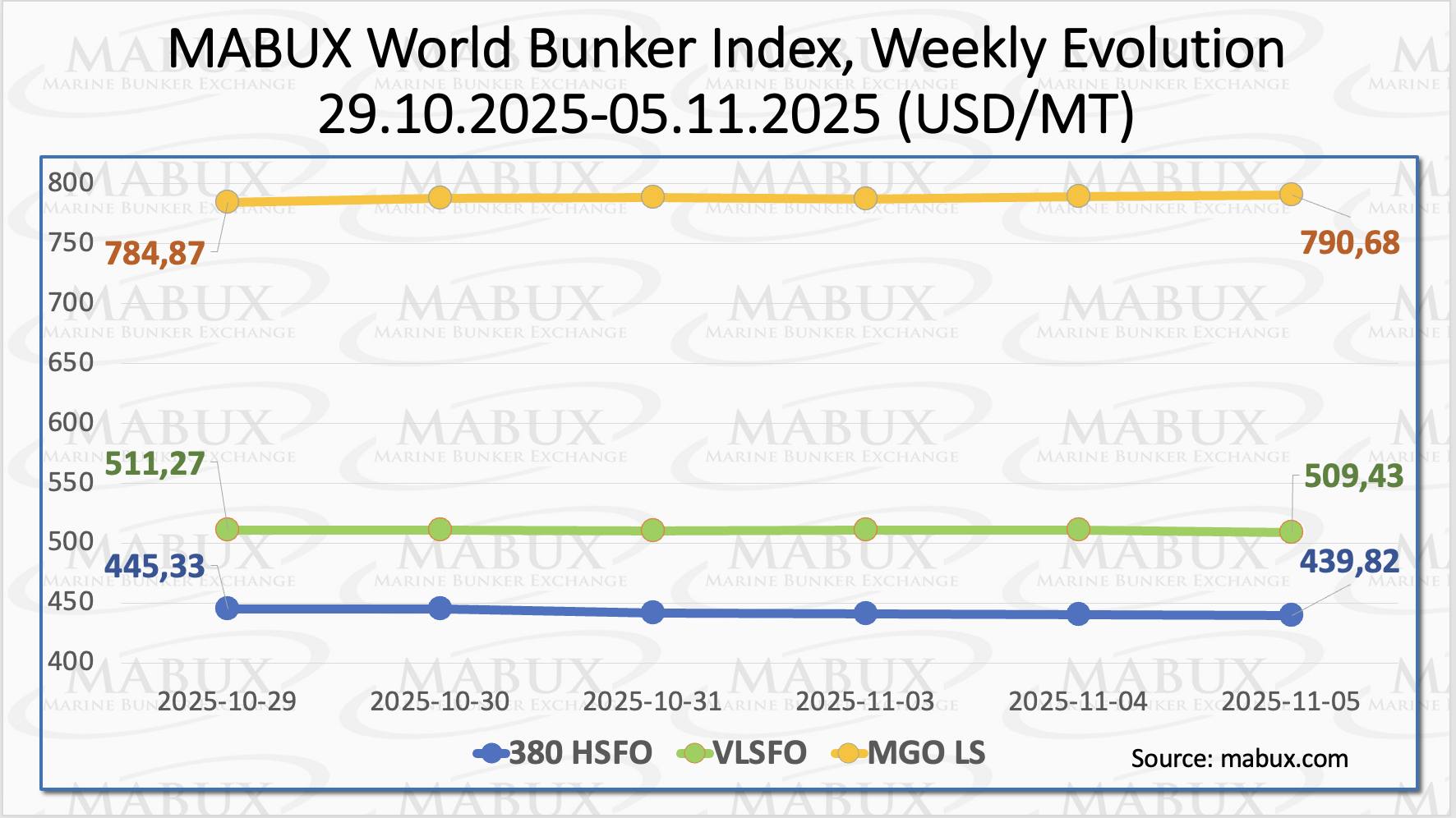

At the end of Week 45, global bunker indices MABUX showed mixed movements with no clear overall trend. The 380 HSFO index declined by US$5.51 to US$439.82/MT, once again falling below the US$450 mark.

The VLSFO index also edged down by US$1.84, to US$509.43/MT. In contrast, the MGO index rose by US$5.81, increasing to US$790.68/MT, gradually nearing the US$800 threshold.

”As of the time of writing, there was no consistent direction in fuel price movements across the global bunker market”, said Sergey Ivanov, Director, MABUX.

