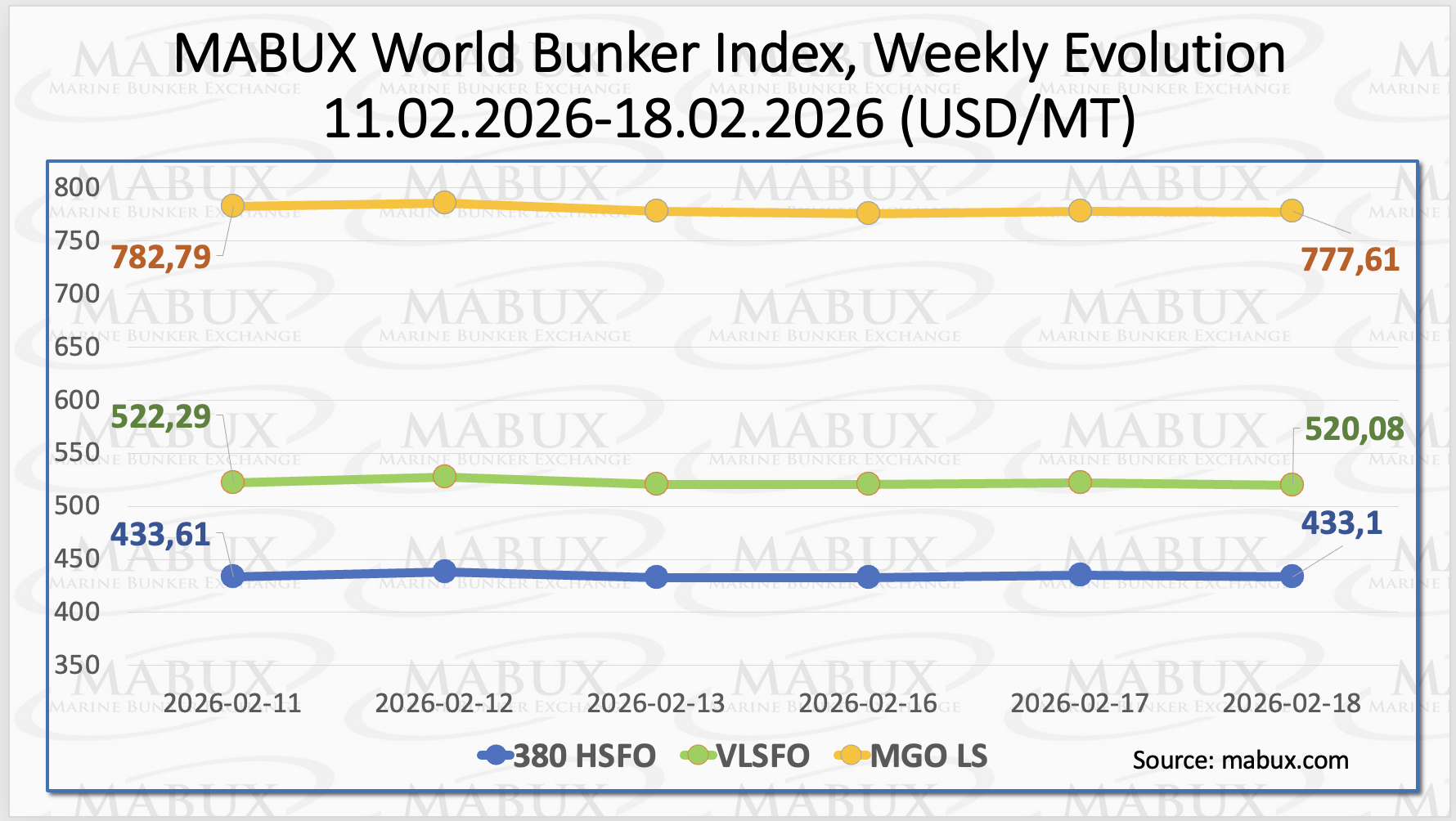

At the end of Week 08, the MABUX global bunker indices recorded a moderate decline, according to Sergey Ivanov, Director, MABUX. The 380 HSFO index decreased by US$ 0.51, from US$ 433.61/MT last week to US$ 433.10/MT. The VLSFO index declined by US$ 2.21, from US$ 522.29/MT to US$ 520.00/MT.

