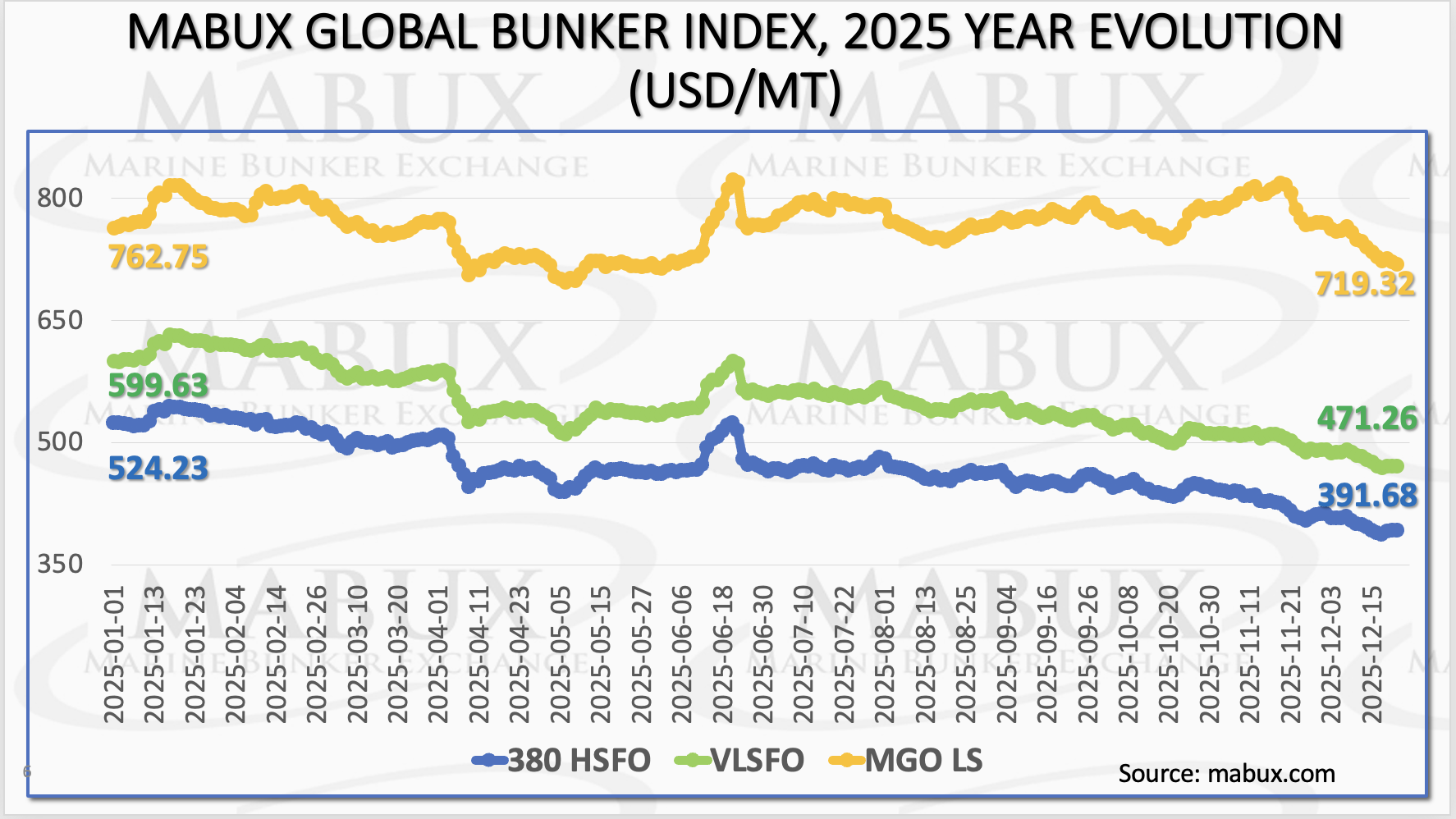

The international bunker fuel market experienced a predominantly downward trajectory throughout 2025, with significant price declines across all major grades, according to the latest MABUX Bunker Yearly Outlook 2025.