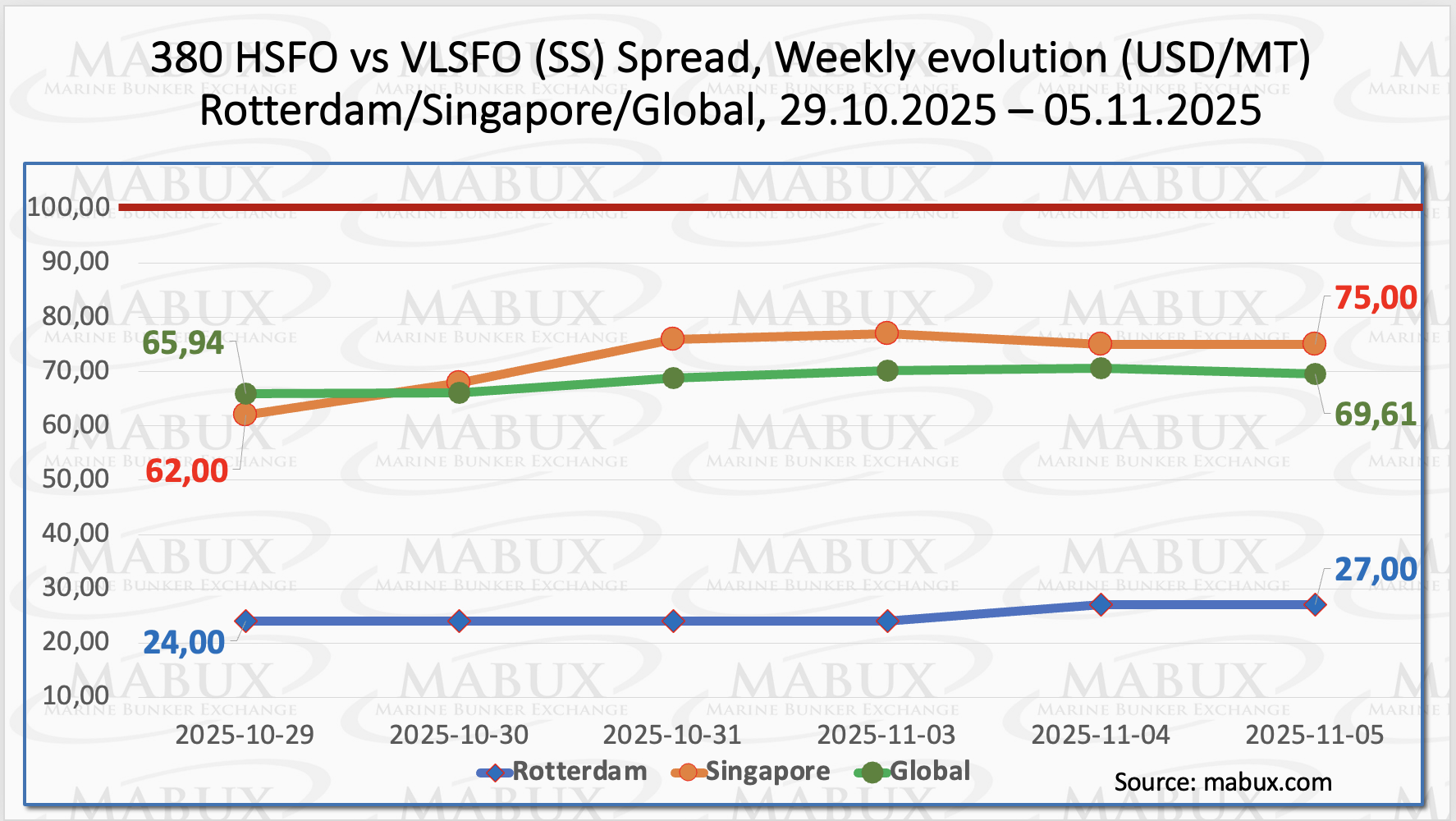

MABUX Global Scrubber Spread (SS) — the price difference between 380 HSFO and VLSFO — showed a moderate increase of US$3.67, rising from US$65.94 last week to US$69.61. The indicator is now approaching the US$70.00 level but remains steadily below the psychological US$100.00 SS breakeven mark.

The weekly average value of the index rose slightly by US$0.35. In Rotterdam, the SS Spread also widened by US$3.00, from US$24.00 to US$27.00, with the port’s weekly average increasing by US$2.83. In Singapore, the 380 HSFO/VLSFO price differential grew more significantly, by US$13.00, from US$62.00 to US$75.00, while the weekly average gained US$9.17.

Overall, the SS Spread demonstrated moderate growth this week, which may signal the start of a short-term upward trend. However, its sustainable position well below the USD 100.00 SS breakeven mark continues to reflect the strong profitability of VLSFO versus HSFO + Scrubber. We expect the upward momentum in the SS Spread to persist next week.

