Global container volumes seem to decline in recent months as the historic growth cycle comes to an end, according to BIMCO.

From mid-2020, global container export volumes saw strong growth and, combined with increasing port congestion, caused supply chain challenges and historically high liner operator financial results which have been the norm in the last several quarters.

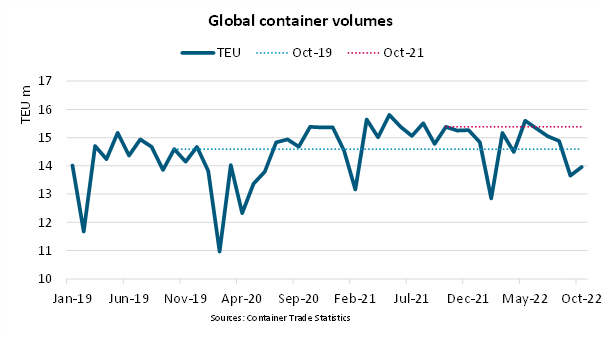

However, in September 2022, box volumes dropped below the numbers recorded in the same month in 2019 for the first time since mid-2020 and statistics just released by Container Trade Statistics have confirmed the trend.

Also, in the next month, global container export volumes fell 9.3% y/y and ended 4.3% lower than in October 2019 figures.

Twenty out of twenty-eight region-to-region trade lanes ended with lower volumes than in October 2021, while eighteen trade lanes saw volumes lower than in October 2019.

“Out of seven regions, five ended with lower import volumes in October 2022 than in October 2019. The Far East, Europe/Mediterranean, and North America regions combined import 75% of global container volumes and saw volume reductions of respectively 5%, 11.0%, and 0.4% versus October 2019,” commented Niels Rasmussen, chief shipping analyst at BIMCO.

The container fleet has grown 11.3% since October 2019, which helps explain why container freight and time charter rates have fallen so quickly during 2022, and particularly in recent months. The lower container volumes have also led to several service closures and an increase in blanked sailings.

As a result, port congestion is improving quickly and no longer restrains supply to the extent seen during the past eighteen months.

As it now appears in BIMCO’s report is likely that global container volumes in 2022 will end approximately 4% lower than in 2021. Growth prospects for 2023 also appear weak due to weak prospects for global economic growth.

At the same time, high contracting of new ships by liner operators during 2021 and 2022 indicates fleet growth of nearly 8% in 2023. All in all, 2023 is much more likely to see the beginning of a new normal rather than a reverse of the recent weakening of the supply/demand balance.