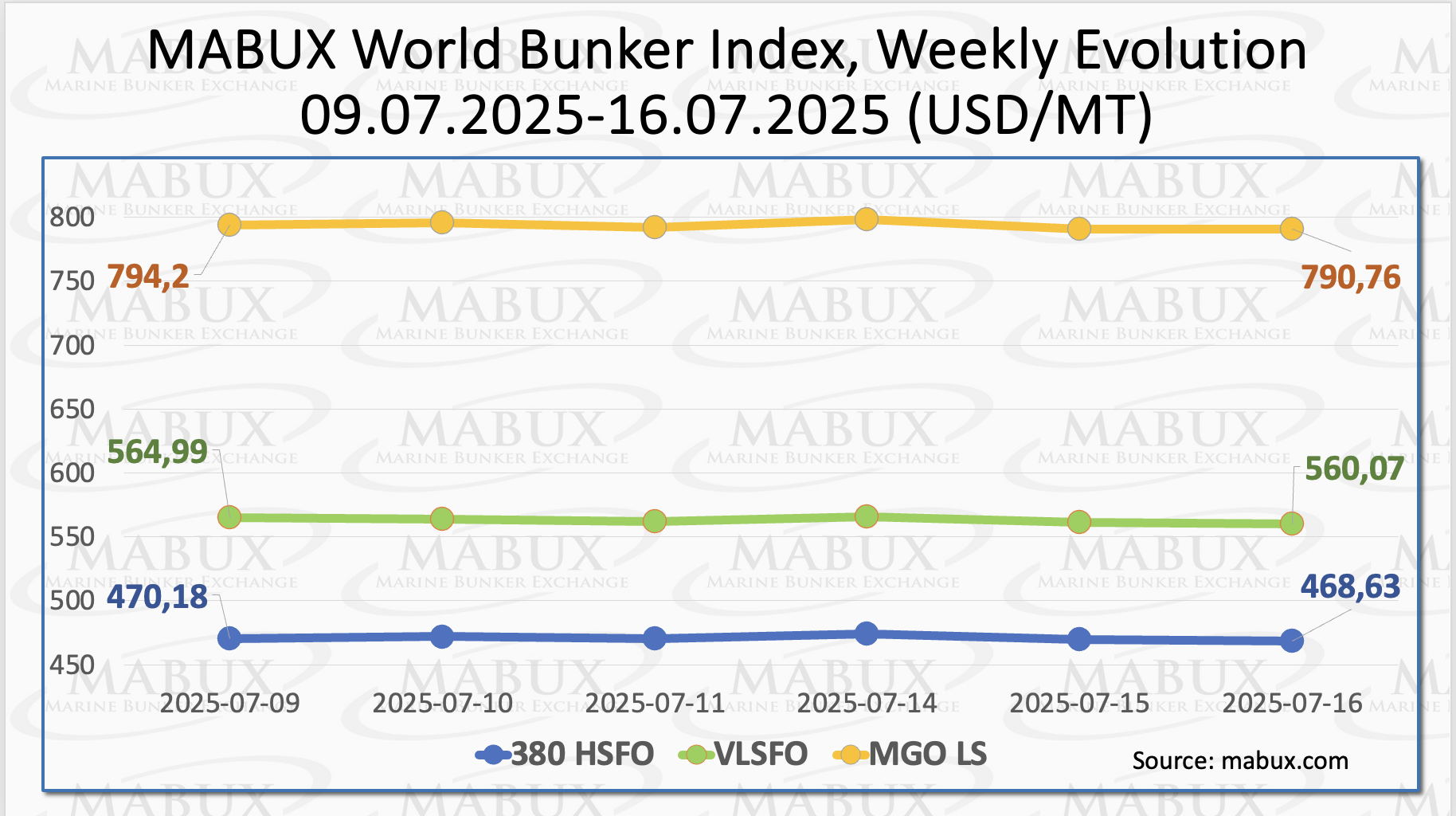

Global bunker indices tracked by Marine Bunker Exchange (MABUX) showed a moderate decline across all segments. The 380 HSFO index decreased by US$1.55, continuing to stay well below the US$ 500.00 threshold.

The VLSFO index also declined, falling by US$ 4.92 from US$ 564.99/MT to US$ 560.07/MT. Meanwhile, the MGO index saw a decrease of US$ 3.44.

”At the time of writing, the global bunker market was showing mixed dynamics without a clearly defined trend,” said Sergey Ivanov, Director, MABUX.

