The Global bunker market continued its recovery in 2023 with a moderate correction downwards following the peak values of 2022, according to the latest report by Marine Bunker Exchange (MABUX).

As of 25 December 2023, the global index 380 HSFO demonstrated a notable increase of US$36.14, rising from US$484.96/MT at the beginning of the year to US$521.10/MT. In contrast, the VLSFO index fell by US$28.19 to US$678.39/MT. The most substantial loss, however, was seen in the MGO index, which decreased by US$132.66 to US$899.17/MT.

“Despite lingering volatility, the overall state of the bunker market remained relatively stable,” commented a MABUX official.

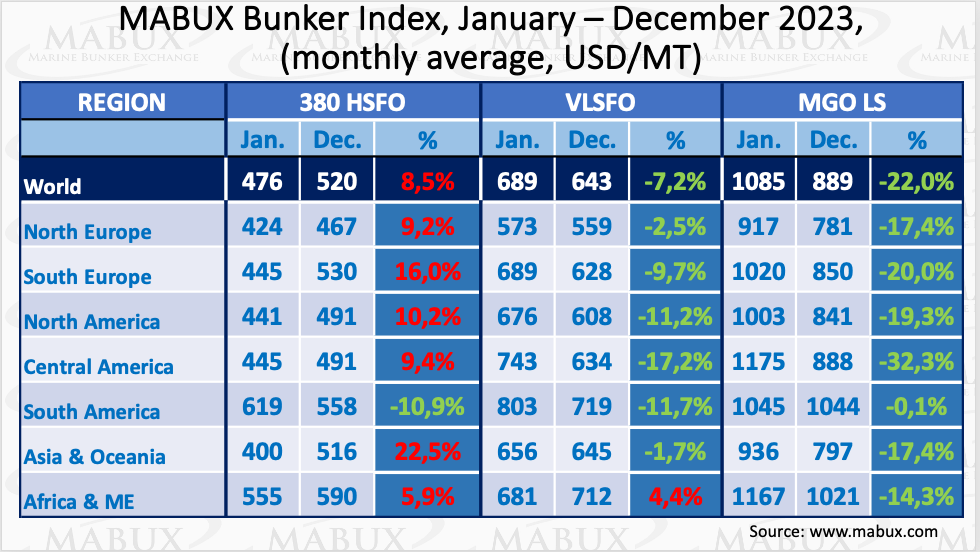

Average global bunker indices for 380 HSFOs climbed by 8.5% in 2023, while VLSFO and MGO LS fell by 7.2% and 22%, respectively. Notably, Asia and Oceania saw the largest growth rates for 380 HSFO prices, with an average increase of 22.5%, while South America experienced a 10.9% decline. VLSFO prices fell internationally, with Central America suffering the greatest drop (17.2%), and Africa/Middle East being the only area where prices grew by an average of 4.4%. MGO LS prices fell across the board, with Central America leading the way with a maximum fall of 32.3% and South America exhibiting a modest decline of 0.1% on average.

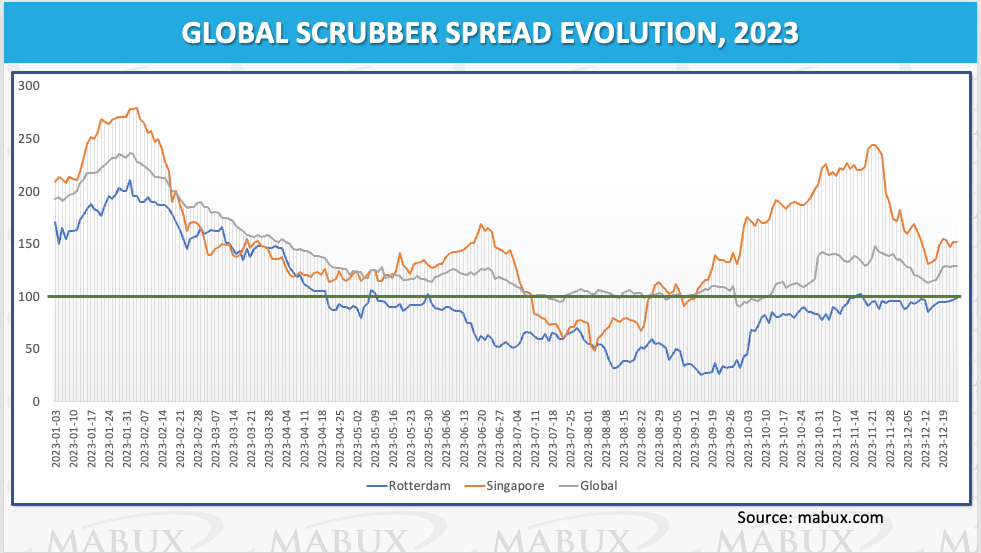

The Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO — rose sharply to US$236.46 in early February 2023, then fell gradually to US$129 by the end of the year. This proximity to US$100 (SS Spread breakeven) suggests that the bunker market has stabilised significantly.

In Rotterdam, the SS Spread went below US$100 in April, reaching a record low of US$25 on 14 September, before rebounding to almost US$100 by 25 December.

