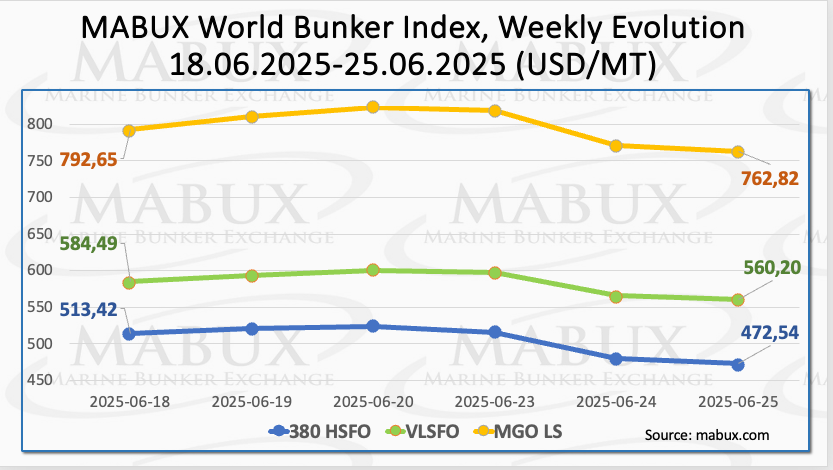

Global bunker indices tracked by Marine Bunker Exchange (MABUX) fell sharply in the 26th week of the year, driven by expectations that a ceasefire between Israel and Iran will ease concerns over potential oil supply disruptions in the Middle East.

The 380 HSFO index dropped to US$472.54/MT, the VLSFO index declined to US$560.20/MT and the MGO index fell to US$762.82/MT.

“At the time of writing, the global bunker market was undergoing an upward correction,” said Sergey Ivanov, Director of MABUX.

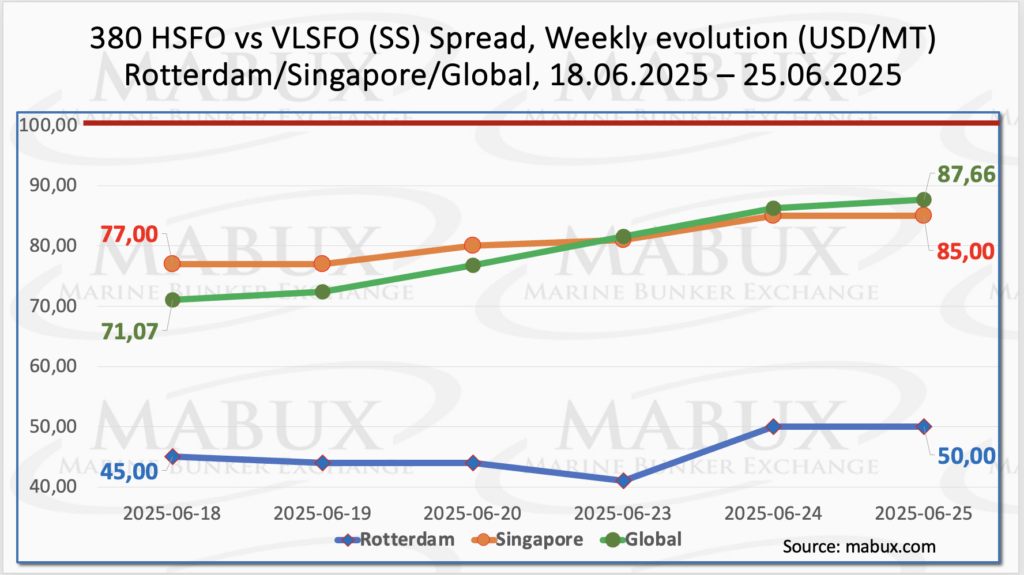

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—rose by US$16.59 in the previous week, climbing to US$87.66. The weekly average also increased by US$5.76.

In Rotterdam, the SS spread edged up by US$5, reaching US$50. However, the Dutch port’s weekly average declined by US$6.50.

In Singapore, the spread widened by US$8 to US$85. The weekly average in the Asian port rose slightly by US$1.50.

Overall, the global bunker market is showing signs of renewed growth in SS indices, largely driven by continued high market volatility, according to the MABUX analysis.

However, with SS Spread values still below the US$100 breakeven point, conventional VLSFO remains the more cost-effective option compared to 380 HSFO with scrubber use.

“A moderate upward trend in SS Spread indices is expected to continue into next week,” noted Ivanov.

The International Energy Agency (IEA) reports that greenhouse gas emissions from the liquefied natural gas (LNG) supply chain could be cut by over 60% using existing technologies.

Currently, global LNG-related emissions total approximately 350 million tonnes of carbon dioxide equivalent (MtCO2e) annually—about 70% of which is CO₂ from flaring and venting, with the remaining 30% being unburned methane. The IEA highlights that curbing methane leaks alone could reduce emissions by nearly 90 MtCO2e per year, or 25% of total LNG emissions, with half of this achievable at no net cost. Additionally, cutting flaring at LNG plants and gas fields could reduce emissions by another 5 MtCO2e annually.

