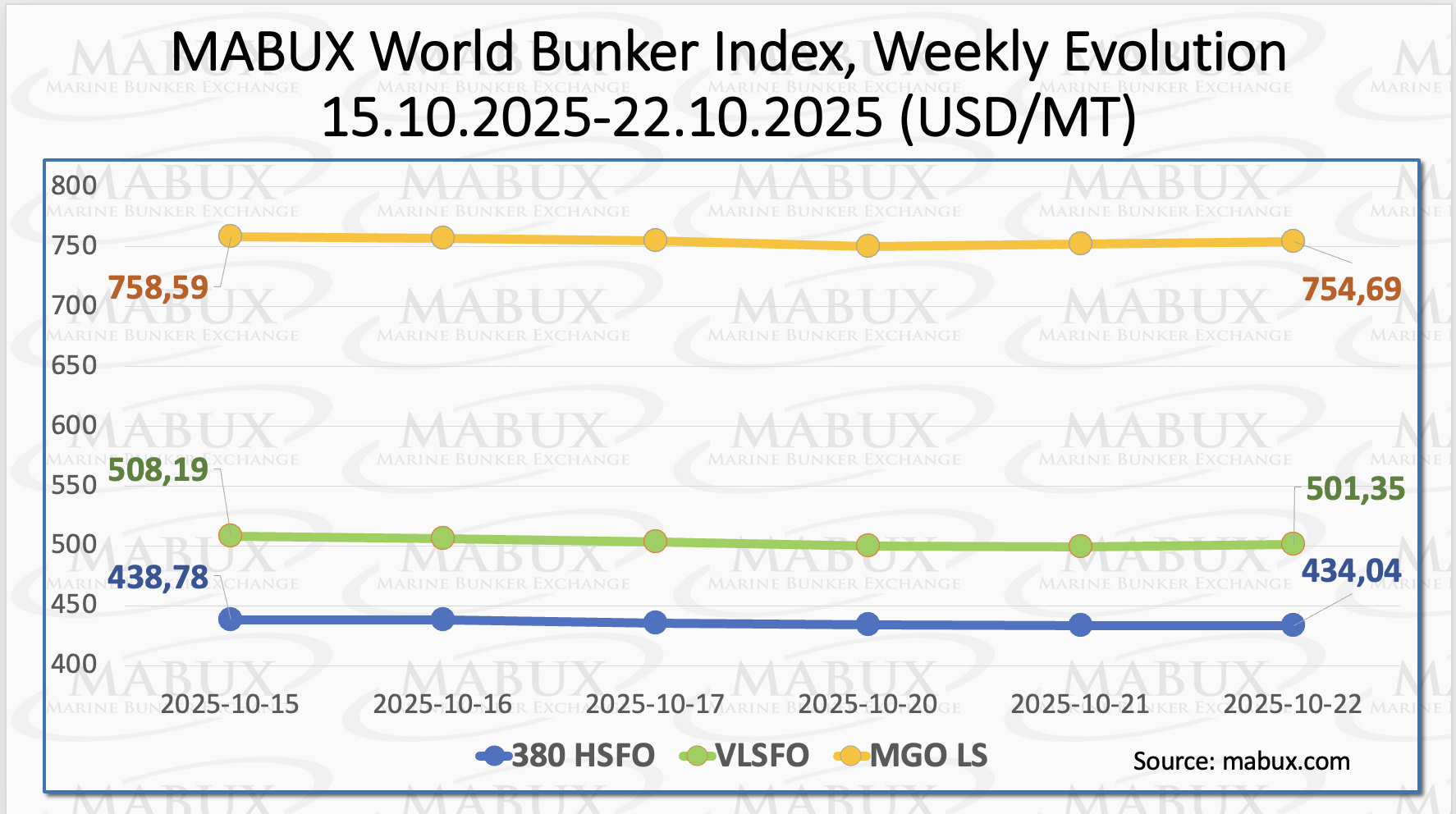

At the close of Week 43, global bunker indices tracked by MABUX continued their moderate downward trend. The 380 HSFO index declined by US$14.74, to US$434.04/MT.

The VLSFO index slipped by US$6.84, to US$501.35/MT, moving closer to the US$500/MT threshold. The MGO index also eased by US$3.90, to US$754.69/MT.

”At the time of reporting, signs of an upward correction were emerging in the global bunker market”, commented Sergey Ivanov, Director, MABUX.

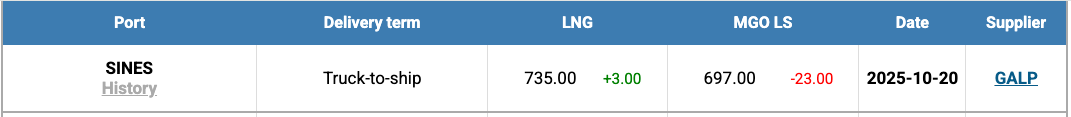

According to the U.S. Energy Information Administration (EIA), North American liquefied natural gas (LNG) export capacity is projected to more than double by 2029 as new terminals come online in the United States, Canada, and Mexico. The agency forecasts capacity to increase from roughly 14 billion cubic feet per day (bcf/d) in 2024 to over 29 bcf/d by 2029. This surge will be driven primarily by the completion of seven major U.S. export terminals. Once fully operational, North America is expected to supply nearly 40% of global LNG volumes by the end of the decade, further strengthening the region’s role as a key player in the global gas market.

