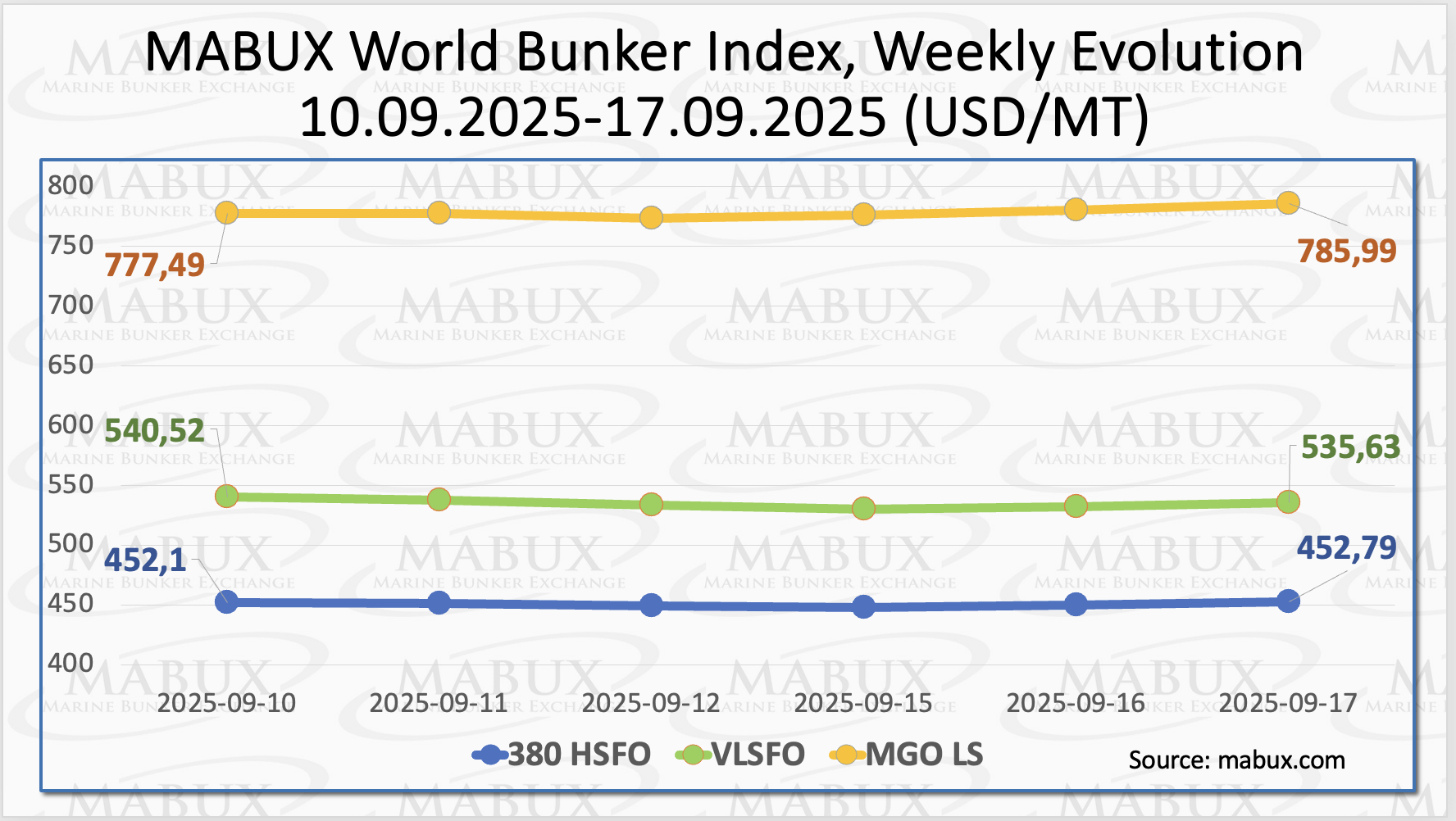

At the end of the 38th week, MABUX global bunker indices continued to fluctuate in different directions without a clear trend. The 380 HSFO index showed only a symbolic increase of US$0.69, moving to US$452.79/MT, thus still remaining around the US$450 mark.

In contrast, the VLSFO index declined by US$4.89, falling to US$535.63/MT. Meanwhile, the MGO index rose by US$8.50, climbing to US$785.99/MT. At the time of writing, there are indications that a downward trend may be forming in the global bunker market.