The MGO LS index posted the most significant reduction, falling by US$ 5.18, from US$ 782.79/MT last week to US$ 777.61/MT. At the time of writing, the global bunker market was characterized by mixed index movements, Sergey Ivanov, Director, MABUX, said.

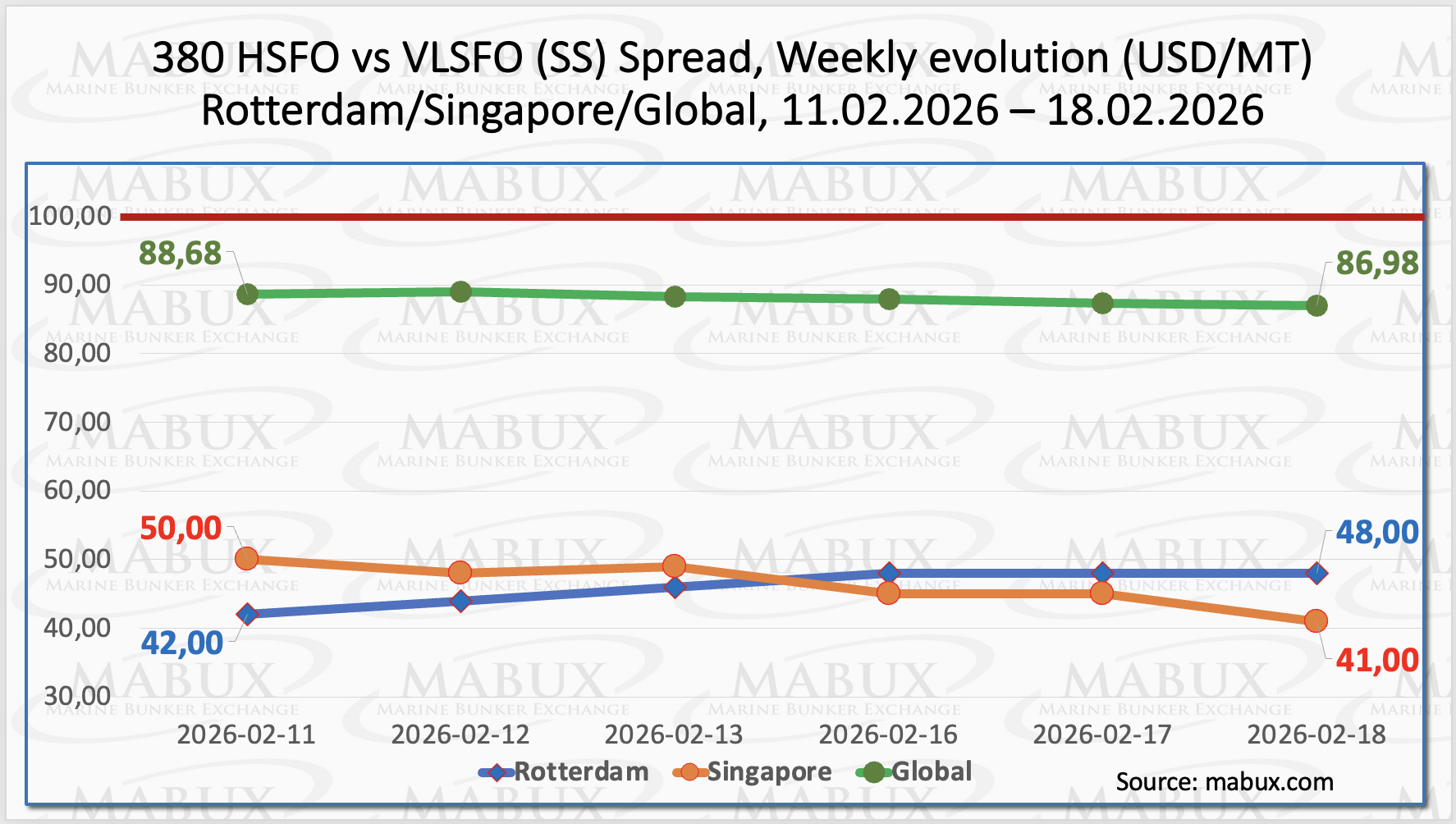

The MABUX Global Scrubber Spread (SS) — the price differential between 380 HSFO and VLSFO — entered a phase of moderate decline, decreasing by US$ 1.70 (from US$ 88.68 last week to US$ 87.11), while remaining firmly below the psychological threshold of US$ 100.00 (SS breakeven). At the same time, the weekly average value of the index increased by US$ 2.78. In Rotterdam, the SS Spread widened by US$ 6.00 (US$ 48.00 versus US$ 42.00 last week), while the port’s weekly average edged up by a marginal US$ 0.17. In Singapore, the 380 HSFO/VLSFO differential narrowed by US$ 9.00 (from US$ 50.00 last week to US$ 41.00), with the weekly average in the port declining by US$ 5.00. Overall, the weekly dynamics of the SS Spread remained without a clearly defined trend. VLSFO continues to retain its position as the more cost-effective bunker fuel compared to the 380 HSFO + scrubber combination. We expect no significant changes in the SS Spread dynamics next week, with mixed index fluctuations likely to persist, Sergey Ivanov, Director, MABUX, commented.