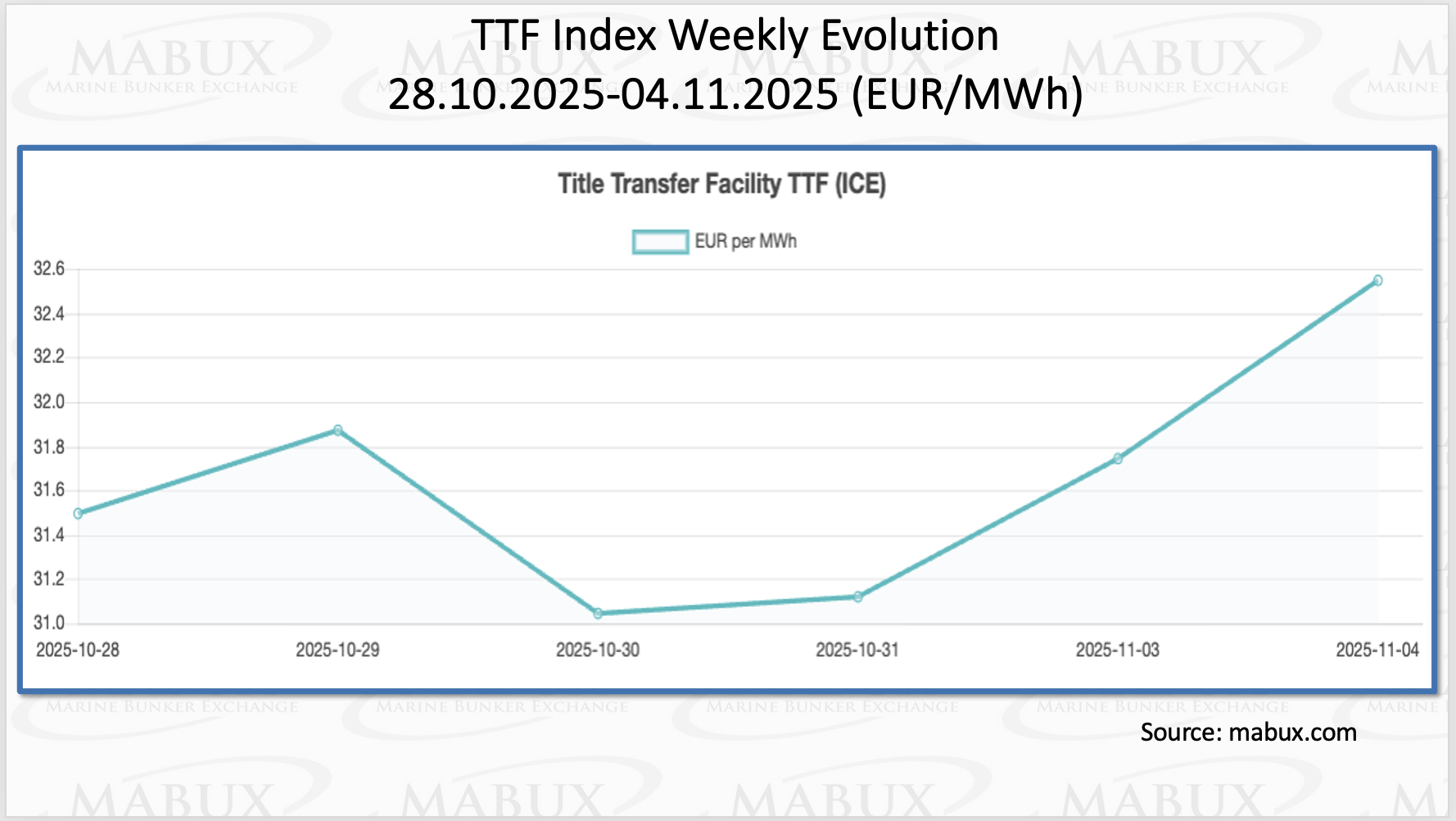

Europe’s natural gas/LNG market remains tightly balanced, with considerable upside risk should any supply disruption occur (given lower pipeline flows and thin storage) and uncertainty on demand. LNG plays a pivotal role as a flexible source, but capacity and delivery constraints persist. While the structural direction (diversification, decarbonisation, lower reliance on Russian gas) is clear, the near‐term winter period remains vulnerable. Price risk remains elevated and operational flexibility (storage, LNG imports, network resilience) will determine market outcomes.

As of November 4, European regional gas storage facilities were 83.02% full, marking a 0.17% increase from the previous week. The rate of storage capacity filling has slowed significantly. Current levels stand 11.69% higher than at the beginning of the year (71.33%). At the end of Week 45, the European TTF gas benchmark recorded moderate growth, rising by €1.057/MWh — from €31.494/MWh to €32.551/MWh.

