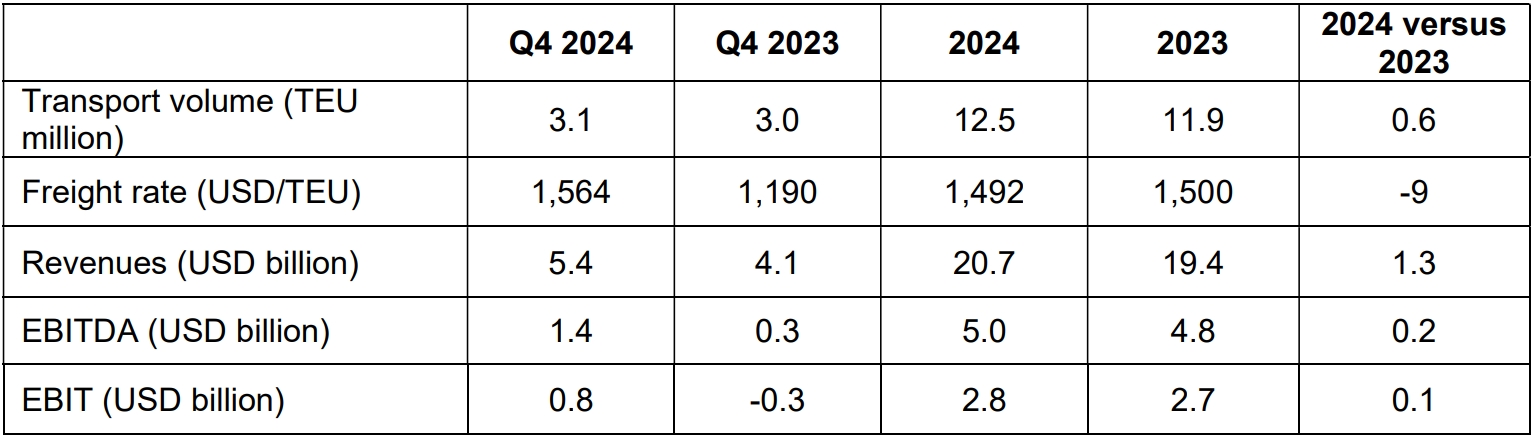

Hapag-Lloyd announced that its transport volumes rose by approximately 5% to 12.5 million TEUs in 2024, despite longer voyage times caused by ship rerouting via the Cape of Good Hope due to security concerns in the Red Sea.

Additionally, based on preliminary and unaudited figures, the German carrier’s revenues grew to US$20.7 billion, largely due to increased demand for container transport.

Furthermore, Hapag-Lloyd reported a Group EBITDA of US$5 billion. In addition, the Group EBIT saw a slight improvement from the previous year, reaching US$2.8 billion. Both key financial indicators were at the upper end of the adjusted earnings forecast released in October 2024, according to the company’s announcement.

The increase was primarily driven by higher transport volumes, supported by a stable average freight rate of US$1,492/TEU, which remained close to the prior-year level (2023: US$1,500/TEU).

Hapag-Lloyd will release its 2024 Annual Report, including audited financial figures and an outlook for the current financial year, on 20 March 2025.