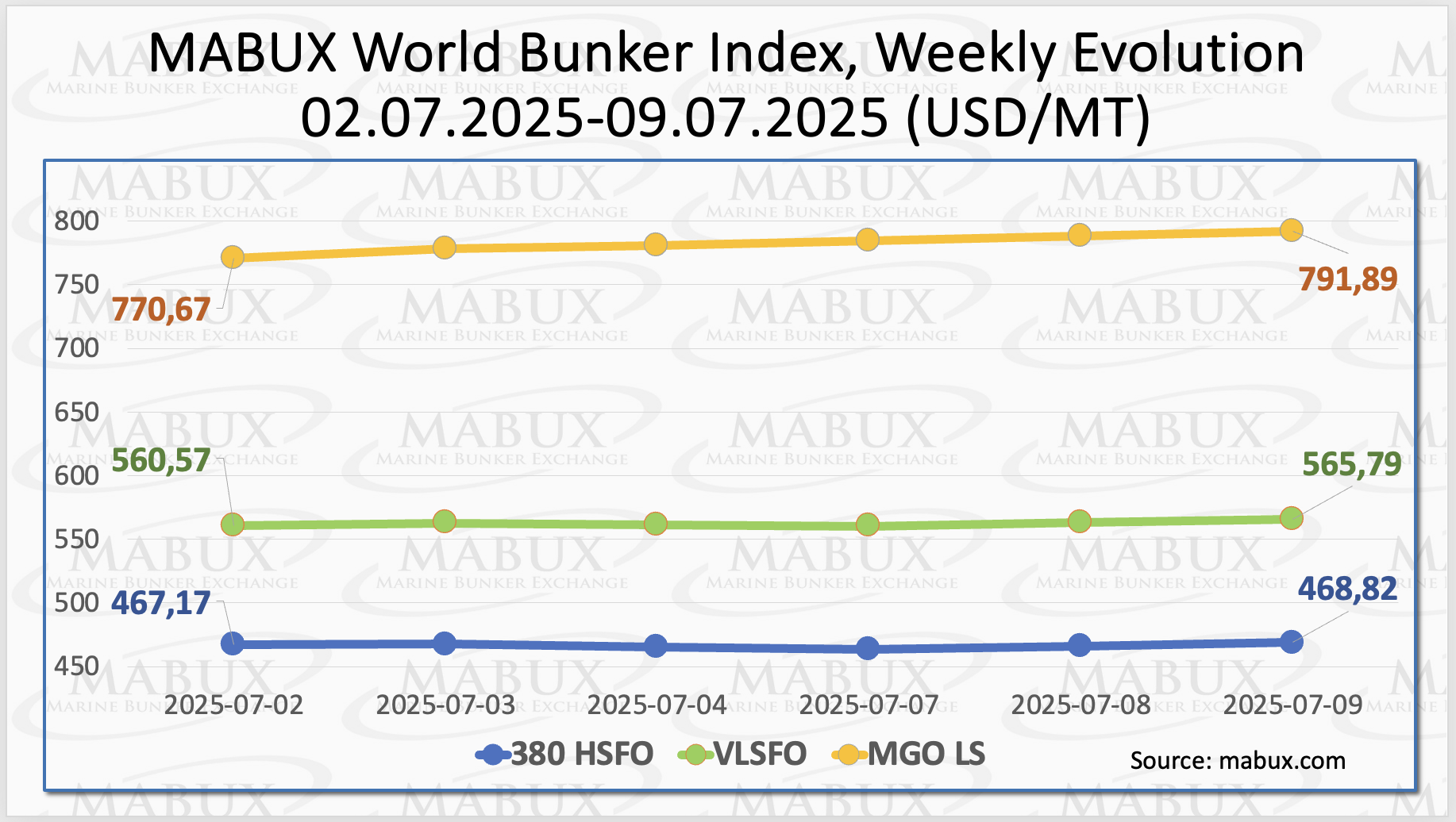

Global bunker indices tracked by Marine Bunker Exchange (MABUX) continued their moderate growth amid signs of relative market stabilization. The 380 HSFO index increased by US$1.65, although it still remains significantly below the US$500.00 mark.

