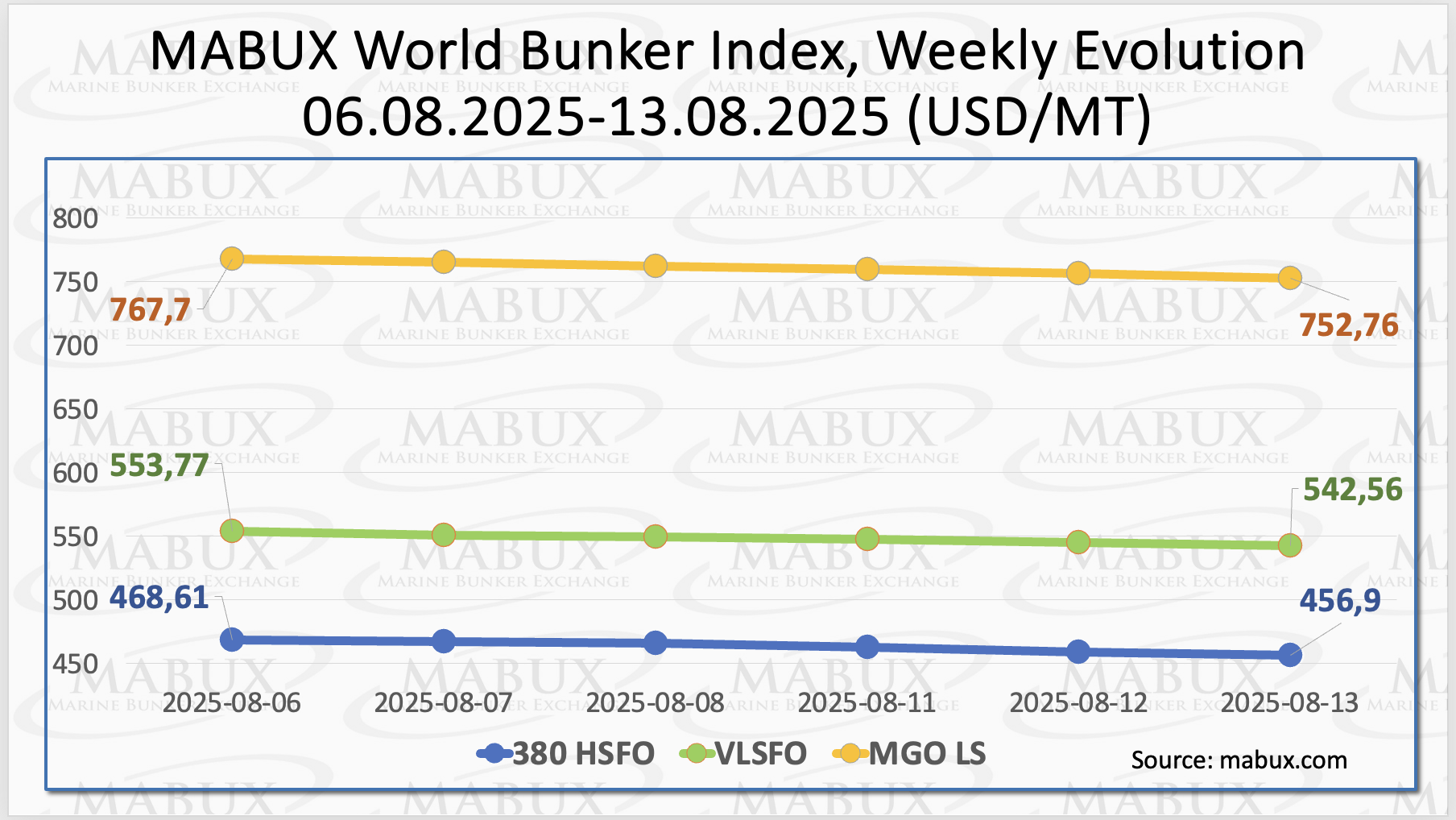

Global bunker indices tracked by Marine Bunker Exchange (MABUX) extended their downward movement. The 380 HSFO index dropped by US$11.71, nearing the US$450 mark. The VLSFO index fell by US$11.21 to US$542.56/MT. The MGO index declined by US$14.94, from USD 767.70/MT to USD 752.76/MT.

”At the time of writing, the global bunker market continues to demonstrate a moderate downward trend,” said Sergey Ivanov, Director, MABUX.