In Singapore, the SS Spread began the year at a high (US$279 on 3 February 2023), fell sharply to US$48 on 3 August and steadily rebounded to values of US$135-$150 by the end of the year.

“The consistently stable SS Spread exceeding US$100 contributed to the profitability of scrubber installations,” noted a MABUX representative, with DNV reporting a total of 5,095 ships with scrubbers installed (in operation and on order) in 2023, up from 4,807 in 2022 and 4,581 in 2021.

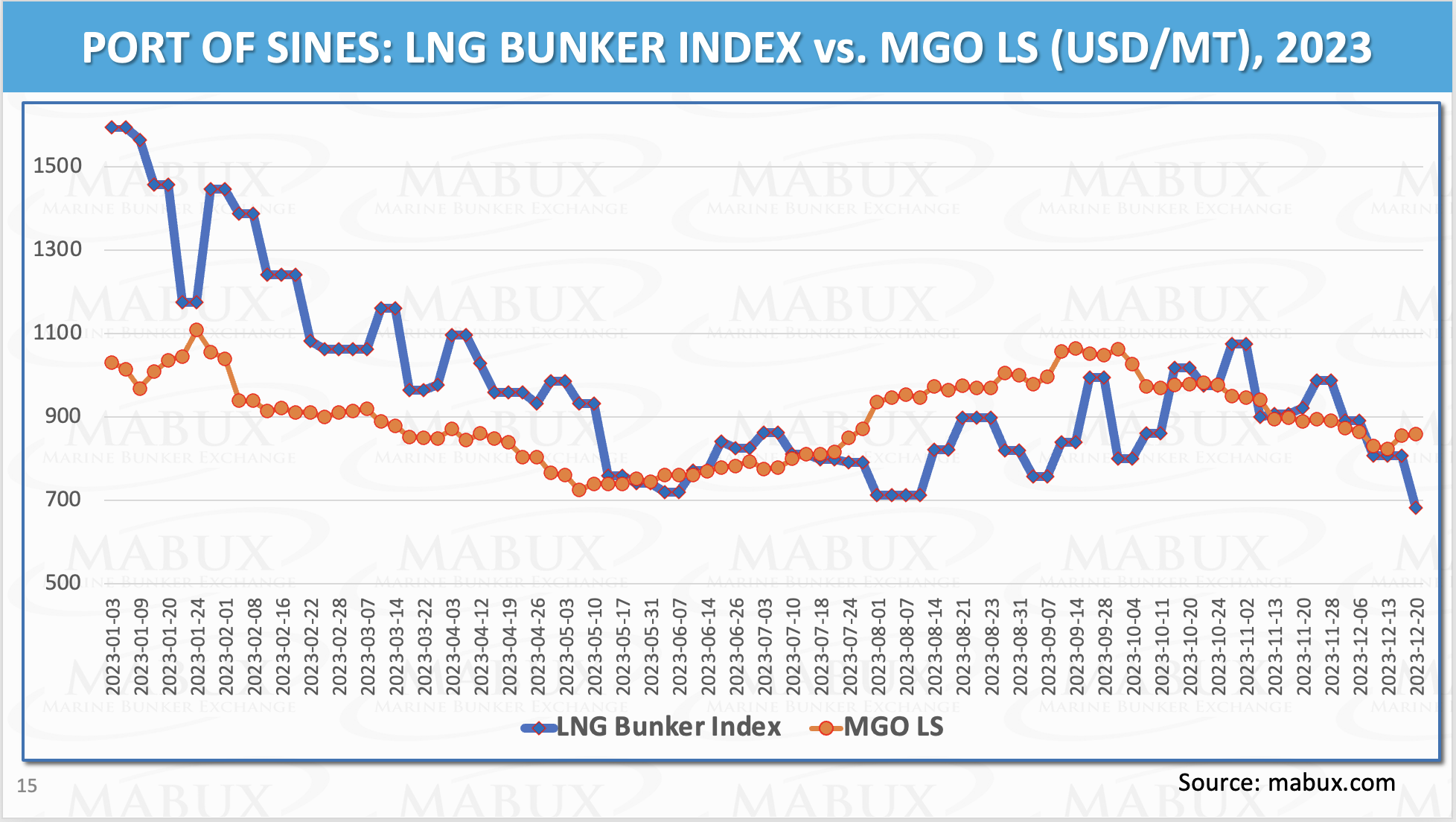

In 2022, liquefied natural gas (LNG) briefly lost its competitive edge against traditional bunker fuels due to sharp price increases driven by weather-related factors, exceptionally high demand in Asia, and a simultaneous shortage of energy resources in Europe.

However, in the previous year, LNG has reclaimed its status as the most favored alternative bunker fuel.

Despite a significant price disparity between LNG and MGO LS in the first half of 2023 (reaching US$448 in the port of Sines, Portugal), this gap not only leveled out but also tilted in favor of LNG by the year’s end. Specifically, as of December 20, 2023, LNG as a bunker fuel in the port of Sines was quoted at US$117 less than MGO LS.

“Overall, we anticipate that the stabiliasation trends observed in the global bunker market throughout 2023 will persist in the medium term. Meantime, drastic shifts in bunker fuel demand appear unlikely,” stated Sergey Ivanov, director of MABUX.