The VLSFO index also showed an upward movement, adding US$5.22 to reach USD 565.79/MT. The most notable increase was recorded in the MGO index, which rose by US$21.22, bringing it close to the USD 800.00 threshold.

”At the time of writing, a slight downward correction was observed in the global bunker market,” said Sergey Ivanov, Director of MABUX.

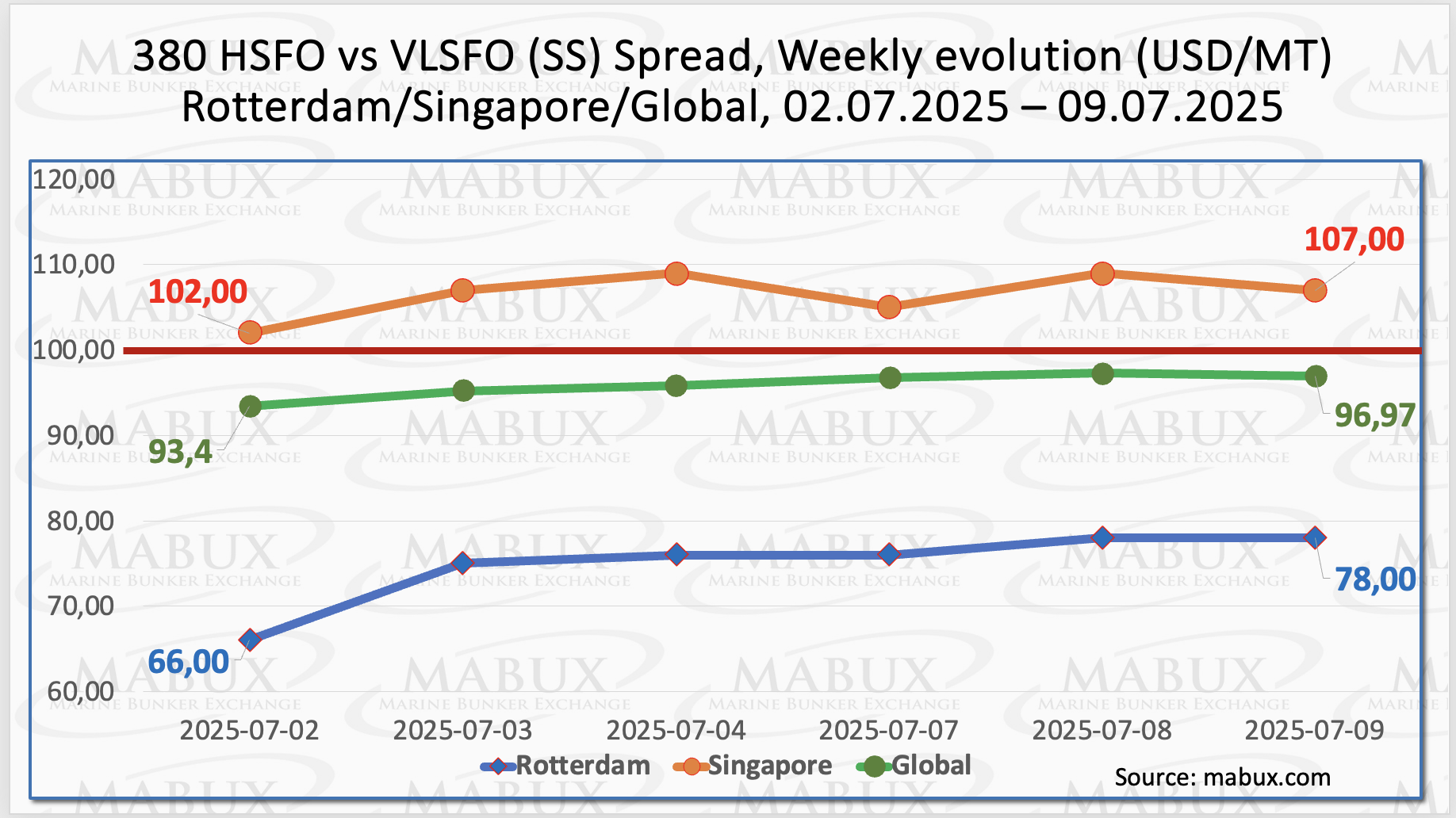

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—increased by US$3.57, approaching the psychological threshold of US$100.00, known as the SS Breakeven point.

The weekly average of the global SS index also rose by US$4.99. In Rotterdam, the SS Spread climbed by US$12.00, while the port’s weekly average jumped by US$17.50. In Singapore, the 380 HSFO/VLSFO spread widened by US$5.00.

The weekly average in the port increased by US$12.67. The global bunker market continues to exhibit a steady upward trend in SS indices, indicating a phase of moderate market stabilization.