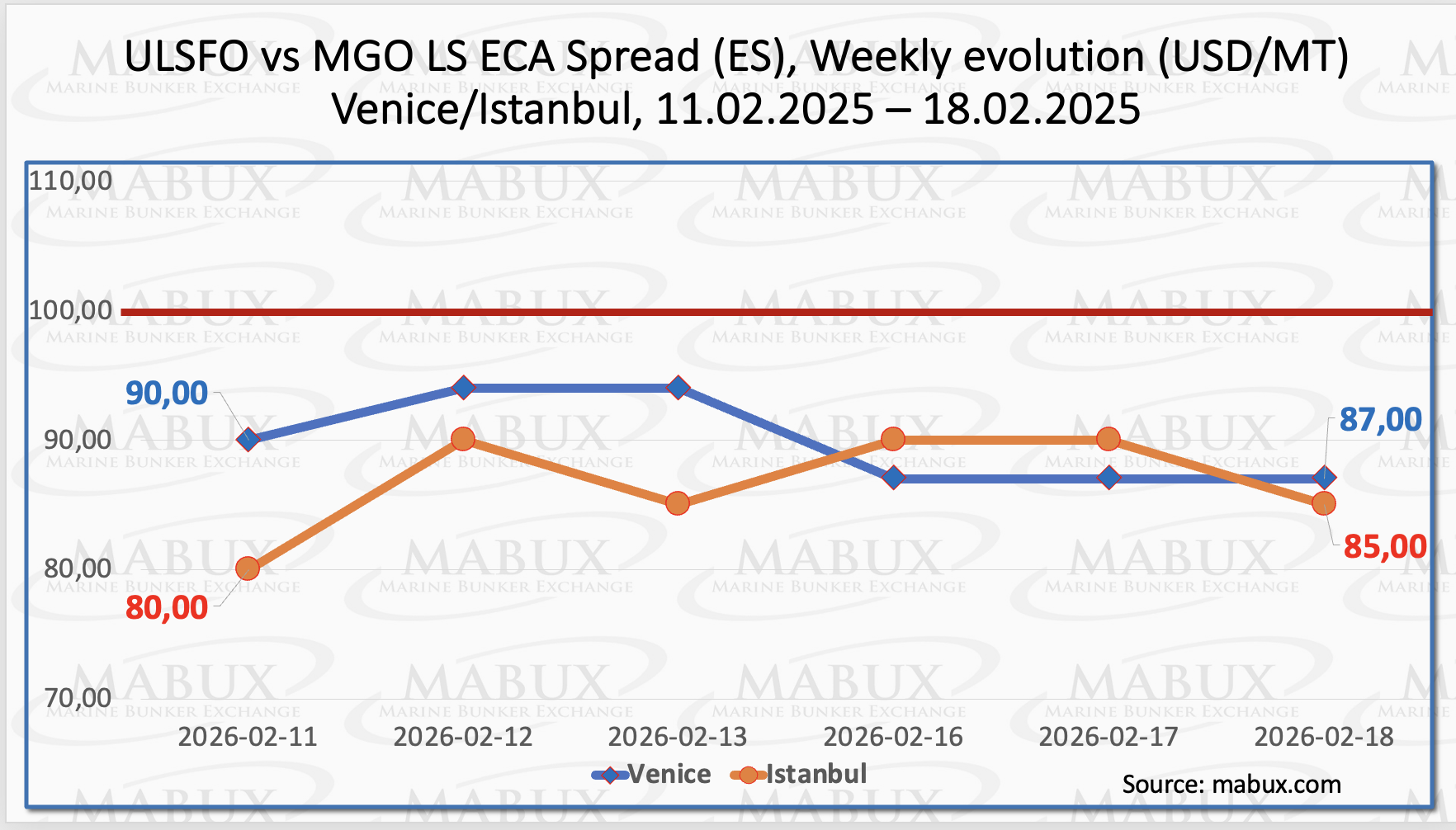

By the end of the week, the Istanbul ECA Spread (ES) increased by US$ 5.00, rising from US$ 80.00 last week to US$ 85.00, and temporarily reaching US$ 90.00 during the week. The weekly average also advanced by US$ 3.34. In Venice, the ECA Spread declined by US$ 3.00, from US$ 90.00 to US$ 87.00. However, the port’s weekly average increased by US$ 3.16. Throughout the week, the ES indices in both ports remained close to the psychological threshold of US$ 100.00. We expect the ECA Spread to maintain a pattern of mixed fluctuations next week, Sergey Ivanov, Director, MABUX, added.

Europe is projected to import a record volume of liquefied natural gas (LNG) this year, driven primarily by the need to replenish storage inventories and sustain ongoing pipeline exports to Ukraine. However, structural challenges persist. Two gas storage facilities in Germany are scheduled for closure after operators notified the federal government that continued operations are no longer economically viable. In contrast, China has been actively replenishing its own gas storage while overall LNG demand has remained subdued throughout most of 2025. Imports only accelerated in the final two months of the year, reflecting seasonal heating requirements. Amid ample supply availability and relatively weak domestic consumption growth, China is positioned to re-export surplus LNG volumes, including to Europe, thereby adding flexibility to global trade flows. In the near term, however, the approaching shoulder season and declining heating demand are expected to exert downward pressure on EU gas prices, partially offsetting the structural bullish factors associated with storage replenishment and supply-side adjustments, according to Sergey Ivanov, Director, MABUX.

