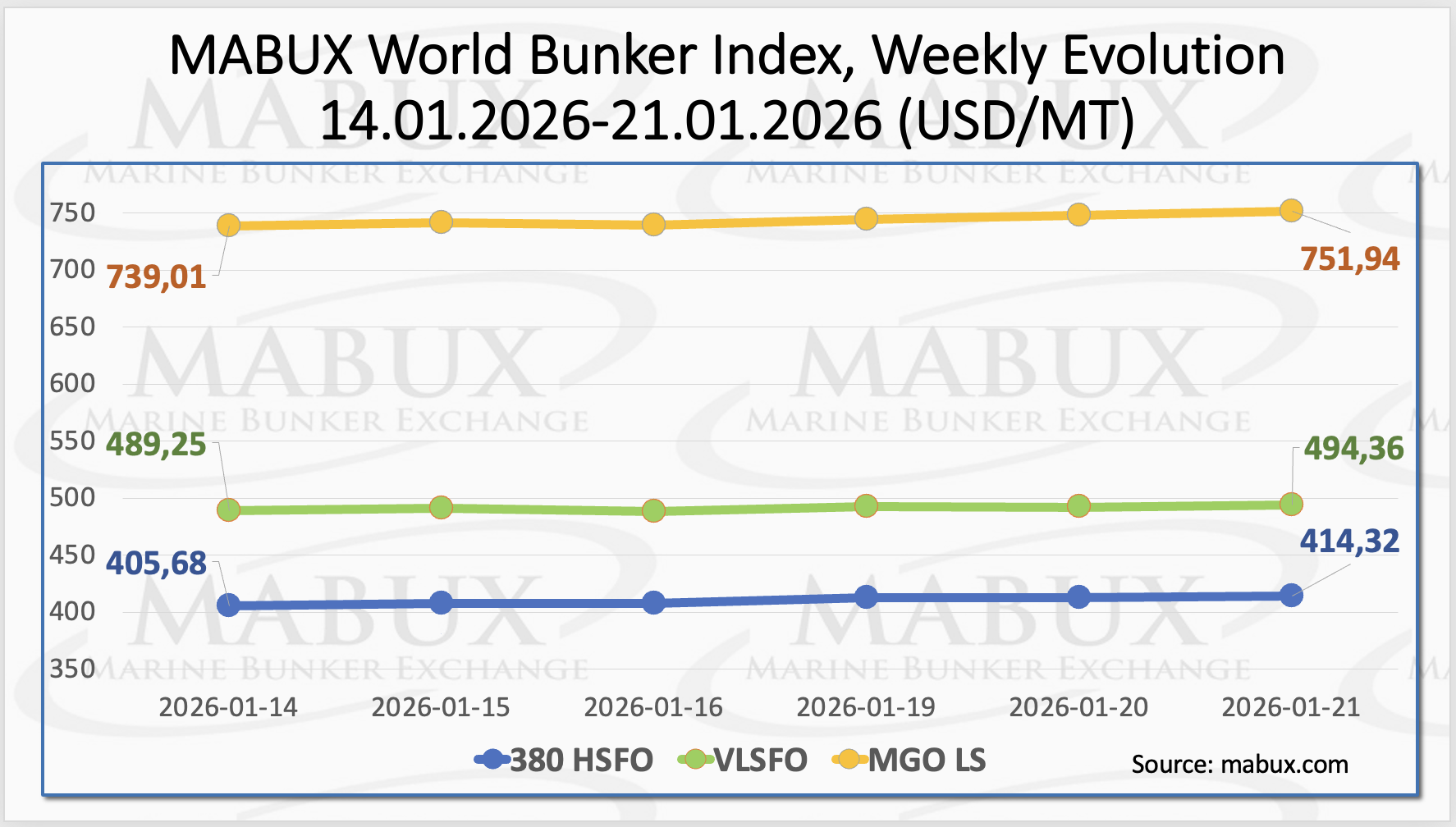

By the end of the Week 04, global bunker indices published by MABUX demonstrated a clear upward trajectory, according to Sergey Ivanov, Director, MABUX. The 380 HSFO index rose by US$ 8.64, increasing from US$ 405.68/MT last week to US$ 414.32/MT.