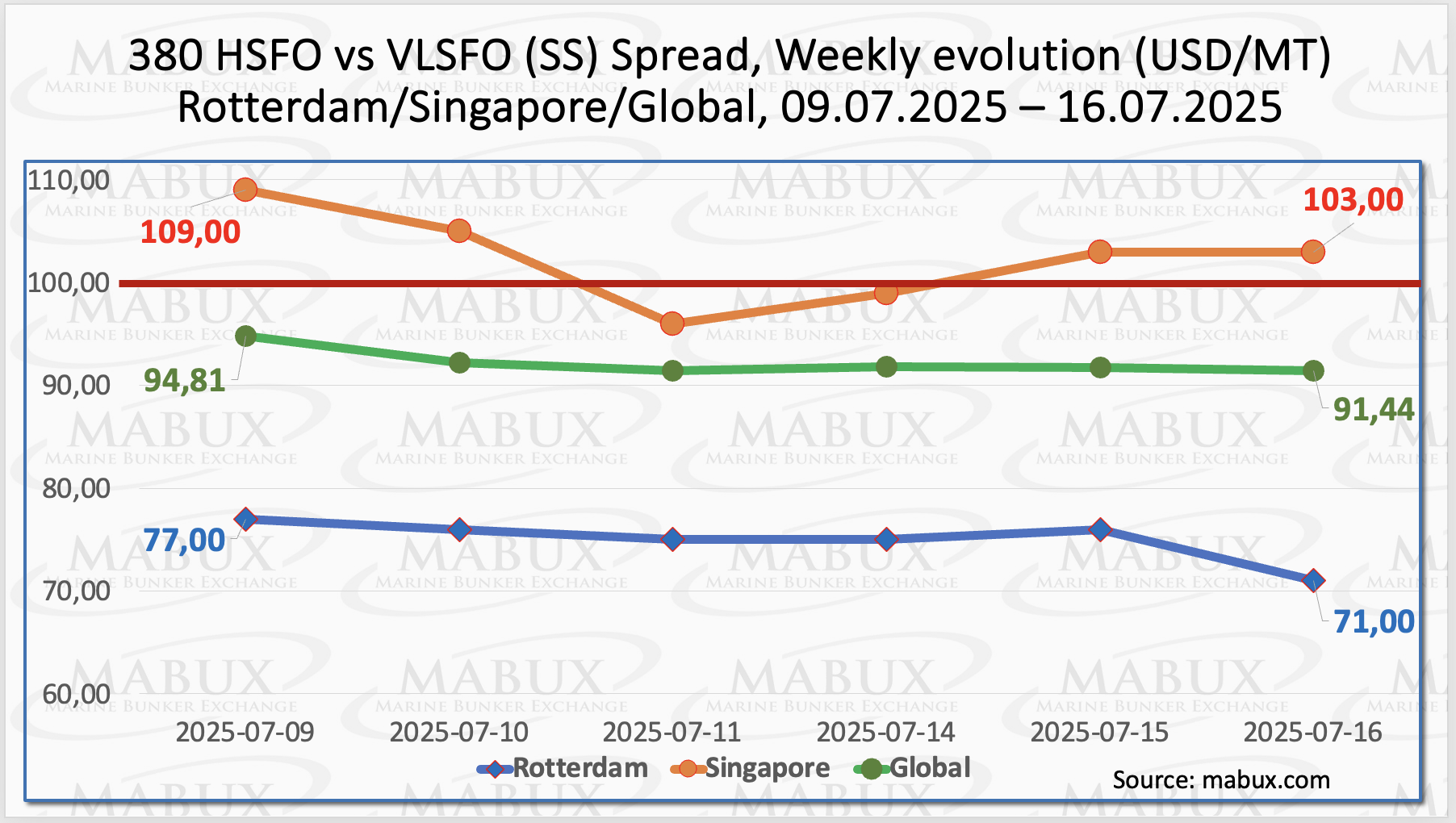

The MABUX Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – decreased by US$ 3.37, once again moving away from the psychological US$ 100.00 SS breakeven mark.

The weekly average of the global index also declined by US$ 3.68. In Rotterdam, the SS Spread dropped by US$ 6.00. However, the weekly average in the port showed a slight increase of US$ 0.17, indicating a momentary stabilization.

In Singapore, the price difference between 380 HSFO and VLSFO also narrowed by US$ 6.00. This brings the index close to the US$ 100.00 threshold, even briefly falling below this level during the week.

The weekly average in Singapore declined by US$ 4.00. The mixed movements of the SS Spread indices reflect the uncertain and transitional state of the global bunker market, which is still in the process of forming a clear and stable trend.

”No significant shifts in the SS Spread dynamics are expected in the coming week, and mixed index movements are likely to persist,” commented Sergey Ivanov, Director, MABUX.

