Shipping firms often rely on contractors to keep their operations running smoothly. This can include drayage drivers, marine surveyors, port service vendors, and other nonemployee workers. While contractors provide flexibility, they also create tax reporting responsibilities. Handling these correctly ensures compliance and avoids penalties.

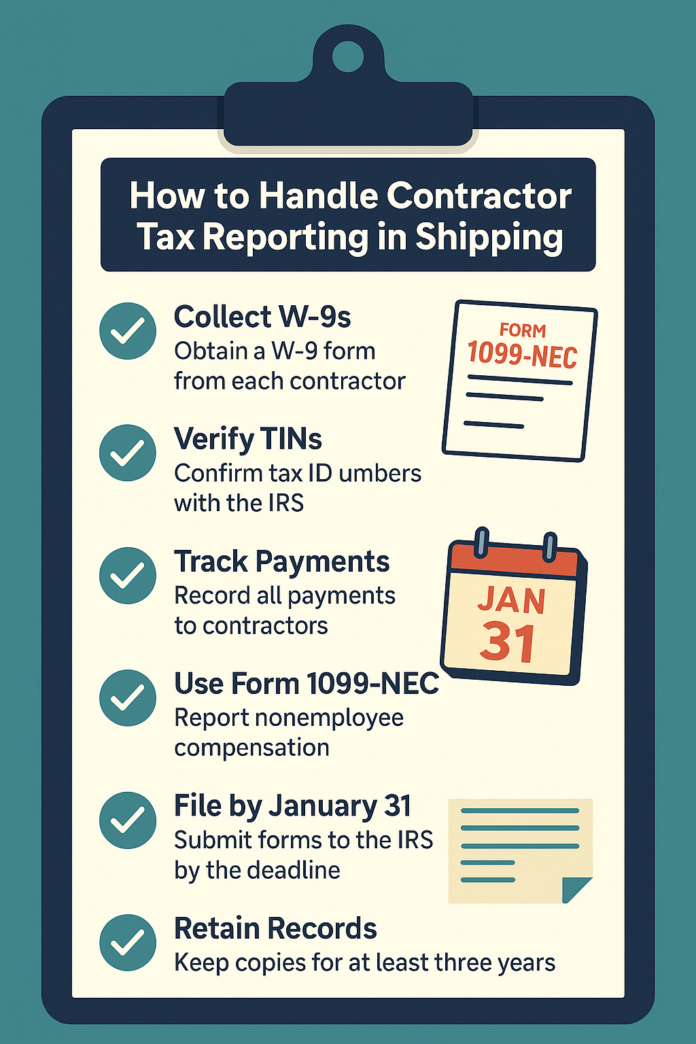

Collect W-9s Early

The first step is collecting a W-9 from each contractor. This form provides the contractor’s legal name, address, and Taxpayer Identification Number (TIN). Make it part of your onboarding process. Without a W-9, you won’t have the necessary information to report payments accurately.

Verify TINs

Once you have a W-9, it’s a good idea to verify the TIN with the IRS. This helps prevent mismatches that could trigger notices or penalties. Many accounting software solutions can automatically handle TIN matching. Even minor errors can create headaches during tax season, so be sure to double-check early.

Track Nonemployee Pay

Write down all payments you make to contractors over the year. Include any fees or payments that go through a factoring company or another third party. Keeping your records organized makes it much easier to prepare accurate 1099s later.

Understand the Correct Form

For reporting nonemployee compensation, use Form 1099-NEC. This form is specifically for contractors and must be filed for anyone you paid $600 or more during the year.

A helpful resource is FormPros’ contractor tax form builder. It guides you through filling out 1099-NECs, e-filing, deadlines, and common errors to avoid.

E-Filing by January 31

The IRS requires that 1099-NEC forms be filed by January 31 each year. This applies even if you’re submitting electronically. Sending forms late can result in fines, so plan your e-filing ahead of time. Some shipping firms integrate reporting with payroll systems to make the process smoother. It’s also a good idea to account for changes in pay rates due to market conditions, like spot rate reduction, when calculating contractor payments.

Record Retention

Hold on to all 1099s, W-9s, and payment records for at least three years. You’ll need them if there’s an audit or a contractor has questions. Storing them digitally is fine, but make sure the files are safe and backed up regularly. When calculating payments or planning budgets, it’s also smart to keep an eye on market trends, such as how trade deals bring welcome stability can affect shipping costs and contractor rates.

Special Notes on Factoring and Third-Party Payments

If you use a factoring company or pay through a third party, make sure you know who files the 1099s. Sometimes the third party takes care of it, and other times it’s your responsibility. Check contracts carefully and keep clear records so there’s no confusion.

Tips for Smooth Year-End Reporting

Get started early, even a few months before January. Check that every contractor has an up-to-date W-9. Go over all payments and make sure the totals are correct. If you pay contractors in different ways, put all the records together so nothing is missed. It can help to have one person or a small team focus on contractor reporting during the busy season.

Doing quick internal checks can catch mistakes before they become a problem. Talk to your contractors too, so everyone knows what to expect and there are no surprises at the last minute.

Stay Compliant

Handling contractor tax reporting in shipping doesn’t have to be stressful. Collect W-9s, verify TINs, track all payments, and file 1099-NECs on time. Doing these steps carefully helps you avoid fines and keeps your business running smoothly. Staying organized and staying on top of deadlines is the best way to make year-end reporting easier.