”With the SS Spread surpassing the US$100.00 breakeven level, the profitability of the 380 HSFO + Scrubber option is being restored relative to conventional VLSFO. This trend is expected to persist into next week,” said Sergey Ivanov, Director of MABUX.

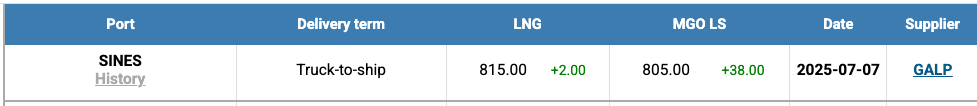

By the end of the week, the price of LNG as a bunker fuel at the port of Sines rose by another US$2, reaching USD 815/MT. At the same time, the price difference between LNG and conventional marine fuel narrowed significantly.

As of July 7, the gap decreased to just US$10 in favor of conventional fuel. On that day, MGO LS was quoted at US$805/MT in the port of Sines.

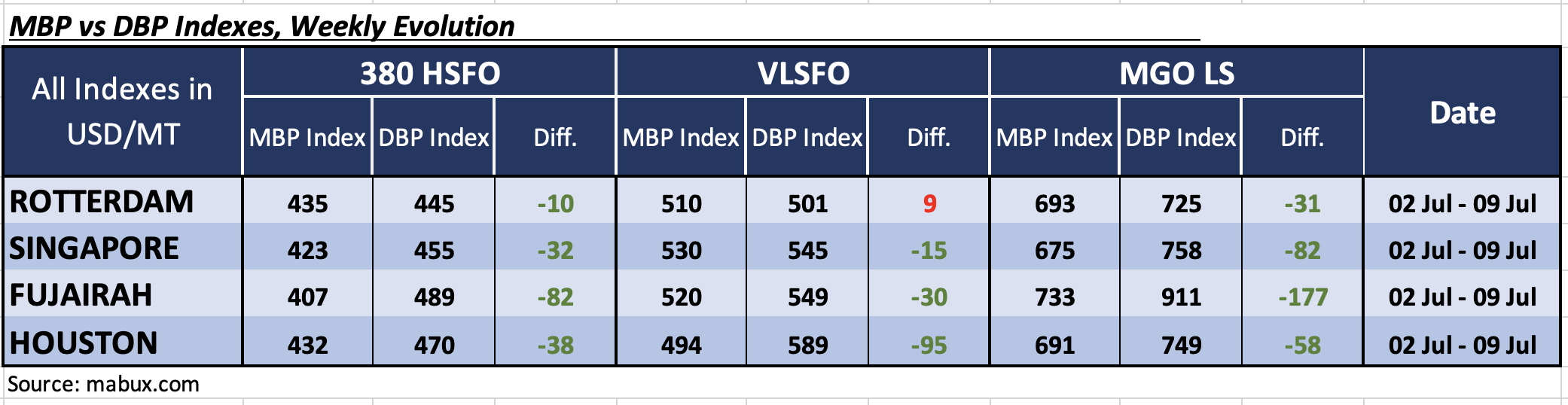

At the end of the 28th week, the MABUX Market Differential Index (MDI)—which compares market bunker prices (MBP) to the MABUX Digital Bunker Benchmark (DBP)—reflected mixed trends across the world’s major ports: Rotterdam, Singapore, Fujairah, and Houston:

