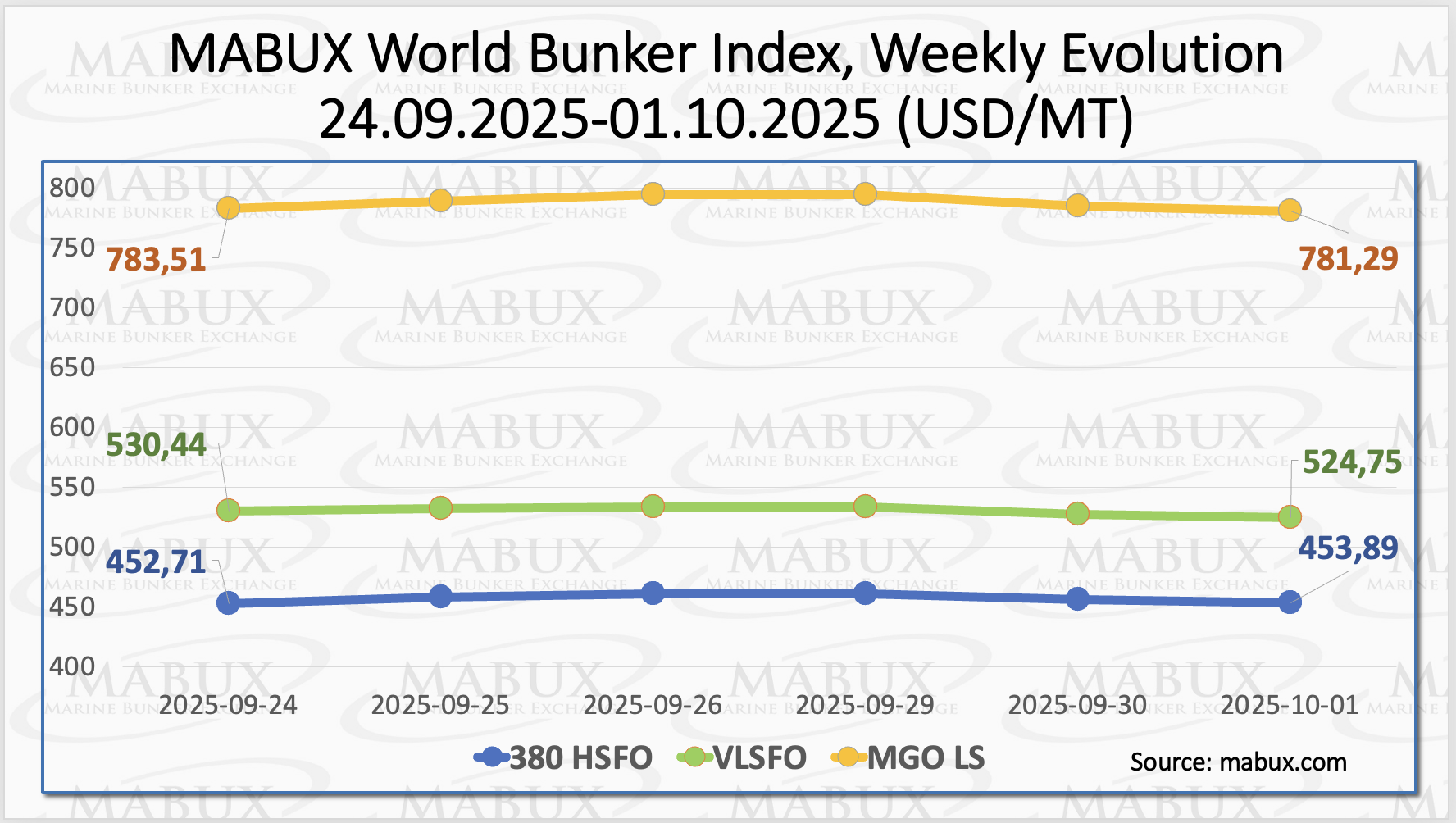

At the close of Week 40, global bunker indices under MABUX showed mixed dynamics without establishing a firm trend. The 380 HSFO index inched up by US$1.18, rising to US$453.89/MT.