The European Parliament has approved a relaxation of the rules and targets governing natural gas storage within the EU. This move aims to enhance flexibility and reduce the risk of energy price spikes during high-demand periods.

Under the revised regulations, EU member states are now required to reach 90% gas storage capacity at any point between 1 October and 1 December, rather than adhering to a fixed deadline of 1 November as was previously mandated.

Additionally, in response to volatile market conditions, member states will be permitted to deviate from the 90% target by up to 10 percentage points. This exception applies during periods of difficult market circumstances—such as instances of market speculation—that may hinder the cost-effective filling of storage facilities.

Importantly, the requirement to maintain a 90% storage capacity has also been extended by two years, now applying through to the end of 2027.

As of July 15, European regional gas storage facilities were 63.24% full, reflecting an increase of 2.32% compared to the previous week, but a decline of 8.09% from the level at the beginning of the year (71.33%).

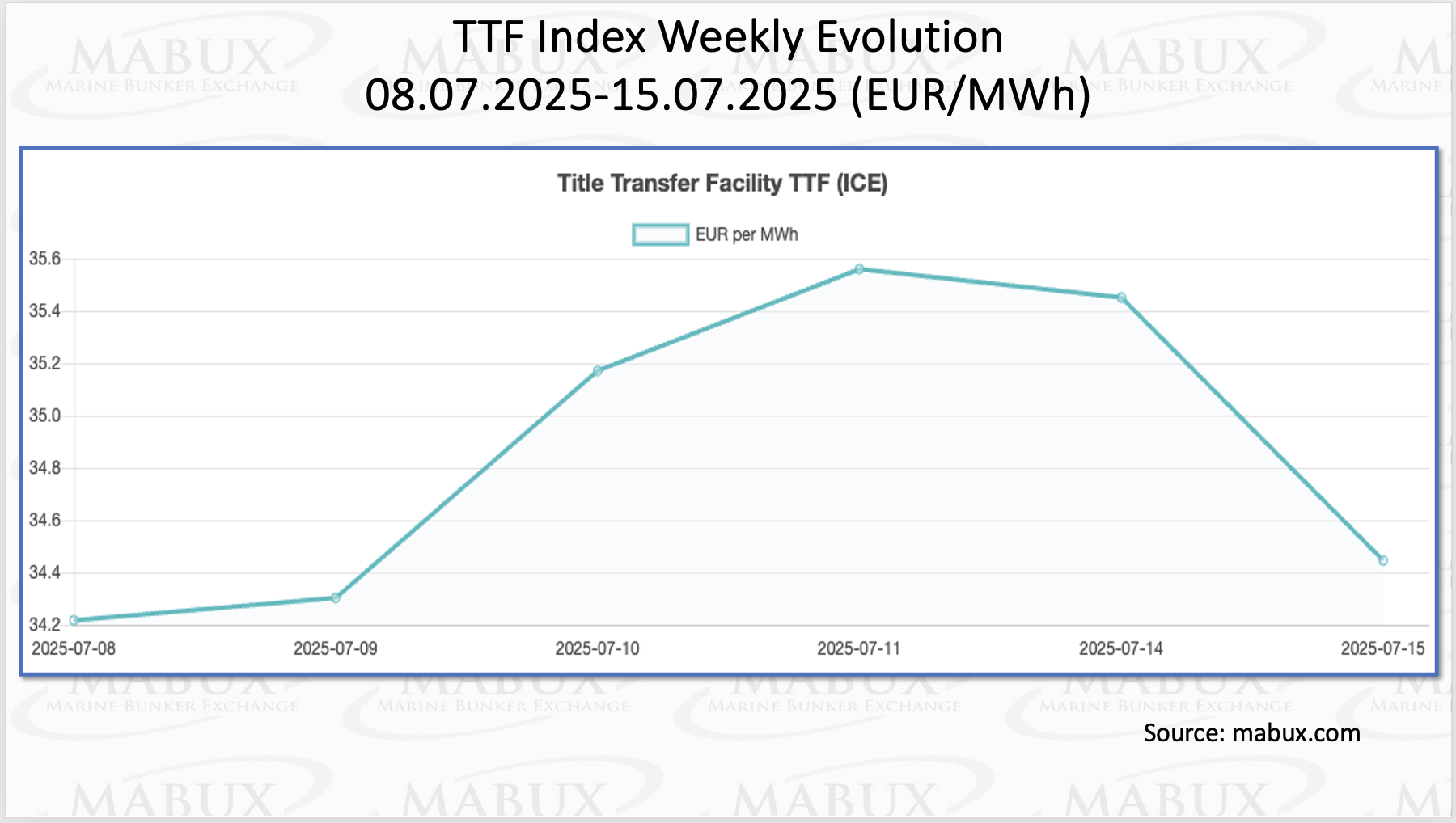

The process of replenishing gas reserves in EU storage sites is ongoing. At the end of Week 29, the European gas benchmark TTF recorded a slight increase of 0.226 EUR/MWh.