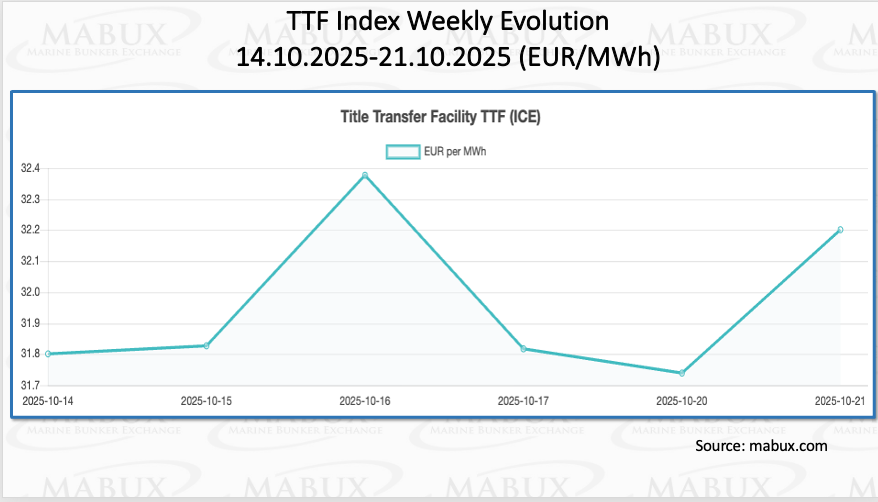

As of October 21, European regional gas storage facilities were 82.83% full, marking a decline of 0.26% from the previous week — the first negative movement since April this year. Current storage levels remain 11.50% higher than at the start of the year (71.33%). With the onset of lower temperatures, the rate of gas withdrawal has slightly exceeded the rate of injection, indicating the beginning of the seasonal drawdown phase. By the end of Week 43, the European gas benchmark TTF reversed its previous downward trend, rising by 0.399 euros/MWh to 32.200 euros/MWh from 31.801 euros/MWh a week earlier.