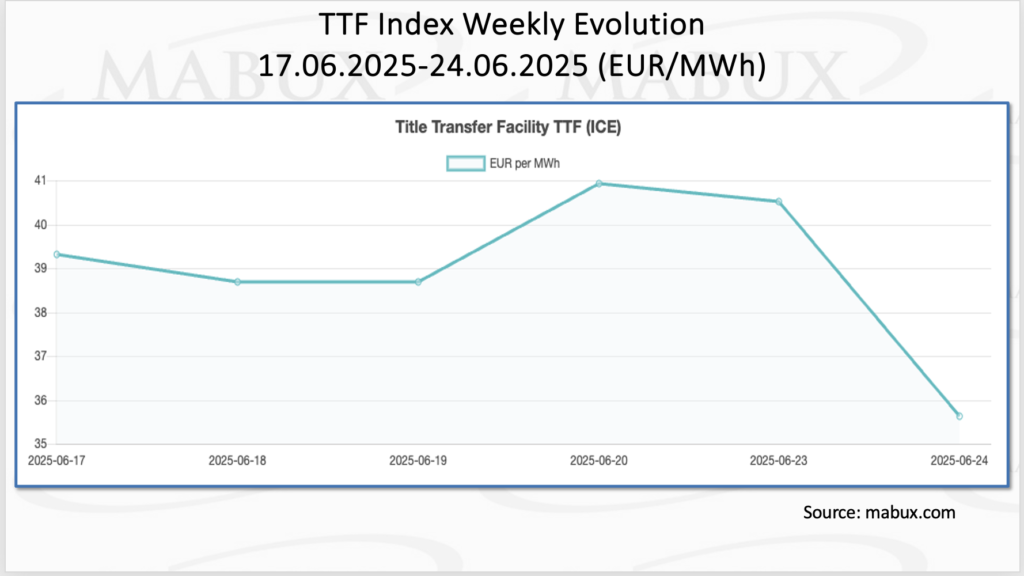

As of June 24, European regional gas storage facilities were 56.59% full—an increase of 2.54% from the previous week, but down 14.74% compared to the beginning of the year (71.33%). The European Union (EU) continues its gradual efforts to refill gas storage.

By the end of Week 26, the European gas benchmark TTF posted another decline, dropping by €3.694/MWh to €35.615/MWh, compared to €39.309/MWh the previous week.

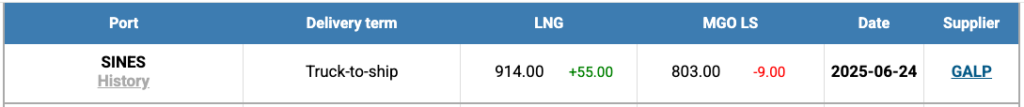

The price of LNG as a bunker fuel at the port of Sines in Portugal continued its upward trend by the end of the week, increasing by US$55 to reach US$914/MT. Simultaneously, the price gap between LNG and conventional fuel widened on June 23, reaching US$111 in favor of conventional fuel—up from US$83 a week earlier.

On the same day, MGO LS was quoted at US$803/MT in Sines.

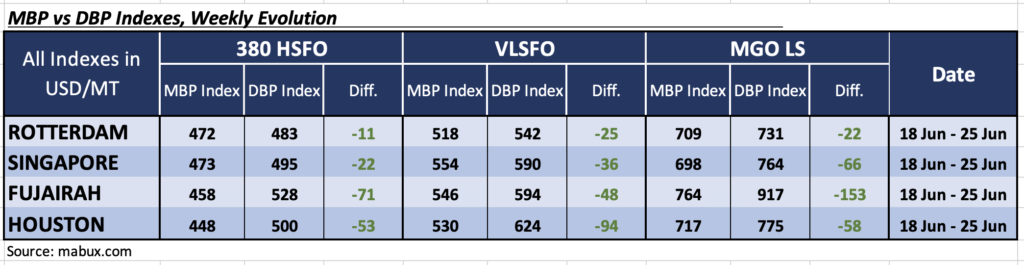

At the end of the previous week, the MABUX Market Differential Index (MDI)—which reflects the ratio between market bunker prices (MBP) and the MABUX Digital Bunker Benchmark (DBP)—indicated undervaluation across all fuel types in all four key ports, Rotterdam, Singapore, Fujairah, and Houston:

- 380 HSFO segment: Weekly average MDI values increased by 5 points in Rotterdam, 19 points in Singapore, 18 points in Fujairah, and 3 points in Houston.

- VLSFO segment: Weekly averages rose by 16 points in Rotterdam, 20 points in Singapore, and 13 points in Fujairah, while Houston saw a decrease of 3 points. Despite the drop, Houston’s MDI remains around the US$100 mark.

- MGO LS segment: Rotterdam returned to the undervaluation zone, bringing all four ports into undervalued territory. Weekly MDI values rose by 24 points in both Rotterdam and Singapore, by 26 points in Fujairah, and by 15 points in Houston. Notably, Fujairah’s MDI continues to remain above the US$100 mark.

“This week marked a complete shift in the overvalued/undervalued structure, with all segments and ports now falling into the undervalued zone. We expect the trend of bunker fuel undervaluation to persist into next week,” commented Ivanov.

He added: “We believe that, given the continued high volatility in the global bunker market, significant and multidirectional price fluctuations may persist without a clear trend. However, should the situation in the Middle East stabilize further, a renewed upward movement in global bunker indices is likely.”