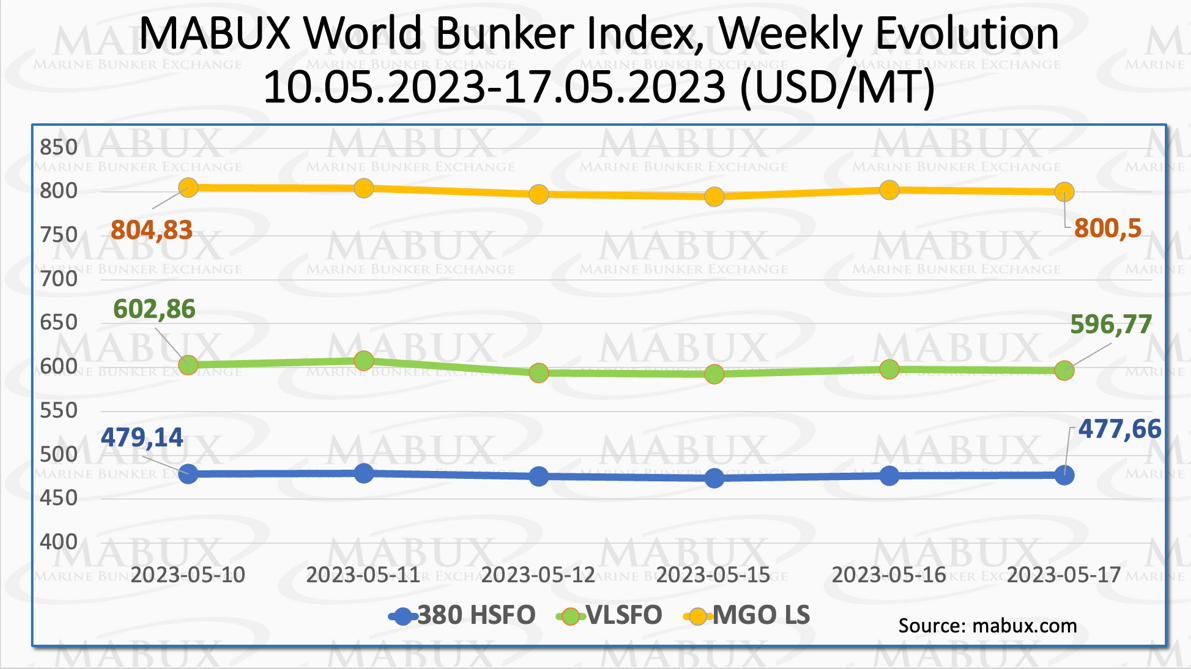

The global MABUX bunker indices declined moderately. The 380 HSFO index dropped by US$1.48, to US$477.66/MT.

The VLSFO index fell by US$6.09, to US$596.77/MT. The MGO index decreased by US$4.33, to US$800.50/MT.

“The market downtrend persisted at the time of writing,” commented a MABUX official.