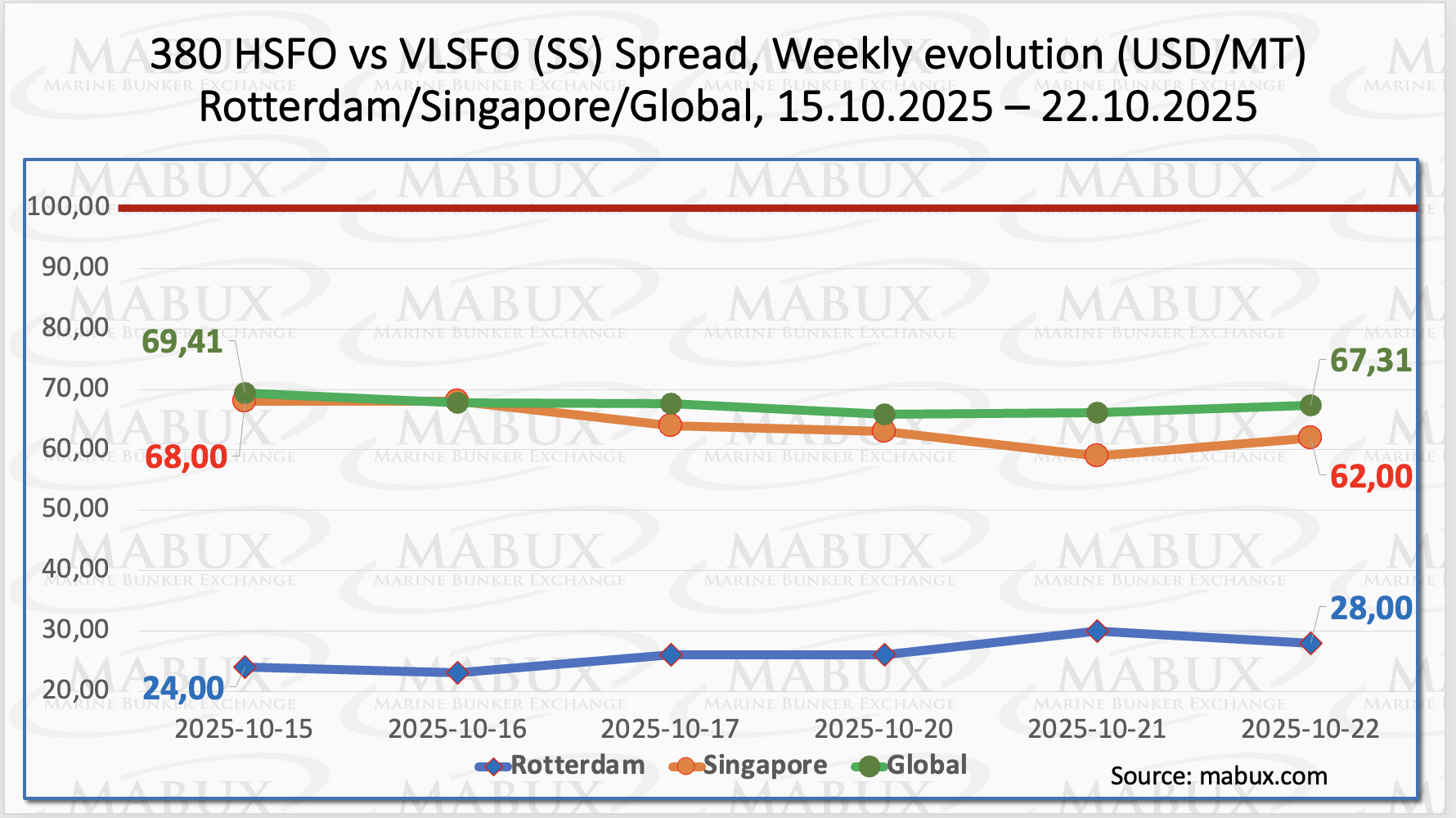

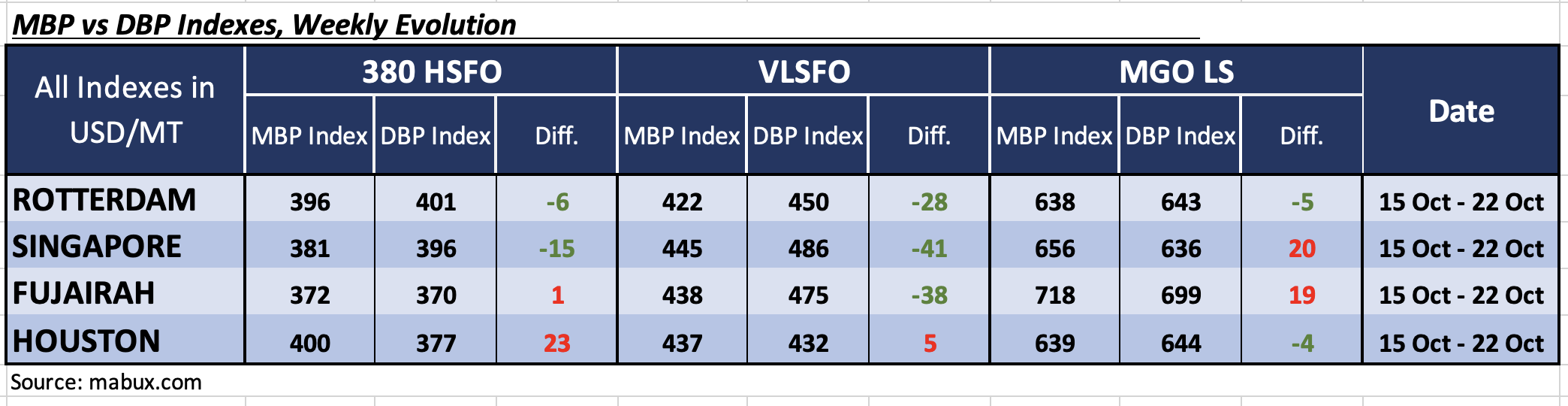

At the end of Week 43, the MABUX Market Differential Index (MDI) — which reflects the ratio between market bunker prices (MBP) and the MABUX digital bunker benchmark (DBP) — indicated the following bunker fuel price dynamics across the world’s major hubs: Rotterdam, Singapore, Fujairah, and Houston:

- 380 HSFO segment: Fujairah and Houston remained overvalued, with average weekly MDI values falling by 10 points in Fujairah but rising by 6 points in Houston. In contrast, Rotterdam and Singapore stayed undervalued, with the index declining by 8 and 2 points, respectively. MDI readings in Rotterdam and Fujairah approached the 100% correlation mark between MBP and DBP.

- VLSFO segment: Houston was the only overvalued port in this segment, with its average MDI rising by 5 points, maintaining a 100% correlation between MBP and DBP. All other ports remained undervalued: the average weekly MDI fell by 6 points in Rotterdam, while it rose by 2 points in Singapore and 4 points in Fujairah.

-

MGO LS segment: Singapore and Fujairah stayed in the overvalued zone, with MDI values increasing by 10 and 13 points, respectively. Rotterdam and Houston remained undervalued: Rotterdam’s MDI declined by 2 points, while Houston’s increased by 3 points. Both ports’ MDI levels are now close to the 100% correlation mark between MBP and DBP.

Ivanov said that no significant shifts were observed in the overall balance of overvalued and undervalued ports last week. The SS Spread structure has reached a state of relative equilibrium, and we expect this balance to persist into the coming week.

”Current market dynamics suggest that an upward trend is emerging in the global bunker market, supported by strengthening crude benchmarks and steady demand fundamentals. Consequently, bunker indices are expected to resume moderate growth in the forthcoming week”, added Sergey Ivanov, Director, MABUX.