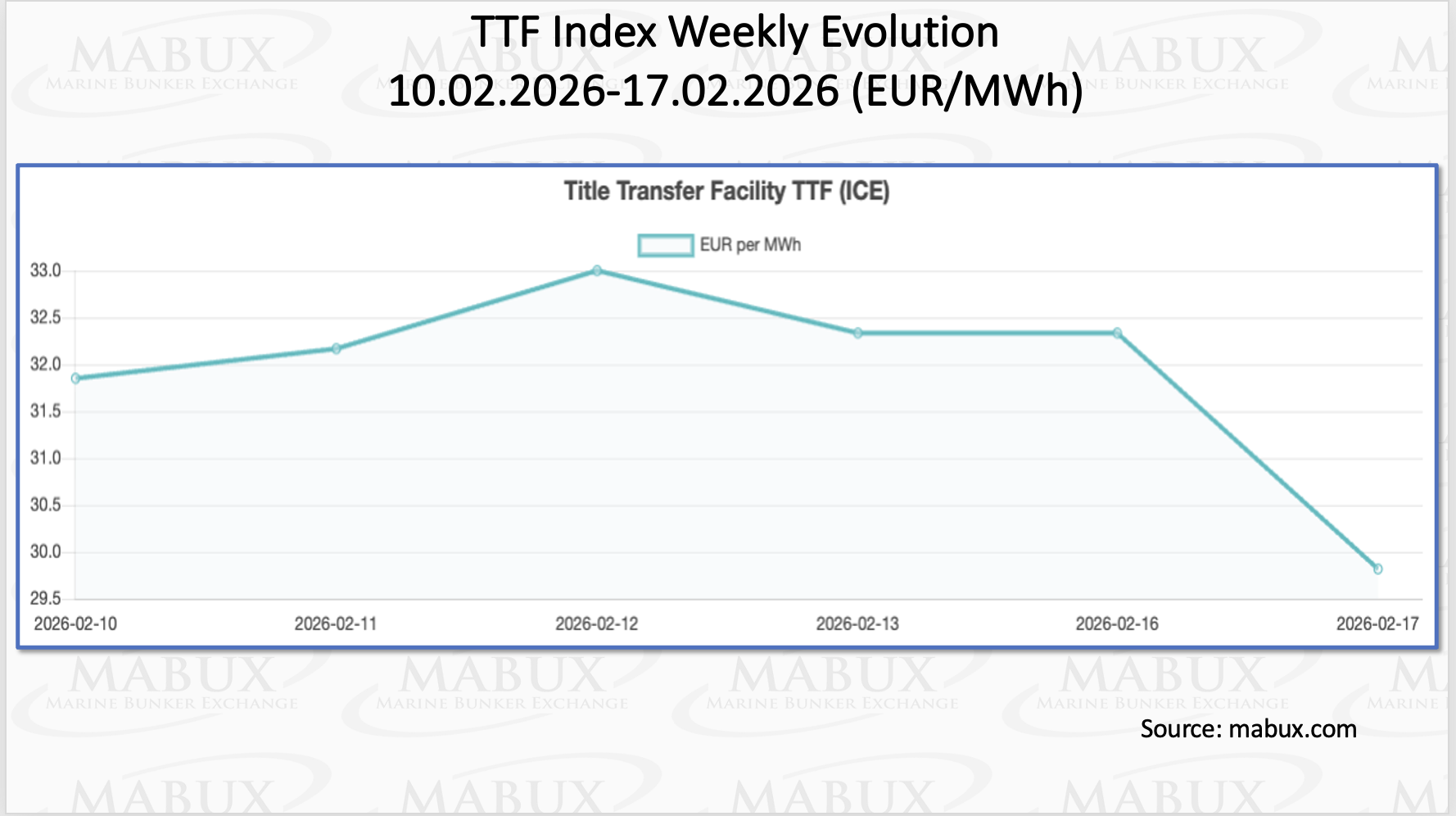

As of February 17, the level of natural gas in European underground storage facilities continued to decline, falling to 33.02% of total capacity, down a further 3.11 percentage points compared to the previous week. Storage levels are now 28.44 percentage points below those recorded on January 1, 2026 (61.46%). At the same time, storage fullness decreased to 22.29% in Germany and to 14.29% in the Netherlands. By the end of Week 8, the European gas benchmark TTF extended its downward