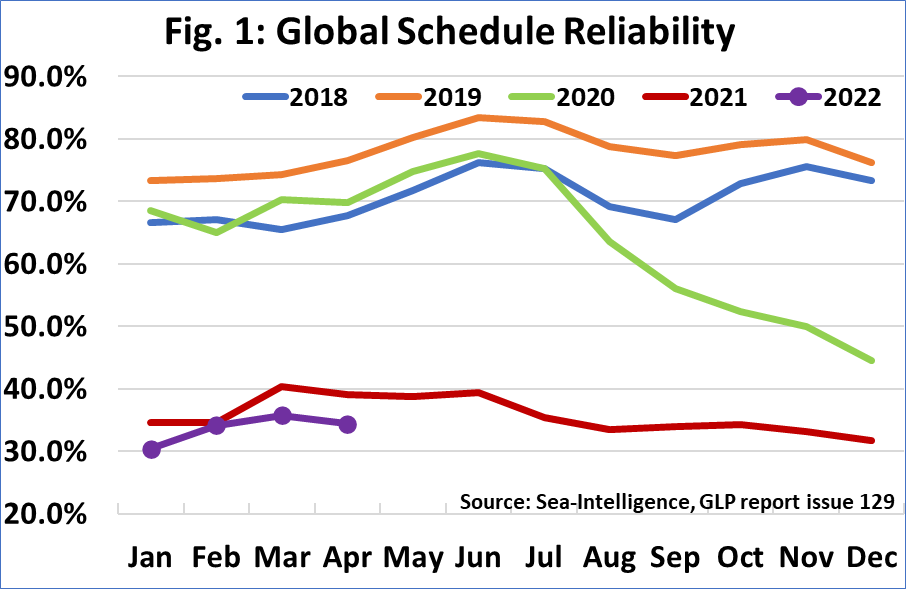

Global schedule reliability seems to continue to follow the trend seen in 2021, with schedule reliability within a small range but at a slightly lower base, according to the Danish maritime data analysis company Sea-Intelligence.

The following are the main points of the Sea-Intelligence report that covers the schedule reliability of the 60+ ocean carriers in 34 different trade lanes.

The global schedule reliability has decreased by 1.3 percentage points month-on-month in April 2022 and fell on an annual basis by 4.7 percentage points.

The above makes the score of 2022 slightly lower than that of 2021 in each of the first four months.

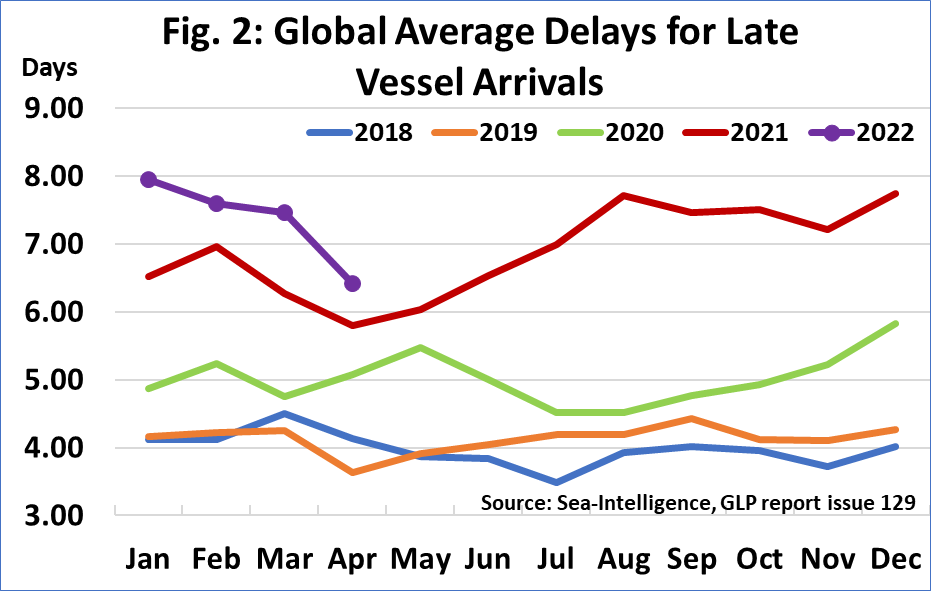

Additionally, the average delay for delayed ship arrivals decreased again, this time by 1.04 days to 6.41 days in April 2022. This is the first time the delay number has fallen below the 7-day limit since August 2021.

“That said, it continues to be the highest across each month when compared historically,” commented Alan Murphy, CEO of Sea-Intelligence.

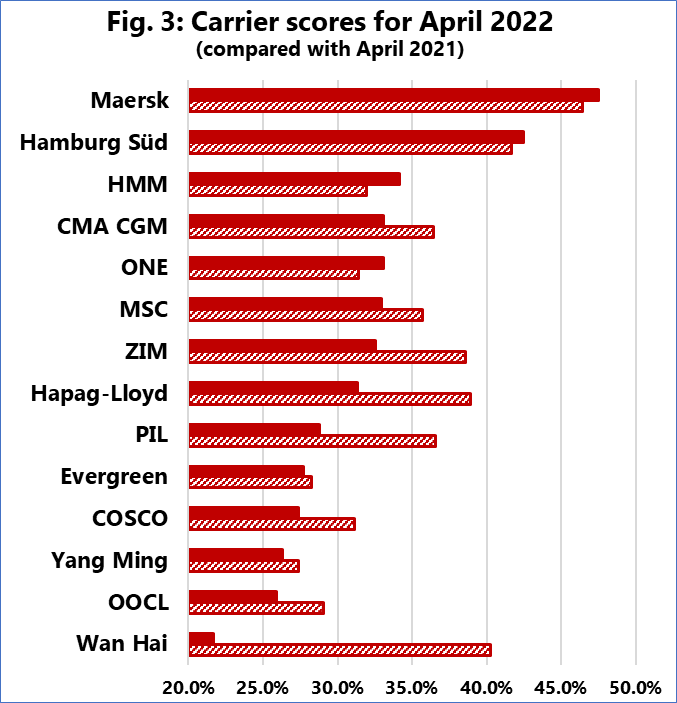

With a score of 47.5%, Maersk was the most reliable carrier in April 2022, followed by its subsidiary Hamburg Süd with 42.5%.

Six companies had a 30% -40% score in schedule reliability and six reported 20% -30% score. In the previous month, once again, many of the carriers were very close to each other in terms of schedule reliability, with 11 carriers within 12 percentage points of each other.

The Taiwanese box line Wan Hai had the lowest schedule reliability in April 2022, marking 21.7%. On a year-on-year level, only four of the top 14 companies improved their schedule reliability in April, with the largest improvement of just 2.3 percentage points.