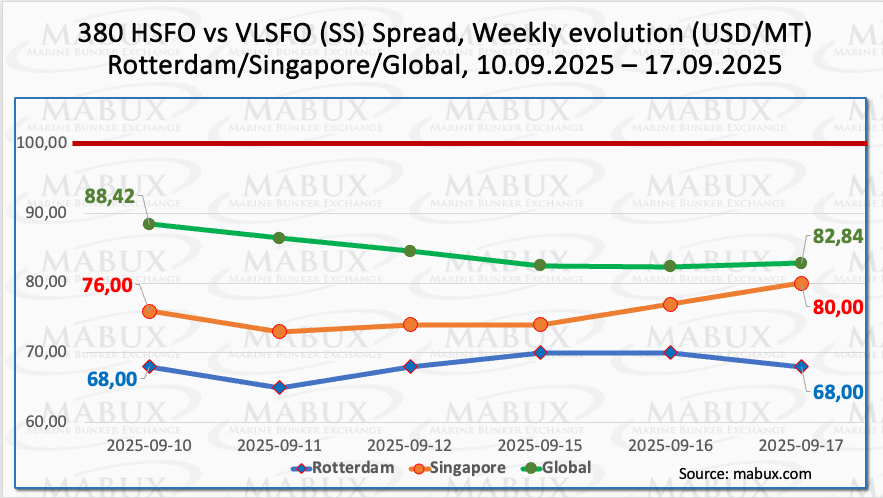

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—narrowed again by US$5.58, falling to US$82.84, and remains steadily below the psychological threshold of US$100.00 (SS Breakeven).

The weekly average also declined by 4.14 USD. In Rotterdam, the SS Spread held unchanged at US$68.00, while the port’s weekly average posted a minor gain of US$0.34. In Singapore, the 380 HSFO/VLSFO price differential increased by US$4.00, rising to US$80.00, but the weekly average at the port, on the contrary, dropped by US$8.00.

Overall, the SS Spread indices continue to show no clear trend, with fluctuations moving in different directions. We believe that this dynamic is unlikely to undergo significant changes in the coming week, with conventional VLSFO expected to maintain higher profitability compared with the HSFO + Scrubber combination.

The EU has faced tense summers in recent years, with gas storage facilities running low and requiring urgent replenishment ahead of winter. At the same time, Europe has sharply reduced its reliance on Russian pipeline gas, cutting imports from more than 40% in 2021 to about 11% in 2024.

This shift has forced the continent to build new supply chains, replacing Russian gas with increased imports from Norway and the United States. In the short term, the EU’s gas situation looks manageable thanks to the rapid expansion of global LNG supply. Longer-term prospects are also favorable: global LNG production capacity is expected to rise from 550 billion cubic meters in 2024 to 649 bcm in 2026 and reach 890 bcm by 2030.

The main driver of this growth is the United States, where gas exports surged 22% year-on-year in the first seven months of 2025, reaching 83 bcm. Global supply and demand for LNG are expected to balance in 2025, before shifting to a surplus of around 50 bcm in 2026 and as much as 200 bcm by 2030.