In contrast, the VLSFO index continued its decline, falling by US$5.69 to US$524.75/MT. The MGO index also moved lower, to settle at US$781.29/MT. At the time of writing, the global bunker market was showing signs of an upward correction.

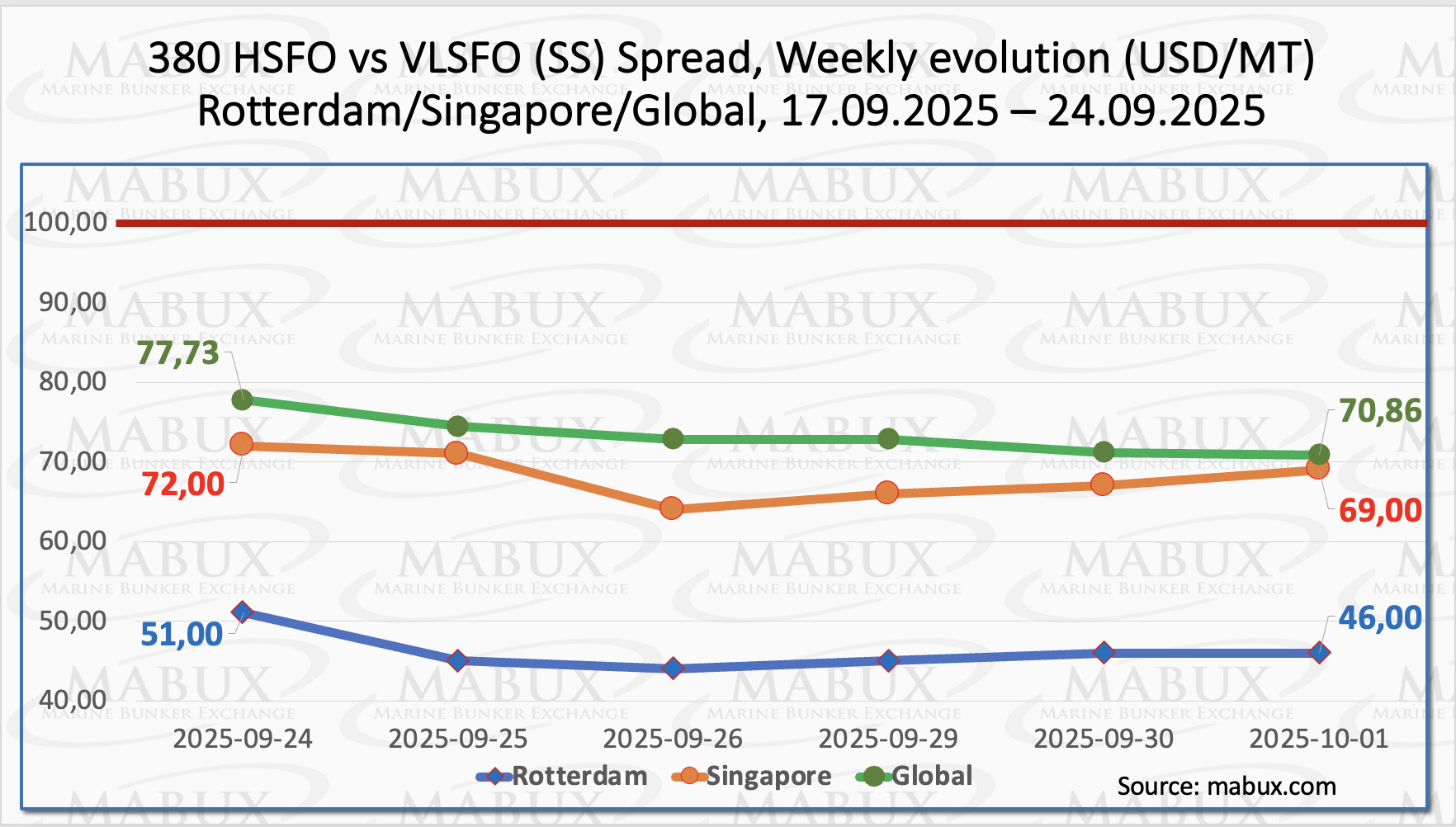

The MABUX Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – extended its decline, falling by US$6.87 to US$70.86, and remaining well below the psychological breakeven level of US$100.00. The weekly average also moved lower by US$8.43.

In Rotterdam, the SS Spread decreased by $5.00, slipping to US$46.00, and dropping below the US$50.00 mark for the first time since June 2025. The weekly average in the port declined more sharply by US$16.00.

In Singapore, the HSFO/VLSFO differential narrowed by US$3.00 to US$69.00, breaching the US$70.00 mark. The port’s weekly average registered a loss of US$9.33. Overall, SS Spread indices have re-entered a downward phase, sharply reducing the profitability of the HSFO + Scrubber option compared to conventional VLSFO.