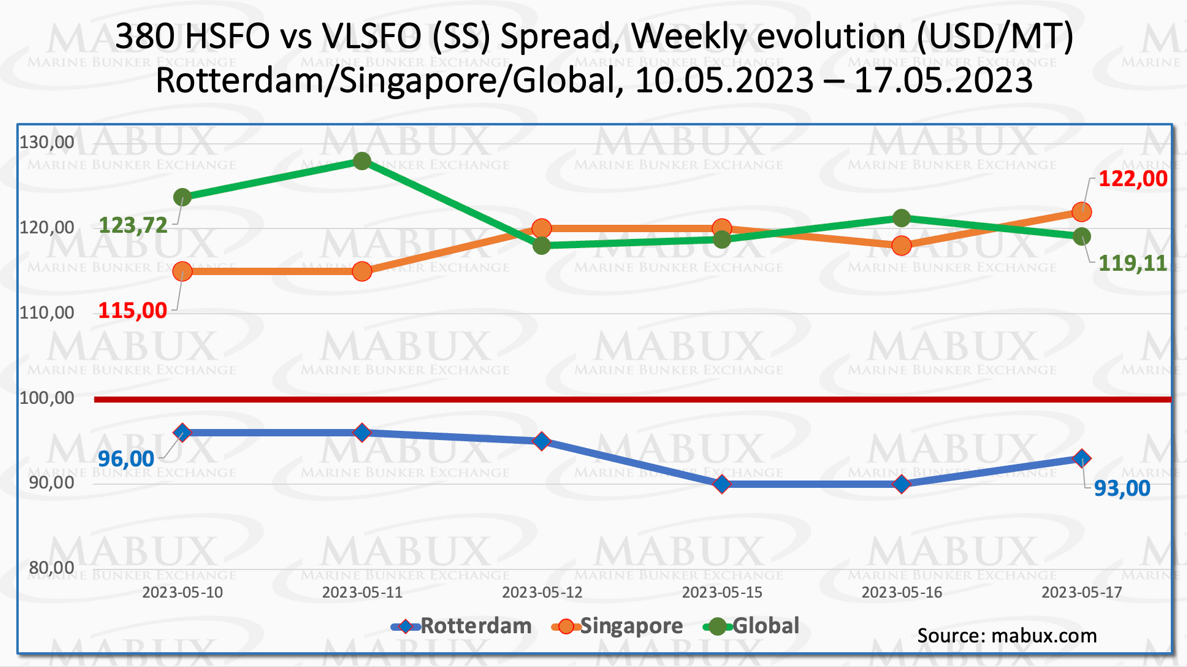

The Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – decreased by US$4.61 to US$119.11.

The weekly average only decreased by US$0.88. In Rotterdam, the SS Spread dropped by US$3, to US$93. The weekly average SS Spread in Rotterdam lost

US$2.34.

In Singapore, the 380 HSFO/VLSFO price difference slightly increased by US$7, to US$122, while the average weekly value decreased by US$12.50.

“Overall, the downward trend in the SS Spread continues,” added a MABUX official.

Low demand for natural gas has sent Europe’s benchmark gas prices towards a seventh consecutive weekly loss—the longest run of weekly losses since 2020. Lower power demand amid mild spring weather in most of Europe is depressing gas prices, while comfortable inventories of gas have not yet led to any rush for filling storage sites ahead of the next winter.

Spot LNG prices for delivery to North Asia in June have also plunged in recent weeks amid weak demand and high inventories in key Asian importers.

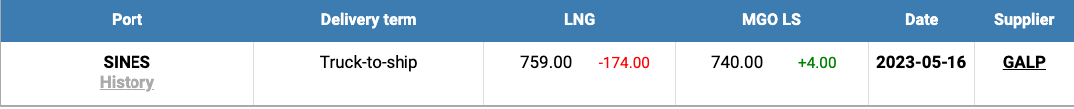

The price of LNG as bunker fuel in the port of Sines, Portugal, has continued its decline and reached US$759/MT on 15 May, which is a decrease of US$174 compared to the previous week.

Consequently, the price difference between LNG and conventional fuel has significantly narrowed, reaching US$19 USD on 15 May. On that day, MGO LS in the port of Sines was quoted at US$740/MT.

This convergence in prices indicates that LNG is once again becoming a competitive fuel option and could be considered as a potential driver for the further development of the LNG fleet.

During week 20, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the MABUX digital bunker benchmark (MABUX DBP Index)) registered an undervaluation of 380 HSFO fuel in all four selected ports.

The average weekly underprice levels increased in Rotterdam and Singapore by two and four points, respectively. Conversely, Fujairah experienced a decrease of four points, while Houston and underprice level remained unchanged.

In the VLSFO segment, Singapore entered the overcharge zone with a positive six point value according to MDI. The other three ports continued to be undervalued, with the average underprice premium increasing between US$4 and US$18.

As for the MGO LS segment, three ports: Rotterdam, Singapore, and Houston – were still underestimated. The average weekly undercharge ratio for these three ports increased by one to five points. Fujairah remained the only overvalued port, but the overcharge premium significantly reduced by minus US$71.

“We expect that the global bunker market retains the potential for further declines. Bunker

indices may continue the downtrend next week,” Sergey Ivanov, director of MABUX.