After a relatively stable first half of the year, prices for the three principal bunker fuels, 380 HSFO, VLSFO, and MGO LS, surged in June before entering a moderate decline in the second half. By the close of 2025, the 380 HSFO Index had dropped by 132.55 USD/MT year-on-year (compared with a modest decline of just 1.96 USD/MT in 2024). The VLSFO Index fell by 128.27 USD/MT (versus -54.00 USD/MT the previous year), while the MGO LS Index recorded a more moderate reduction of 43.43 USD/MT (against -125.66 USD/MT in 2024).

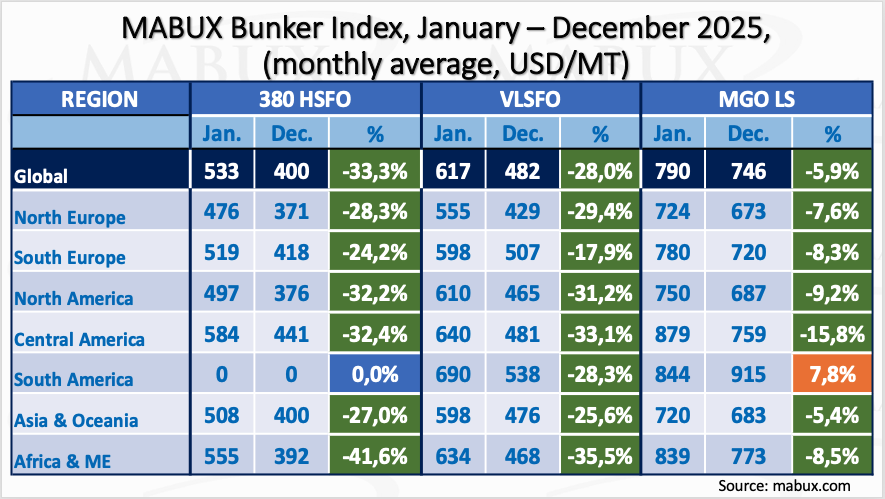

The downward pressure was felt uniformly across all key global regions. In the 380 HSFO segment, price reductions ranged from 24% to 42%, with the steepest drop recorded in Africa/Middle East (-41.6%). VLSFO prices declined by 18% to 35% across regions, again with the largest fall in Africa/Middle East (-35.5%). MGO LS saw more moderate declines of 5% to 16%, though South America was the outlier with a +7.8% increase.

MABUX analysts expect this bearish sentiment to persist into the early months of 2026 unless significant new growth drivers, most likely sudden geopolitical developments affecting energy supply or freight markets, emerge.

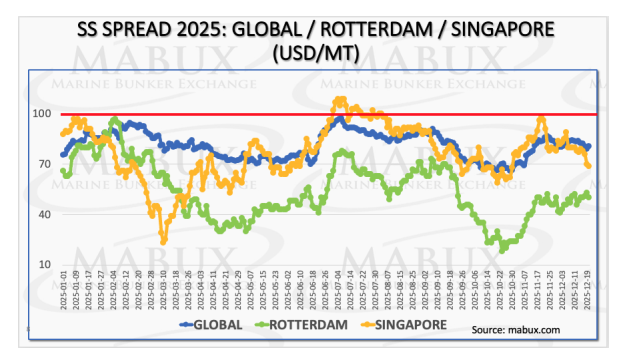

Scrubber Economics Remain Challenging

The Global Scrubber Spread (difference between 380 HSFO and VLSFO) stayed consistently below the critical 100 USD/MT breakeven threshold throughout 2025, fluctuating in the 79–84 USD/MT range by year-end. This sustained low spread confirms that conventional VLSFO remains the more economically attractive option compared to the HSFO + scrubber configuration for most operators.