The VLSFO index gained US$ 5.11, reaching US$ 494.36/MT compared to US$ 489.25/MT the previous week and moving closer to the psychological US$ 500/MT threshold. The MGO LS index recorded the most significant growth, adding US$ 12.93 and rising from US$ 739.01/MT last week to US$ 751.94/MT.

However, as of the time of writing, early indications of a potential downward correction have begun to emerge in the global bunker market, according to Sergey Ivanov, Director, MABUX.

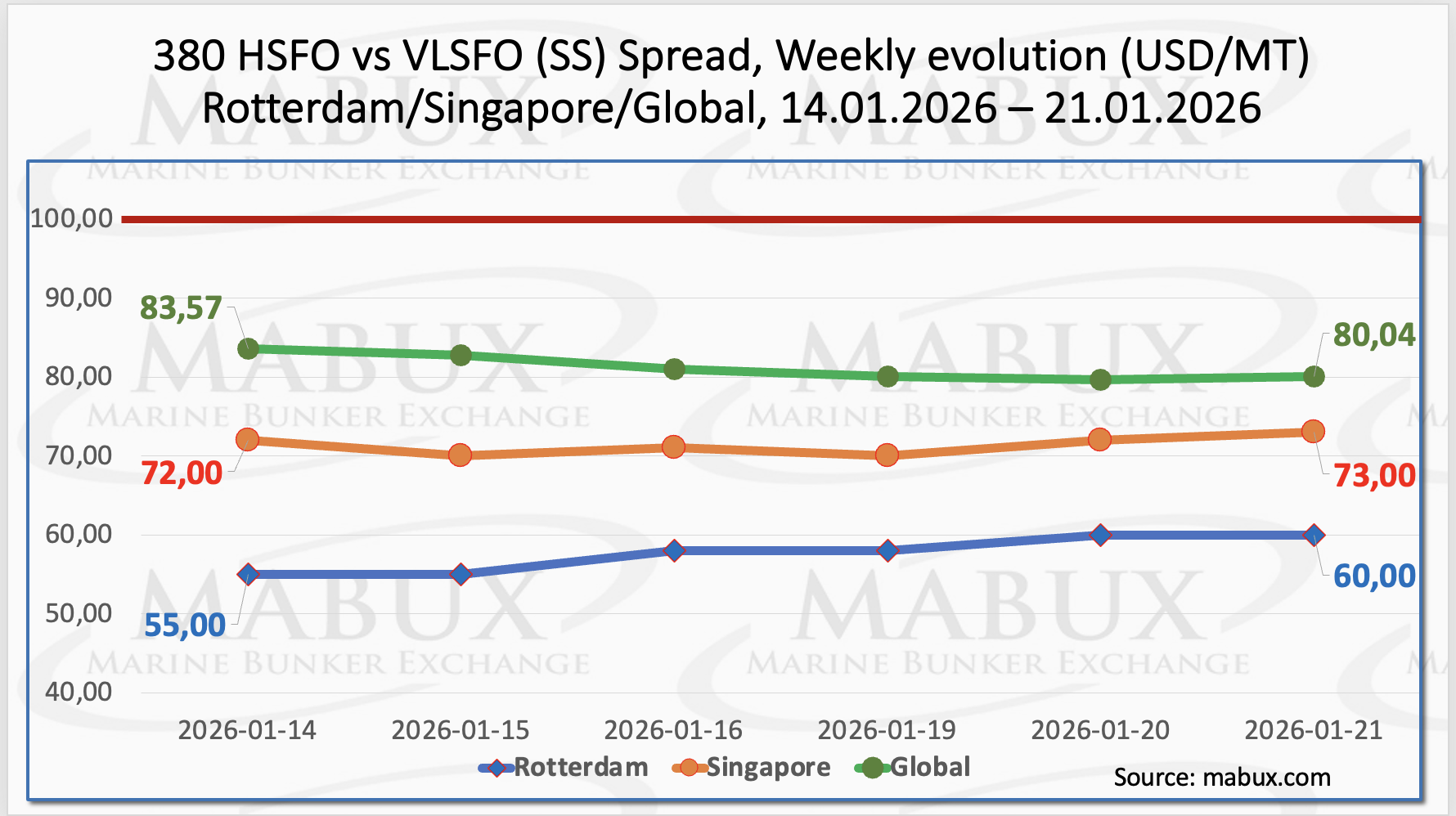

The MABUX Global Scrubber Spread (SS)—the price differential between 380 HSFO and VLSFO—registered a moderate decline of US$ 3.53, decreasing from US$ 83.57 last week to US$ 80.04. The index remains firmly below the psychological threshold of US$ 100.00 (SS breakeven). Meanwhile, the weekly average value of the global SS index was virtually unchanged, edging down by just US$ 0.07.