trend, declining by 2.024 euros/MWh to 29.822 euros/MWh, compared to 31.846 euros/MWh last week, thereby falling below the 30.000 euros/MWh threshold.

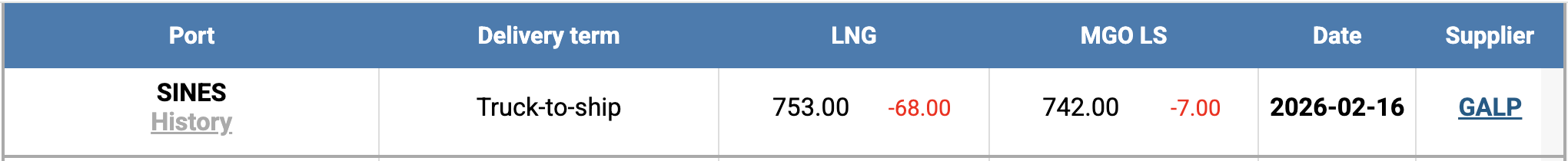

The price of LNG as a bunker fuel at the port of Sines (Portugal) declined over the week by US$ 68.00, falling to US$ 753/MT from US$ 821/MT the previous week. The price differential between LNG and conventional fuel remains in favor of conventional fuel, narrowing to US$ 11. As of February 16, MGO LS was quoted at US$ 742/MT in the port of Sines.