Despite the unfavourable economics, the global scrubber fleet continued to grow. According to DNV data, the total number of vessels with scrubbers installed or under installation reached 6,712 by the end of 2025, up from 6,168 in 2024 and 5,469 in 2023. Adoption remains concentrated in large-tonnage segments, led by bulk carriers, tankers, and container ships.

Mediterranean ECA Drives Shift Toward ULSFO

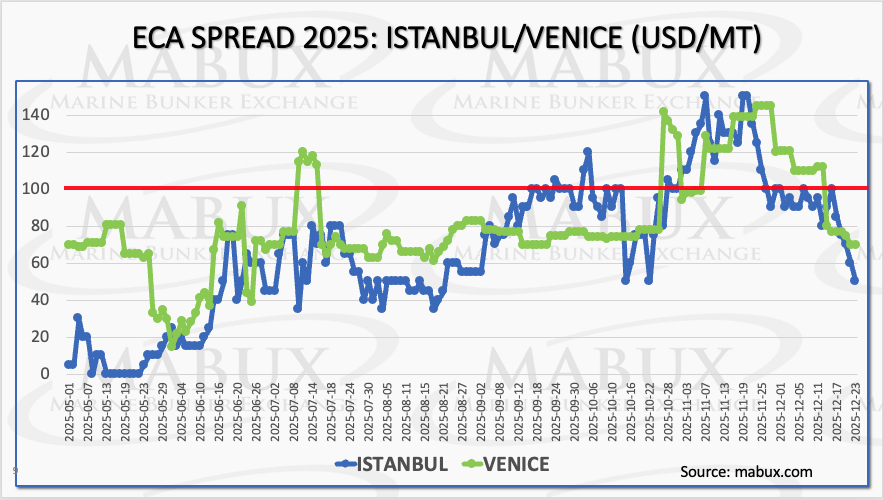

The introduction of the Mediterranean Emission Control Area (MedECA) on May 1, 2025, has already begun reshaping regional bunker demand patterns. The ECA Spread (difference between ULSFO 0.10% sulfur and MGO LS) showed initial volatility in ports such as Istanbul and Venice but has since stabilized around the 100 USD/MT level, maintaining a clear cost advantage for ULSFO.

MABUX forecasts a significant restructuring of the MedECA bunker mix in 2026, with MGO LS potentially rising to 45% share (from 27% in 2024), ULSFO reaching 25% (from 1%), while VLSFO drops sharply to 4% (from 55%).

Alternative Fuels: LNG Maintains Lead, Methanol Accelerates

LNG continued to dominate the alternative fuels segment in 2025. Prices in the ARA region fell dramatically from 905 USD/MT to 638.50 USD/MT, narrowing the premium over MGO LS to just 38 USD/MT by late December. Similar declines were observed in Sines, Portugal.

The number of LNG-powered vessels (in operation and on order) climbed to 881 units in 2025, up sharply from previous years, with container shipping driving much of the growth.

Methanol is emerging as the second major alternative pathway, with the operational fleet reaching 97 vessels after 51 new entries in the past 12 months, again led by the container sector.

Looking Ahead: More ECAs and Structural Changes

MABUX warns that upcoming ECA designations, including the Canadian Arctic and Norwegian Sea from March 1, 2026, and a planned Northeast Atlantic ECA in 2027, will effectively create a vast contiguous low-sulfur zone across much of the North Atlantic.

These regulatory changes are expected to:

- Accelerate the decline in VLSFO demand

- Boost demand for compliant fuels (MGO LS and ULSFO)

- Sustain the HSFO + scrubber model in the medium term

- Encourage faster infrastructure development for alternative fuels.

Overall, while the global bunker market currently benefits from balanced fundamentals, any escalation in geopolitical risks could quickly reverse the prevailing downward trend.

The full MABUX Bunker Yearly Outlook 2025, authored by Director Sergey Ivanov, provides detailed regional breakdowns, index charts, and forecasts for the year ahead.