In Rotterdam, the SS spread moved in the opposite direction, increasing by US$ 5.00 to US$ 60.00 compared with US$ 55.00 last week, while the port’s weekly average value declined slightly by US$ 0.33. In Singapore, the 380 HSFO/VLSFO price differential also widened by US$ 1.00, rising from US$ 72.00 last week to US$ 73.00, although the weekly average value at the port decreased by US$ 0.84.

Overall, SS spread indices continue to move in mixed directions without forming a clear trend. They remain consistently below the US$ 100.00 level, thereby sustaining the higher economic attractiveness of conventional VLSFO consumption relative to the 380 HSFO plus scrubber configuration. ”We expect the SS spread to maintain its mixed dynamics in the coming week”, Ivanov commented.

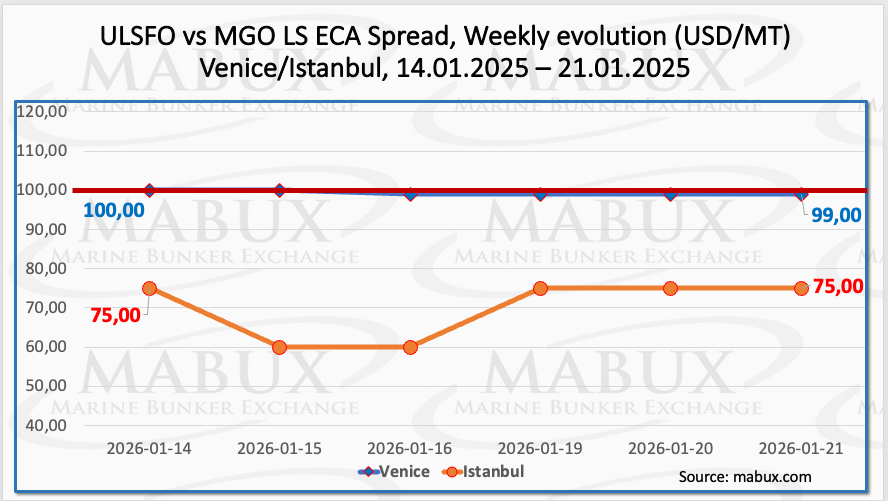

By the end of the week, the Istanbul ECA Spread (ES) remained unchanged at US$ 75.00, while its weekly average value increased by US$ 10.83. In Venice, the ES narrowed by US$ 1.00, declining from US$ 100.00 to US$ 99.00 and thereby slipping below the psychological US$ 100.00 threshold, although the weekly average value rose by US$ 6.33. Overall, no significant changes were observed in the ECA Spread dynamics at either port. We expect ES values to remain largely stable in the coming week.

In 2025, several European countries recorded sharp spikes in LNG purchases. For LNG exporters, the key question is whether Europe’s LNG imports in 2025 were artificially inflated as part of efforts by a number of countries to narrow their trade deficits with the United States. According to Kpler, European LNG imports from the U.S. last year rose by nearly 60% compared with 2024 levels. However, as international attention increasingly shifts toward geopolitical considerations, European countries may scale back their demand for U.S. LNG. If so, LNG import volumes from the United States that were aimed at reducing trade imbalances in 2025 could be curtailed in 2026.