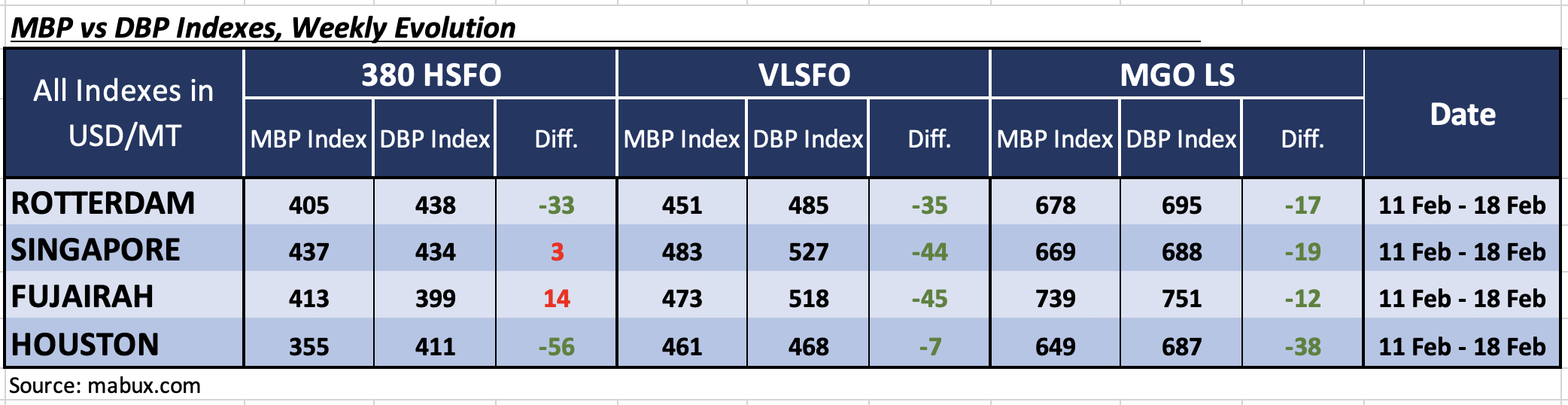

At the close of Week 08, the MABUX Market Differential Index (MDI) — representing the ratio of Market Bunker Prices (MBP) to the MABUX Digital Bunker Benchmark (DBP) — reflected the following bunker price trends across the world’s крупнейшие hubs: Rotterdam, Singapore, Fujairah, and Houston, Sergey Ivanov, Director, MABUX, said:

• 380 HSFO segment: Singapore moved into the overvalued zone, joining Fujairah, with the average weekly overvaluation increasing by 6 and 7 points, respectively. Rotterdam and Houston remained in the undervalued zone, with MDI levels declining by 4 points in Rotterdam and by 2 points in Houston. Singapore’s MDI remained close to the 100% correlation mark between MBP and DBP.

• VLSFO segment: All ports continued to be undervalued, with the MDI declining further: by 5 points in Rotterdam, 1 point in Singapore, 7 points in Fujairah, and 6 points in Houston. Houston’s MDI approached the 100% correlation threshold between MBP and DBP.

• MGO LS segment: All ports remained undervalued. The MDI decreased by an additional 1 point in Rotterdam, 8 points in Singapore, and 11 points in Fujairah, while increasing by 1 point in Houston.

By the end of the week, the balance between undervalued and overvalued ports continued to shift toward overvaluation. In the 380 HSFO segment, two ports — Singapore and Fujairah — are now classified as overvalued. In the remaining bunker fuel segments, undervaluation levels continued to narrow, gradually approaching the 100% correlation mark between MBP and DBP. We expect this trend of diminishing undervaluation — with the potential for additional ports to enter the overvalued zone — to persist next week, Sergey Ivanov, Director, MABUX, concluded. ”We believe that the global bunker market currently lacks drivers capable of forming a sustainable trend. Bunker indices will continue to fluctuate in different directions next week”, Ivanov added.