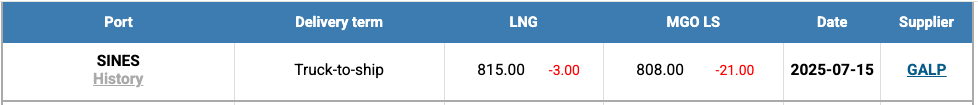

The price of LNG used as a bunker fuel in the port of Sines (Portugal) declined by 3 US$ over the past week, settling at 815 US$/MT as of the end of the week. At the same time, the price differential between LNG and conventional marine fuel narrowed to 7 US$ in favor of conventional fuel. On July 15, MGO LS was quoted at 808 US$/MT in the port.

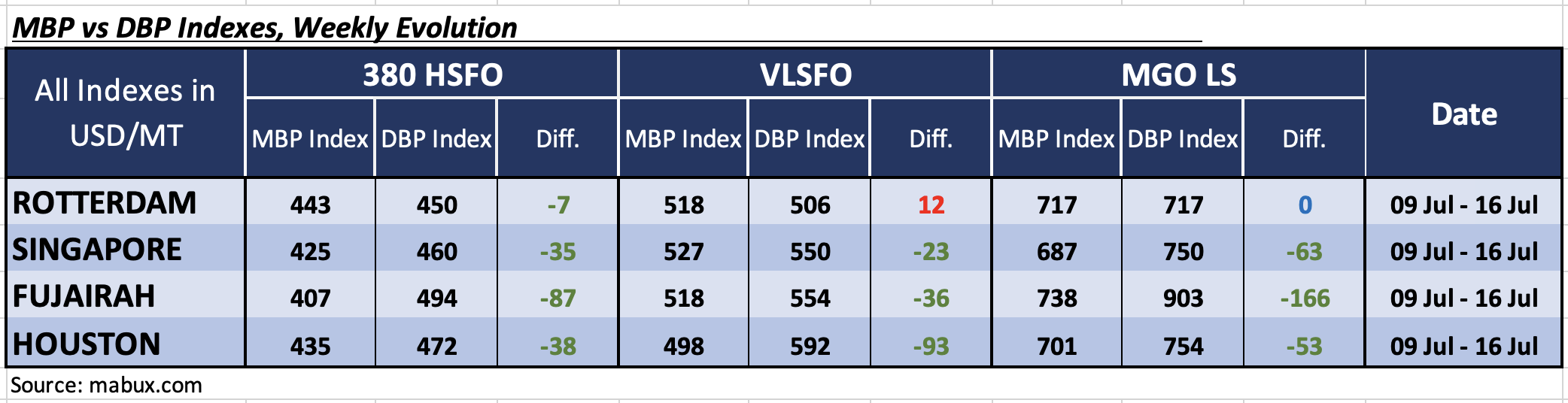

At the end of Week 29, the MABUX Market Differential Index (MDI)—which reflects the ratio between market bunker prices (MBP) and the digital bunker benchmark MABUX (DBP)—showed the following weekly trends in the world’s major bunkering hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: All four ports remained in the undervalued zone. MDI values decreased by 3 points in Rotterdam, increased by 3 points in Singapore, rose by 5 points in Fujairah, and remained unchanged in Houston.

• VLSFO segment: Rotterdam was the only port in the overvalued zone, with its MDI rising by another 3 points. Singapore, Fujairah, and Houston remained undervalued. In this group, MDI increased by 8 points in Singapore and by 3 points in Fujairah, but fell by 2 points in Houston, where the index continues to hover around the US$ 100.00 mark.

• MGO LS segment: Rotterdam recorded a 100% correlation between MBP and DBP, indicating market parity. The other ports remained in the undervalued zone, with MDI values falling by 9 points in Singapore, 11 points in Fujairah, and 15 points in Houston. Notably, Fujairah’s MDI continues to stay above the USD 100.00 level.

”By the end of the week, there were no major shifts in the overall structure of overvalued and undervalued ports. The prevailing trend remains a widespread undervaluation of bunker fuel across all segments. Based on current dynamics, we expect the existing MDI trends to persist into the following week,” said Ivanov.

He added: ”We believe that the global bunker market is currently in a phase of establishing a stable trend, which is expected to be accompanied by moderate and multidirectional price fluctuations in the coming week”.