”However, we view this decline as temporary, with the likelihood of an upward correction within the next one to two weeks,” commented Sergey Ivanov, Director, MABUX.

As per S&P Global Commodity Insights, natural gas is the only fossil fuel projected to increase its share of the energy mix in the U.S., China, and India by 2050, even as global oil and coal consumption declines. The report highlights that scalability and commercial hurdles remain the key barriers to moving directly from coal to renewables, positioning natural gas as a critical bridge in the global energy transition. S&P Global also projects that renewables will grow from just 4% of global energy supply today to 20% by 2050.

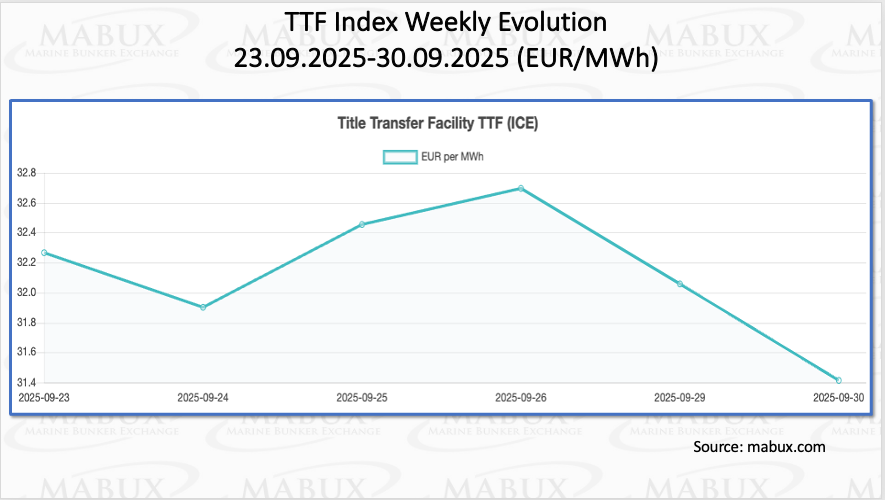

As of September 30, European regional gas storage facilities stood at 82.59% capacity, up 1.76% from the previous week. This level is 11.26% higher than at the beginning of the year (71.33%), although the pace of injection remains relatively modest. By the close of Week 40, the European TTF gas benchmark posted a moderate decline of €0.854/MWh, settling at €31.411/MWh compared with €32.265/MWh a week earlier.

