Maersk blamed overcapacity for its record EBIT losses in the fourth quarter but it failed to mask the fact that it has continuously underperformed the market, according to Linerlytica’s latest report.

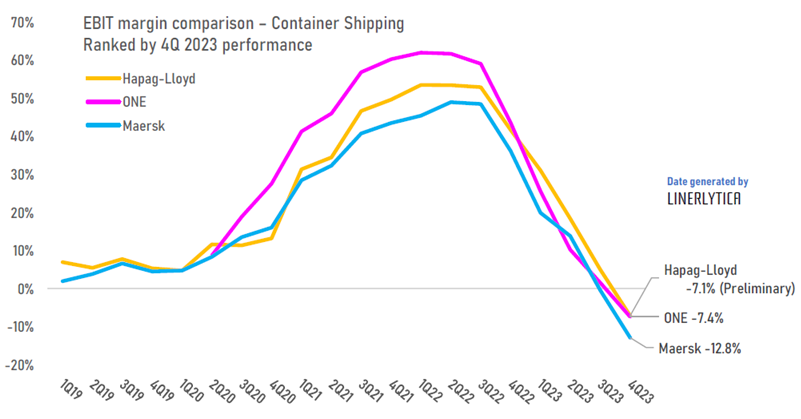

The Danish ocean carrier reported EBIT losses of US$920 million for its Ocean business with EBIT margins dropping to -12.8% in the last quarter of 2023, which is more than 5% lower than its liner peers that have announced their latest quarterly results.

Linerlytica noted that “Maersk’s underperformance compared to its liner peers has become more glaring, with its EBIT margins lagging by as much as 20% behind its closest rivals since 2020.”

Maersk’s revenue takes US$30 billion hit in “transitional year”

Linerlytica pointed out that “it remains to be seen how long can Maersk investors tolerate the below-par performance which will continue in 2024 with Maersk expecting EBIT losses ballooning to -US$5 billion in the worst case scenario.”

However, the Copenhagen-based box line continues to pursue logistics acquisitions and has confirmed a bid for Schenker despite its logistics services delivering EBIT margins of just 1.7% in the fourth quarter of the last year.

Meanwhile, Linerlytica reported that “despite Maersk’s best efforts at painting a pessimistic picture for the container shipping market, rates have retained most of their recent gains heading into the post-Chinese New Year slack period.”

The SCFI and CCFI indices are 117% and 28% higher compared to the same period last year, which, according to Linerlytica, will help to reverse the container shipping companies’ massive fourth-quarter losses.

“Charter rates have continued to firm, with Maersk ironically being the most active charterer accounting for almost one-third of recent market fixtures including forward fixtures for delivery into the 2nd quarter of 2024,” noted Linerlytica, whose charter rate index has risen by 27% since the Red Sea diversions started in mid-December and current rates are 65% higher than the 2019 average.