![]()

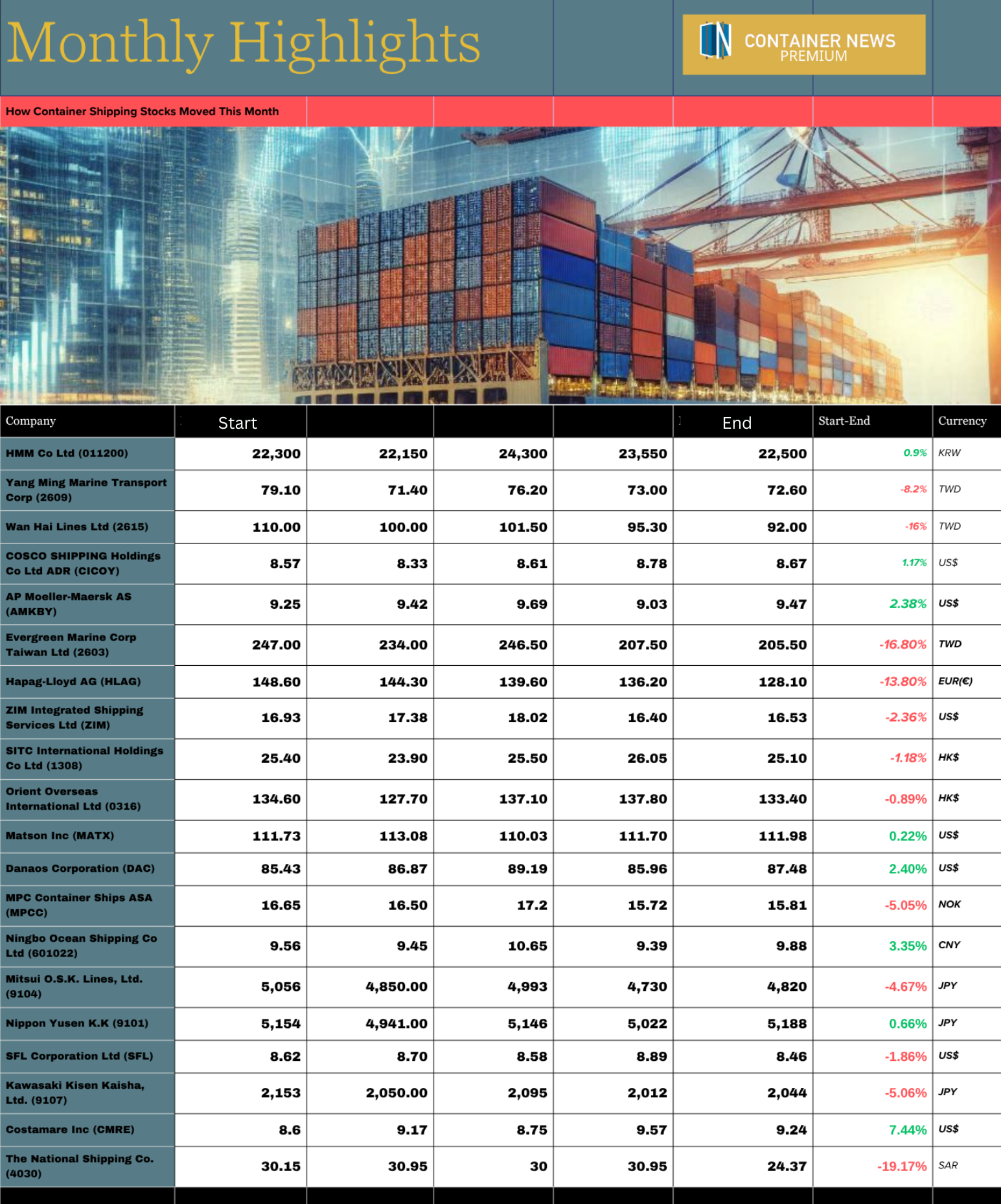

June was a turbulent month for container shipping stocks, reflecting the sector’s sensitivity to freight rates, fuel prices, and global demand. As investors weighed macroeconomic data and trade volumes, stock performances across major shipping lines showed sharp contrasts, with a few standout winners and several notable declines.

Mixed Signals Across the Industry

The month saw divergent performance between Asian, European, and American carriers. While some companies like Maersk delivered modest gains, others such as Evergreen, Wan Hai, and The National Shipping Co. suffered steep declines.

This performance disparity underlines the uneven pace of recovery and pricing power across regions. The Trans-Pacific trade lanes remained volatile, while intra-Asia demand softened, especially for Taiwanese operators.

Asian Carriers Under Pressure

Taiwan’s top three shipping companies ,Evergreen Marine, Yang Ming, and Wan Hai , all saw their stock values drop in June. Evergreen in particular experienced a double-digit decline, reflecting mounting pressure from reduced spot rates and softening demand. Similarly, Japan’s Mitsui O.S.K. Lines and Kawasaki Kisen Kaisha (K Line) showed only limited resilience, fluctuating throughout the month before ending slightly lower.

South Korea’s HMM had a relatively stable month with minor fluctuations, hinting at better cost management and exposure to longer-term contracts.

European Giants Struggle to Maintain Momentum

Germany’s Hapag-Lloyd and Denmark’s Maersk experienced moderate volatility. Hapag-Lloyd dropped steadily throughout the month, reflecting investor concerns about forward freight rate guidance. Maersk, however, ended the month slightly stronger thanks to signs of stability in its logistics division and terminal operations.

U.S. Players Show Resilience

American operators like Matson Inc. generally fared better. Matson remained steady, bolstered by strong demand for U.S.-bound shipping and integrated logistics.

Chinese and Hong Kong-Based Lines Hold Firm

COSCO Shipping Holdings managed a positive return this month, albeit marginal. Investors responded well to its ongoing investment in greener vessels and digital transformation. Hong Kong-based SITC and OOIL (Orient Overseas) had mixed results, swaying with the market but showing operational strength through consistent earnings reports.

What This Means for the Industry

June’s stock market results emphasize the importance of diversification, long-term charters, and global exposure for container shipping companies. Investors appear to be rewarding asset-light models and punishing overexposure to volatile spot markets.

As we enter the second half of the year, the focus will shift to peak season volumes, contract renewals, and geopolitical impacts on global shipping lanes.