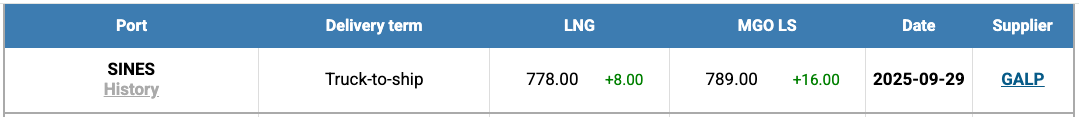

The price of LNG as a bunker fuel at the port of Sines (Portugal) rose by US$8.00 this week, reaching US$778/MT. Despite this increase, the price differential shifted in favor of LNG: the gap widened to US$11 in favor of LNG, from US$9 in favor of conventional fuel the previous week. On the same day, MGO LS was quoted at US$789/MT at Sines.

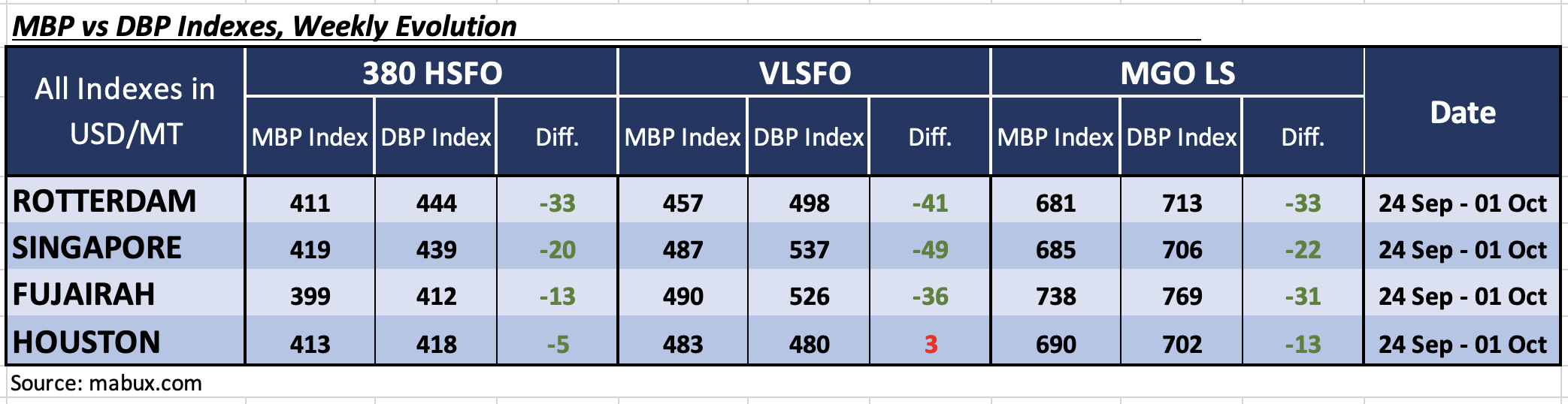

At the close of Week 40, the MABUX Market Differential Index (MDI) – the ratio of market bunker prices (MBP) to the MABUX digital bunker benchmark (DBP) – reflected the following price dynamics across the key hubs of Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: All four ports remained undervalued, with weekly averages declining by 8 points in Rotterdam, 7 points in Singapore, 10 points in Fujairah, and 11 points in Houston. Notably, Houston’s MDI moved close to the 100% correlation level between MBP and DBP.

• VLSFO segment: Houston was the only overvalued port, although its average MDI fell by another 6 points, nearing the 100% correlation threshold. The other ports remained undervalued, with average MDI undervaluation widening by 10 points in Rotterdam, 3 points in Singapore, and 4 points in Fujairah.

• MGO LS segment: All ports stayed within the undervalued zone. MDI values increased by 2 points in Rotterdam, were unchanged in Singapore, rose by 5 points in Fujairah, and gained 2 points in Houston.

”No major shifts were observed in the balance of overvalued and undervalued ports. In both the 380 HSFO and VLSFO segments, MDIs continued to edge closer to full correlation with the digital benchmark, while undervaluation remained the prevailing trend. Looking ahead, we expect a gradual erosion of undervaluation premiums in the coming week”, added Ivanov.

”The global bunker market should remain relatively stable next week, although signs of a sustained upward correction may appear by the end of the period”, said Ivanov.