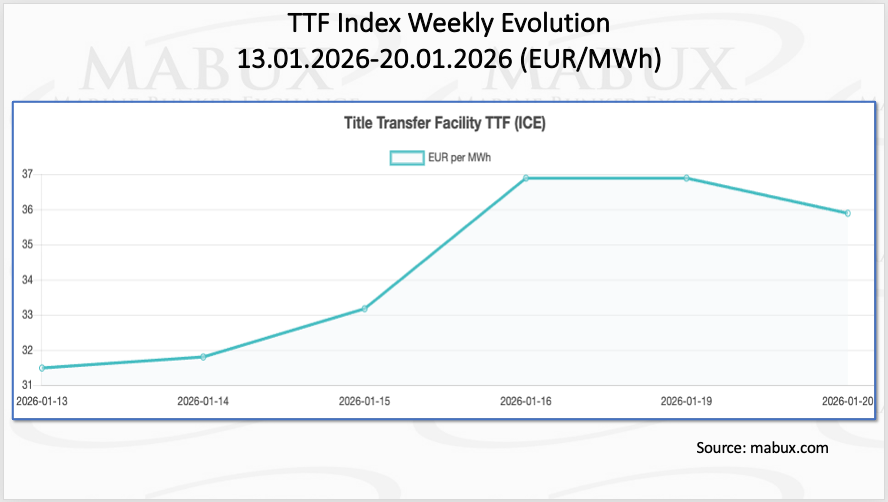

As of December 20, European regional gas storage facilities were filled to 49.12%, down by 3.37 percentage points compared to the previous week. Gas inventories continue to decline at an accelerated pace, with current storage levels already 12.34 percentage points below those recorded on January 1, 2026 (61.46%). Against this backdrop, the European TTF gas benchmark posted moderate gains during week 4, increasing by €4.414/MWh to €35.887/MWh, compared with €31.473/MWh last week.

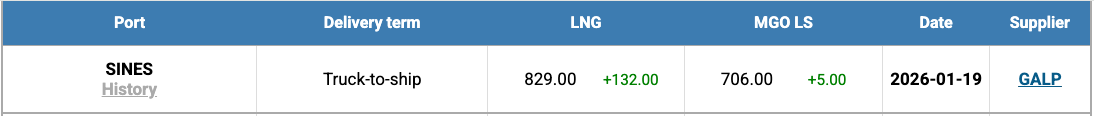

The price of LNG as a bunker fuel at the port of Sines (Portugal) rose sharply this week, increasing by US$ 132.00 to US$ 829/MT, compared to US$ 697/MT last week. As a result, the price differential between LNG and conventional fuel shifted in favor of conventional fuel, widening to US$ 121, unchanged from the previous week. As of January 19, MGO LS at the port of Sines was quoted at US$ 708/MT.

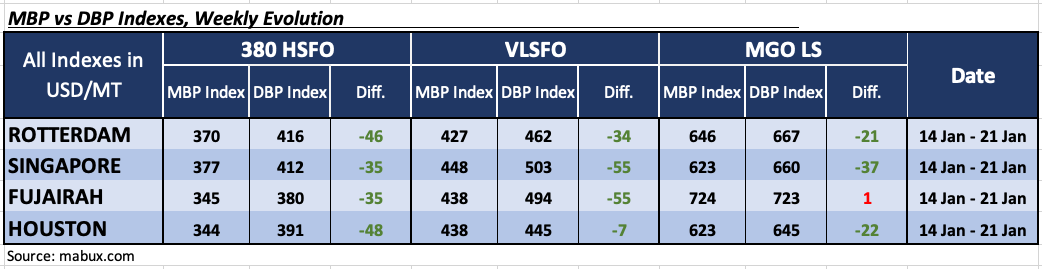

By the end of Week 04, the MABUX Market Differential Index (MDI)—which reflects the ratio of market bunker prices (MBP) to the MABUX Digital Bunker Benchmark (DBP)—recorded the following pricing dynamics across the world’s largest bunkering hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: All four ports remained in the undervalued zone. Average weekly MDI values were unchanged in Rotterdam, declined in Singapore by 4 points, but increased by 4 points in Fujairah and by 6 points in Houston.

• VLSFO segment: All ports also continued to trade in the undervalued zone. The MDI rose by 2 points in Rotterdam and by 1 point in both Singapore and Fujairah, while declining by 6 points in Houston. Notably, Houston’s MDI is now close to the 100% correlation level between MBP and DBP.

• MGO LS segment: In the MGO LS segment, Fujairah remained the only overvalued port; however, the degree of MDI overvaluation declined by 22 points, bringing it closer to the 100% correlation level between MBP and DBP. The remaining three ports were undervalued, with the MDI increasing by 9 points in Rotterdam, 15 points in Singapore, and 19 points in Houston.

Overall, no material changes were observed in the balance between overvalued and undervalued ports over the past week. ”We expect the MDI to remain broadly stable in the coming week, with undervaluation continuing to dominate the global bunker market”. said Ivanov.

”We believe that the global bunker market will retain the potential for a moderate upward trend next week, although corrective movements cannot be ruled out”, Ivanov added.