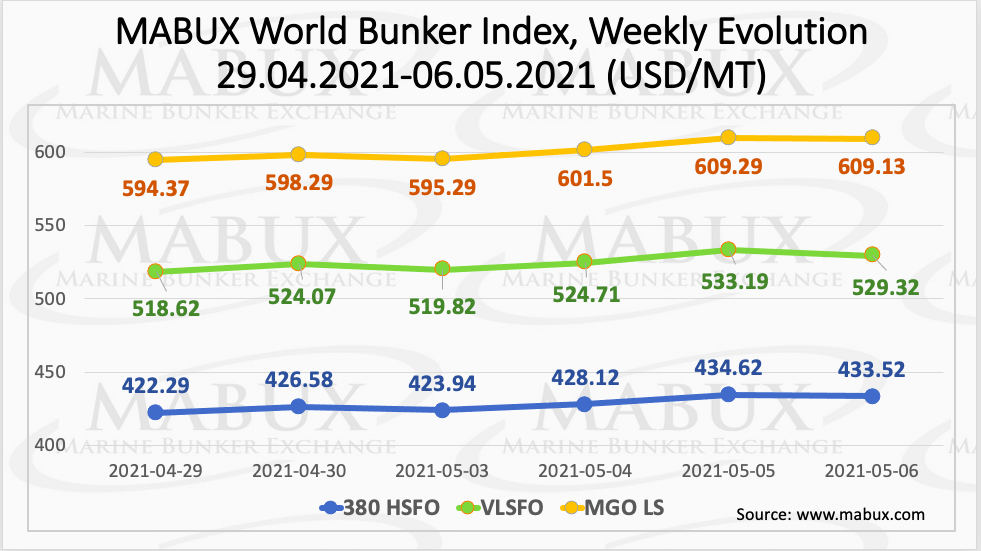

Meanwhile, during week 18, MABUX World Bunker Index continued firm upward movement following general trends on global crude oil market. 380 HSFO index rose to US$433.52/MT, VLSFO Index increased to US$529.32/MT, while MGO Index climbed to US$609.13/MT.

The MABUX ARA LNG Bunker Index, available from 29 April and calculated as an average price of LNG as marine fuel in the ARA region, showed a weekly average of US$524.14/MT.

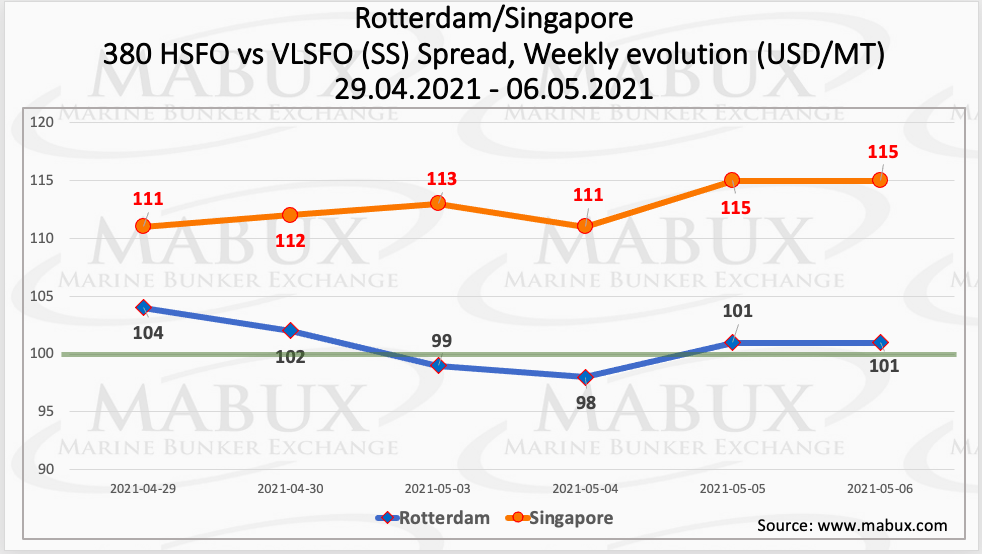

In addition, the average Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – widened slightly to US$96.78.

SS in Rotterdam has narrowed again during the week while still staying above US$100 point (US$100.83), while in Singapore, SS has added US$1.83 to US$112.83.

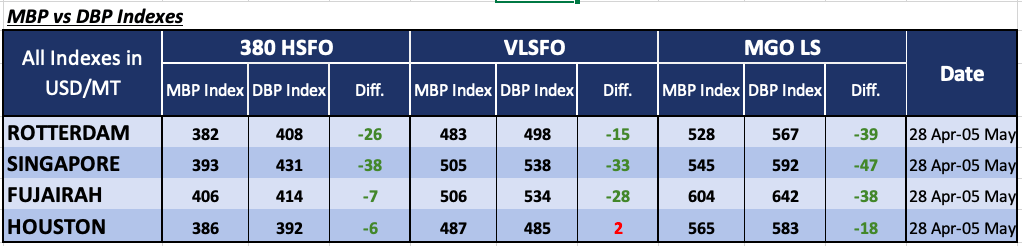

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs showed this week that 380 HSFO fuel was undercharged in all four selected ports ranging from US$6 to US$38 in Singapore.

“The margin of the underestimation has not had any drastic changes,” commented MABUX in its report.

At the same time, the situation with VLSFO bunker prices, according to MABUX DBP Index, practically has not changed as well: underpricing in Rotterdam by US$15, in Fujairah – by US$28, in Singapore – by US$33. In Houston, VLSFO remained overcharged by US$2.

MABUX DBP Index also registered undercharge of MGO LS in all selected ports ranging from US$18 in Houston to US$47 in Singapore.