Weaker demand and lower freight rates have significantly impacted Hapag-Lloyd’s first-half earnings, according to the company’s CEO, Rolf Habben Jansen, who, however, noted that the German shipping firm achieved to expand its terminal portfolio in this period.

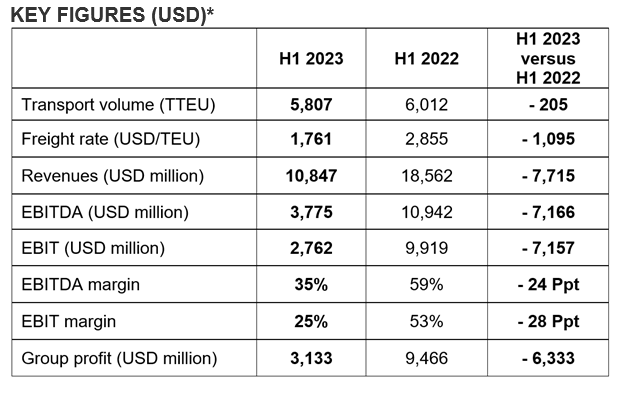

In the first six months of the year, Hapag-Lloyd reported a revenue of US$10.8 billion, earnings before interest, taxes, depreciation and amortisation (EBITDA) of US$3.8 billion, earnings before interest (EBIT) of US$2.8 billion and profit of US$3.1 billion.

In the same period, the Hamburg-based carrier moved 5.8 million TEUs, which translates to a 3.4% decline over the first half of 2022. The drop in box volumes is mainly caused by lower demand for container transports on the Far East and European trade routes to North America, according to Hapag-Lloyd’s first-half report.

As expected, the company reported a lower average freight rate of US$1,761/TEU in the first half of 2023 from US$2,855/TEU in the same period last year.

Additionally, Hapag-Lloyd’s transport expenses were below the prior-year level, at US$6.3 billion, primarily due to lower expenditures for demurrage and detention and a decreased bunker consumption price of US$625 per tonne from US$703 per tonne in 2022 first half.

“In the second half of the year, we will continue to focus on formulating our ‘Strategy 2030’. This strategy will guide us forward on our strategic path to success in 2024,” stated Rolf Habben Jansen.

For the full year 2023, Hapag-Lloyd confirms the forecast it published on 2 March with EBITDA expected to be in the range of US$4.3 to 6.5 billion and EBIT to be in the range of US$2.1 to 4.3 billion.

However, the German company pointed out that “the ongoing war in Ukraine, geopolitical uncertainties, persistent inflationary pressures and high inventory levels are creating risks that could negatively impact the forecast.”