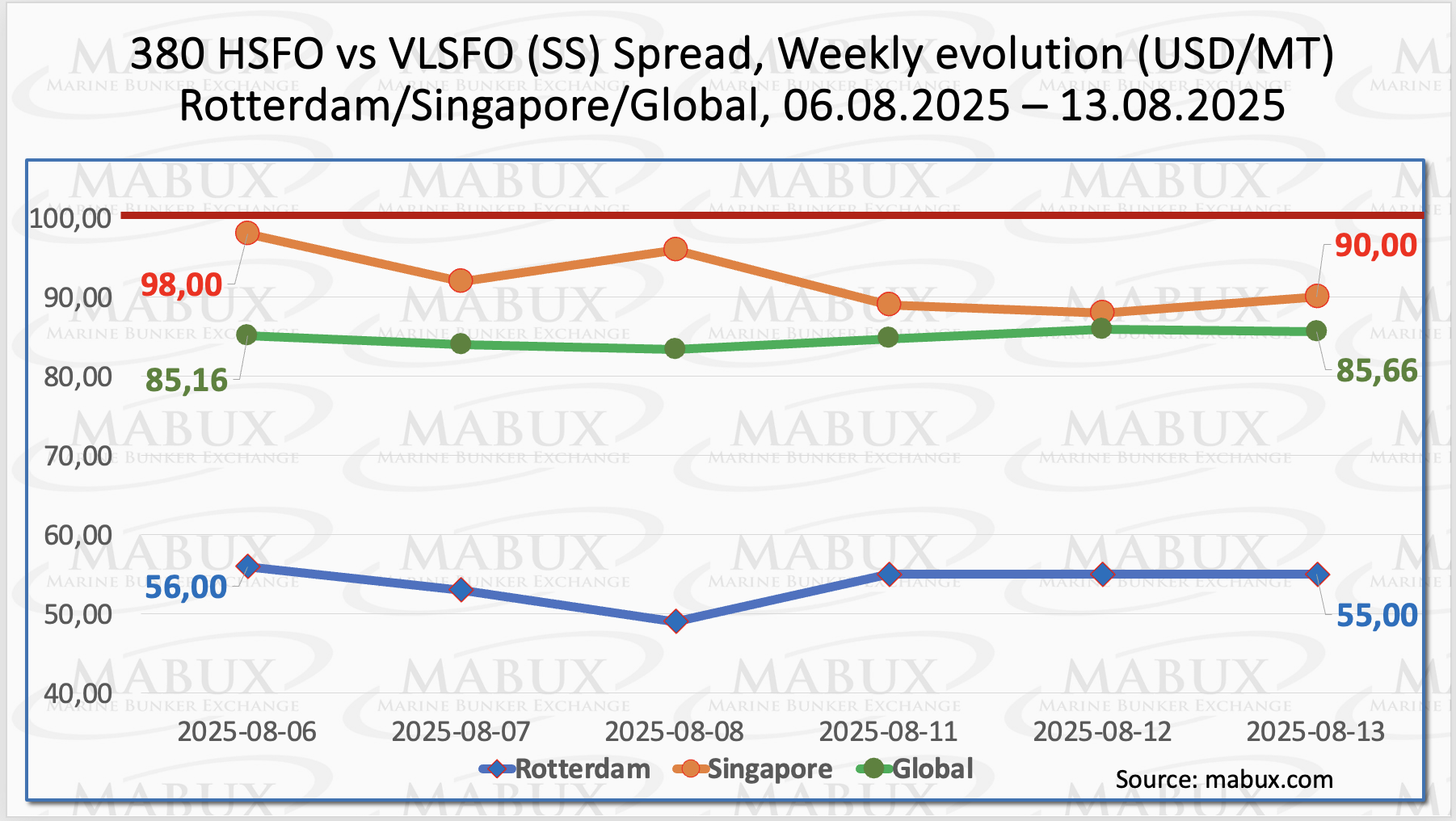

The MABUX Global Scrubber Spread (SS) was virtually unchanged, edging up by just US$0.50 to US$85.66, and still staying well below the psychological US$100.00 SS breakeven level. In contrast, the weekly average of the index fell by US$1.57.

In Rotterdam, the SS Spread narrowed by another US$1.00, with the index briefly dipping below the US$50.00 mark during the week. The weekly average in the port dropped by US$7.34.

In Singapore, the 380 HSFO/VLSFO spread declined by US$8.00, to US$91.00, once again below the US$100.00 mark, while the weekly average fell by US$6.66. ”The downward trajectory in SS Spread indices is expected to persist next week, with conventional VLSFO likely to maintain better margins than HSFO plus scrubber,” commented Ivanov.