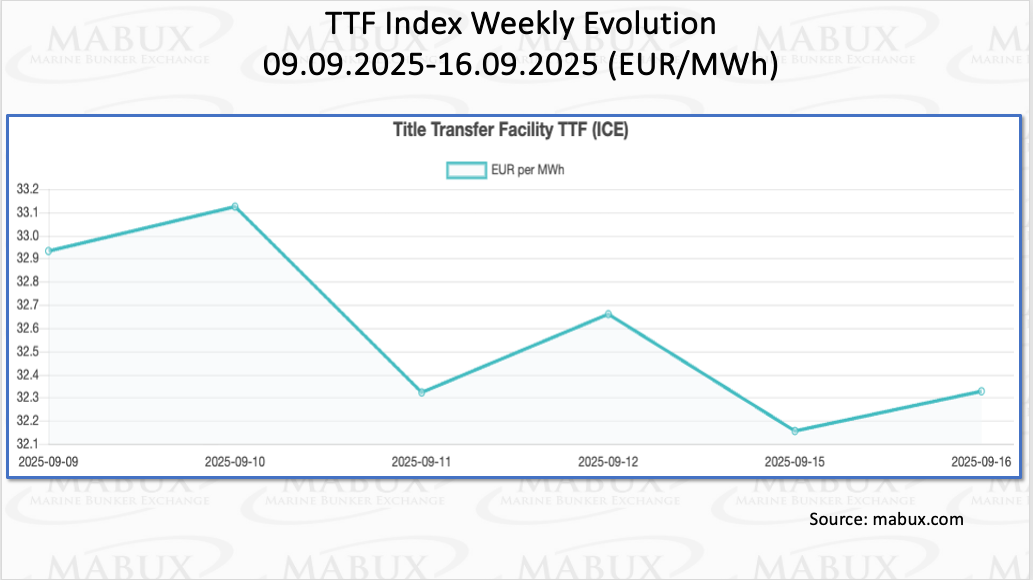

As of 16 September, European regional gas storage facilities were 80.83% full, reflecting a 1.20% increase compared to the previous week. Current occupancy levels stand 9.50% higher than at the beginning of the year (71.33%), although the pace of injections has shown a slight slowdown. By the end of the 38th week, the European gas benchmark TTF posted a minor decline of 0.602 euro/MWh, falling from 32.931 euro/MWh a week earlier to 32.329 euro/MWh.

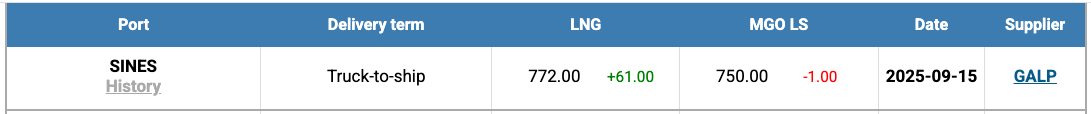

The price of LNG as a bunker fuel in the port of Sines (Portugal) rose sharply by $61.00 by the end of the week, reaching US$772/MT compared to US$711/MT the week before. At the same time, the price spread between LNG and conventional fuel shifted back in favor of conventional fuel: minus US$22 versus minus US$51 in favor of LNG a week earlier. On the same day, MGO LS was quoted at US$750/MT in Sines.

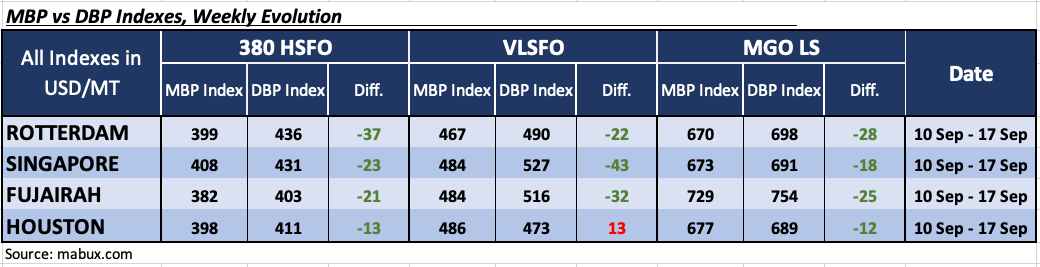

At the end of the 38th week, the updated MABUX Benchmark Market Differential Index (MDI)—which reflects the ratio of market bunker prices (MBP) to the MABUX digital bunker benchmark (DBP)—showed the following dynamics across the world’s largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: All ports remained in the undervalued zone. Average weekly values increased by 2 points in Rotterdam and Singapore, by 7 points in Fujairah, but declined by 7 points in Houston.

• VLSFO segment: Houston continued to be the only overvalued port, although its average MDI level decreased by 5 points. The other ports remained undervalued. Average weekly undervaluation levels rose by 3 points in Rotterdam, 10 points in Singapore, and 13 points in Fujairah.

• MGO LS segment: all ports also stayed in the undervalued zone. MDI values fell by 4 points in Rotterdam, 6 points in Singapore, and 12 points in Houston, while Fujairah recorded a modest increase of 2 points.

”Overall, no significant changes were observed in the distribution of overvalued and undervalued ports during the past week. MDI levels across all ports and fuel segments remain close to the 100% correlation mark between MBP and DBP, signaling relative stabilization in the global bunker market. However, the undervaluation trend continues to dominate, and we do not expect major fluctuations in MDI dynamics next week”, commented Sergey Ivanov, Director, MABUX.

”We believe that the global bunker market has currently reached a state of relative balance, and fuel prices are likely to continue fluctuating in different directions around present levels next week”, added Ivanov.