- 380 HSFO segment: All ports remained in the undervalued zone. The MDI values increased by 6 points in Rotterdam, 13 points in Singapore, 6 points in Fujairah, and 9 points in Houston.

- VLSFO segment: Rotterdam continued to be the only overvalued port, with its MDI increasing by 6 points, bringing it to the 100% correlation mark between MBP and DBP. The remaining ports—Singapore, Fujairah, and Houston—were all undervalued, with the level of undervaluation rising by 5 points in Singapore, 6 points in Fujairah, and 7 points in Houston. Notably, Houston’s MDI is now approaching the $100.00 mark.

- MGO LS segment: All selected ports remained undervalued. The MDI increased significantly across the board: by 23 points in Rotterdam, 30 points in Singapore, 39 points in Fujairah, and 10 points in Houston. Fujairah’s MDI continues to stay above the US$100.00 threshold.

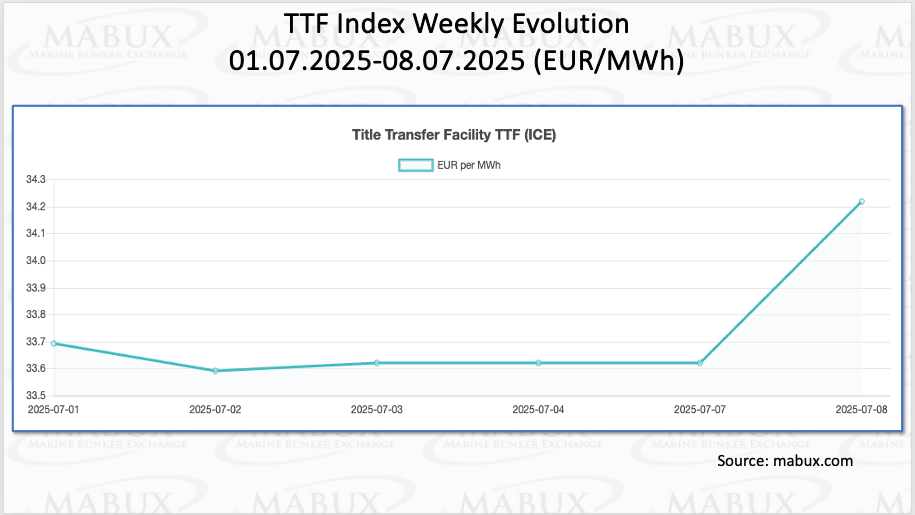

Europe is ramping up its liquefied natural gas (LNG) purchases to refill storage facilities ahead of winter, a move that is driving up global prices and dampening demand in Asia. This pattern may become a seasonal trend until new LNG production capacity comes online.

As of July 8, European regional gas storage facilities were 60.92% full, marking a 2.02% increase from the previous week but a 10.41% decrease compared to the beginning of the year, when storage stood at 71.33%.

According to the EU’s storage target, gas storage levels must reach 90% by November, or by December at the latest. This target effectively compels European buyers to increase LNG purchases, regardless of prevailing market prices.

By the end of Week 28, the European gas benchmark TTF posted a moderate gain of 0.526 euro/MWh, rising from 33.693 euro/MWh to 34.219 euro/MWh.

”Overall, the structure of overvalued and undervalued ports saw little change compared to the previous week. Rotterdam remains the only overvalued port, and only in the VLSFO segment, while the undervaluation trend persists globally. No significant changes in the SS Spread dynamics are anticipated for the upcoming week,” commented Ivanov.