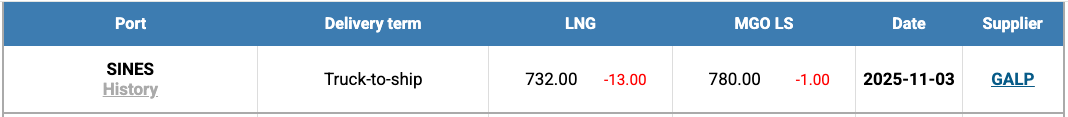

The price of LNG as a bunker fuel at the port of Sines (Portugal) posted a moderate decline this week, down by USD 13.00 to US$732/MT, compared to US$745/MT last week. The correction reflects a mild easing in global LNG quotations, amid stable demand and sufficient regional supply. The price differential between LNG and conventional bunker fuel remained firmly in favor of LNG, widening to US$48 versus US$40 the week before. This was supported by the relatively steady price of MGO LS, which was quoted at US$780/MT at the port of Sines on the same day. The sustained price advantage continues to support LNG’s competitiveness as an alternative marine fuel.

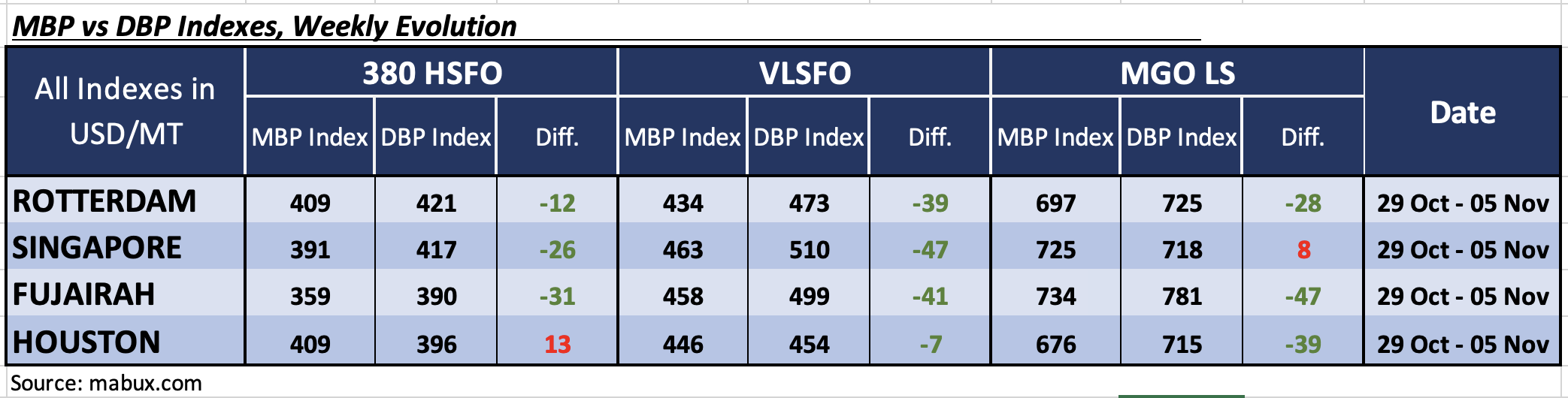

At the end of Week 45, the MABUX Market Differential Index (MDI) — representing the ratio between Market Bunker Prices (MBP) and the MABUX Digital Bunker Benchmark (DBP) — reflected the following bunker fuel pricing trends across the world’s major hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: Three ports — Rotterdam, Singapore, and Fujairah — remained undervalued. The average weekly MDI increased by 4 points in Rotterdam, 5 points in Singapore, and 19 points in Fujairah. Houston continued to be the only overvalued port in this segment, with its MDI decreasing by 4 points.

• VLSFO segment: Houston shifted into the undervalued zone, resulting in all four ports being undervalued. The average weekly MDI undervaluation widened by 2 points in Rotterdam and 12 points in Houston, but narrowed by 3 points in Singapore and 2 points in Fujairah. Houston’s MDI remained close to the 100% correlation level between MBP and DBP.

• MGO LS segment: Singapore remained the only overvalued port, with its MDI rising by 4 points and staying near the 100% correlation threshold. The other three ports were undervalued: MDI values fell by 5 points in Rotterdam but increased by 33 points in Fujairah and 11 points in Houston.

”Overall, by the end of the week, the balance between overvalued and undervalued ports continued to shift further toward undervaluation, with Houston joining this category in the VLSFO segment. We expect the trend toward undervaluation in MDI values to persist in the global bunker market next week,” added Ivanov.

”The global bunker market appears to be in the process of forming a more sustainable trend. However, market fundamentals and regional dynamics remain uneven. We anticipate that next week’s bunker index movements will likely continue to exhibit mixed fluctuations without a definitive directional pattern, reflecting a period of market adjustment and cautious sentiment among participants”, commented Sergey Ivanov, Director, MABUX.