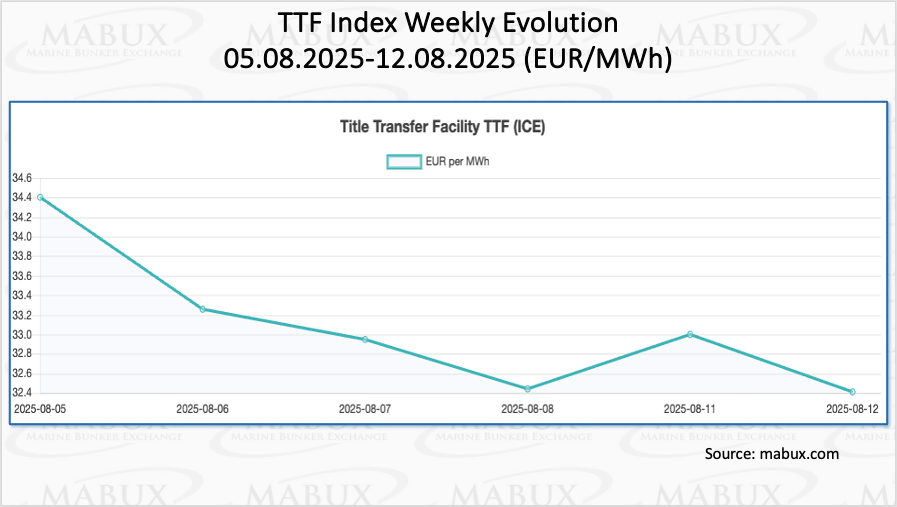

Global gas prices continue to trade within a narrow range despite ongoing geopolitical tensions. Market fundamentals remain favorable, with stable supply levels holding firm even amid occasional production disruptions. A notable recent development was the commissioning of the LNG Canada project; however, it has yet to significantly affect the global LNG market balance. Persistently high temperatures are fueling expectations of rising demand in Asia, but so far this has not resulted in a marked increase in import volumes. The absence of clear demand growth continues to support price stability within the current range.

As of August 12, European regional storage facilities were 72.27% full — an increase of 2.31% compared to the previous week. For the first time this year, storage capacity levels also surpassed the figure recorded at the start of the year (71.33%), exceeding it by 0.94%. The process of filling gas storage facilities continues. By the end of Week 33, the European gas benchmark TTF declined by 1.997 euros/MWh, falling from 34.406 euros/MWh last week to 32.409 euros/MWh.

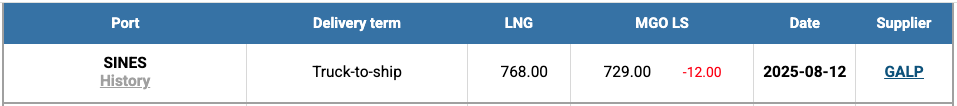

The price of LNG as a bunker fuel in the port of Sines (Portugal) remained unchanged at US$768 by the end of the week. At the same time, the price gap between LNG and conventional fuel widened in favor of conventional fuel: on August 12, the difference reached US$39 compared to just US$4 a week earlier. On that day, MGO LS in the port of Sines was quoted at US$729/MT.

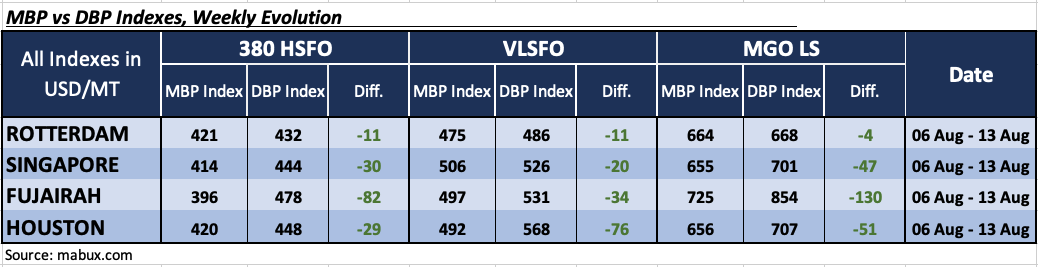

At the close of Week 33, the MABUX Market Differential Index (MDI) indicated undervaluation across all bunker fuel types in the world’s largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: The average weekly undervaluation narrowed by 7 points in Rotterdam, 15 points in Singapore, 13 points in Fujairah, and 2 points in Houston.

• VLSFO segment: Average weekly MDI undervaluation declined by 2 points in Rotterdam, 13 points in both Singapore and Fujairah, and 15 points in Houston.

• MGO LS segment: Rotterdam shifted into the undervaluation zone, bringing all four ports into undervaluation territory. MDI values rose by 12 points in Rotterdam and 8 points in Singapore but decreased by 5 points in Fujairah and 1 point in Houston. Rotterdam’s MDI remained close to the 100% correlation mark between MBP and DBP, while Fujairah’s MDI approached the US$100.00 mark.

Ivanov added: ”Overall, the market structure has fully shifted toward undervaluation in all bunker fuel segments. We expect this trend to persist into next week”.

”We expect moderate, mixed movements to persist in the global bunker market next week, with a potential upward trend emerging toward the week’s end,” stated Sergey Ivanov, Director, MABUX.